💡 Jackson Hole: Deciphering The Fed Summit

Issue 179

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Jackson Hole: The Fed’s Most Important Off-Stage Performance

The Data Dilemma

Powell’s Jackson Hole History

Decoding This Year's Impossible Puzzle

Inspirational Tweet:

Oh the pomp.

The circumstance.

The unabashed Fed-sponsored ballyhoo.

What we are talking about here, of course, is the annual Economic Policy Symposium in Jackson Hole Wyoming, where central bankers, finance ministers, academics, and market ‘experts’ from all over the world gather to pontificate n the economy and enjoy one last late-summer boondoggle.

All on the taxpayers’ tab, of course.

But this year has a special significance to it. Because all eyes have been and continue to be on the Fed and Chairman Jerome Powell, and so, investors from around the globe will hang on every syllable uttered at this year’s Summit.

Especially by Powell.

But how did this Summit get to be so important, why is this years’ gathering more significant than ones of past, and what may we expect from the markets in reaction to what may come out of the horse’s (Powell’s) mouth in Wyoming?

All good and important questions, and ones we will address, nice and easy as always, here today.

So, pour yourself a big mug of coffee, wrap yourself in your favorite mountain wool blanket, and settle into a comfortable seat for this Sunday’s Informationist.

Upcoming Event

Before we start, a quick announcement of an appearance I’ll be making soon. It’s free and I expect it to be full of signal. Here are the details!

Three years ago, the signs were subtle. Now, the ground is shaking.

AI is reshaping jobs right now. Cryptocurrency is embraced by banks and embedded in retirement law. Commodities are surging into a supercycle redefining global wealth.

On August 27th, Jefferson Financial is sponsoring an event that will connect the dots — showing you how these forces fit together and what they mean for your portfolio, your income, and your family’s future.

🏔️ Jackson Hole: The Fed’s Most Important Off-Stage Performance

Let’s face it. Jackson Hole isn't just another Fed speech. It's become the place where monetary policy gets tested before it becomes official.

Hosted by the Kansas City Fed every August since 1982, Economic Policy Symposium started as a quiet academic gathering in sleepy Wyoming and has somehow since evolved into one of the world's most watched economic events.

Why Jackson Hole?

Simple.

It's far away from the Washington DC circus.

No press conferences or podiums. No formal congressional hearings. Just fresh mountain air, some Snake River fly fishing, a little backyard barbecue, and the supposed freedom to float ideas without cementing any in concrete.

And that's exactly what's happened over the years. Ben Bernanke used Jackson Hole in 2010 to hint at QE2 before making it official. Janet Yellen laid the groundwork there in 2015 for the first rate hike after the financial crisis.

And Powell has turned it into his personal testing ground for trying out new messaging.

Attendance has exploded too. What used to be a handful of Fed officials and select academic economists has become a cadre of central bankers, finance ministers, and market heavyweights from around the world.

Every word gets parsed by traders in real time.

But this year's a bit different. Powell's walking into Wyoming with economic data that's all over the map.

The jobs report was brutal - only 73,000 jobs added in July, with unemployment jumping to 4.2%. But here's the kicker: massive revisions cut previous months to the bone. May went from 144,000 jobs down to 19,000. June fell from 147,000 to 14,000. We're talking about an economy that's only added 35,000 jobs per month since May.

All after the BLS revised past numbers and then the head of the Bureau was fired by Trump.

If you are wondering about this and have not yet read about it, I wrote a whole newsletter all about the BLS and its sketchy data a couple weeks ago. You can find that here:

Then came inflation data that looked... benign?

Core CPI held steady at 3.1%, overall inflation at 2.7% - the lowest since early 2021. If you just looked at consumer prices, you'd think the Fed had this whole inflation thing figured out.

Victory!

Except then producer prices exploded.

A 0.9% jump in one month - the biggest surge in two years. That screams businesses getting crushed by input costs they haven't figured out how to pass along to consumers yet.

And retail sales? Still climbing. American consumers are acting like all is fine. Or is it just another hopeless symptom of YOLO?

In any case, Powell now has to thread a needle between four completely different signals:

Jobs data: Screaming recession

Consumer inflation: Looking manageable

Producer prices: Flashing warning signs

Consumer spending: Still going strong

To be clear: his challenge isn't just picking the right policy.

It's about picking the right words to describe the Fed’s current position on all this without either spooking markets or boxing himself into moves the data may not support next month.

Because who knows what comes next…amiright?

🤨 The Data Dilemma

Let’s talk a bit about the recent data to get a handle on what Powell is dealing with here.

In essence, he has to explain how four completely different pieces of economic data somehow fit together into a coherent story.

Let's break it down, shall we?

First, the jobs report. Brutal doesn't begin to cover it. Sure, 73,000 jobs in July was bad enough. But those revisions?

Someone call 9-1-1.

The government slashed May from 144,000 jobs down to just 19,000. June got cut from 147,000 to 14,000.

Think about that for a second.

Since May, this economy has been adding an average of 35,000 jobs per month. And three-quarters of July's gains came from healthcare alone.

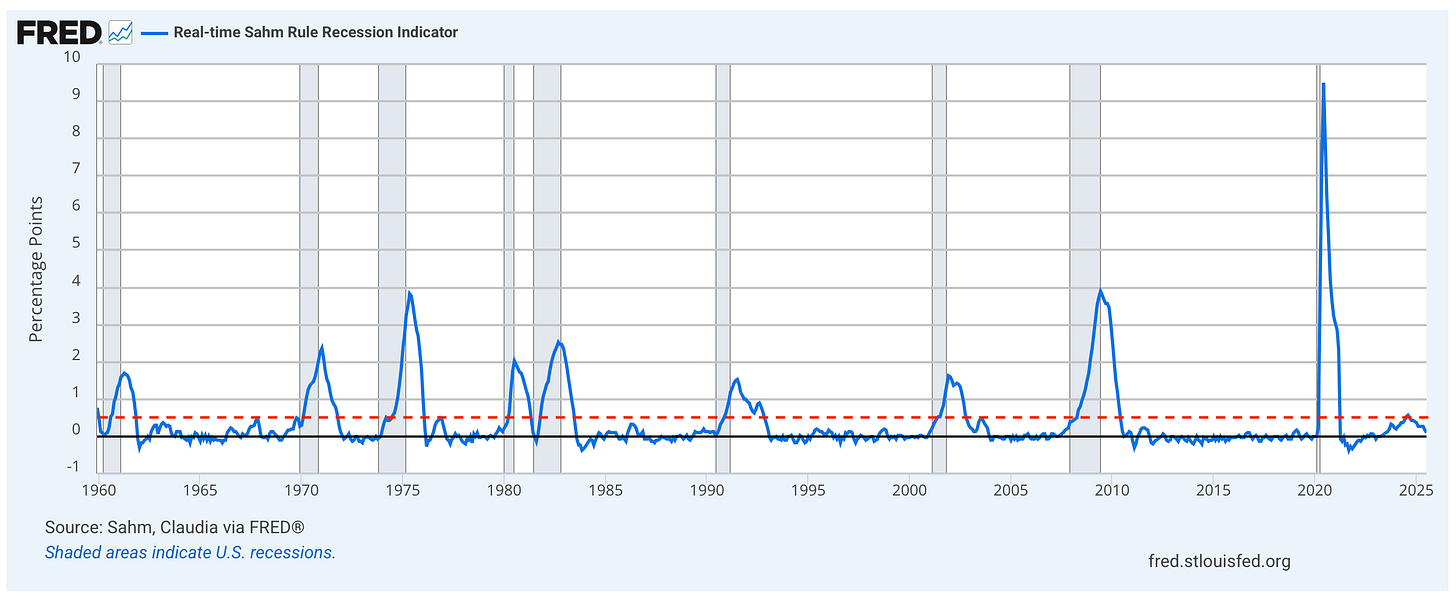

Still, the unemployment rate moving to 4.2% might look concerning at first glance, but the Sahm Rule - a recession indicator that's been right every time since the 1970s - is actually moving away from its trigger point, not toward it.

I also wrote all about the Sahm Rule a while ago, and if you haven’t seen it or if you just want a refresher you can find that article right here:

TL;DR: When the unemployment rate jumps .5% higher than the lowest rate in the last year (math simplified for sake of concept here), then the Sahm Rule is tripped and we are already in a recession.

It has been 100% accurate since its implementation.

But read that TL;DR again.

The caveat is that the rule is not something to wait for…it’s a terrible lagging indicator and more of a confirmation tool. If it is tripped, it is too late.

We are already in recession.

OK, so, knowing that, where is it now and what is it telling us, if anything?

Looking at the last update at the Fed from last month, the rule is sitting at about .1%, nowhere near .5% and has actually moved away from the trigger (red dotted line).

So, according to Claudia Sahm’s rule, unemployment is rising, but not severely yet.

One little wrinkle.

The unemployment rate does not get revised, even after the BLS changes the past months’ numbers. So, maybe the rule is a bit flawed.

Then Wednesday's inflation report comes out and suddenly everything looks... normal? Core CPI right where everyone expected at 3.1%. Overall inflation at 2.7%—the lowest we've seen since March 2021.

Goods prices staying calm despite all the trade war talk and posturing. I mean looking at consumer prices, you'd think Powell could declare victory on inflation and start cutting rates tomorrow.

That’s what the market thought, anyway, judging by the expected Fed Funds rate (we will get to that in a moment).

But first, let’s talk about Thursday's producer price report (PPI).

Holy cannoli.

A 0.9% jump in one month. Services costs alone spiked 1.1%—the biggest increase since March 2022. That's not noise, people. That's businesses getting absolutely hammered by rising costs.

Here's the scary part: if companies can't absorb these input cost increases forever, they're eventually going to pass them through to consumers. Which means that nice, calm consumer inflation story could fall apart fast.

And then to make Powell's life even more complicated, retail sales climbed again in July. Americans are still spending like the job market isn't falling apart and recession warnings don't exist.

So how exactly does Powell talk about an economy where:

The job market looks like it's crashing

Consumer inflation appears under control

Business costs are exploding

Consumers keep spending anyway

The answer lies in understanding exactly how Powell has used Jackson Hole before to prepare markets for what's coming next...

🥸 Powell’s Jackson Hole History

It’s pretty remarkable, actually.

Powell has turned Jackson Hole into his policy testing lab. Not where he announces decisions—that's what FOMC meetings are for. But Jackson Hole is where he floats ideas, tests market reactions, and sets up whatever's coming next.

Let's look at his greatest hits.

August 2019: The "Mid-Cycle Adjustment" Masterpiece