💡 The Most Crowded Trade on Wall Street

Issue 131

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What Is TLT (And Why Should You Care)?

The Mechanics of Short Selling

The Most Crowded Trade on Wall Street

Investment Implications (And What to Do About It)

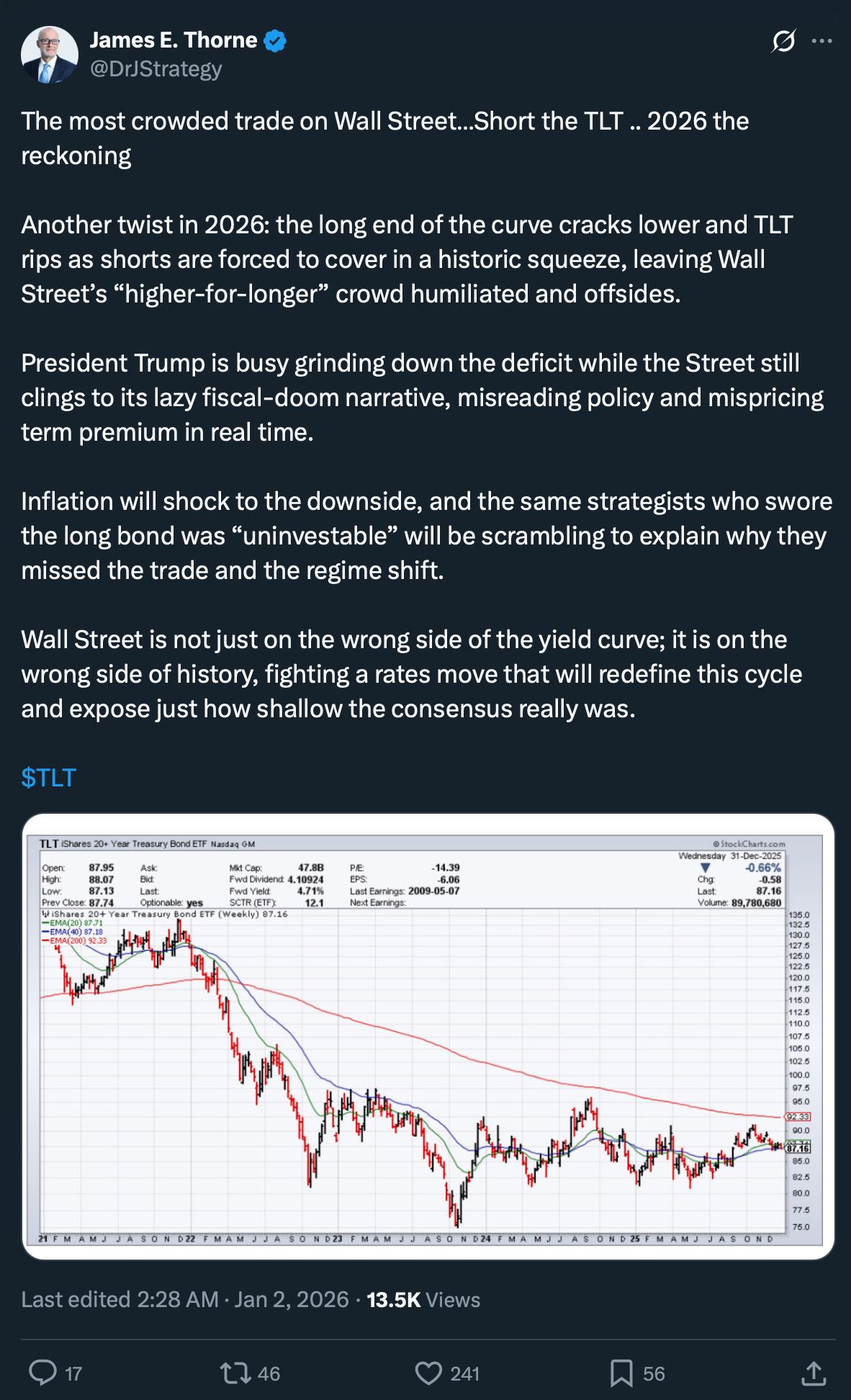

Inspirational Tweet:

If you have not already heard or read about it, there’s a trade that hedge funds have piled into, deeper than any time in at least 15 years.

They’re calling it “the most crowded trade on Wall Street.”

But it’s not some random meme stock or AI moonshot. It’s the most important government bond ETF in the world.

The ticker? TLT.

The trade? Betting that long-term interest rates will stay high, or go even higher.

The problem? When everyone crowds onto one side of a boat, even a small wave can cause a big shift.

So what exactly is this trade? How does shorting it actually work? And what exactly does this crowded positioning mean for your portfolio?

All good questions, and ones we will answer, nice and easy as always, here today.

So, pour yourself a big cup of coffee and settle into your favorite seat for a look at the most crowded trade on Wall Street with this Sunday’s Informationist.

Partner Spot

Bitcoin Is the Greatest Asymmetry

As billions of people compete for a fixed supply of 21 million coins while fiat currency supplies continue to expand, bitcoin’s risk-reward profile stands apart. On January 7 at 10 AM CT, join Unchained and Parker Lewis for an online video premiere exploring the forces shaping bitcoin’s opportunity today and what current market and policy conditions may mean going forward.

A talk originally given on December 10th at the Old Parkland debate chamber in Dallas, Parker covers:

Why bitcoin is fundamentally asymmetric, grounded in first principles

How probability—not short-term price—shapes the risk-reward profile

What current market conditions and Fed policy mean for bitcoin in 2026

If you want a clearer framework for thinking about bitcoin’s opportunity and the risks of overlooking it, this is the talk to share with friends and family.

Tuesday, January 7 at 10 AM CT — online, free to attend. Register now:

💸 What Is TLT (And Why Should You Care)?

Before we get into the trade itself, let’s make sure we’re all on the same page.

TLT is the ticker symbol for the iShares 20+ Year Treasury Bond ETF, managed by none other than BlackRock. It’s one of the easiest and most popular ways for investors to get exposure to long-duration US Treasury bonds. Specifically, bonds with maturities of 20 years or more.

Why does this matter?

Because long-term Treasury yields are the heartbeat of the entire financial system. They influence everything from your mortgage rate to corporate borrowing costs to how much the US government pays to service its growing mountain of debt.

Here’s the simple relationship between those bonds and the TLT share price: when long-term yields rise, TLT falls. When yields fall, TLT rises.

Translated: when interest rates rise, TLT falls and vice-versa.

That’s it. TLT is essentially a bet on the direction of long-term interest rates.

With nearly $48 billion in assets under management and about 550 million shares outstanding, TLT is the single most liquid way for most investors to express a view on the long end of the yield curve.

So when institutional traders want to bet that rates are going higher, or hedge their portfolios against rising yields, they often do it by shorting TLT.

Which brings us to a question I am often asked by regular everyday non-professional investors.

What does it actually mean to “short” something, and how does it work?

📉 The Mechanics of Short Selling

OK, so everyone keeps hearing about “shorts” and “short interest” and “crowded trades.” But what does shorting actually mean?

If you do not understand this, you are not stupid, it’s a bit confusing to anyone who is new to the idea.

So, let’s start from scratch.

Put simply, when you short something, you’re betting that it goes down instead of up.

But how do you actually profit from a decline? You can’t just buy something and hope it falls. The mechanics are completely opposite. You have to borrow shares, sell them immediately, and hope to buy them back later at a lower price.

Sounds straightforward enough. But there’s a big detail and risk to be aware of for any short seller.

See, when you buy a stock the normal way, the worst that can happen is it goes to zero. You lose 100%. Done. But when you short? Your losses are theoretically unlimited. Because there’s no ceiling on how high a price can go.

And it gets worse. If the trade moves against you, your broker can force you to close the position at the worst possible time. And if that happens to a bunch of short sellers at the same time, you get a feedback loop that can send prices parabolic.

This is exactly what happened to Melvin Capital after it rang up massive losses from shorting GameStop (GME) in 2021. And believe me, they weren’t the only casualty from that trade.

As you know, hedge funds are notorious for shorting stocks. Hence the label ‘hedge’ fund.

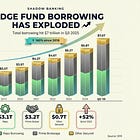

Remember last week’s newsletter? Where we talked about hedge funds piling on massive leverage in their portfolios? Right. This is part of that.

If you want to go back and peek at exactly how, here is the link to that issue:

TL;DR: Hedge funds are using about $700 billion is securities lending primarily for short selling right now.

Now you may be asking, where do the borrowed shares come from? Who’s on the other side of this trade? And what does any of this have to do with your 401(k)?

Let me show you exactly how it all works. Take a few minutes to look at this infographic first: