💡 Will Hedge Funds Blow Up From Leverage?

Issue 198

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What Is Hedge Fund Leverage?

Repo Borrowing: The Overnight Money Machine

Prime Brokerage: The Big Bank Credit Line

Securities Lending and Derivatives: The Hidden Web

The LTCM Parallel: When Leverage Breaks

Inspirational Tweet:

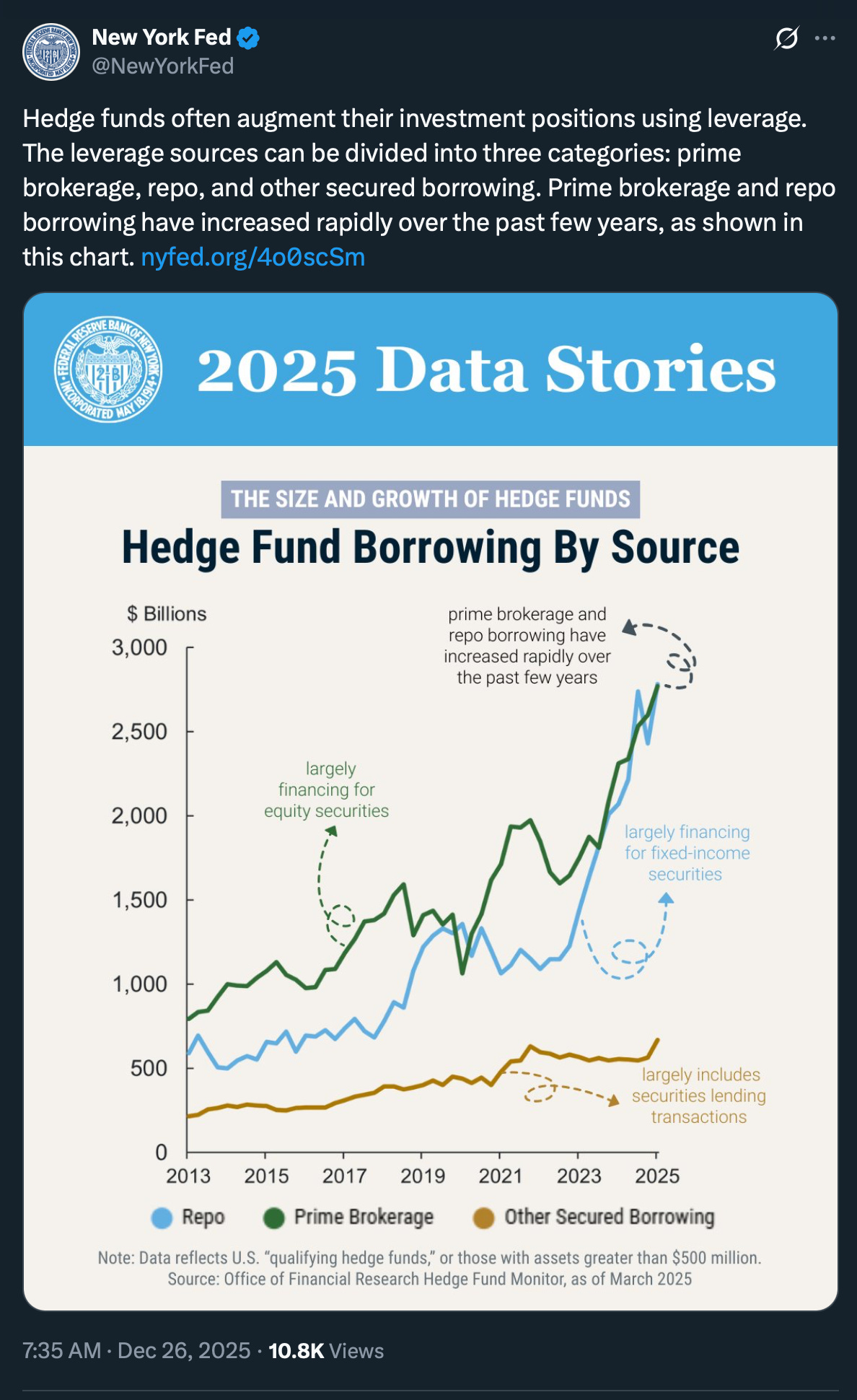

The New York Fed quietly dropped this chart the day after Christmas, and I almost spit out my egg nog.

Not really, I don’t drink that stuff. Almost as nasty as that chart. 😝

Look at those lines.

Hedge fund borrowing has tripled over the past decade. Repo borrowing alone is approaching $3 trillion. Prime brokerage is nearing $3 trillion more. All three sources of leverage are at or near record highs.

Of course, the Fed is publishing data that’s already a few months old. The updated numbers are even worse. Combined, hedge funds have now borrowed over $7 trillion.

And here’s what concerns me: most of this borrowing is financing a handful of crowded trades, using overnight loans that have to be rolled every single day.

If that sounds like a recipe for disaster, well, we’ve seen this movie before. It was called Long Term Capital Management. And it nearly broke the entire financial system.

So how exactly are these funds borrowing all this money? How does their leverage actually work? And should you be worried about what happens to your portfolio if and/or when it all unwinds?

Good questions, important ones. And we will answer each of them, nice and easy as always, here today.

Now, a quick note: this is the last Informationist of 2025, and I wanted to make it a good one. It’s a bit longer than usual, with more graphics than normal. I’ve been working on a new visual style to make these complex topics easier to digest, and I think you’re going to like them.

So, with that, pour yourself a big cup of coffee, settle into your favorite chair, and take your time with this one. No rush. Because we are closing out the year by getting you smart on the mountain of leverage hedge funds are piling up and why it could matter for your own portfolio someday soon.

Partner spot

Bitcoin Is the Greatest Asymmetry

As billions of people compete for a fixed supply of 21 million coins while fiat currency supplies continue to expand, bitcoin’s risk-reward profile stands apart. On January 7 at 10 AM CT, join Unchained and Parker Lewis for an online video premiere exploring the forces shaping bitcoin’s opportunity today and what current market and policy conditions may mean going forward.

A talk originally given on December 10th at the Old Parkland debate chamber in Dallas, Parker covers:

Why bitcoin is fundamentally asymmetric, grounded in first principles

How probability—not short-term price—shapes the risk-reward profile

What current market conditions and Fed policy mean for bitcoin in 2026

If you want a clearer framework for thinking about bitcoin’s opportunity and the risks of overlooking it, this is the talk to share with friends and family.

Tuesday, January 7 at 10 AM CT — online, free to attend. Register now:

🤓 What Is Hedge Fund Leverage?

Let’s start with the basics, shall we?

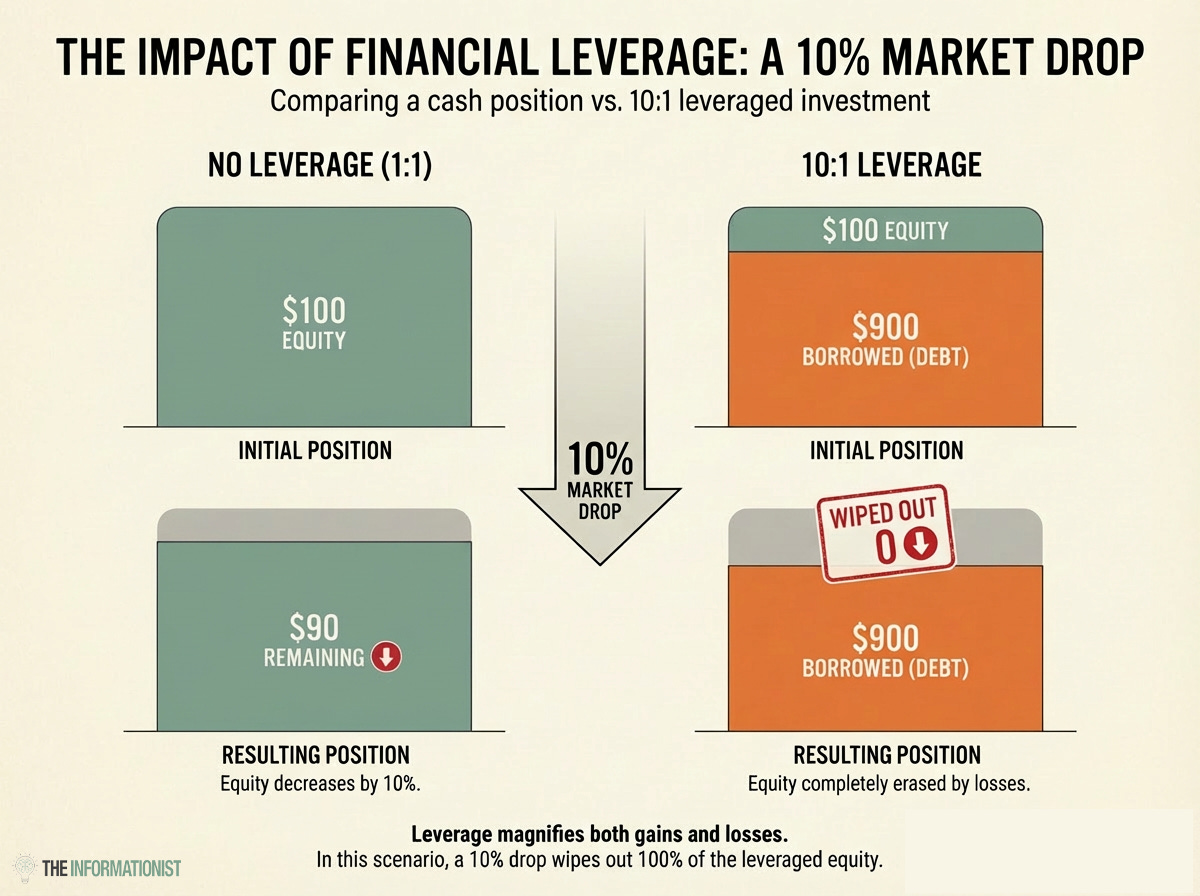

Leverage is simply using borrowed money to amplify your bets. If you put down $100 of your own money and borrow $900 more, you’re leveraged 10:1. If your investment goes up 10%, you don’t make 10%, you make 100% on your original money.

Beautiful, right?

But here’s the thing. If that investment goes down 10%, you don’t lose 10%. You lose everything. Your entire investment. Gone.

This is the double-edged sword of leverage. It magnifies gains and losses.

Now, you and I might use a little leverage when we buy a house with a mortgage. Maybe we put 20% down and borrow the rest. That’s 5:1 leverage, and banks are pretty comfortable with that.

Hedge funds? They play a different game entirely.

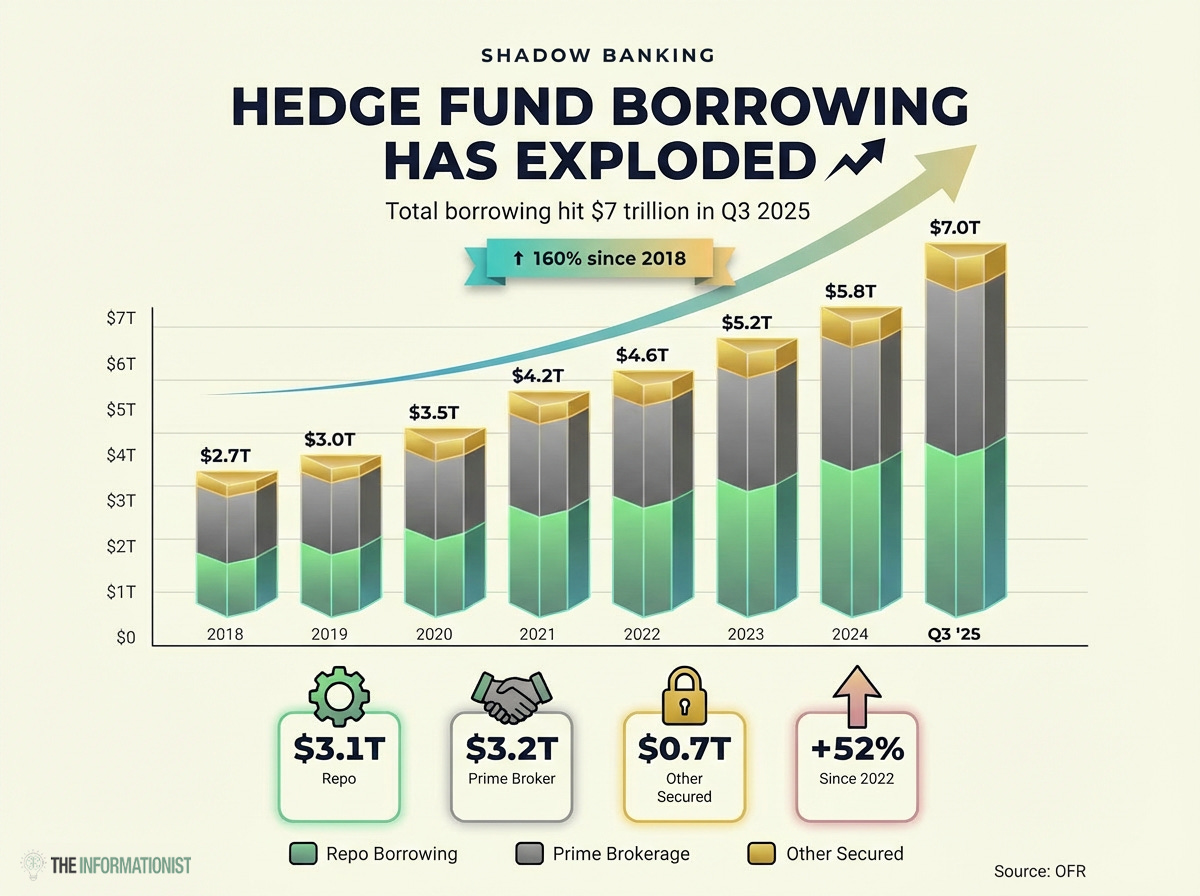

According to the latest data from the Office of Financial Research, total hedge fund borrowing hit a record $7 trillion in Q3 2025. That’s up 160% since 2018.

And gross leverage among hedge funds recently hit 294%, a five-year high.

Put simply, for every dollar of actual investor capital, hedge funds are controlling nearly three dollars of assets. Some funds, particularly those running certain arbitrage strategies, are leveraged 50:1 or even 100:1.

Good Lord.

But not all leverage is created equal. As you can see in the chart, hedge fund borrowing breaks down into three categories: repo borrowing (green), prime brokerage (gray), and other secured lending (gold).

Let's walk through each one, so you understand exactly what these funds are doing and how.

And then we will walk through how it can all affect you.

🧐 Repo Borrowing: The Overnight Money Machine

See that green section of the bars that’s been growing relentlessly? That’s repo borrowing, now sitting at $3.1 trillion and climbing.

So what exactly is repo?

I’ve spoken quite a bit about repos before, but for those of you who are new around here or for anyone who wants a refresher, it’s pretty simple.

Repo is short for repurchase agreement. It’s essentially a short-term collateralized loan, but structured as two transactions.

Let’s say a hedge fund owns Treasury bonds (many own a lot of them). Now it ‘needs’ cash to make more investments. So it enters a repo: it “sells” Treasuries today and agrees to buy them back tomorrow (or in a few days) at a slightly higher price. That price difference is effectively the interest on the cash it borrowed.

The hedge fund gets cash today, the lender holds Treasuries as collateral, and then the transaction reverses at maturity.

Simple enough.

But here’s where it gets really spicy — and dangerous for everyone.