💡Is Japan About to Blow Up the Global Financial System?

Issue 202

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What Just Happened in the JGB Market

Why Japan’s Debt Bomb is Different (And Worse)

The Yen Carry Trade and the Global Trap

The BOJ’s Iron Triangle

Investment Implications (And What to Do About It)

Inspirational Tweet:

While the mainstream media spent the week obsessing over Davos soundbites, Trump’s Greenland comments, and whatever they consider “news” these days, serious investors were focused on something else entirely.

The open rebellion in Japan’s bond market.

That’s right. The 40-year Japanese Government Bond just spiked above 4% for the first time in over three decades. Liquidity in the world’s second-largest bond market has never been worse. And the Bank of Japan is now at its highest interest rate since 1995, with more hikes coming.

Why should you care?

Because Japan has been serving a bottomless punch bowl to global markets for 30 years. Free money for anyone who wanted it.

That era is ending. And when it fully unwinds, the ripple effects will be felt in every portfolio on the planet.

So, what does this mean for US markets? For your 401(k)? For the Fed?

All good questions. And ones we’re going to answer, nice and easy as always, here today.

So, pour yourself a big cup of coffee and settle into your favorite seat, because we have a lot to cover and it is extremely important, as we explore the end of Japan’s free-money era with this Sunday’s Informationist.

Upcoming Appearance

The Age of Debasement

The cracks in the foundations of money are becoming harder to ignore. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk.

On January 28 at 1PM CST, join me in this online event as I present my latest report, The Debasement Trade, and take live Q&A.

Hosted by Unchained, this event will cover:

Why debasement is structural, not cyclical

How inflation and financial repression challenge familiar portfolios

Why gold tends to move first—and bitcoin often moves further

Wednesday, January 28 at 1PM CST — online, free to attend.

😵💫 What Just Happened in the JGB Market

OK, so what’s actually happening in Japan right now?

In short: the bond market is staging an open rebellion. And the numbers are staggering.

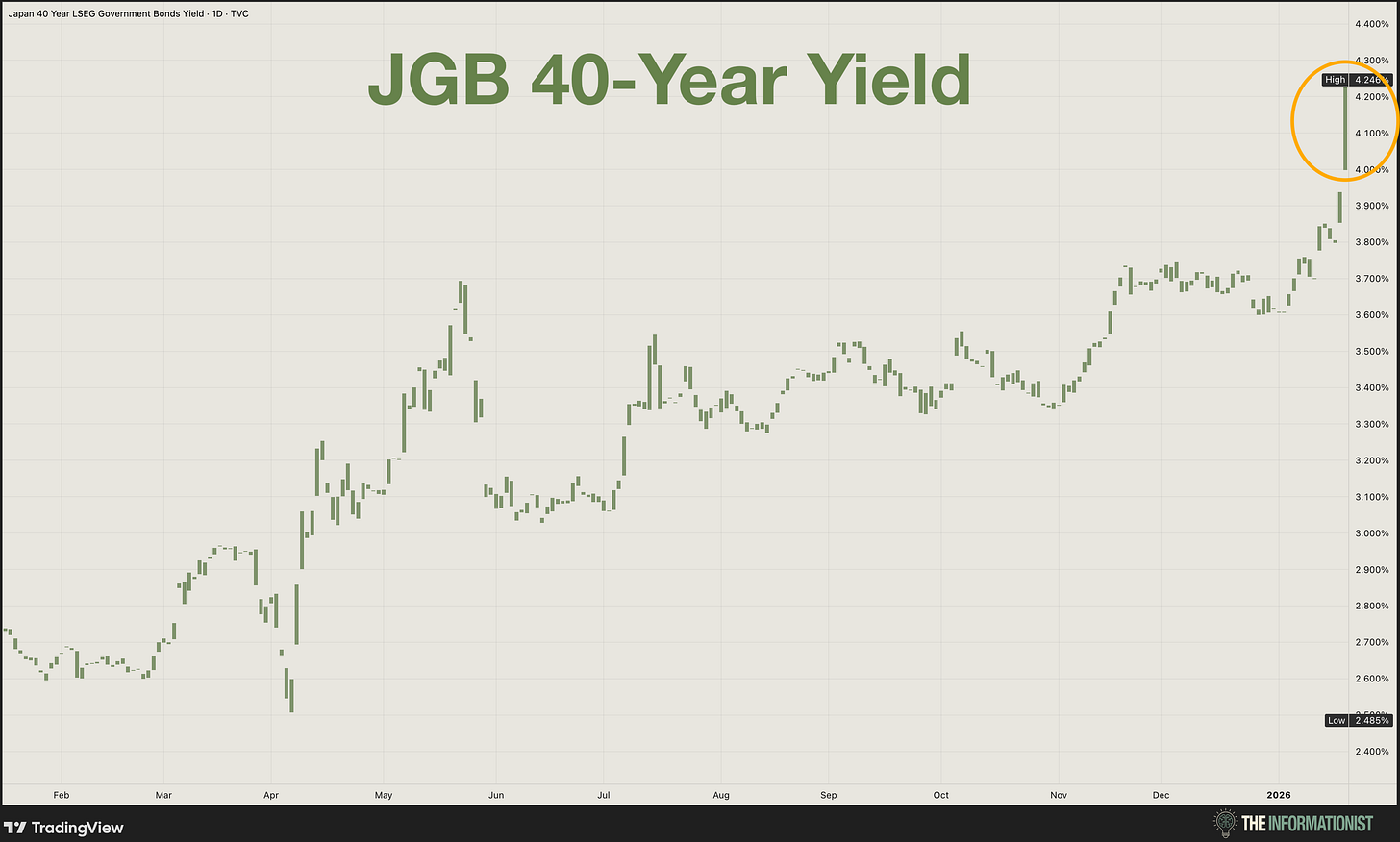

Japan’s 40-year government bond yield just spiked above 4.2% for the first time in over 30 years. The 30-year Japanese government bond (JGB) hit 3.6%. The 10-year is at 2.25%, more than double where it was just a year ago.

Just look at that spike on the right side of the chart.

A country that’s kept rates at or near zero for decades just saw its longest-dated bonds blow through 4%. In a matter of hours.

For the long-time readers of The Informationist, you know I’ve been covering the Bank of Japan saga for years now. Back in 2023, I wrote about the BOJ’s “experiment” with yield curve control, warning that it couldn’t go on forever. Last summer, I asked whether the yen was about to hyperinflate.

Well, the experiment is over. And the results are in.

If you need a refresher on yield curve control and how Japan is using it, you can read a full breakdown here:

Here’s what happened this week.

The BOJ raised its policy rate to 0.75% in December, the highest since 1995. At this week’s January meeting, it held steady in a split 8-1 decision, but one board member actually proposed hiking to 1%.

Governor Kazuo Ueda made it clear: “We will keep raising rates in line with improvement in the economy and inflation.”

In other words, they’re not done. Analysts now expect rates to hit 1% by mid-2026, potentially higher if the yen keeps weakening.

And even at 0.75%, real rates (rates minus inflation) are still deeply negative. Japan’s inflation is running north of 3%, meaning savers are still losing purchasing power even after the hike.

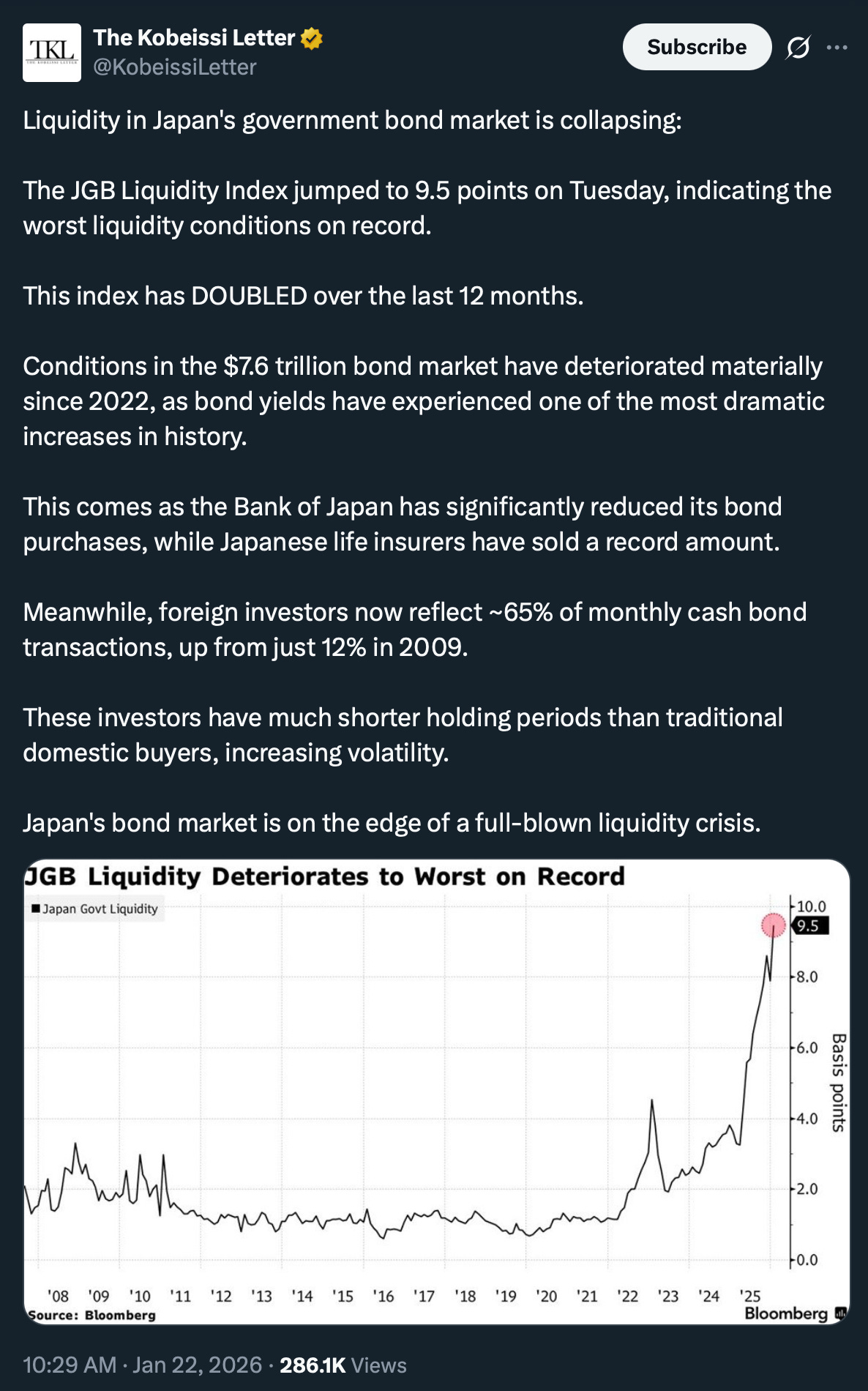

But here’s what really has traders spooked: as Kobeissi highlighted above, liquidity in the world’s second-largest government bond market has never been worse. The $7.6 trillion JGB market is showing classic signs of stress.

Why does this matter?

Because Japan’s government bond market is the benchmark for pricing trillions more in corporate debt, mortgages, and derivatives across Asia. When liquidity deteriorates this severely, prices become erratic. Buyers disappear. Volatility explodes.

And that’s exactly what we’re seeing.

📉 Why Japan’s Debt Bomb is Different (And Worse)

Now you may be asking, why is this happening now?

The answer involves some math that most PhD economists still drinking the Modern Monetary Theory funny juice prefer to ignore.

A little ice in that drink: Japan’s gross debt-to-GDP ratio stands at over 250%. That’s the highest in the developed world. Not Greece. Not Italy. Japan.

The numbers: $9 trillion in debt against an annual national output of $4 trillion.

And the largest owner of Japanese debt in the world?

You got it. The BOJ itself. It owns roughly 50% of all Japanese government debt.

And here’s what’s wild: that’s actually down from 55% in 2022. The BOJ is quietly stepping back. Meanwhile, foreign investors have also been bailing, with their holdings dropping to just 12% of the total. The lowest since 2019.

So who’s left to buy? Great question.

For decades, this didn’t matter much. The BOJ could print yen, buy its own bonds, and keep yields suppressed near zero. Japanese savers dutifully stuffed their money into JGBs despite earning nothing. The system worked because inflation was nonexistent.

That’s no longer the case.

Japan is now experiencing something it hasn’t seen in 40 years: persistent inflation.

In the words of John McClane:

Because when you have inflation, bond investors start demanding compensation for it. They want positive real yields.

And here’s the trap.

If JGB yields keep rising, the Japanese government’s interest expense explodes. At over 250% debt-to-GDP, even small yield increases translate into massive budget impacts. Every 1% increase in borrowing costs adds over 2.5% of GDP to annual interest expense.

Read that again slowly.

Japan cannot afford higher interest rates. But the market is demanding them anyway.

Sound familiar? It should. We discussed this exact dynamic in the context of the US Treasury recently, that you can find here:

The difference is that Japan is further down this road. Much further.

And now we have a new wrinkle. Japan’s recently elected Prime Minister, Sanae Takaichi, is rolling out what she calls “Sanaeconomics” (yeah, an answer to Abenomics, the policy that started all this). Her platform includes a ¥21.3 trillion ($140 billion) stimulus package, food tax cuts, and a snap election on February 8.

In other words, she’s doubling down on fiscal spending at the exact moment bond vigilantes are waking up.

This feels a lot like the UK’s “mini-budget” crisis of 2022, when Liz Truss proposed unfunded tax cuts and the gilt market promptly collapsed. The BOJ had to intervene to prevent pension funds from blowing up.

We covered this situation back then, you can read the full free article here:

The big difference is that Japan’s debt situation is far worse than the UK’s ever was.

So what does this mean for you and your portfolio?

Here’s the thing. Japan has been serving a bottomless punch bowl to global markets for three decades. Free yen for anyone who wanted it. Borrow for nothing, invest anywhere, profit.

Now that punch bowl is being carted off. And the party is ending.

If you want to understand how this could ripple through US Treasuries, your 401(k), and every risk asset on the planet, keep reading.