💡Debt Ceiling Crisis: Part 2?

Issue 149

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Current Debt Ceiling Situation

Wen Default?

The Treasury’s Checking Account

Extraordinary Measures

Inspirational Tweet:

Once again, the United States finds itself in the precarious position of running out of room to borrow more and cover its expenses.

That’s right, another Debt Ceiling Crisis.

You know, that arbitrary number that we call a ‘limit’ and move higher every year or two?

But what exactly is the pending crisis, how bad is it, and what are the options and so-called extraordinary measures that Yellen and Co. can use to avoid a default?

Good questions and tons to unpack here. But have no fear, we will do it nice and easy as always today.

So, grab yourself a big cup of coffee and settle into a comfortable chair for a review of the US Debt situation with this Sunday’s Informationist.

🫣The Current Debt Ceiling Situation

As you may recall, we just did this whole thing pretty recently. The government spends too much, the bills outpace the tax receipts, the borrowing balloons, and we trip the debt ‘ceiling’.

The most recent crisis was in the spring of 2023, where the Treasury and Yellen were forced to use ‘extraordinary measures’ to keep the government running without the need for more borrowing or missing a crucial obligation, or worse, an interest payment on past debt.

If you don’t recall this, or you want a refresher, I wrote all about it back when I happened. You can find that Informationist issue here:

The ultimate outcome of that crisis was the suspension of the debt ceiling altogether until January 1, 2025.

And since that fateful date in June of 2023, US debt has risen approximately $4.5 trillion, from the pre-suspension level of $31.47 trillion.

Now the debt stands at a monstrous $36.17 trillion.

But wait, you say, didn’t I see some auctions the last couple of weeks? If the debt ceiling is already in effect, how is the US Treasury still issuing bonds?

Good question. Let’s unpack that.

First, the ceiling was reinstated on the first day of the year, using the last day of December, 2024 as the level of the new limit. Here is the debt to the penny on that day:

So, the new limit is $36.218 trillion.

But, due to a Medicare-related accounting entry, the debt was immediately reduced by $54 billion the next day. And this gives the Treasury a bit of breathing room, as you can see here:

Like finding a crumpled up $50 bill in your jeans pocket.

Woohoo!

Except that $50 has to feed you and your whole extended family until that application for a new credit card goes through.

Oh.

Also, as debt matures, the Treasury can re-issue more. debt to replace it.

In fact it pretty much has to do that, as it can’t just pay for the debt from revenues, as the US government operates in a deficit and must borrow more money to pay off maturing debt.

Some may call this a Ponzi scheme.

I digress.

There may be some additional confusion however, as you likely heard that Congress recently passed a budget in order to avoid a government shutdown.

See, on December 20th, the U.S. House and Senate passed a second Continuing Resolution (first one was back in September) to extend federal spending and avert a government shutdown through March 14, 2025.

The resolution was passed just hours before midnight when the first stopgap measure was set to expire.

But you know what the resolution did not address?

If you guessed the debt ceiling, you get a cookie. Or maybe a Capital Turkey Club, I hear those are pretty good in the Senate cafeteria, especially after an all-night session.

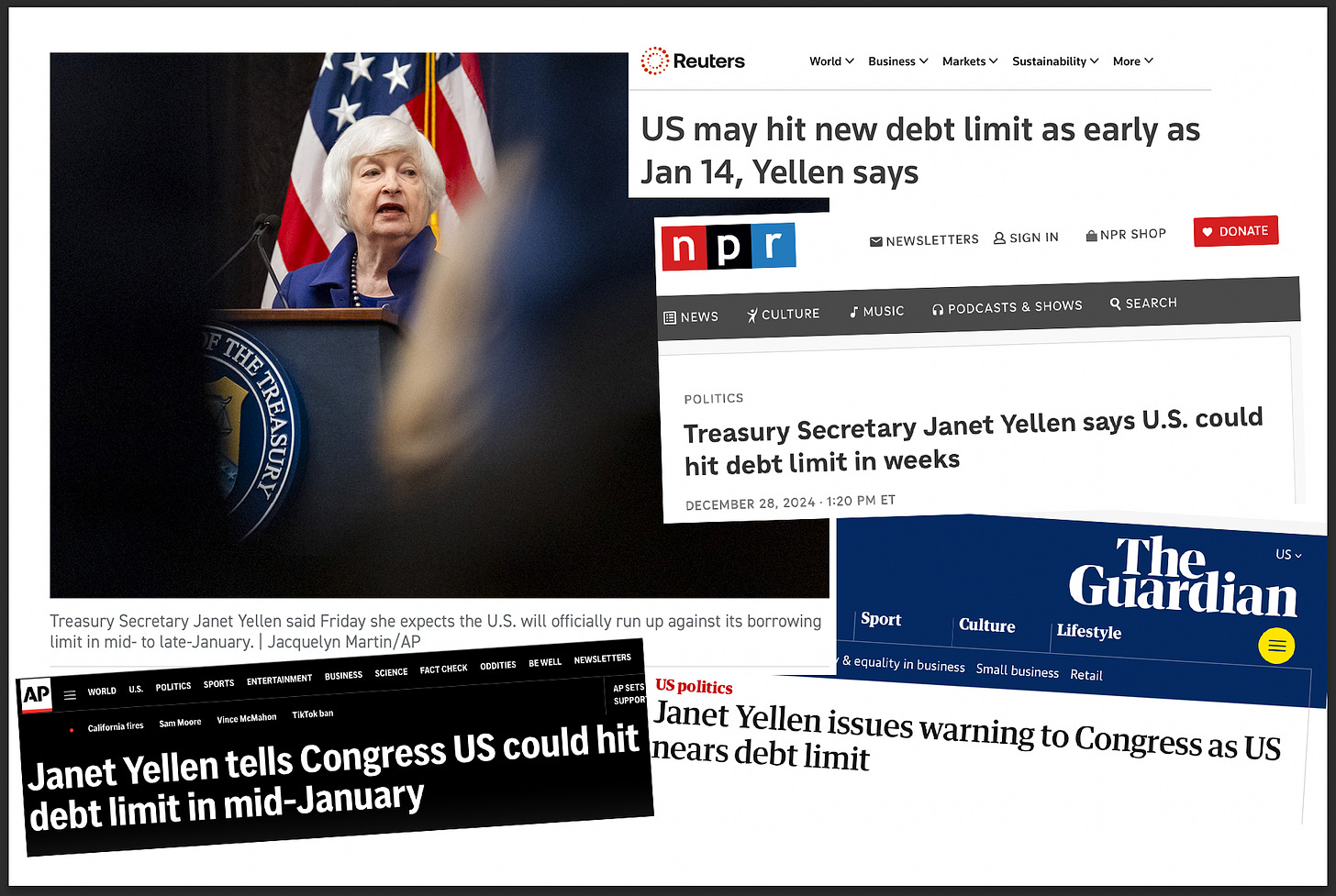

In any case, this is why Yellen is on the news-circuit, warning Congress and Trump alike, that we have a pending crisis unless something is done soon.

How soon?

🔍 Wen Default?

Well, it turns out that $54 billion doesn’t get you very far on a $6.9 trillion budget, so even with that extra breathing room, the US will soon find itself up against the debt wall.