World Yields are Inverting: Why it Matters

Issue 69

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

Yield Curve Inversion

G7 Treasury Yields

Italy & Japan Curves

How to Protect Yourself

Inspirational Tweet:

Sovereign bond yields have been inverted for a while now and have begun to invert even more lately. This spells trouble for economies and markets, pretty much everywhere in the developed world.

But why are yields so important, what are the curves telling us, and—most importantly—what does it mean for our investments and portfolios?

If this all sounds overwhelming or confusing, no worry. As always, we’re going to break it all down in bite size pieces and make it super easy to understand today.

So, grab your favorite mug of coffee and settle in, it’s Informationist time.

Join the 🧠Informationist community and get access to every post + the entire archive of articles.

Partner spot

With an overwhelming stream of AI newsletters, I’ve cut mine down to a few and I really like the AI Tool Report. You can check it out for free, right here:

📉Yield Curve Inversion

First things first, let’s review yield curves and their implications. I’ve covered this before, and here’s a post you may find helpful:

TL;DR: A yield curve takes all the yields of the various maturities of government bonds and plots them on a chart. In a healthy economy, yields of shorter paper are lower than longer paper and should look like this:

In (soon to be) troubled economies, the curve often becomes inverted, where longer maturities yield less than shorter ones.

Why?

Because investors expect financial conditions and the economy to worsen. They expect the yields to drop in the future, reflecting this falloff in economic conditions.

And the yield curve ends up looking something like this:

I explain much deeper in the above article, and I encourage you to check it out when you get a chance. But for now, just know that inversions are exceptionally accurate in predicting the likelihood of a recession—virtually every US recession has been preceded by an inversion in the UST yield curve.

That said, inversions are less accurate in predicting the timing of a recession. Some occur a few months before and some happen years before any recession hits.

But now, let’s check the UST yield curve and take the US economy’s temperature:

Just glancing at the above plot, we see that it’s severely inverted and super steep on the short end of the curve.

Not good.

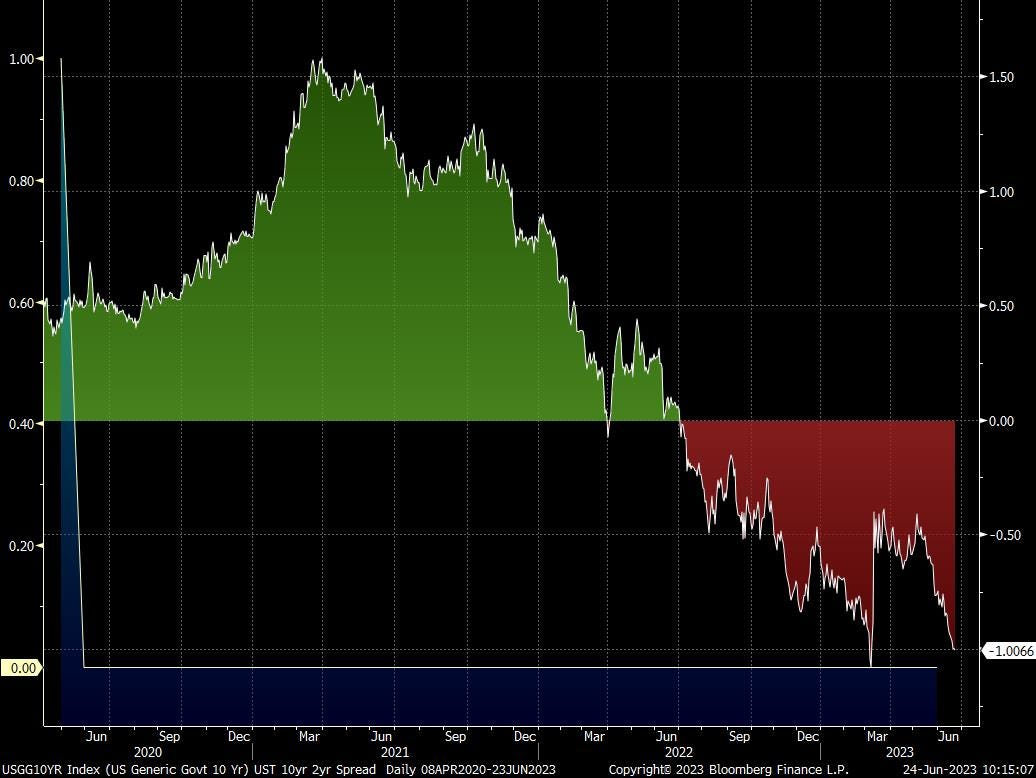

What’s more, if we dig in and focus on the 2 to 10-year spread (subtract the yield of 2-yr from 10-yr) we see that the spread inverted way back in July of 2022.

And the inversion has recently become extremely pronounced.

How extreme?

It’s approaching the same level as the banking crisis this past spring. 😮

Bottom line, investors are firmly expecting future yields to be far lower than current ones. This means they expect the Fed to lower rates in the future. And we all know that the Fed only lowers rates when the economy is stressed and conditions need to be loosened.

Say it with me: Recession.

But here’s the thing. The US isn’t the only nation experiencing inverted yield curves. Virtually all the G7 countries are seeing the same phenomenon, too.

🫣 G7 Treasury Yields

Zooming out to the G7 nations, we see that five out of seven are also quite inverted:

And as Lisa points out in her post above, the German 2 to 10yr spread is as inverted as it has been since 1992, touching -82bps. 😱

France too, whose 2 to 10yr is now at -.39bps, a level it also hasn’t seen since 1992.

No surprise, as the ECB just hiked the benchmark Central Bank rate by another 25bps, even though France’s services sector shrank unexpectedly in June and German business activity has considerably slowed. Manufacturing and services are slowing down or stalling across virtually all of Europe…pointing to?

You got it, an incoming recession.

In the UK, the 2 to 10yr has also recently fallen off a cliff and is currently -.84bps, the worst it’s seen since 2000. No surprise, after the Bank of England shocked markets with a 50bp rate hike last week, pushing that benchmark rate up to 5%.

UK investors expect economic pain and rates lower soon.

But take a look at the Canadian yields. First, the 2 to 10yr spread is sitting at -1.31, the largest it’s been since 1990. And worse, look at the whole curve (orange line). No bump, no hump in the middle, it looks more like a Wet n’ Wild water slide, the yields are slipping right off into the abyss.

Yikes.

Canada’s clearly expecting serious pain. But what about Italy and Japan?

🤨 Italy & Japan Curves

First, looking at the Italian curve above, we see there is only a slight inversion at the short end of the curve, but the 2 to 10yr is actually not inverted.

Does this mean all is good in Italy? No recession on the horizon?

Not exactly.

Because the problem with Italy is investors demanding higher rates the further out the maturity. This is because there is significant risk that Italian banks fail in the near future, taking rates through the roof with them. Investors are demanding to be compensated for this risk.

In fact, the ECB has been controlling that yield curve by buying Italian bonds to keep rates from skyrocketing, as this would just push Italian banks closer to the brink.

But what about Japan? Not included in the above chart, that curve isn’t inverted at all.

As you can see, Japan is still living in the world of ZIRP, or Zero Interest Rate Policy. The Bank of Japan (BoJ) has also been using yield curve control there, as it is trying to induce inflation in the region by keeping rates quite low or below zero.

This is because Japan is an entirely different economy than the US, with a different demographic (older population) and economics (net exporter). Also, The BoJ owns over 50% of its own debt, so the treasury market functions quite differently there than in the US or Europe.

All that said, Japan will have its own chickens to deal with, as they too will eventually come home to roost. In a big, big way. (Hint: Japan’s debt to GDP is over 265% 😵)

OK, the world is headed for recession or worse. Got it. But what can we do about it?

🧐 How to Protect Yourself

If you’ve been reading my work or following me on Twitter, you know how I am positioned for the near future.

I hold a large percentage of cash in my portfolio that is fully FDIC insured. I will use this cash to buy high quality equities or other securities in the event of an economic downturn. I make sure it is fully insured, because I believe banks are still at risk.

More on that here, if you have not yet seen it and are interested:

I also hold a large percentage allocation to hard monies, like gold, silver, and Bitcoin, and am buying them opportunistically in here.

This is because I believe they will perform quite well on the other side of a recession or market shock, especially if and when the Fed has to print and expand the money supply to inject liquidity and ensure markets remain fully functional.

All of this fits my personal needs for liquidity, my age and risk tolerances. I highly encourage you to sit down with your investment advisor to determine your own plan.

Please do not skip this step! The worst thing you can do is act like Christine Lagarde of the ECB or Justin Trudeau of Canada and stick your head in the sand, expecting it all to just work itself out.

That’s it. I hope you feel a little bit smarter knowing about yield curves and inversions and are ready to talk to your own advisor intelligently. If you enjoyed this newsletter and know someone you think would like it too, please share with them!

And if you are a paid subscriber, leave a comment, answer a comment, join the awesome 🧠Informationist community below!

Talk soon,

James✌️

I take this very literal, “So, grab your favorite mug of coffee and settle in”

I look forward to my morning pour-over brew, whether at home, or at a local roaster if I’m traveling on a Sunday. Today is a mug from Tanzania AB Isaiso, roasted at The Source in Sioux Falls, SD.

Thanks again for another great post!