The Treasury's $175 Trillion Hole

Issue 122

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What are ‘Unfunded Liabilities’

The Ugly Reality

Possible Solutions?

Inspirational Tweet:

If you’ve been paying attention to what is going on in Washington, then you are well aware that the geniuses in DC—both parties, mind you—have run the federal debt up to nearly $35 trillion.

Easy to do when you are running $2 trillion deficits and spending over $1 trillion just on interest on that debt.

But something that is not covered so widely, and is often shrugged off or completely ignored, is the ‘unfunded liability’ that the Washington elite have managed to amass on behalf of the country.

That’s right, $175 trillion of obligations that will eventually come due, as Professor St. Onge points out here.

And virtually none of it is currently accounted for.

But what exactly is this so-called ‘liability’? And is it really a problem?

More importantly, is there anything that can be done about it?

Good and important questions, especially if you are Gen-X or younger or if you are a Silent Gen or Boomer and have kids and/or grandkids.

But if you have no idea what all this means and why you should care, no worries. Because we’re going to unravel the mystery liabilities right here today.

And we will do it nice and easy, as always.

So, grab your favorite cup of coffee and settle into your favorite chair for a Sunday morning read of The Informationist.

🤔 What are ‘Unfunded Liabilities’

You all have heard it. You all know. At least you should by now…

The government spends too much.

This irresponsible and relentless spending has led to annual deficits of over $2T at a time that we are not even in recession or (officially) at war.

This has merely added to a now-gargantuan level of federal debt that currently stands at $34.7 trillion, and is growing each day. But that’s not all. Because on top of that volcano of debt, we have what’s called an ‘unfunded liability’.

Put simply, this is a debt that the government must eventually pay, but has not set aside any money for.

So, what are we talking about here? Who does the government have to pay? And why?

Well, likely you. And me.

And pretty much every other US citizen.

Because this liability is all the Social Security, Medicare, and Medicaid benefits that we have each accrued in our lifetimes.

We’ve paid into this program, by legal requirement, with every single paycheck we have earned.

The government has taken that money.

And instead of managing it properly, ensuring it grows with inflation in order to match future obligations, it has squandered and/or spent it already.

Put simply, if you’re Gen-X or younger, when we retire, there will be a large shortfall of benefits for us.

At least as it currently stands.

Why?

Well, there are a confluence of factors that I wrote all about recently. If you haven’t seen that or want to peek again for a refresher, you can find it right here:

For the TL;DR crowd: there are several key issues threatening the sustainability of Social Security. First, the system's structure depends on current workers' contributions to fund retirees' benefits.

If that sounds a bit like a Ponzi-scheme to you, trust me, you are not alone.

In any case, this government-mandated program is in deep, deep doody.

Because demographic and employment changes, such as Boomers retiring early during Covid lockdowns, decreasing birth rate and increasing life expectancies, and all around poor fiscal management from DC, are straining the 1940’s-enacted model.

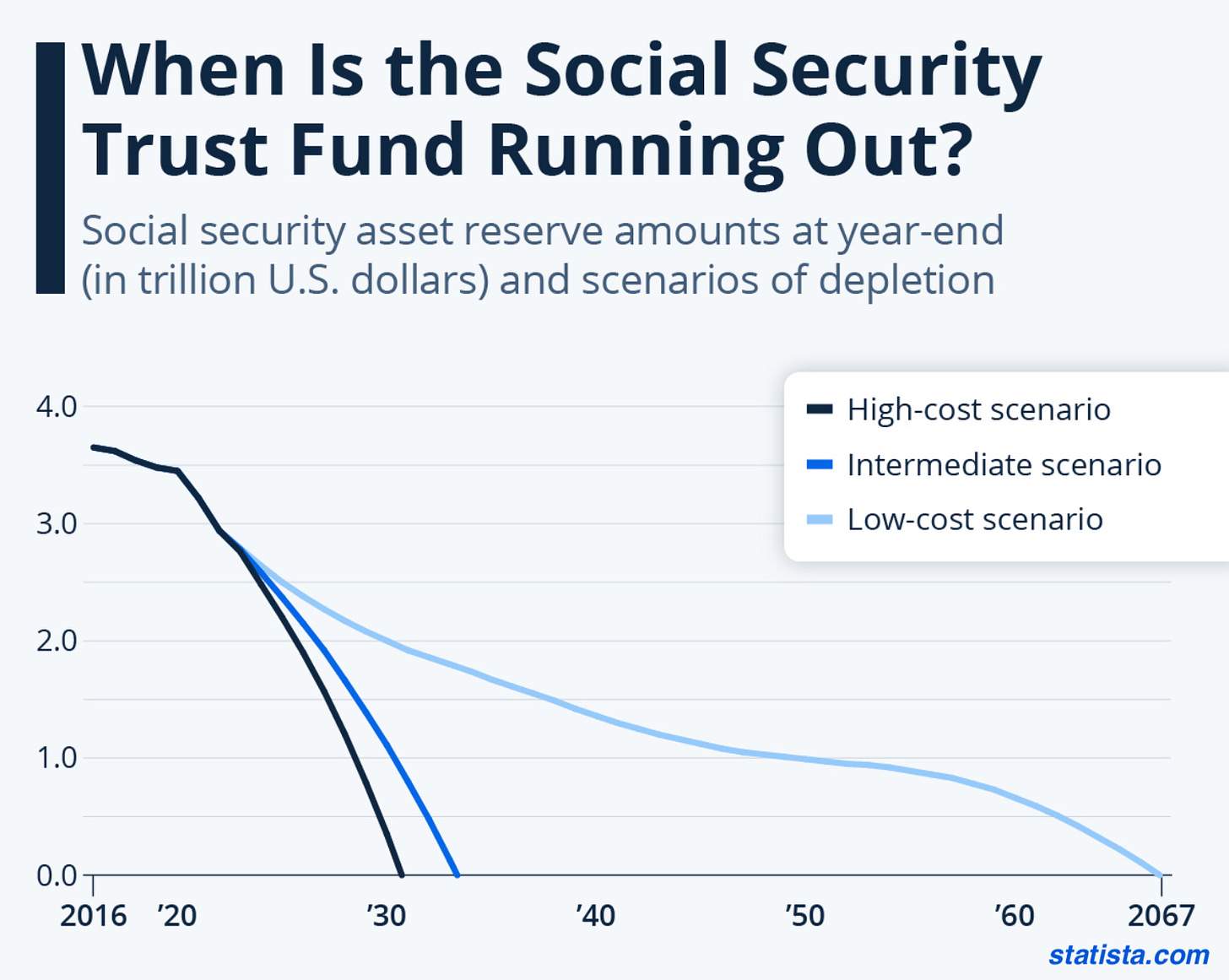

As a result, the Social Security Trust Fund will be depleted by 2033, leaving just ~70% of benefits for retirees after that.

Basically, the only money they will be able to pay out after the Trust Fund is defunct will be determined by what they are able to collect.

Because it is ‘unfunded’ and the Ponzi-like scheme must continue for retirees to get anything at all.

OK, you say, maybe it’s not so bad. Maybe the government can dig itself out of that 30% hole and right the ship. Get it back to 100%.

But, then you see the numbers we are talking about, and it pretty much obliterates that thought at its conception.

😱 The Ugly Reality

There are lots of different ways to look at and calculate the total liability that we are talking about here.

But the US Treasury likely has the best handle on the actual demographics and accounting that will determine the ultimate amounts.

Lucky for us, they compile and publish an annual report that includes these facts and figures.

Aptly named Financial Report of the United States Government, you can find an Executive Summary of the full report on the US Treasury website.

Digging deep into and all the way down to page 192 of this 255-page report, we find the calculation and explanation of this Social Security and Medicare problem (we will shorten this to SSM for simplicity sake here).

And we see that there are two ways that the Treasury looks at the SSM liability: The 75-year Horizon and the Infinite Horizon.

75-Year Horizon

Starting out semi-optimistically, the Treasury details the next 75 years of the SSM budget.

And, using a present value calculation (i.e., everything is translated into today’s dollars by extracting expected inflation, etc.) they estimate that the US expects to take in about $137.4 trillion in taxes and premiums during that time.

This sounds like a lot, right?

I mean, $137.4 trillion can buy a lot of walkers and wheelchairs.

But, then we see that the expected SSM payouts total $215.7 trillion.

That’s a shortfall of $78.3 trillion.

How can they make that up, close that gap?

Well, according to the report: ‘no provision exists for covering the Medicare … and Social Security Trust Fund deficits once assets are depleted’.

oops?

But wait.

This is the optimistic case.

Because when you consider the ongoing, or Infinite Horizon of needs, this gap explodes wider.

Infinite Horizon

Using near-radical honesty and transparency, Yellen and the Treasury go into detail of how, even as bad as it seems, the 75-year Horizon actually underestimates the problem.

Yellen’s report says: “…limiting the projections to 75 years understates the magnitude of the long-range unfunded obligations because [these projections] reflect the full amount of taxes paid by the next two or three generations of workers, but not the full amount of their benefits.”

Translated: The 75-Year Horizon counts all the money the Treasury will collect from a person born this year in taxes over the next 62 years, but not the benefits it will need to pay out to that person (and anyone born thereafter) beyond the 75-year mark.

And so, the Infinite Horizon calculation takes this problem into account, assuming the entirety of the problem as it exists today.

And what to they find?

That the current participants will use $105.4 trillion more in SSM than they will pay in SSM-related taxes. That’s $102.2 trillion more than the fund currently has to cover it.

But that’s not all.

Because on top of that, future participants, who have yet begun to pay into the system, will create an additional shortfall of approximately $66.9 trillion.

All in, that’s $175.3 trillion of total liability, and with just $3.2 trillion in the Trust Fund, it leaves $172.1 trillion of unfunded liabilities.

And they printed it for the whole world, and presumably DC’s Team-Genius (aka Congress), to see.

The total problem broken out by program:

Social Security will need $66 trillion

Medicare A (Hospital Care) will have a surplus of $15.3 trillion (hooray)

Medicare B (Outpatient Care & Supplies) will need $99.3 trillion

Medicare D (Prescription Drugs) will need $22.1 trillion

Add it all up, and we get our $172.1 shortfall, an unfunded liability.

🤨 Possible Solutions?

So, what can the Treasury, or rather Congress, do?

Well, Yellen says herself in the report: This [underfunded liability] can be satisfied only through increased borrowing, higher taxes, reduced program spending, or some combination.

More debt.

Higher taxes.

Future benefit cuts.

Or a super-combo of any or all of the above.

Let’s walk through these backwards, one by one, shall we?

Cutting benefits would be super unpopular with voters. They would call for politicians heads—rightly so—as many or most of the affected would have paid in for years already, only to essentially be stolen from when it comes time to collect the benefits they were promised all these years.

Gen-X would presumably be hit the worst, as they paid in for decades, only to be rugged right as they retire in the next ten years.

Yeah, this would be political suicide, and I cannot see any career politician (aren’t they all, these days?) voting for this. Not if they want to be re-elected, and let’s face it, that’s all they ever want.

While possible popular with less wealthy, raising taxes would also likely be unpopular with a large swath of the political donor base. Additionally, as plenty of empirical evidence shows, raising taxes often disincentivizes productivity (lowering research and development of new products, less re-investment into productive product lines, less expansion, etc.) and so payrolls fall and the result is higher taxes on lower productivity.

We wind up at the same spot, but with decreasing productivity, only making the shortfall problem worse. And let’s face it, to fill that $172.1 trillion gap, the Treasury/IRS would need to triple payroll taxes for the next 75 years.

Can you imagine the economic carnage and political fallout from such a scenario?

This is why when you hear politicians claim they can ‘just tax the millionaires and billionaires to solve the social security problem’, you now know they are firmly full of 💩.

The collective net worth of the 741 billionaires in the US is ~$5.2 trillion. Even seizing even penny of that would leave us $167 trillion short.

Moving on.

And so, the easiest solution?

Issue debt.

Just borrow more and kick that can right on down the road for the next politician, the next retiree, the next generation to deal with.

It’s fast become Congress’s favorite past-time.

Some would now say, it’s the American Way.

But with more debt comes the need for more inflation. It’s the only way the Treasury and the Fed can keep this whole charade going.

If this has you asking why, and you have not seen it yet, I wrote all about the debt spiral problem two years ago (yes, it is still highly relevant) and its consequences right here:

If you’re up for some more Sunday reading, I highly recommend you have a look. Or maybe bookmark it for later.

And I suggest you hold onto those hard assets and hard monies—gold, silver, and Bitcoin—you have, or start to accumulate them. Because inflation, my friends, is here to stay.

And that’s my plan to protect against it.

That’s it. I hope you feel a little bit smarter knowing about unfunded liabilities and the problem the Treasury is facing, and how it may affect you in your payouts, taxes, or inflation.

If you enjoyed this free version of The Informationist and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️

I have known about this for decades. As a recently retired Boomer who spent a lucrative career in the Oil & Gas business, I did not retire at 60 (a common age for professionals to hang up the career) and instead worked till I was 65. I did this because I planned retirement assuming only getting 5 years of Soc. Sec together with the equivalent UK old age pension. The rest of my income is private pensions and investments/savings. I now assume these "national" security pensions will eventually be means tested and once my RMDs start in 2029, I will lose them. This may or may not happen but I think it's a conservative yet sensible approach.

There are few more perturbing issues than the fact that neither political party in the USA has addressed this issue. The UK took some steps toward bolstering their Social Security system about 10 + years ago but the UK old age pension is not nearly as generous as the US version, especially for higher wage earners. Australia made some radical changes to its system about 20 years ago and probably has a much better system now than most countries.

If you think the USA is bad you should consider some of the European countries e.g. France where the problem is comparable but as we know once the French get annoyed with government they start throwing petrol bombs!

Something has to be done that will certainly involve a combination of the things James mentioned. The problem is that neither party will address it until it becomes a crisis and that will be almost immediately before the fund runs out in the early 2030s. The good news is that the overall debt crisis is going to arrive sooner than that anyway.... so I expect the Social Security problem will simply be part of that farrago either during the next administration or the following one latest.

A related topic here is how sick we are as a nation…. Consider that the 4th path (and likely the hardest). Check out Blue Zones on Netflix or Fiat Food by Matt Lysiak. Our healthcare costs much higher than needed because of food supply, diet and lifestyle.