💡 The Debasement Trade: Wall Street's Fancy Answer For Currency Destruction

Issue 186

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Decoding the “Debasement Trade”

The Math Isn’t Mathing

Why Gold and Bitcoin Are the Escape Hatches

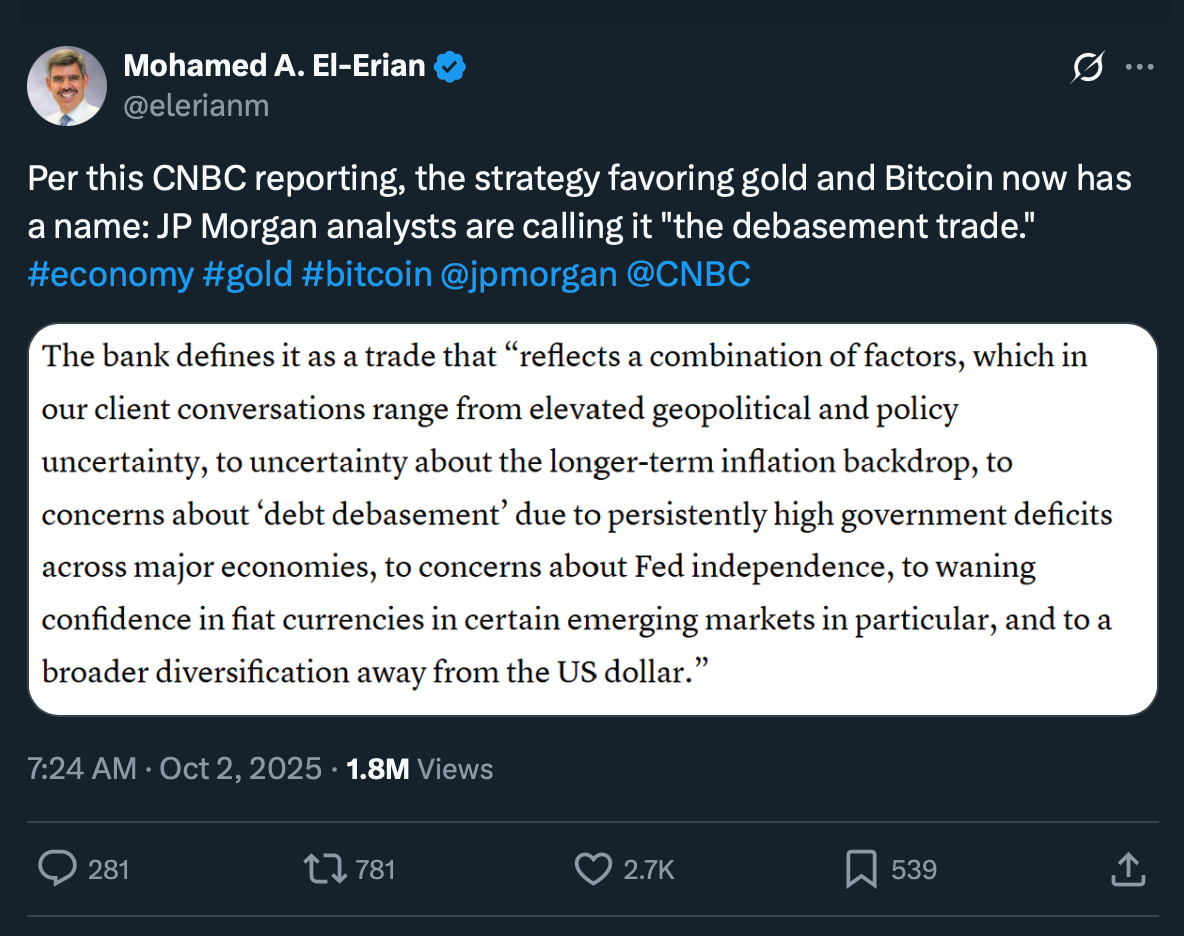

Inspirational Tweet:

Did you catch that?

Wall Street has officially given fancy branding to something that’s been staring us in the face for years: governments destroying their currencies and smart money quietly heading for the exits.

When JP Morgan starts naming trades for their clients, it means two things: (1) the trade is already happening, and (2) it’s about to go mainstream.

Some of it arguably already has.

If you are scratching your head, wondering what JP Morgan is even talking about, have no fear. Because we are going to explain the debasement trade, why it’s inevitable, and most importantly—how you can position yourself before the rest of Wall Street does.

And we will do it nice and easy, as always.

So, grab a big mug of your favorite coffee, and settle into a comfortable chair as we unpack these concepts and more with this Sunday’s Informationist.

Partner spot

You know the story of bitcoin’s market cycles: euphoric blow-offs, brutal crashes. Maybe not anymore. The Bitcoin _Checkpoint takes a deep look at how the 2023–2025 cycle has rewritten market structure—and why these changes could be permanent.

Inside you’ll find analysis of record-low volatility, ETF flows absorbing billions monthly, and why long-term holders remain in control with $1.3T in unrealized profit. Plus, download now for automatic access to the event where James Check took a deep dive into the report himself.

🔡 Decoding the “Debasement Trade”

What JP Morgan Is Really Saying

First, let’s decode what JP Morgan said in that paragraph above. Untangle the Wall Street speak so to, er…speak.

Like so:

“Elevated geopolitical and policy uncertainty” = We have no idea what governments are going to do next, and neither do they.

“Uncertainty about the longer-term inflation backdrop” = Inflation isn’t going back to 2% and staying there.

“Concerns about debt debasement due to persistently high government deficits” = Governments are printing money to make it easier to pay their bills, and it’s not stopping.

“Concerns about Fed independence” = The Fed is going to do whatever it takes to keep the government solvent, e.g., print more money.

“Waning confidence in fiat currencies” = People are realizing their dollars, euros, and yen are losing purchasing power.

“Broader diversification away from the US dollar” = Even the dollar—the world’s reserve currency—is losing its safe haven status.

And putting that all together in a nice, neat little sentence:

Your cash is being debased. You need hard assets. Now.

Let’s go a bit deeper, though, shall we?

For instance, what does ‘debasement’ actually mean?

In essence, it’s when a government deliberately destroys the purchasing power of its currency. Historically, this was done through clipping coins or diluting precious metal content.

Like this:

Or this:

Today, though, it’s far more sophisticated—and insidious.

Modern debasement happens through:

Government overspending backstopped by the central bank

When the government spends far more than it taxes and the central bank helps finance it, you get more dollars chasing the same stuff.

Think: big deficits + QE (money printing) to enable the Treasury to keep spending.Credit booms from banks

Banks create new deposits when they lend. When lending surges faster than the real economy, money claims outrun goods, pushing prices up.

Think: rapid loan & deposit growth during easy policy.Financial repression (aka negative real rates)

Keeping interest rates below inflation makes cash and “safe” bonds lose purchasing power over time, quietly shrinking real debt burdens.

Think: CPI > Treasury yields for long stretches.Weaker currency (imports inflation)

A falling exchange rate makes imports cost more, raising domestic prices.

Think: dollar down vs. trading partners → higher prices for energy, goods, travel.Crisis rescues paid with new money

When bailouts/backstops are effectively funded by newly created central-bank money, losses get socialized via the price level.

Think: emergency facilities (fancy acronyms like the BTFP program when Silicon Valley Bank collapsed) that expand base money without being unwound.

The ultimate result of any or all of this? Every dollar you hold buys less over time.

And there is a simple reason for this phenomenon and why it will continue: the government needs ongoing inflation to make their debt burden manageable.

This, of course, is nothing new.

Governments have been doing it for centuries. But what makes this moment different—what makes JP Morgan finally name the trade—is the scale and speed at which it’s happening today.

We’re not talking about 2-3% annual inflation that slowly erodes purchasing power over decades. We’re talking about:

$37+ trillion in US debt and climbing

Annual deficits over $2 trillion

Interest payments exceeding $1 trillion per year

Negative real yields on long-term Treasuries

Central banks trapped between inflation and insolvency

The math no longer works.

And when institutions like JP Morgan start telling clients to position for debasement, they’re acknowledging that the game has changed.

The era of pretending the dollar is “as good as gold” is over.

The era of assuming your savings will maintain purchasing power is over.

The era of trusting that governments will somehow fix their balance sheets through fiscal discipline is over.

Let’s revisit the math for a moment to see exactly why.

🌀 The Math Isn’t Mathing

Many of you have heard me talk about this before, ad nauseam. And so, I won’t go deeply into it here. That said, for today’s purposes, it’s worth revisiting the math for a moment. If you’re sick of hearing about it, feel free to skim this part—I don’t blame you!

But here’s the uncomfortable truth that JP Morgan is packaging for institutional clients: the “debasement trade” isn’t really a trade at all—it’s the recognition that we’ve entered the mathematical endgame of a debt spiral that’s been building for decades.

Let me show you the numbers, and you’ll see why.

The Credit Card That Never Gets Paid Off

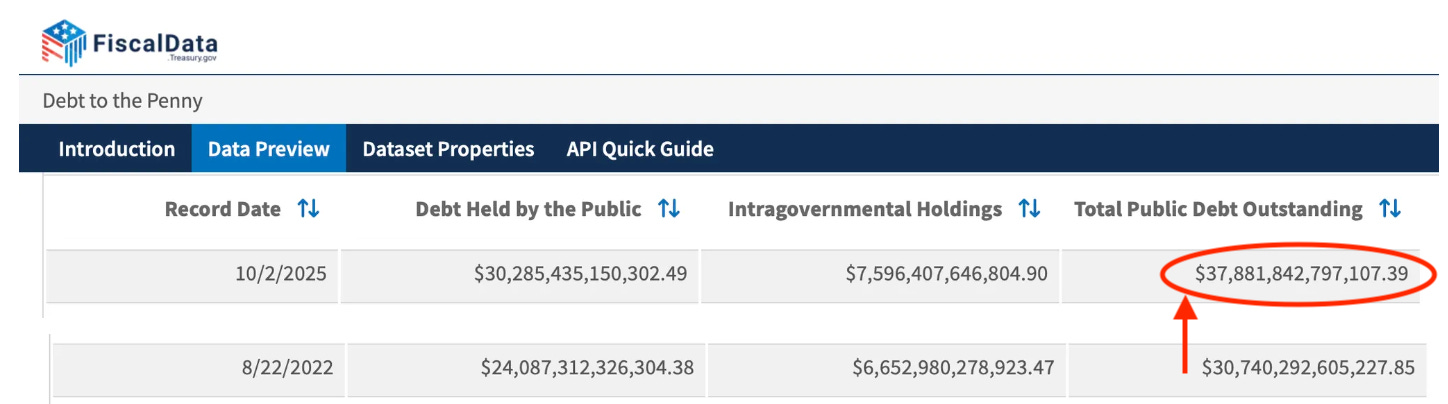

Back in August 2022, I wrote about the US debt spiral and laid out the simple math. At that time, US debt was around $30.7 trillion. Tax revenues were projected at $4.8 trillion annually. Sounds manageable, right?

But here’s where it gets ugly. After you subtract mandatory entitlement spending ($3.7T) and defense ($800B), you’re left with just $300 billion to cover interest payments. Problem was, even at historically low rates, annual interest expense was already $400 billion.

That’s an interest coverage ratio of 0.75x—a fancy (clearly today’s word of the day) way of saying that we couldn’t even pay the interest on our debt without borrowing more money.

And that was before rates went up.

Fast Forward to Today: The Spiral Accelerates

Holy mother of God.

As of October 2025, US federal debt has blown past $37.8 trillion—that’s over $7 trillion added in just three years.

But the problem isn’t just the debt itself—it’s also what we’re paying to service it.

Annual interest expense has exploded to over $1.1 trillion, making it the second-largest line item in the federal budget after Social Security.

Even when we net out the interest we pay ourselves (asinine, I know), it’s still virtually tied for second.

Here’s the Treasury’s spending report through the first 11 months of 2025 (it ends this month on September 30th):

That’s right, we will ultimately spend more on interest this year than we do on defense, Medicare, or any other single program.

Let me put that in perspective: we’re spending roughly $3 billion per day just on interest payments. Not principal. Not paying down debt. Just interest.

And it is only going to get worse.

How?