💡 MicroStrategy's Bitcoin Strategy

Issue 142

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Strategy

The Yield

The Multiple

Is MSTR for you?

Inspirational Tweet:

With the price of Bitcoin exploding higher the past few weeks, MicroStrategy’s stock price has been explosive, too. Especially after their most recent earnings call where Michael Saylor and his team laid out the company’s overall Bitcoin strategy.

But what exactly are they doing? And how are they doing it?

You may hear terms like ‘leveraging from convertible debt’, ‘selling volatility’, and ‘tapping ATMs’.

But what do these mean in laymen’s—not Wall Street speak—terms?

And should you perhaps add MSTR stock to your own portfolio?

If the MicroStrategy talk has left you scratching your head in confusion, have no fear. Because we are going to unpack all this and more, in super simple and easy to understand concepts as always, here today.

I repeat, we will avoid overly technical terminology and analysis and stick to the basics.

So, pour yourself a nice big cup of coffee and settle into your favorite chair for a Sunday review of concepts behind MicroStrategy with The Informationist.

Partner spot

America's Most Secure Mobile Service

Really quickly and before we start, I cannot stress this enough. If you’re not protecting yourself from cyber attacks and SIM-swaps, you’re at serious personal risk these days. After seeing four of my colleagues go through the nightmare of SIM-swaps (someone literally taking control of your phone from afar)—identifies stolen, bank accounts compromised, emails hijacked, social media held for ransom—I knew I was at risk, too.

So, I switched to a service called Efani, and it was super easy and seamless. It feels just like being with Verizon or AT&T, but I can rest easy knowing that my phone is ultra-secure. My colleagues learned the hard way, but now we’re all on Efani, and I couldn’t be happier. I honestly wouldn’t share this with you if I didn’t completely believe in the service myself. Whether you use Efani or something else, please don’t wait until it’s too late to protect yourself.

And if you choose Efani by using the link below, you get $99 OFF.

The Efani SAFE plan is a bespoke cybersecurity-focused mobile service protecting high-risk individuals against mobile hacks, providing best in class protection with 11-layers of proprietary authentication backed with $5M Insurance Coverage. Don’t wait. Protect yourself today.

🧐 The Strategy

At the core of it and in the most basic terms, MicroStrategy is a software company that strategically buys Bitcoin.

But this doesn’t really cover the brilliant strategy around the buying of that Bitcoin, and how it has transformed the company into so much more than just a legacy-style software company.

In Michael’s own words from the most recent earnings call at the end of October:

“MicroStrategy is a publicly traded company that adopted Bitcoin as our primary treasury reserve asset by using proceeds from equity and debt financings as well as cash flows from our operations, we strategically accumulate Bitcoin and advocate for its role as digital capital.”

See, Michael and Co. have found a way to use the MicroStrategy balance sheet buy Bitcoin in a way that is accretive (i.e., adds value rather than diluting it).

But how?

It’s pretty simple in concept (though mathematically complicated in execution for the normal person) and laid out here in a slide from the call:

The Bitcoin Treasury Company (BTC for short…cute) is MicroStrategy. And the buckets below it represent the three main ways that the company acquires more Bitcoin: through debt, through equity, and through cash from its earnings as a software company.

Let’s break these apart, shall we?

Debt

This has been the most important and powerful part of the MicroStrategy story and strategy thus far.

What MSTR is doing is they are borrowing money by issuing convertible bonds. As promised, we will not get too technical here, but here is why this is so important.

Convertible bonds (converts) are a type of bond that can be converted into equity (shares of stock) at a certain price. The strike price.

This strike price is usually pretty far above the current stock price.

Converts are type of bond that hedge funds love to own.

Why?

Because it gives them optionality. A fancy way of saying ‘excess value’.

They can buy the bond and, knowing it can be converted into shares of stock at a certain price, they can short some of those shares against it, trade around those shares and make money, or simply wait until the underlying company shares increase to the conversion value and lock in gains.

Alternatively, they can just sell the bond because it has increased in value, along with the price of the stock.

Optionality.

And because volatility of the stock is actually a positive for bonds like this, MicroStrategy can issue these bonds at near-zero interest rates.

MSTR is super volatile because of the Bitcoin they already own and hold on their balance sheet.

Traders don’t really care about the yield of these bonds, they want the optionally.

And so, after initially having to offer a high interest rate and collateral (secure the bonds by some assets to lower the risk for the bond buyer) to entice investors to buy these bonds, MSTR can now issue them for super cheap.

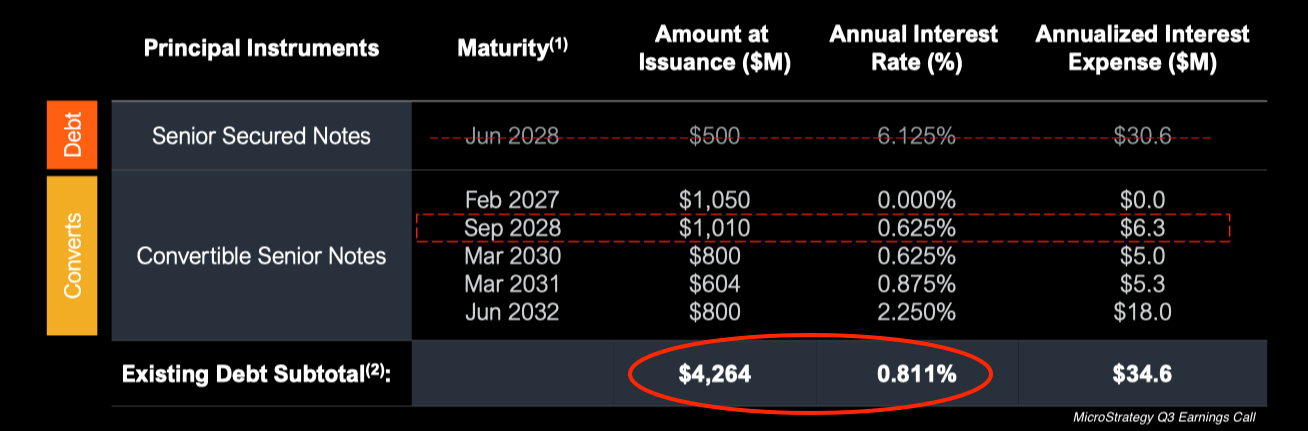

In fact, they just issued a new bond in order to retire a tranche of bonds that was paying 6.125% and secured by assets of the company.

The new bond is a convert, of course, and only pays 0.625% interest.

You can see this with the chart below that shows their current debt and the red-lined cross-out of the retired issue at the top.

And what you will also notice is that MSTR has borrowed a total of $4.3B at a blended average fixed rate of just 0.8%. 🤯

That’s with Fed Funds still up above 4.5%. Absolutely incredible.

And what have they done with that money they borrowed?

Well, they bought Bitcoin with it, of course.

But that’s not all they used.

Equity

The second financial lever that MSTR is using to buy Bitcoin is the issuance of equity.