💡The 50-Year Mortgage: Financial Innovation or Expensive Trap?

Issue 192

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What Trump is Proposing (And Why It Matters)

The 30-Year vs 50-Year: Running the Numbers

The Other Side of the Borrowing Coin

Inspirational Tweet:

Another week, another wild idea out of the White House.

This time, Trump posted a graphic on Truth Social comparing himself to FDR, with one key difference. Where FDR championed the 30-year mortgage during the New Deal, Trump suggested he’d go further: the 50-year mortgage.

Within hours, his own FHFA Director Bill Pulte called it “a complete game changer” for housing affordability.

And the internet exploded.

Conservative commentators, housing experts, and even Fox News host Laura Ingraham told Trump the idea “has enraged your MAGA friends.”

The Wall Street Journal editorial board torched it. Kevin O’Leary from Shark Tank explained on CNN why ‘it’s a terrible deal’.

And within 48 hours, Trump himself walked it back, saying, “it’s not like a big factor. It might help a little bit.”

So which is it? A game changer or a raw deal?

Well, to see if a 50-year mortgage actually makes sense, we need to run the numbers. While on the face of it, the pitch sounds appealing—lower monthly payments, easier to qualify—the math tells the whole story.

But don’t worry, we’re going to unpack and lay it all out for you, nice and easy as always, here today.

So pour yourself a big cup of coffee, and settle into your favorite chair for a simple dive into mortgages with this Sunday’s Informationist.

Partner spot

Secure your bitcoin’s future—and your family’s peace of mind. Too many heirs lose access to bitcoin because there’s no clear inheritance plan. We’ll show you how to change that.

On Wednesday, Nov 19 at 11:00 AM CT, join Dhruv Bansal (CSO, Unchained), Jeff Vandrew (CFO & CLO, Unchained), and Joshua Preston (CEO, Gannett Trust) for a live fireside chat on how to make your bitcoin legacy secure, simple, and built to last.

We’ll cover:

Transfer on death beneficiaries: A new Unchained feature for designating who inherits your bitcoin and remove uncertainty for your family.

Connections: Our vaults are uniquely built to let you share custody to help your heirs or trusted partners securely recover your bitcoin when it matters most.

Estate planning: How Gannett Wealth Advisors’ expert financial guidance integrates with Unchained to protect your keys and your legacy.

Bring your questions—this conversation is designed to give you clarity on how to make inheritance seamless with real bitcoin, not IOUs.

WHEN: Wednesday, Nov 19 at 11:00 AM CT — online, free to attend.

🧐 What Trump is Proposing (And Why It Matters)

The concept is simple: instead of paying off your mortgage in 30 years, why not spread it over 50? I mean, lower monthly payments, easier to qualify.

Problem solved, right?

At first glance, the logic makes sense.

Homeownership has become unaffordable for millions of Americans. Median home prices are near all-time highs. Mortgage rates have been stuck above 6% for years.

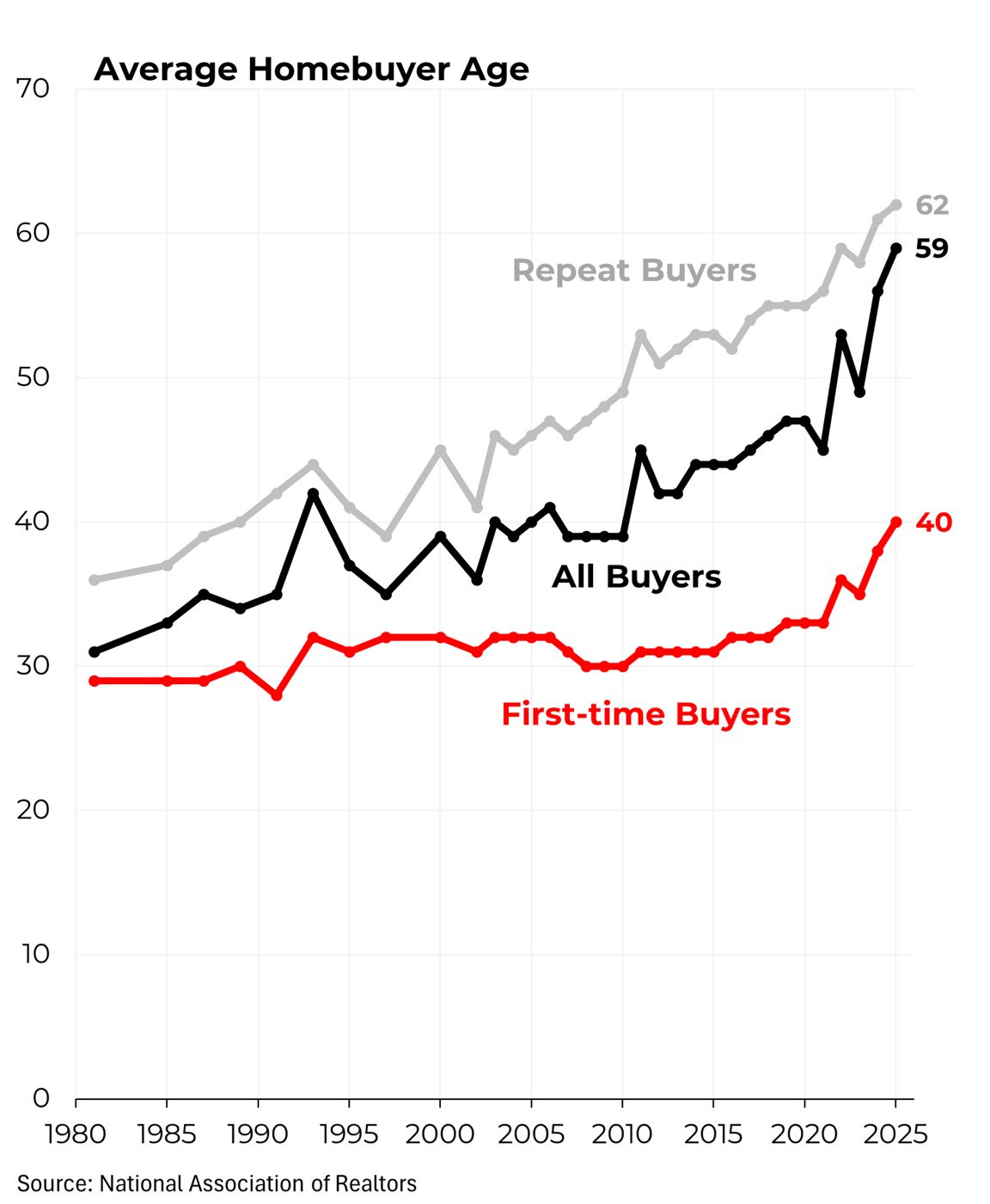

As a result, average first-time homebuyers are now 40 years old, the highest ever recorded.

Just ten years ago, first-time buyers were in their early 30s. Now prices and rates have made homeownership nearly impossible for young families.

So Trump’s idea is, let’s lower the monthly payment by stretching the loan over 20 more years. That way, more Americans can afford to buy.

But there’s a problem with this logic. Well, actually several problems.

First, under current law (the Dodd-Frank Act), mortgages longer than 30 years are not treated as “Qualified Mortgages.” That means Fannie Mae and Freddie Mac can’t back them. So getting a bank to back that 50-year mortgage is harder than the conventional 30-year. Changing this would require legislation.

And we all know how efficiently Congress operates these days. If at all. 🤡

Second, and more importantly: this still doesn’t solve the affordability problem. It actually could make it worse.

You may be asking, how?

Let’s go back to first principles, shall we? Like Econ 101.

When you make it easier for buyers to qualify by lowering monthly payments, you’re not increasing housing supply. You’re increasing demand. More buyers chasing the same number of homes means prices go up.

The US Chamber of Commerce estimates we’re currently short 4.7 million homes.

And Realtor.com Senior Economist Joel Berner agrees: “More flexible financing is essentially a subsidy for housing demand, which will add to the pool and buying power of homebuyers without increasing the supply of homes, which will drive home prices up. The ‘savings’ from 50-year mortgages may be totally negated by rising home prices.”

Also, there’s the small matter of what this type of mortgage does to your wealth over time. And that’s where the math gets, well…interesting.

But we have to look at both sides of the equation on this one.

Because here’s what nobody’s talking about: Why would the Trump administration actually push for this?

Sure, the official story is “helping Americans afford homes.” But like most government policies, the real motivations run deeper.

Here are two things 50-year mortgages actually accomplish:

Inflated Asset Prices (By Design)

Remember that supply-demand problem we just talked about? That’s not a bug, it’s a feature.

more buyers = higher prices = homeowners feel wealthier = votes for incumbents

The “economy is strong” narrative writes itself, even if those homeowners are drowning in debt. Plus, higher home values mean more property tax revenue and stronger bank collateral.

More Debt (Which the System Needs)

And as we will show in a moment, 50-year mortgages drive a whole lot more revenue for banks in the form of interest. And we all know banks love being on the right side of the interest equation.

So that’s why the government wants this (and banks won’t mind it). Now let’s look at what it actually means for your wallet.

🫨 The 30-Year vs 50-Year: Running the Numbers

Let’s be very clear about what you’re getting into with a 50-year mortgage. When we run the numbers, it may make your head spin.

We’ll use the $400,000 loan, roughly what you’d need for a median-priced home after a 20% down payment. And for today’s purposes, we will simplify all the math by just focusing on the interest of the loan.

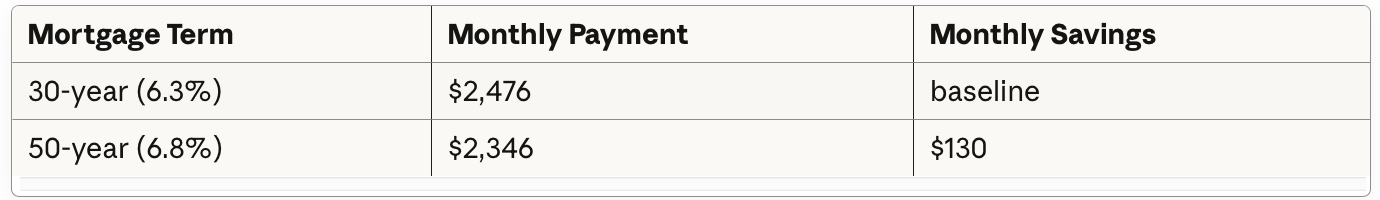

30-year mortgage: 6.3% rate (current market)

50-year mortgage: 6.8% rate (likely higher due to added risk of a longer note)

Monthly Payments

There it is. You save $130 a month with the 50-year mortgage. That’s 5.3% less than the 30-year payment.

Woohoo! That’s great, right? Right?

Well, let’s see what that $130 monthly savings actually costs you over the life of that loan. Here’s where the math gets brutal.

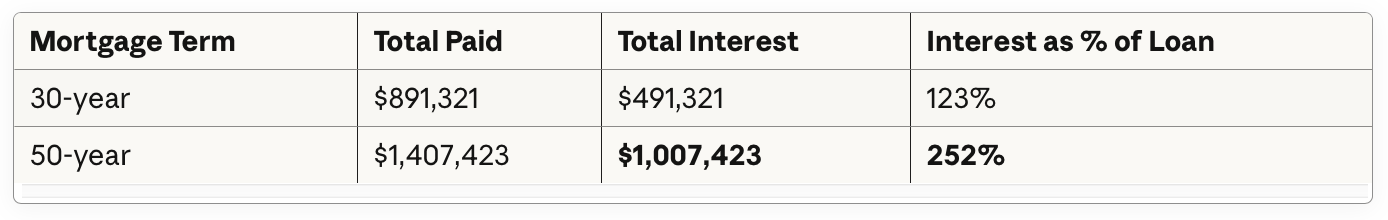

Total Interest Paid Over Life

Good, God. 😱 On a 50-year mortgage, you pay $1,007,423 just in interest.

That’s $516,102 more than the 30-year mortgage. You’re not buying a house once. You’re paying the bank about two and a half times the price of the house in interest alone.

With a 30-year mortgage, you pay 123% of the loan amount in interest. That’s already a lot. But with a 50-year mortgage, you pay 252% of the loan amount in interest.

But wait, it gets worse.

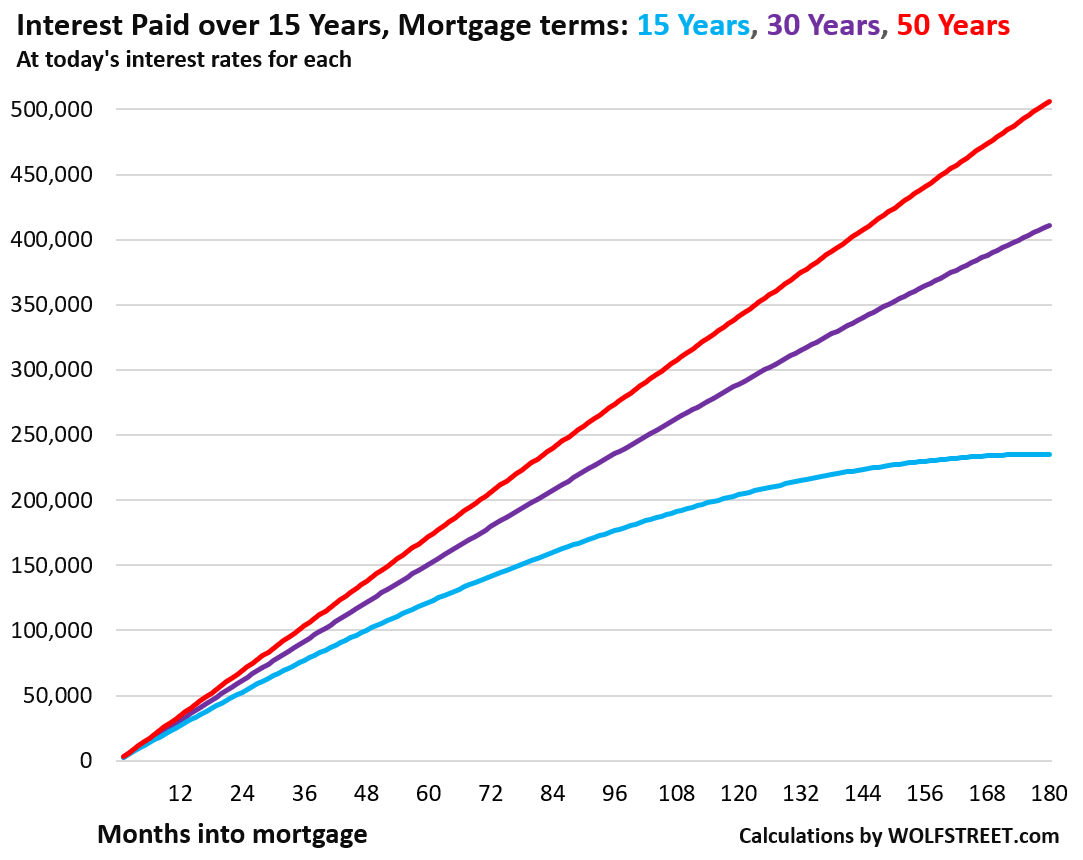

If you did not know—and why would you, unless you studied your mortgage statement—mortgages are front-loaded with interest.

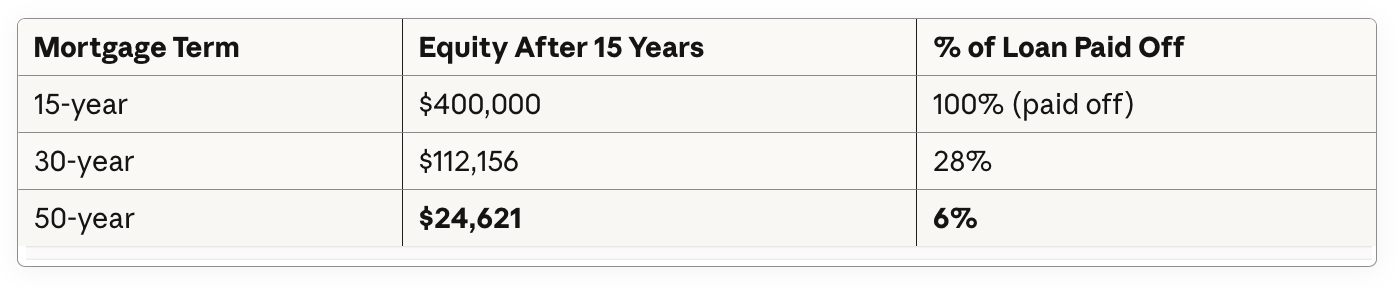

What I mean is, in the early years, almost your entire payment goes to the bank, not your equity. And so, here’s what you’d own after 15 years of monthly payments:

That’s right, after 180 payments on a 50-year mortgage, you’ve built just $24,621 in equity. That’s barely 6% of the total loan.

Said another way, you have $87,535 less equity than if you’d taken a 30-year mortgage. A massive difference.

The 50-year mortgage (red line) keeps you trapped in interest payments for decades. After 15 years, you’ve barely made a dent in the principal.

Meanwhile, the 30-year mortgage holder has accumulated more than four times that.

Now some of you may be asking, OK, OK, but what about home price appreciation?

Fair point. But here’s the problem: everyone’s home appreciates. Whether you have a 15, 30, or 50-year mortgage, your home’s value is rising (or falling) at the same rate. The difference is how much of that equity is yours vs. the bank’s.

Stop for a moment and think it through. Slowly.

With a 50-year mortgage, after 15 years you own just 6% of your home. The bank owns 94%. If your home appreciates by 50% over those 15 years (a solid gain), the bank captures most of that upside because they still hold 94% of the collateral.

Meanwhile, the 30-year mortgage holder owns 28% of their home. Same appreciation, but they capture a whole lot more of that equity gain.

And lastly, as we saw in the chart above, the average first-time homebuyer in America is now 40 years old.

A 40-year-old with a 50-year mortgage, makes payments until they’re 90 years old.

At 90, you still might not own your home outright. And many retirees live on fixed incomes from Social Security and retirement accounts.

A mortgage payment, even a small one, can be a huge burden.

OK, so now that we have the downside case out of the way, let’s see how you, as an intelligent investor, can out game the system.

🤫 The Other Side of the Borrowing Coin

Now here’s where this gets really interesting—and where we completely flip the conventional analysis on its head.

Most financial advisors will tell you the 50-year mortgage is terrible because—as we showed above—you build equity slowly and pay massive interest.

But what if you understand currency debasement? What if you know Ray Dalio’s principles about debt and inflation?

Then the 50-year mortgage might actually be brilliant.

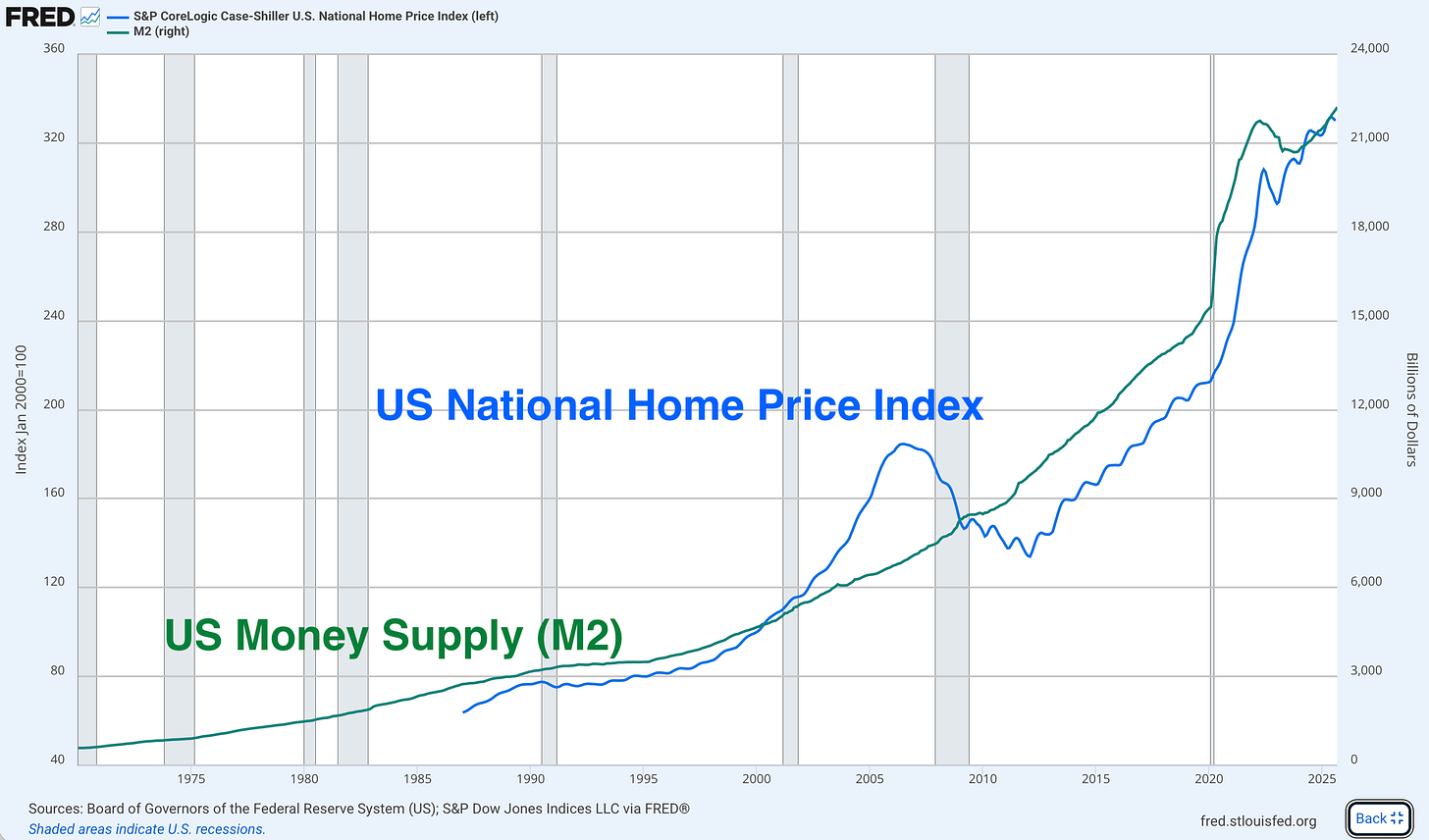

See, since 1971, when Nixon ended the dollar’s link to gold, the M2 money supply has expanded from $700 billion to $21.5 trillion, a 6.5% annual debasement. Your dollar didn’t weaken naturally. The Fed created 30 times more of them.

And can you guess what that does to home prices?

Exactly. Home prices and money supply move in lockstep.

When M2 explodes (like during COVID in 2020), home prices explode with it. When M2 grows steadily, home prices grow steadily. This isn’t coincidence—it’s cause and effect. Assets priced in dollars rise as dollars become more plentiful.

But why do they keep printing money?

As Dalio puts it: “Countries don’t default; they devalue.”

Governments print more money and inflate away the debt’s real value. The US has $38 trillion in debt and pays $1 trillion annually just in interest. The only way out is debasement, i.e., creating more dollars to pay down old debt.

This is Dalio’s core insight: “When countries have too much debt, lowering interest rates and devaluing the currency that the debt is denominated in is the preferred path, so it pays to bet on it happening.”

So here’s the strategy for sophisticated borrowers:

You exploit three things simultaneously:

1. Negative real rates - Borrow at 6.3% while currency debases at 6.5%, and you’re effectively earning 0.2% just by holding the debt

2. Invest the savings - The 50-year mortgage saves you $130/month versus the 30-year, which you invest in hard assets

3. Maximum time - Hold the debt for 50 years, letting inflation destroy its real value while your assets compound

Here’s what the math looks like on a $400,000 mortgage:

Your debt gets inflated away:

After 50 years at 6.5% debasement: real value drops from $400,000 to just $17,162 (96% reduction).

Your investments compound:

Investing $130/month at 10% annual returns for 50 years creates $2,255,462

Net result: $2.24 million in wealth.

The 50-year mortgage gives you 20 more years of this dynamic than the 30-year, 20 more years of negative real rates working for you while your assets compound.

But this only works if you actually invest the difference. If you spend that $130/month on dinners and vacations, you’re just getting crushed by interest payments while building 6% equity.

So what’s the verdict?

The 50-year mortgage is a powerful tool that could make sophisticated investors richer and unsophisticated borrowers poorer.

If you understand Dalio’s principles and actually invest the $130/month difference into hard assets, you’re getting maximum leverage at fixed rates in an environment where the government must debase the currency.

This is exactly what I do to protect myself. I own hard assets that appreciate with money supply growth. Bitcoin, gold, and quality businesses.

If you do not yet fully understand this investment approach and the reasons behind it, I wrote all about it recently, and you can find that article right here:

Until next week, keep your investing head on a swivel and keep learning about how to protect yourself from this system of debasement.

That’s it. I hope you feel smarter knowing about the true dynamics of 50-year mortgages and how currency debasement can either work for you or against you, depending on how disciplined you are.

If you enjoyed this free version of The Informationist and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️

“Mortgage” literally translates to “death pledge or death contract”. The now 40 year old average home buyer + 50 year mortgage = 90 years old. Average life span in US = 74.8-81.1 years old. Even the current 30 year model lands us right around average life expectancies 😳

Thanks for the breakdown James. I've thought about a variation of the strategy you lay out in the last half of the article with my own home, which I own outright. Should I open up a HELOC and regularly draw out of it to buy gold & BTC to hold overtime. Let debasement draw down the value of the amount I owe on the HELOC while the hard assets appreciate? Haven't pulled that trigger yet.