💡Is Social Security Doomed?

Issue 117

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Birth of SSA

Social Security Trust Funds

Inflation and COLA

Social Insecurity

Inspirational Tweet:

Social Security Works, a PAC whose mission is ‘to protect and expand Social Security’, among other things, makes a bold statement here.

While I agree with the post, it bears noting that this even has to be said in the first place.

But why is that? Why have we been hearing rumblings about Social Security insolvency on the horizon?

Is it true? Will anyone who is Gen-X and younger be frozen out from being paid back the money they paid into Social Security their whole professional life?

And if so, Why?

Good questions, and important ones, too. Especially if you’re a Gen-X or Millennial who has been paying into this program for decades now.

Let’s answer these questions and more, nice and easy as always, today.

So, grab your favorite cup of coffee and settle in for a Sunday dive into Social Security with The Informationist.

🤑 Birth of SSA

First things first. What the heck is Social Security, how did it come about, and why have we been paying into this near-defunct program all these years anyway?

Well, back in August, 1935, in response to the Great Depression, President Franklin D. Roosevelt signed the Social Security Act.

The first benefits were paid to retirees in January, 1940.

Social Insurance Principle

Social Security was designed as a social insurance program, where contributions from current workers fund the benefits for current retirees. The mandatory contributions ensured broad participation and risk-sharing across the workforce.

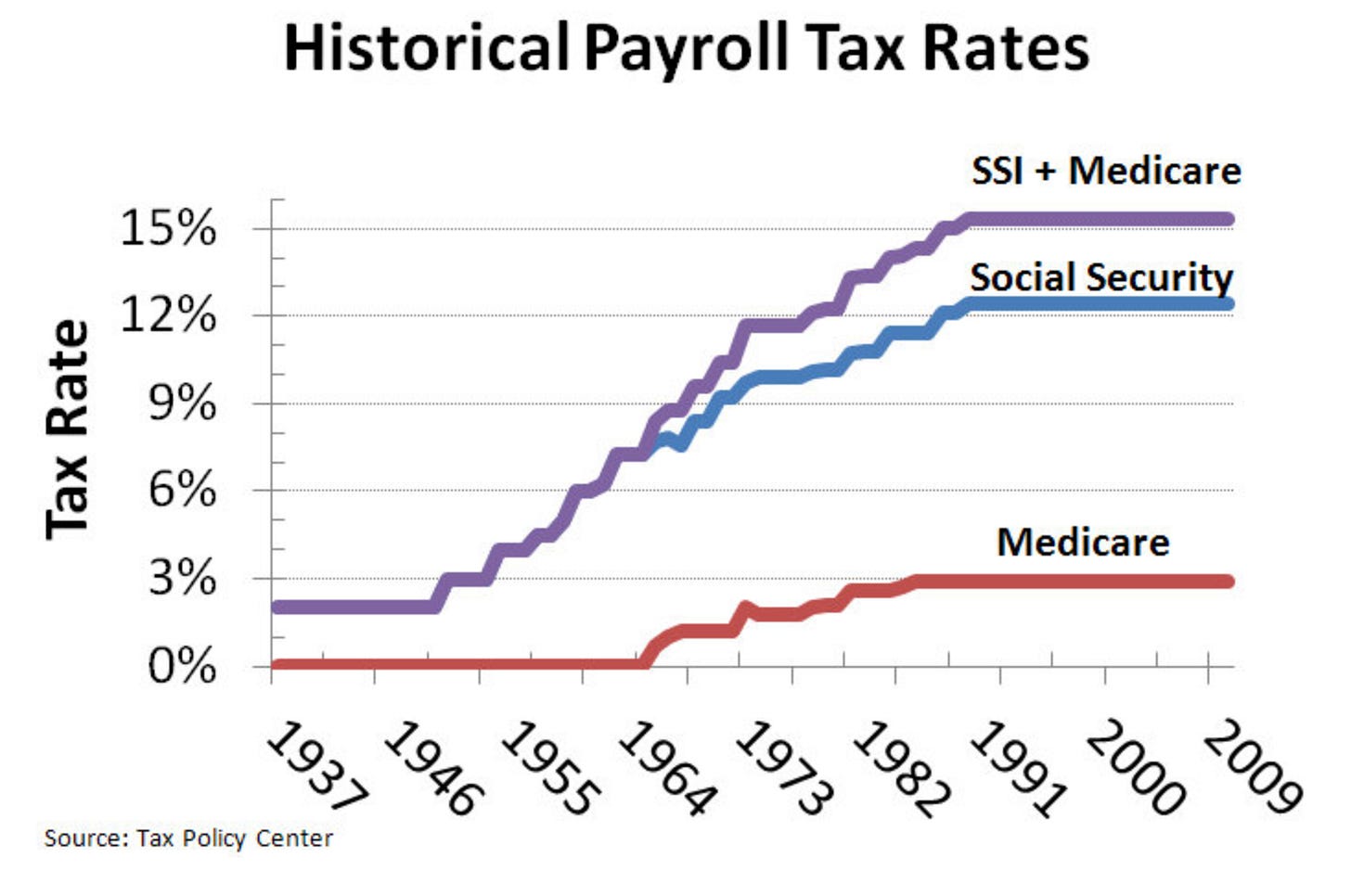

As far as the amount taxed, it started at 1% for both employers and employees (for a total of 2% of earnings), eventually growing to 3.625% for each, totaling 7.25% by 1965.

Then they added a Medicare tax.

And they kept ratcheting up the total amount being taxed for the next several decades.

Like so:

You know the old adage, ‘If the camel gets his nose in the tent, the rest of him is soon to follow’?

Yeah, well, the camel here is the US Treasury🐪 and the tent is your paycheck ⛺️.

Beware of the camel’s nose.

But let’s assume that this program was started with honorable intentions. I mean, it has been a lifeline for many people over the last 80+ years, right?

But how well has the Social Security System really worked?

To answer that, we have to understand how it works first.

🧐 Social Security Trust Funds

There are town main aspects of the Social Security program, the Administration (or SSA), and the Trust.

The SSA is the federal agency responsible for administering Social Security programs, like retirement, disability, and survivor benefits.

In other words, the SSA processes applications, determines eligibility, calculates benefits, and distributes payments.

It also conducts research, collects data, and publishes annual reports on the financial status of trust funds, as well as providing expertise to Congress, drafting regulations, and implementing legislative changes.

The other aspect, the Social Security Trust Funds consist of the Old-Age and Survivors Insurance (OASI) Trust Fund and the Disability Insurance (DI) Trust Fund.

These Trusts are managed by none other than the US Treasury, who collects revenues and invests the surpluses.

And what do they invest in?

Would you guess US Treasuries?

See, by law, the Social Security Trust Funds are required to invest any surplus revenues in special-issue Treasury securities. These securities are not available to the general public and are specifically issued for the Trust Funds.

The interest rates on these special-issue securities are formulaic, based on the average yield on marketable Treasury securities.

The ones the public buys.

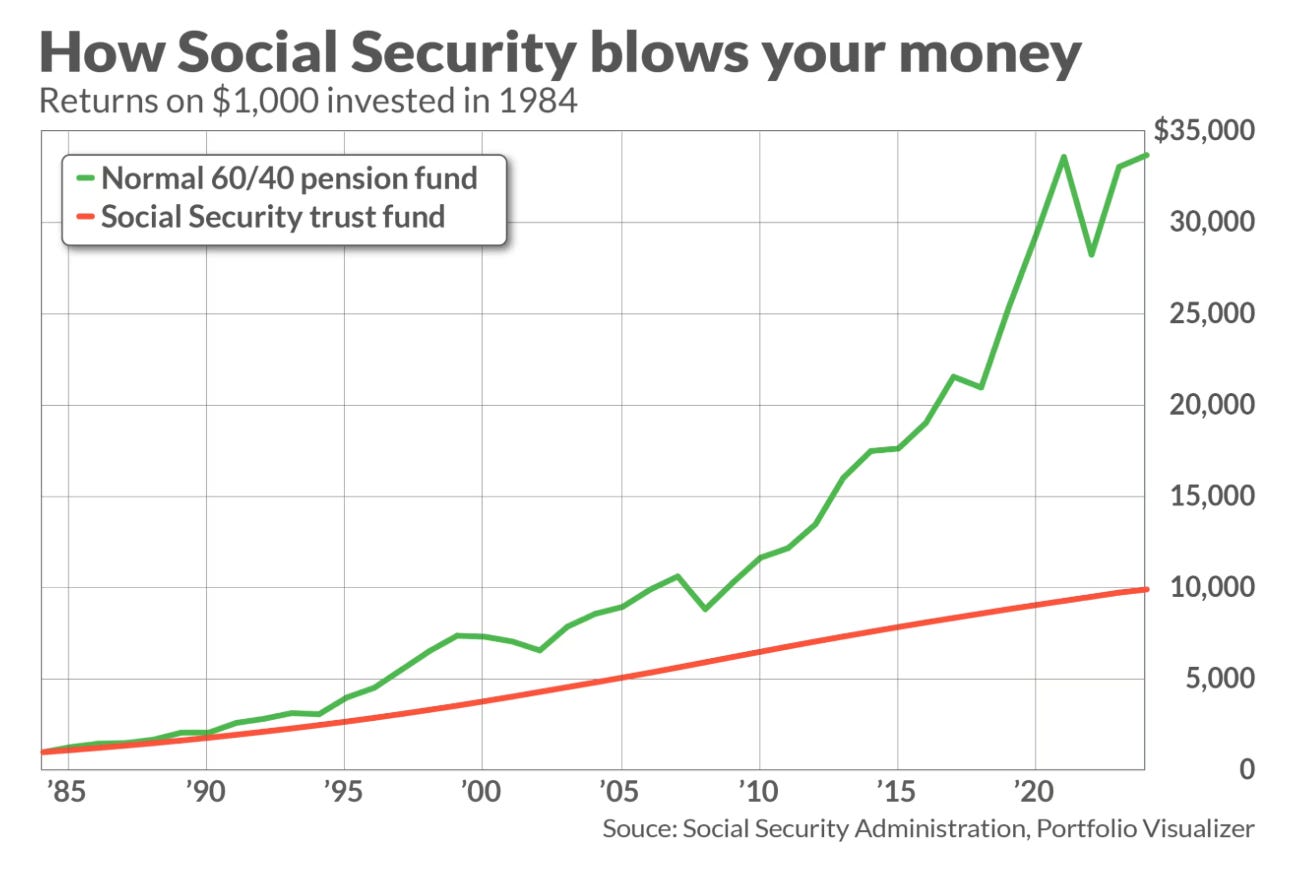

Now you may be asking, OK, so how have the Trusts’ returns been?

Let’s see.

Ouch.

And this may be why.

Look back at the first chart here and how the 60/40 portfolio with risk assets really decoupled from Treasuries in 2010 or so.

Why?

When you unnaturally manipulate yields and drive them lower for over a decade, you create negative real yields.

Translated: money is not just cheap, it pays to take out loans and borrow, as inflation outpaces the yield on bonds.

Further translated: You are being paid to borrow money at those artificially low rates.

An so, it makes it difficult for bonds returns to compete with risk assets, which, as a result, appreciate markedly.

Oops.

And did anyone else notice that little detail up there about who was buying what from who in this whole Social Security Trust Fund scenario?

Exactly.

The US Treasury collects taxes from you and me, then it invests that money in US Treasury bonds.

But not just any US Treasuries. These are special ones.

Ones that they issue itself. To itself.

And then pay interest on them.

To itself.

And since we operate in a perpetual deficit, in order to pay itself and pay off the principle of continuously maturing debt, the Treasury has to go ahead and issue even more debt to the public.

Just to keep the whole charade going.

If by now, that tent image from above has morphed into a three-ring circus tent in your mind, you’re not alone. 🎪🎪🎪

🤔 Inflation and COLA

Remember, though, because of all that money manipulation, we also have other phenomenon to deal with.

Inflation.

And so, the SSA adjusts for inflation through a mechanism called the Cost-of-Living Adjustment (COLA).

These adjustments have been in place since 1975.

Surprise, surprise. That’s 4 years after Nixon took the US dollar completely off the Gold Standard and when monetary expansion exploded.

See, before 1975, Social Security benefit increases were determined by special legislation.

Now, with the introduction of automatic COLAs, increases are based on changes in the Consumer Price Index (CPI) for Urban Wage Earners. In 2023, the COLA was 8.7%, to account for the most recent Fed-induced inflation spike.

Great for the current and soon-to-be retirees, but added stress on the system overall.

How much stress?

Well, let’s get to that question of how well has the Social Security System really worked?

🤨 Social Insecurity

You know how the Fed has been perplexed by the labor market since the whole lockdown thing?

It turns out that a lot of later-aged workers were either scared right out of working (too dangerous to be surrounded by infectious diseases) or just plain lost their passion for working after having a taste of semi-retirement when forced to stay home.

Either way, labor participation plummeted, and mainly from Baby Boomers close to retirement age.

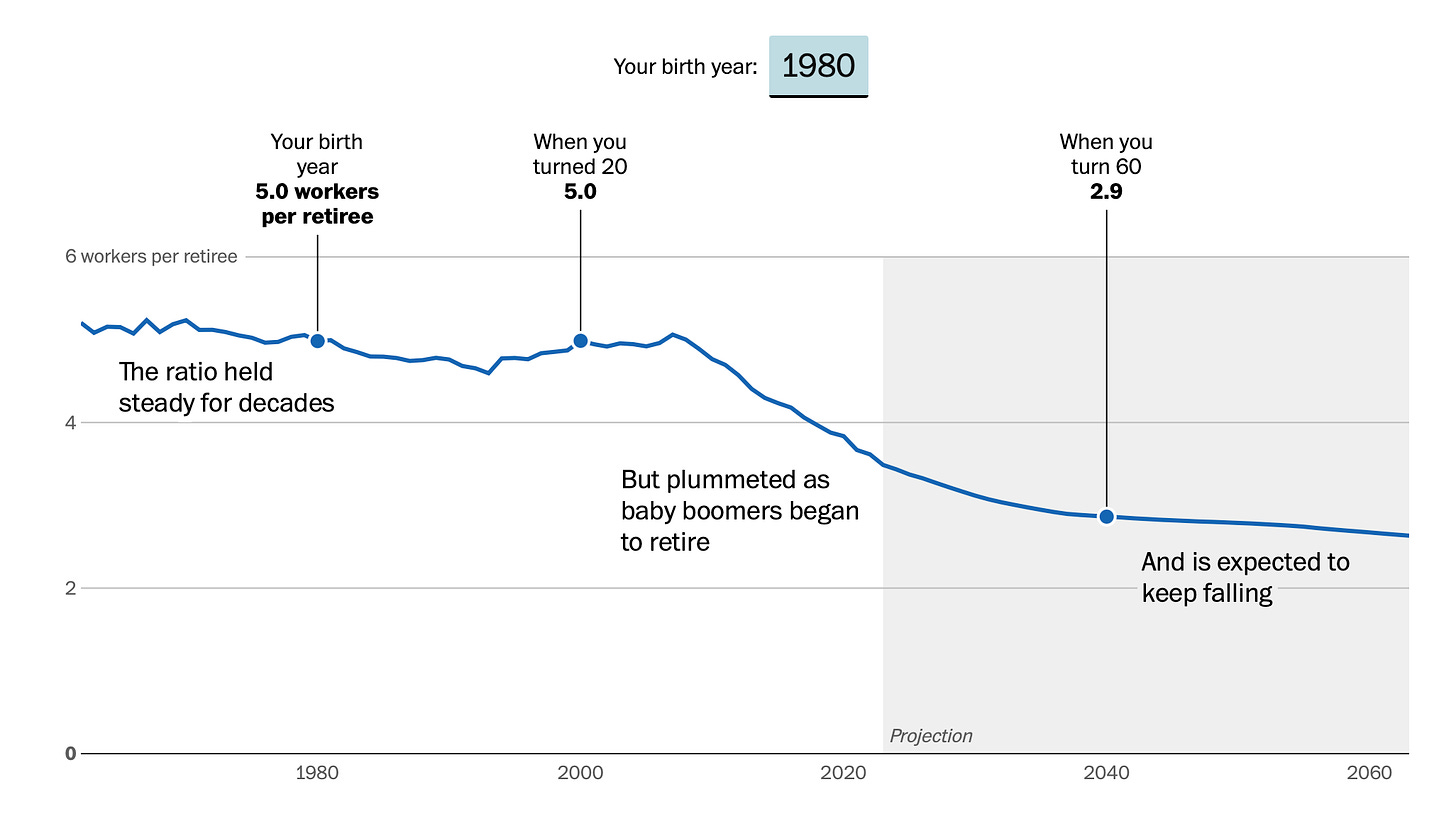

And remember above, where we detailed the nature of the program? That key aspect called Social Insurance Principle, where contributions from current workers fund the benefits for current retirees?

The whole reason that this program is mandatory and not a choice.

With all the expedited retirements, it seems the Baby Boomers are leaving the younger generations holding the bag, so to speak.

And so if you are a Gen-X or younger, there simply won’t be enough current workers to fund the program and pay you back for all of your contributions over the years or decades.

In a nifty little graphic created by The WaPo of all pubs, you can see how it looks for someone your age. Here’s an example of a Gen-X/Millennial worker:

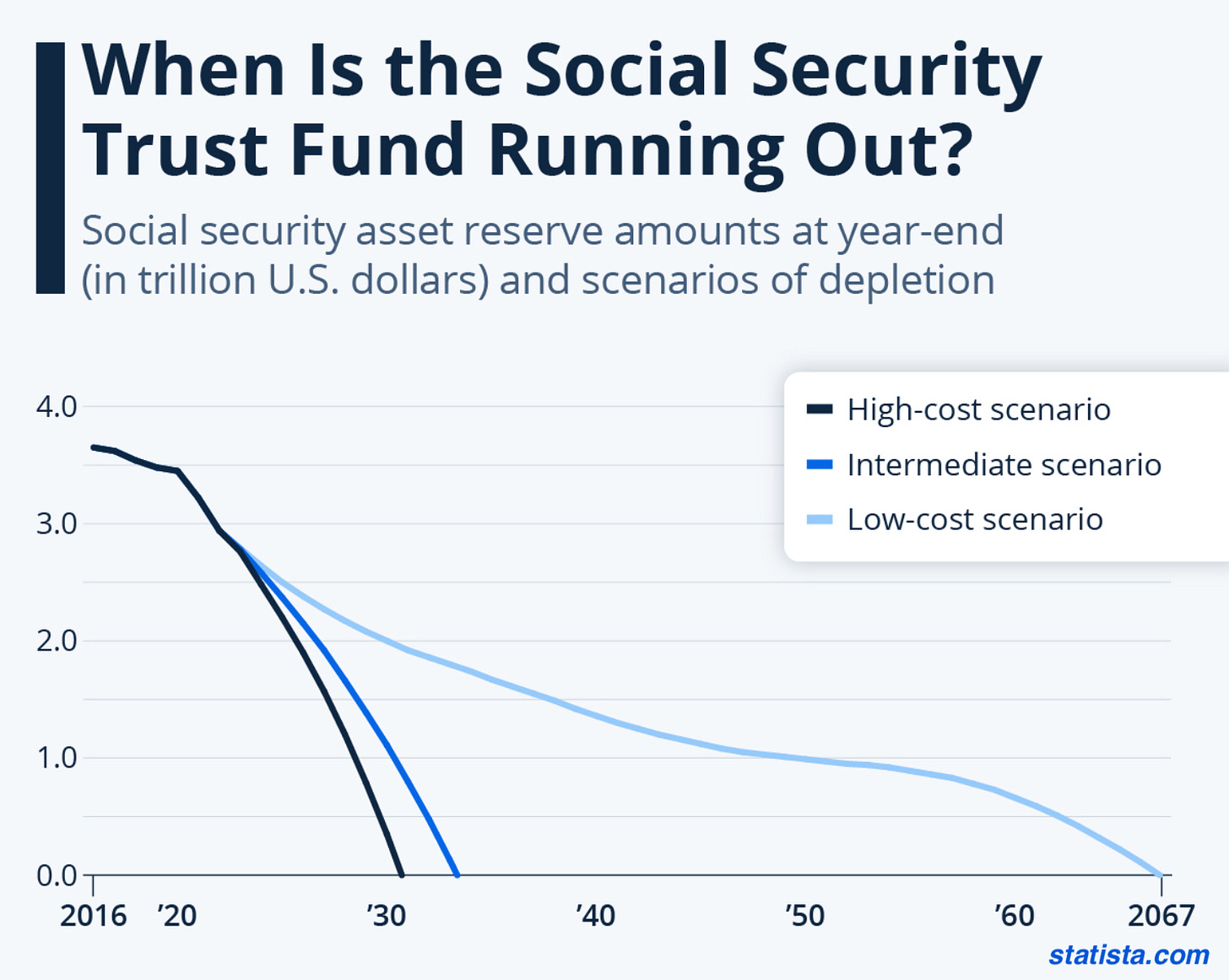

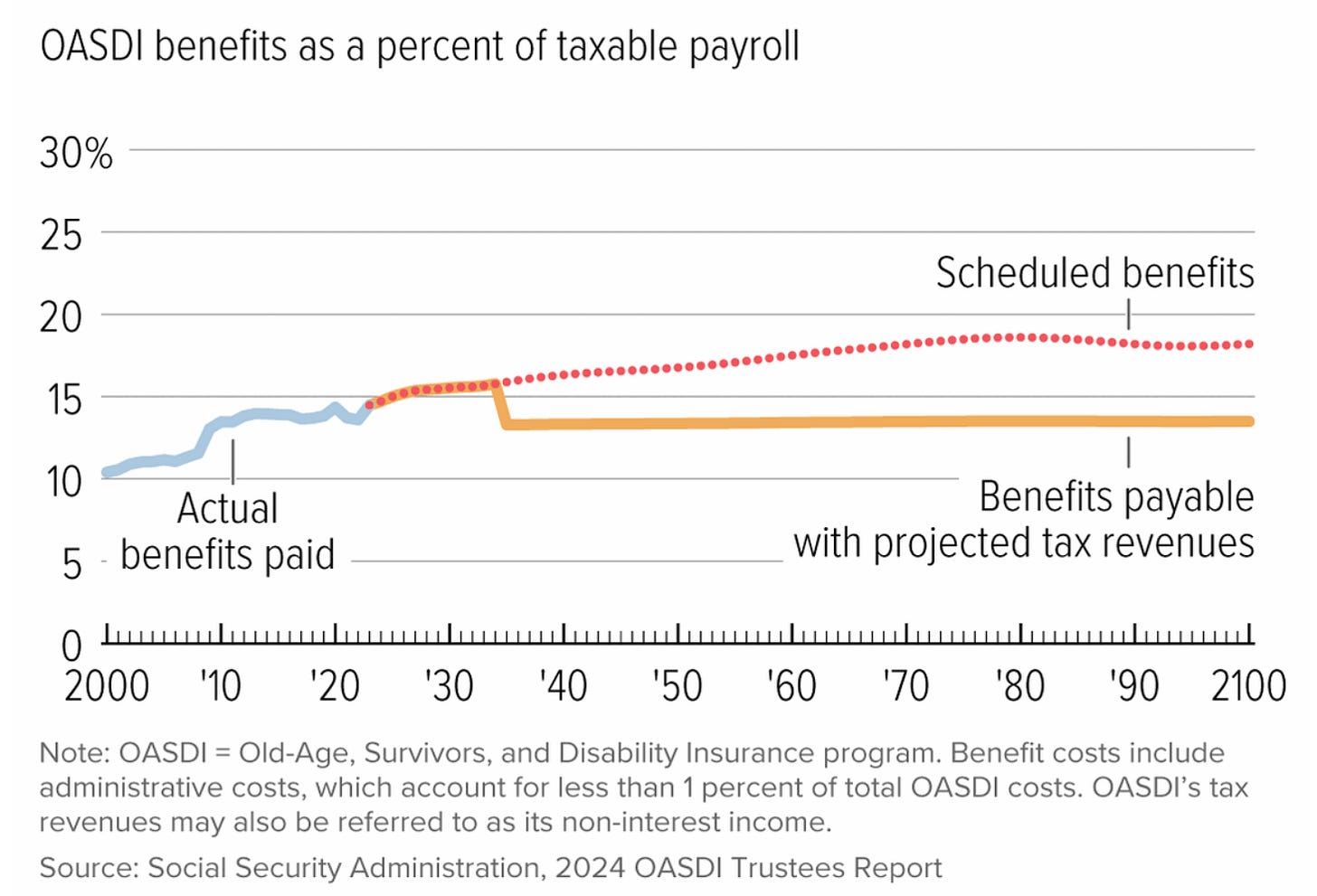

And because of the Social Security genius created math of pay-in versus pay-out, this is where we are headed:

‘Sucks to be you’ (and me).

How much does it suck?

Well, I know I am getting dinged for at least 28% and will only receive about 72% of what I paid in, as it stands.

At least that’s what the latest figures show.

This is because the Treasury will have no Fund anymore. It will be insolvent.

Drained.

Like an FTX IOU, we’ll be lucky to get 70 cents on the dollar.

And the only money they will have for payouts is the taxes they collect from current workers.

What a deal.

Sounds like that camel may just take up a bit more of the tent, doesn’t it?

Bottom line, it is clear that Social Security is not sustainable over the long term at current benefit and tax rates.

The only question remains is, what direction will the Treasury and government go to ‘shore up’ the Social Security system?

I doubt they will cut benefits, as that is pretty much political suicide.

They also won’t cut spending elsewhere in order to make up the shortfall with other taxes. They need to get re-elected, remember, and their protected and favored pork-belly receiving constituents are the ones who re-elect them.

They may raise the payroll and Social Security taxes again. It has been a while, and so, that is a possibility.

Though it’s also unpopular to raise taxes on the entire nation, across the board.

And so my guess is that rather than fiscal reform, there will be additional fiscal manipulation instead.

Whether it is straight money printing or special Fed and/or Treasury created acronyms that are ‘temporary’ (until they are permanent, like so many other government-created short-term fixes), they will find the cash somewhere.

Magically.

But make no mistake.

Inflation. Taxes. Special programs that are fiscally funded through deficits and monetary expansion.

One way or another, we will pay for it.

Even though so many of us already paid in.

And so, if you are like me, you are determined to not ever need Uncle Sam to pay you back. You’ll seek to be financially independent from the Social Security system.

One way to do this is to relentlessly gather assets that appreciate in face of long-term perpetual inflation. Assets like gold, silver, and Bitcoin.

Or create cash flows that are super easy to maintain, even in retirement.

That’s my plan anyway.

Because I don’t trust that ‘it will all just work itself out’, magically.

And, as far as I can see, neither should you.

That’s it. I hope you feel a little bit smarter knowing about Social Security, the state of the system, and how it may affect you.

If you enjoyed this free version of The Informationist and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️

Great read, thank you James! Question here that always puzzled me - the limit at which the contributions stop. In 2024 it is $168,600. One would think that inreasing this limit, or eliminating it alltogether could help with the deficit and make it more fair with wealthy earners contributing at the same rate as the lower paid earners. I don't see even Democtrats suggesting this seemingly very obvious measure. Is this some sort of "taboo"?

As far as I know, nowadays only Qataris and Norwegians can stay calm in that matter. Here in Poland we have similar worries....