💡MSTY: Renting out MSTR Volatility

Issue 162

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

MSTR: Plain Vanilla Volatility

MSTY: Volatility with a Yield Twist

So Far, So Good? MSTY vs MSTR vs BTC

Is MSTY Right for You?

Inspirational Tweet:

There’s a new shiny ETF in town that you may have been hearing about lately. MSTY, or the YieldMax MSTR Option Income Strategy ETF, has generated plenty of buzz since being launched last year.

But along with that buzz has come quite a bit of confusion.

What is MSTY? How exactly does it get its yield? And should I own MSTY alongside or maybe even instead of MSTR?

Or Bitcoin itself?

All valid and interesting questions and ones we will answer here today.

But have no fear, we aren’t going to analyze the complicated structure of MSTY or dive deep into the math of the underlying options strategy it uses to create the yield.

No, we like to stay high level and simple around here, so you can grasp the concepts and use them for your own decisions. We will keep it nice and easy, as always.

So, grab yourself a big cup of coffee, and settle into your favorite chair for a journey into Bitcoin yield land with this Sunday’s Informationist.

🤩 MSTR: Plain Vanilla Volatility

First things first, let’s cover the basics of MSTR and Michael Saylor’s (brilliant) strategy for his company, er…Strategy.

If you’ve been reading my stuff re: MSTR, and or know all this already, feel free to skim this part and move onto the next.

But for those of you who are new to the Saylor Strategy game of MSTR, let’s unpack it really quickly and easily here, shall we?

Founded in 1989 by Michael Saylor, MSTR built data analytics and business intelligence tools, competing in the same general category as Oracle and SAP.

The behemoths.

MSTR was a solid business, but never became a rocket ship of earnings. In fact, MSTR traded sideways for most of the 2010s.

But that all changed in 2020, when Saylor made the first of what would become a long series of bold moves: using the company’s cash reserves to buy Bitcoin.

As his company’s stock began to mimic the volatility of its underlying Bitcoin, Saylor and his financial wizards (like Shirish Jajodia, MSTR’s Corporate Treasurer) realized that they could capture the volatility and monetize it to buy more Bitcoin.

How?

By selling convertible bonds to traders who were looking for volatility in the MSTR stock along with upside optionality in the price of Bitcoin.

Huh?

What I mean is, convertible bond traders (aka hedge funds) love buying bonds that can be converted into common stock at a certain price. This allows them to buy that bond with the hopes of converting it into much more valuable stock in the future.

And in the meantime, they can trade around the volatility and make money.

In essence, volatility of Bitcoin causes volatility in MSTR, and this volatility is valuable.

The best part? Because of this massive volatility, MSTR has been able to issue bonds with zero coupons. That’s right, they’ve been borrowing money for free.

Billions and billions of dollars of it.

And Saylor and MSTR have capitalized on this opportunity like no one in the world.

The Convert Strategy: Monetizing Volatility to Buy BTC

Issue zero-coupon convertible notes

Use proceeds to buy Bitcoin on the open market

As MSTR stock price rises with Bitcoin, refinance or issue more bonds, to compound the leverage

This creates a feedback loop: higher BTC → higher MSTR stock → more favorable converts → more BTC purchases

In essence, MSTR has turned its own stock volatility into a Bitcoin accumulation machine. The company doesn't hedge. It doesn't sell BTC. It just keeps buying.

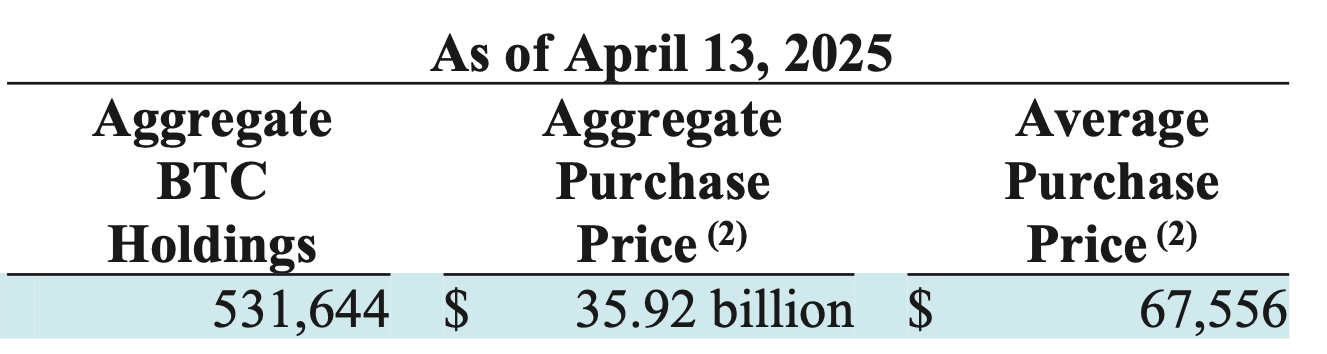

And now it owns over a half a million Bitcoin. From the latest SEC filing:

Thirty. Six. Billion. Dollars. of Bitcoin. 🤯

OK. That’s a pretty high level overview. If you want more details and exactly how this all works, I wrote a whole newsletter about it recently. You can find that here:

Now that we have the base covered. What’s this business about a new ETF that seeks to capitalize on both MSTR upside and give investors attractive yields?

🤑 MSTY: Volatility with a Yield Twist

We’ve seen how MSTR has found a way to monetize volatility to sell convertible bonds and buy more Bitcoin, but now other professionals have found a way to create income from the same underlying stock volatility.

Enter the MSTY ETF.

Incidentally, Bitwise just launched a similar ETF, Bitwise MSTR Option Income Strategy (Ticker: IMST), but it is so new that I won’t include it in here. It is quite similar to MSTY, though, FYI.

MSTY is managed by YieldMax, a relatively new ETF issuer that has carved out a niche offering single-stock income strategies on high-volatility names like Tesla (TSLY), Nvidia (NVDY), Coinbase (COIY), and others.

Their model is straightforward: build ETFs that mimic covered call strategies to deliver income, allowing retail investors to access complex options-based strategies without doing it themselves.

According to the fund’s official description:

“YieldMax MSTR Option Income Strategy ETF is an exchange-traded fund incorporated in the USA. The Fund aims to obtain current income. The Fund’s secondary investment objective is to seek exposure to the share price of the common stock of MicroStrategy Incorporated (‘MSTR’), using a synthetic covered call strategy to obtain gains and exposure.”

YieldMax created MSTY to turn Bitcoin-adjacent volatility into monthly income.

But what’s this synthetic option and covered-call business all about?

Good questions. Let’s unpack them super simply, shall we?