💡 Shadow Banking and Private Credit: The $1.7 Trillion Leverage Machine

Issue 183

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What Is Private Credit (And Why Should You Care)?

The $1.7 Trillion Leverage Machine

From Auto Loans to Your Retirement: Where Private Credit Lives

The Warning Signs (And What to Do About It)

Inspirational Tweet:

Private Credit.

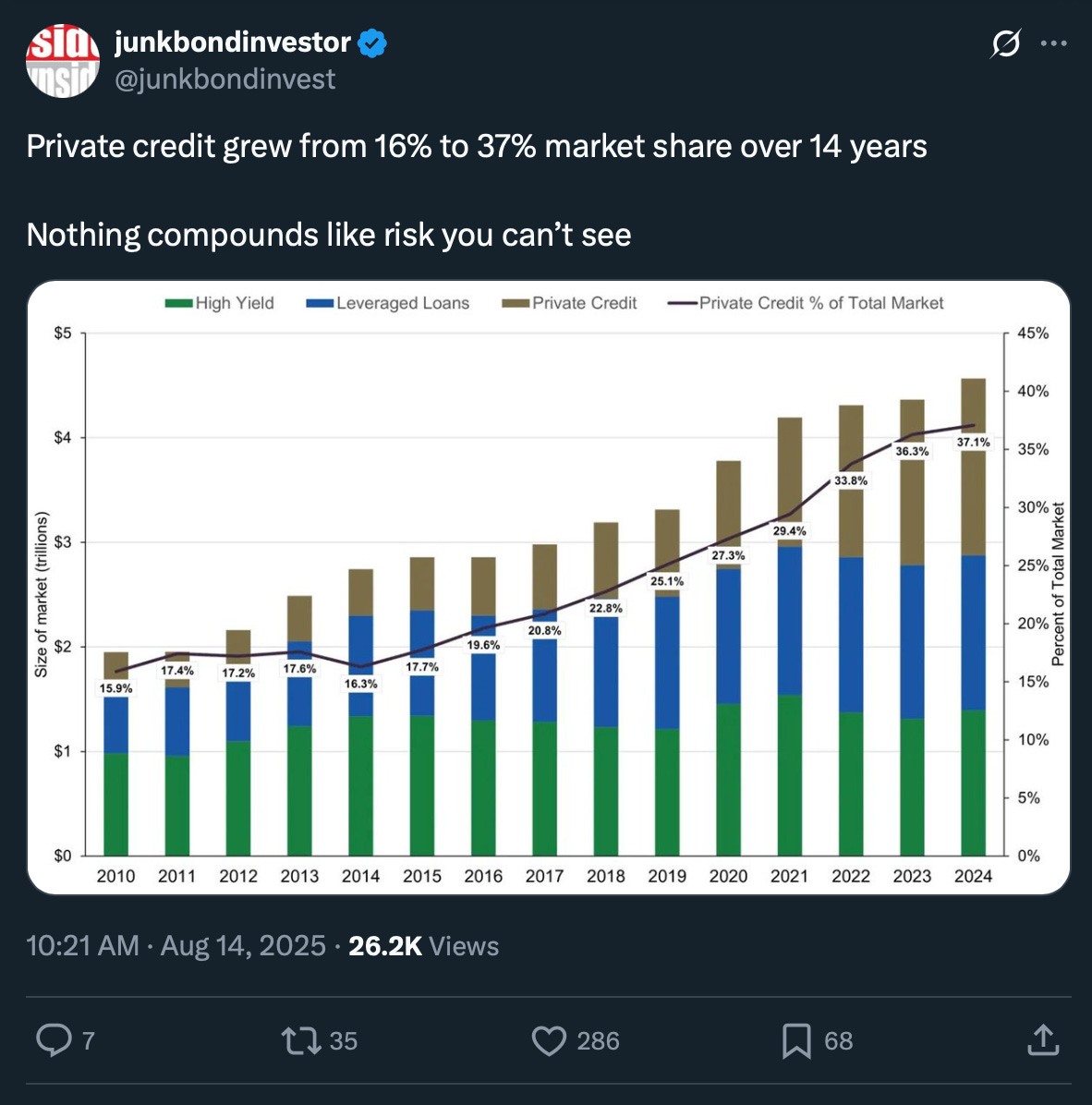

A segment of the Shadow Banking system, private credit has exploded in the last decade or so and has become an integral part of the financial system.

Especially here in the US.

But what exactly is private credit, how and why is it different than other credit or debt?

And perhaps most importantly, is it now a giant risk to markets and your investments?

All great questions and ones we will answer, nice and easy as always, here today.

So pour yourself a big cup of coffee and settle into your favorite chair for a peek into the shadows of private lending with this Sunday’s Informationist.

🤓 What Is Private Credit (And Why Should You Care)?

OK, so first things first. You've probably heard the term "shadow banking" thrown around—but what is it?

Kinda creepy sounding, right? Like something from a Matrix movie or V for Vendetta.

Shadow Banking.

In reality, it’s just the term used to describe the global system of non-bank financial institutions that do bank-like things without bank-like regulations.

That said, the shadows run pretty deep, as it’s estimated that the size of this shadow banking system is upwards of $239 trillion.

This is because shadow banking touches everything from money market funds to hedge funds to insurance companies. But the fastest-growing, most leveraged, and potentially most dangerous part?

Private credit.

Okaaaaay…you say, what is private credit?

Well, private credit is the lending arm of shadow banking—specifically, loans made by hedge funds, private debt funds, and other non-bank institutions directly to companies.

And while money market funds and insurance companies are at least somewhat regulated, private credit operates in the deepest shadows with minimal oversight.

Think of shadow banking like an entire parallel financial system, with private credit as its most aggressive lending machine.

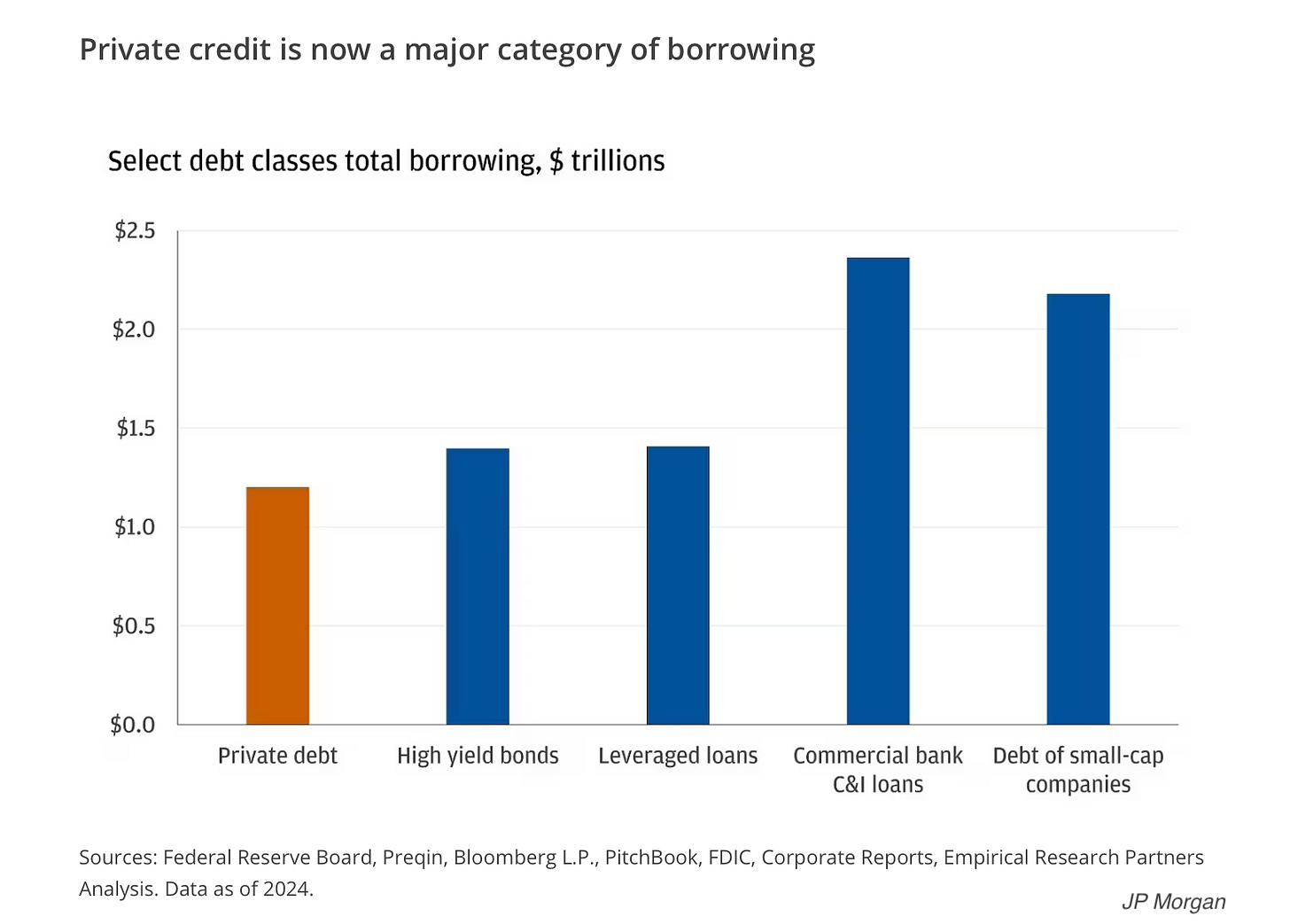

At its simplest, when Amazon needs a billion dollars, they go to JPMorgan or issue bonds in the market. When small or mid-sized companies need $100 million, they're just as likely now to go to Apollo, Blackstone, or Ares Capital instead.

And here's the kicker: This market has exploded from $500 billion to $1.2 trillion in the US alone, with global estimates ranging up to $1.7 trillion.

Think about that, all of this debt and borrowing happening in the darkness of minimal regulation.

You may now be asking, why should I care about some hidden corporate lending market?

Good question. Here's why it matters to you personally:

If you work for a private equity-owned company (and 20 million Americans do), your employer's debt probably comes from private credit. These funds provided the leverage for the buyout and continue to fund operations.

If you have a pension or 401(k), you're probably invested or somehow exposed directly to private credit. According to recent IMF data, pension funds make up 28% of private credit investors, while foundations and endowments add another 21%.

If you're a saver, private credit is why you're seeing all these new "alternative yield" products from BlackRock, Apollo, and others promising 8-12% returns. They're trying to get your money into this market.

According to the Fed's latest Financial Stability Report, non-banks now hold $21.9 trillion in loans, up from $15 trillion before the Great Recession. This includes all types of non-bank lenders within the shadow banking system.

Within that, private credit has grown to be about 12% of all bank loans to non-financial corporations globally, per the OECD.

How?

See, after 2008, regulators tried to make traditional banking “safer” with new rules—Basel III, Dodd-Frank, the Volcker Rule. These rules made it expensive for banks to hold certain types of loans on their balance sheets. The Supplementary Leverage Ratio alone made banks think twice about leveraged lending.

I’ve written all about the SLR before, and if you want to read more about that, you can find it right here:

In essence, the SLR made it difficult and expensive for banks to hold certain types of liabilities on its balance sheet.

Of course, the lending didn't just stop. It moved into the shadows instead.

By using private credit funds—the shadow banking system's answer to traditional bank lending.

No Basel III capital requirements.

No Federal Reserve stress tests.

No FDIC examiner asking difficult questions.

The result? In leveraged lending specifically (loans to companies with a lot of debt), according to the Fed itself, non-banks now originate 68% of the market.

That's more than double their share from before the financial crisis.

But that’s not even the worst of it.

No, the way the money is lent and the leverage it allows just exacerbates the risks.

🌶️ The $1.7 Trillion Leverage Machine

Here's where private credit gets really spicy—and, of course, potentially dangerous. It's not just about the $1.7 trillion in private credit itself. It's about how that credit is funded and leveraged throughout the shadow banking system.

To understand better, let’s walk through how it works:

Step 1: The Fund Raises Money A private credit fund like Apollo or Blackstone raises $10 billion from pension funds, insurance companies, and wealthy individuals. These investors lock up their money anywhere from 5 to 12 years.