💡 Can Bitcoin Bonds Save the Treasury?

Issue 158

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Concept

The Impact

The Reality

Inspirational Tweet:

Bitcoin Bonds or “Bit Bonds” are another cutting-edge financial concept created by Andrew Hohns of Newmarket Capital.

I know what you are thinking: It sounds intriguing but maybe also a little confusing.

I mean, what exactly is a Bit Bond and how could it possibly save the US Treasury?

And how could it be good for US investors?

If the mere thought of bonds and that type of math makes you recoil from financial-jargon, rest easy.

Because we are going to unpack the whole Bit Bond concept for you, nice and easy as always, today.

So, pour yourself a big cup of coffee and settle into your favorite chair for a short Bitcoin bond-backed journey with this Sunday’s Informationist.

Upcoming Event

Before we start, a quick announcement of an appearance I’ll be making soon. It’s free and it’s going to be fun and full of signal. Here are the details!

Thinking about blending traditional investments and the Bitcoin revolution?

Sometimes Wall Street’s classic wisdom and the wild world of digital assets seem like two different universes. On March 21st, 9 AM – 12 PM PT, join me LIVE as we bridge these worlds. I’ll be joined by, a tax strategy expert, and SDIRA specialist and a bitcoin mining operator to explore how classic portfolio strategies can align with the Bitcoin revolution. We’ll dive into market trends, risk management, and the sweet spot between stability and innovation. Got questions? There will be a live Q&A to give you the chance to ask—how do you craft a resilient, forward-thinking portfolio?

Reserve your spot here and let’s decode the future of investing together.

🤓 The Concept

First things first, if you feel like you’ve heard about Andrew Hohns recently, you likely have.

Because yes, it is the same Andrew Hohns who brought the concept of “Battery Finance”, the fund that is adding Bitcoin to collateral for commercial real estate loans.

If you are wondering what that’s all about, I wrote about it recently and you can find that right here:

Pretty smart guy, this Andrew. I got to spend some time with him at a conference up in Jackson Hole recently.

Remember this tweet from me last week?

Yeah, that applies here. The guy is a freaking genius, IMO.

And now Andrew has floated the idea of Bit Bonds—a novel US Treasury instrument designed to incorporate Bitcoin into government financing.

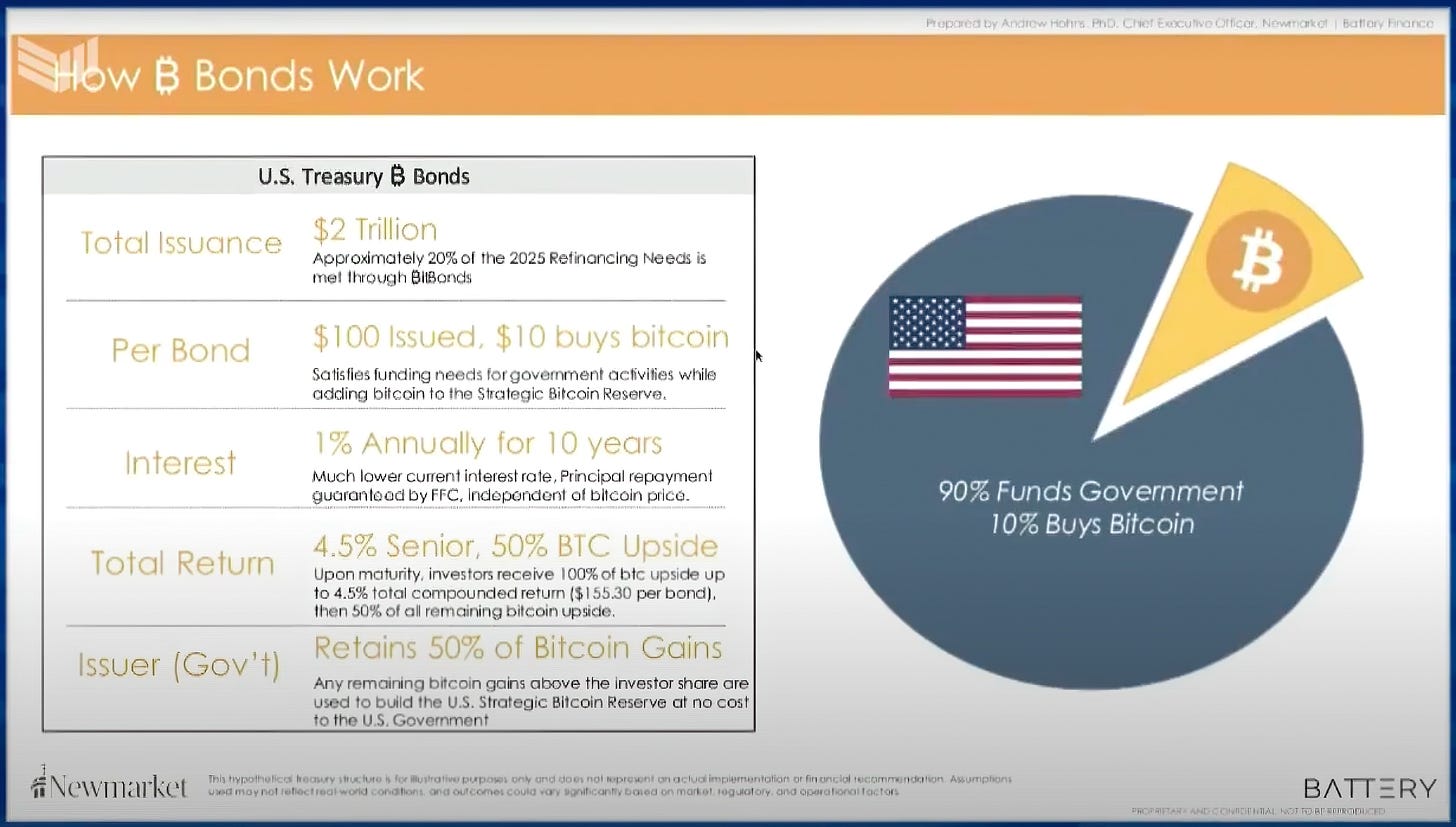

Andrew’s proposal is for the US government to issue $2 trillion in bonds, allocating 10% ($200 billion) of the proceeds to purchase Bitcoin, while the remaining 90% funds standard government expenditures (read: The Deficit).

As if this part is not interesting enough, Andrew takes it a step further.

See, unlike traditional Treasuries, which carry interest rates ‘aligned’ with current market rates, Bit Bonds rates would be completely independent of market forces.

How?

Well, the Bit Bond looks to borrow a page from Michael Saylor’s volatility monetization playbook.

If you are wondering what Saylor is doing and how, I wrote all about the Strategy here:

TL;DR: Saylor has found a way to using the underlying volatility of his stock in order to sell zero-coupon convertible bonds.

Genius, really.

OK, but how do Bit Bonds do this?

Well, much in the same way, Bit Bonds would capture the upside volatility for investors.

See, a Bit Bond would offer a fixed interest rate of just 1% for the first 10 years.

The incentive here is that, in addition to this guaranteed 1% return, investors would gain exposure to potential Bitcoin price appreciation. The idea is to create a win-win scenario: lower borrowing costs for the government and enhanced return potential for investors.

The key here is that the Bit Bond structure includes a profit-sharing mechanism:

Investors receive a 1% annual interest rate on their principal over the 10-year period

If Bitcoin appreciates enough to generate a total return of 4.5% per year, investors receive all of the gains up to that threshold

Any Bitcoin appreciation beyond the 4.5% annual yield equivalent is split 50/50 between investors and the U.S. government

This allows investors to benefit from Bitcoin upside while also allowing the Treasury to retain a portion of the gains, effectively subsidizing the government's debt

Here is the slide showing the concept from Andrew’s recent presentation:

The goal of the win-win scenario: lower borrowing costs for the government and enhance return potential for investors.

We will look at estimated investor math behind the bonds and Bitcoin’s performance in a moment, but let’s first see how it would impact US Treasuries.

🤯 The Impact

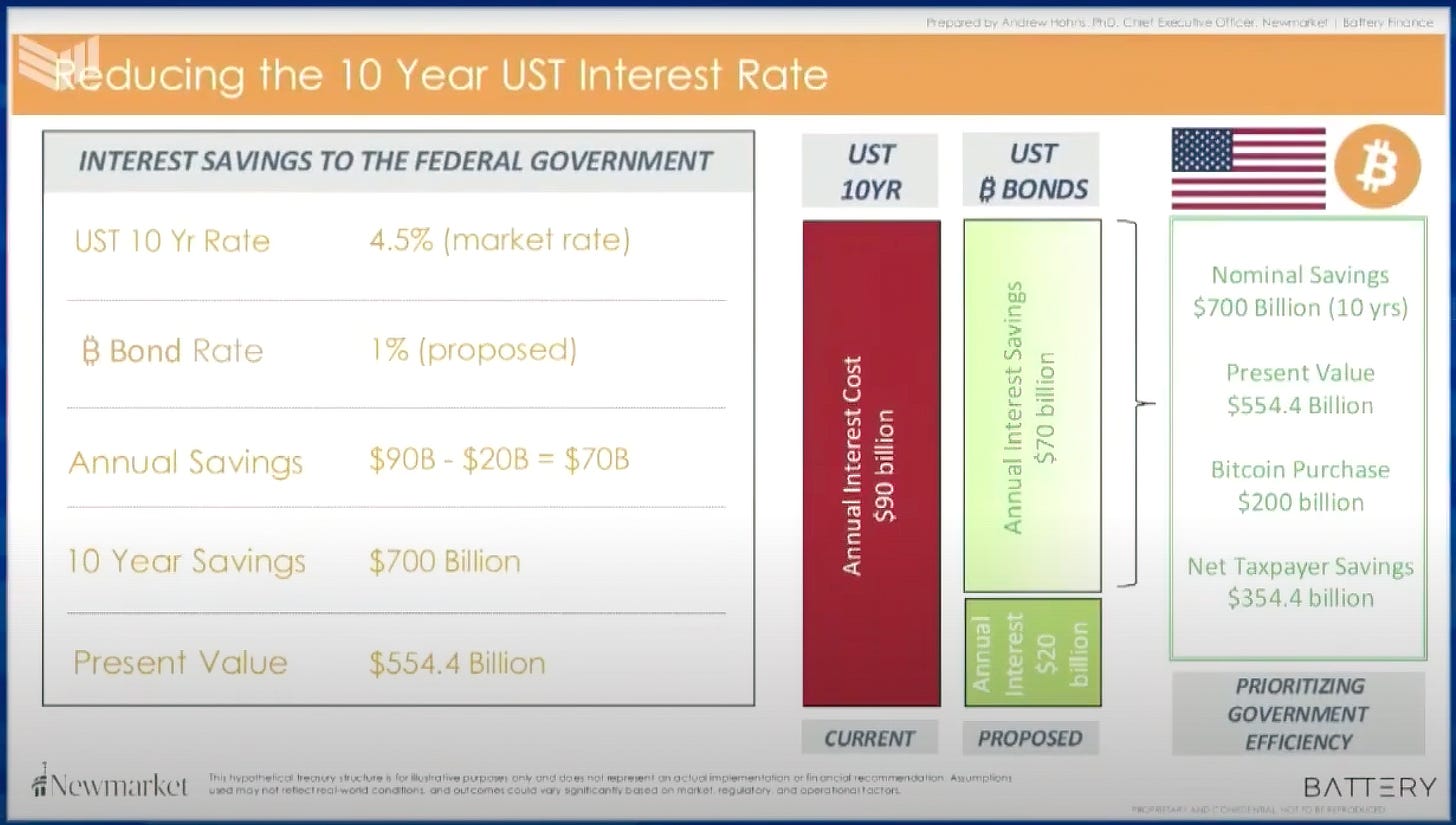

One of the most significant advantages of Bit Bonds would be their impact on U.S. government borrowing costs. With current 10-year Treasury yields hovering around 4.5%, the ability to issue bonds at a fixed 1% rate would translate to massive interest savings.

Here’s another slide from Andrew’s recent presentation.

So, by Andrew’s calcs, on a $2 trillion issuance, the government could save approximately $70 billion per year in interest expenses, totaling $700 billion over the decade.

Even after accounting for the $200 billion allocated to Bitcoin purchases, the net present value savings are estimated to be around $550 billion.

Pretty compelling case right there, if you ask me.

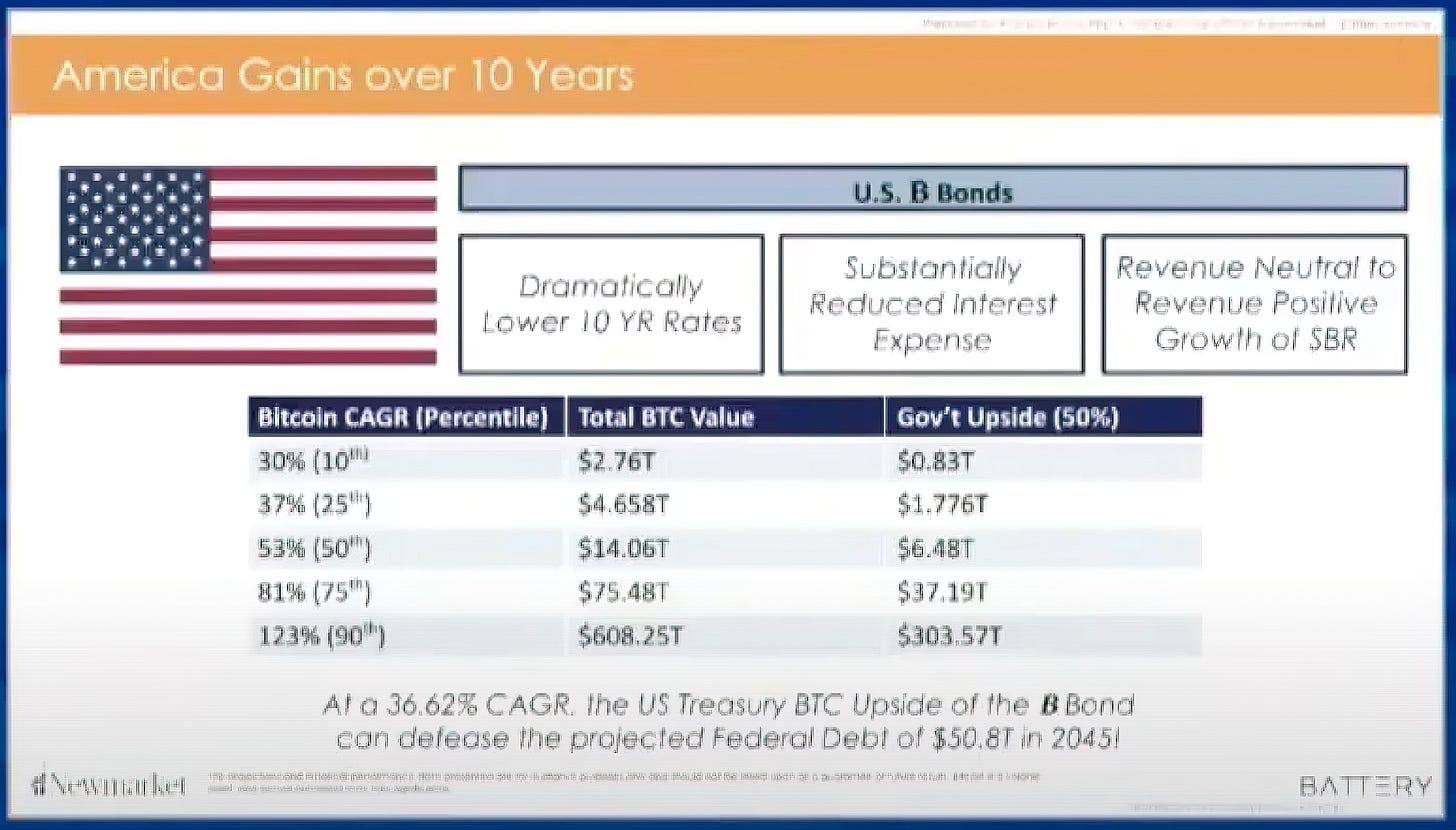

But that’s just the interest expense side. What about the Bitcoin upside for the Treasury?

Wow. With a 37% CAGR (Compound Annual Growth Rate) of Bitcoin, the US Treasury could wipe out the estimated $50.8T of debt by 2045.

OK, sounds great for the govie, what about from the investor’s standpoint? How would a Bit Bond perform for them?

Good question, let’s see.