Are TIPS a Good Investment?

Issue 65

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

What are TIPS?

What are I-Bonds?

How are they priced?

Are they a good investment?

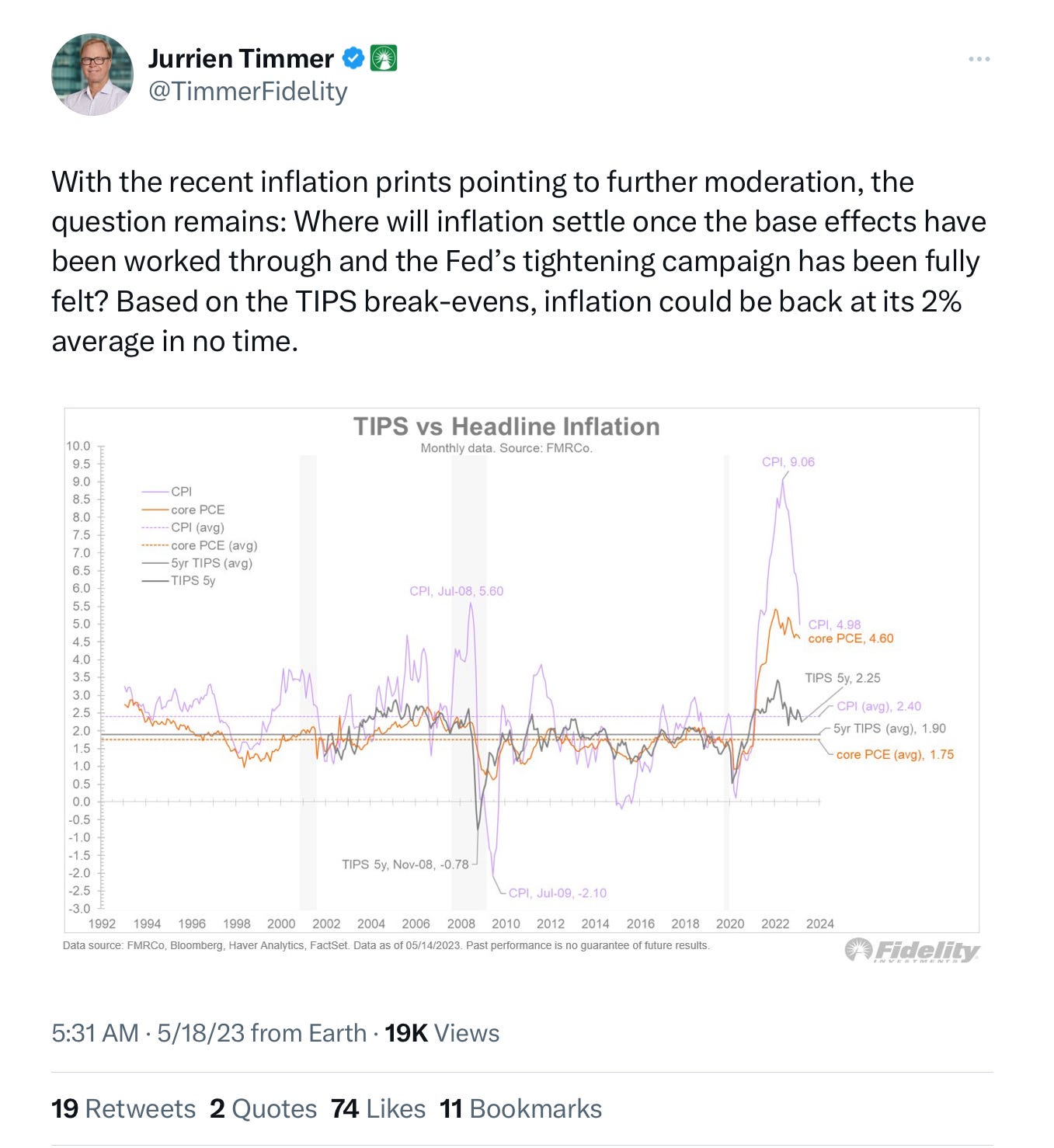

Inspirational Tweet:

Ah yes, inflation. Something we haven’t hear quite enough about recently, have we? Cue the obligatory eye rolls and glares of irritation. 🙄😡

It’s not that we’re sick of hearing about inflation. It’s that we’re sick of experiencing the effects of it. I mean, who here hasn’t noticed that a Costco ribeye now costs about what a Whole Foods Wagyu filet used to?

In any case, whether we can believe the above chart or not, that’s not really the point here. What we need is a way to battle inflation. To fight back.

To save our hard earned money and protect it from that silent super tax.

And so, it’s no surprise that a lot of people have been asking me recently if buying TIPS or I-Bonds is a good way to do just that.

But first, let’s clarify what these securities are, how they’re priced, and what makes them different from each other. And most importantly, are they, in fact, a good investment?

Lots to cover here today, but no worries, we’ll cut through it like a Navy Seal Ka-bar through that $140 Wagyu filet. So, grab yourself a cup of coffee and settle in—it’s Informationist time.

Join the 🧠Informationist community and get access to every single post + the entire archive of articles for a fraction of the cost of a college finance course.

You’ll learn a whole lot more, faster and easier. That’s my guarantee.

🧐What are TIPS?

To start, let’s clear up exactly what these securities are and what their stated purpose is. Whether or not they succeed, well, that’s a different story entirely, as we’ll see.

But in essence, TIPS (Treasury Inflation-Protected Securities are exactly what they sound like: bonds offered by the US government that (supposedly) protect investors from inflation.

How?

First, let’s remember how bonds work. When you buy a bond, you have the face value and the interest rate. And so, if the price of the bond goes down, that means the interest you earn on that bond rises, and vice versa.

Back to TIPS.

First issued in 1997, TIPS are bonds sold by (surprise surprise) the US Treasury. They’re available in maturities of 5, 10, and 30 years, they pay interest (on face value) semi-annually, and the value of the bond principal is adjusted semi-annually based on changes in the Consumer Price Index (CPI).

Remember that last little oh-so-important detail. We’ll come back to it in a minute.

In any case, upon maturity, investors are paid an adjusted principle or original principal, whichever is greater.

Sounds pretty good, right? What’s the catch?

Well, let’s check out the I-Bonds next and then we’ll carve a little deeper into these fatty deals.

🤨What are I-Bonds?

Much like TIPS, I-Bonds also are meant to protect investors from inflation. They’re also offered by the US Treasury, but interest that accrues is not subject to federal income tax until the bond is cashed in, and they are exempt from state and local income taxes.

Two small catches: I-Bonds only come in 30-year maturities and total purchases are limited to $10K.

Wait. Loan the government your money for 30-years? Ha.

No problem, you say, I’ll just sell in the secondary market if I don’t want to hold them any more.

Except I-Bonds don’t trade in the secondary market. The US Treasury itself is the one and only buyer and seller that you can deal with.

So, you’re locked up for one year minimum. If you want to sell them after that and it is less than five years, you’ll forfeit your last three months of interest to the dealer, the Treasury.

Which gets us to how these are priced and earn interest for you.

The earnings rate for I-Bonds is a combination of a fixed rate, which stays the same for the life of the bond, and the inflation rate, which is adjusted twice a year (in May and November) based on changes in the CPI.

There’s that pesky CPI again.

Just how important is it? First let’s look at how each of these bonds are priced and that may help us better understand.

✍️ How are they priced?

One key to all this seems to be exactly how these so-called inflation protection bonds are priced in order to ‘protect’ you.

TIPS Pricing

The principal of a TIPS is adjusted based on changes in the CPI-U. The CPI-U measures the average change in prices over time that urban consumers supposedly pay for a basket of goods and services.

See, the US Treasury adjusts the principal of TIPS twice a year (semiannually) to account for inflation or deflation. This is done by multiplying the principal by one plus the semiannual inflation rate.

And so if there is inflation, the principal is increased, and if there is deflation, the principal is decreased.

Let’s say, you have a TIPS with a principal of $1,000:

If the semiannual inflation rate is 1%, the adjusted principal would be $1,000 * (1 + 0.01) = $1,010

And if the semiannual inflation rate is -1%, the adjusted principal would be $1,000 * (1 - 0.01) = $990

The above adjusted principal is then used to calculate the amount of interest payments. Let’s say you’re $1,000 TIPS has a 3% interest rate, and so in the above example:

$1,010 * .03 = $30.30

and

$990 * .03 = $29.70

The higher the inflation, the more interest you are paid, and vice versa.

One more thing.

The initial price paid for a TIPS is determined in the US Treasury auction. If you’re interested in how this works, I covered UST auctions in a recent article here:

TL;DR: the stronger the auction, the higher the bond price and lower the yield, and vice versa.

And because these are often bought and sold in the secondary market, you have to also take into account and calculate the actual yield you are getting according to the price you pay for the TIPS in the market.

I.e., it’s more complicated to trade these than I-Bonds.

I-Bonds Pricing:

I-Bonds are sold at face value, not in auction. So, if you buy a $50 I-Bond, you will pay $50, and it will be worth $50 upon redemption.

Simple.

Then, the total return on I-Bonds is based on a combination of a fixed rate and the inflation rate. The fixed rate remains the same for the life of the bond, while the inflation rate is adjusted semiannually based on changes in…

you guessed it: CPI-U.

The calculation is:

Composite rate = [Fixed rate + (2 x Semiannual inflation rate) + (Fixed rate x Semiannual inflation rate)]

Come again?

OK let's say you have an I-Bond with a fixed rate of 0.5% (or 0.005), and the most recent semiannual CPI-U inflation rate was 2.5% (or 0.025).

Substitute these values into the formula:

Composite rate = [0.005 + (2 x 0.025) + (0.005 x 0.025)] = [0.005 + 0.05 + 0.000125] = 0.055125

Therefore, the composite rate for this I-Bond would be approximately 5.51% for the next six months.

Interesting.

One aspect of these bonds is very clear. They are highly dependent on one thing and one thing only: the CPI-U number.

🤨 Are they a good investment?

Ah, the CPI. One of our favorite government manipulation—er, calculations coming out of the Bureau of Labor Services or BLS.

Which we sometimes just shorten to BS around here.

Why?

Because, let’s face it. The CPI is a hopelessly flawed and problematic calculation that sometimes seems to have absolutely nothing to do with the real life, actual prices that people are paying for goods and services they need.

I’ve gone into this in depth a number of times, and if interested, you can read much more about CPI here:

And here:

TL;DR: the actual inflation numbers are far higher than the Fed and BS and White House ever admit to.

Period.

I go into the flaws and reasons in great detail in the above articles, and I encourage you to check them out.

In any case, the point is that neither TIPS nor I-Bonds offer positive real rates in the real (non-Fed-BS fantasy land) world.

Remember:

Interest on bond - inflation rate = real rate

And in order to actually be protected from inflation, you need a positive real rate of return on your investment.

That’s number one.

Secondly, why lock yourself into a flawed inflation-priced bond that you may have to pay a penalty on when redeeming within 5 years? When they manipulate inflation down to the 2 to 3% range (when it is really more like 7 to 9%, or more), your bond will yield less and less every month.

In fact, seeing how we are currently on a virtually 100% likelihood trajectory of a recession, I-Bonds seem a less than ideal investment at this time. Especially if we hit a hard recession (also likely, IMO), which could lead to deflation.

In that case, I’d personally rather just own some good ol’ 3.5 to 5% yielding USTs. At least on the short end.

*Note: if you’re concerned about the US defaulting on those USTs, I covered all that here:

Or if you’d rather listen to it, You can find the podcast here:

TL;DR: If the US does default, it’ll be a technical default and short-term event. All USTs are highly likely IMO (like 99.999% likely) to be paid in full with interest, even if a few days or weeks late.

Yes, I still own some USTs and keep separate cash in fully FDIC+ insured accounts to have on hand in order to take advantage of such an event.

And if you’re truly worried about coming inflation due to a hard recession and then an equally hard Fed pivot to the money printer, then why wouldn’t you hold some hard assets instead?

Like gold. Like silver.

Like Bitcoin.

Because if and when the Fed does pivot, those hard assets will likely soar far ahead of any CPI-U inflation adjustment for these so-called TIPS and I-Bonds.

Remember, the US Treasury’s mission is the pretend inflation is lower than it is, hide the fact that it is actually high, and obscure the reality that the USD is programmed to debase.

Still, I believe studies like this are an important exercise for all of us.

After all, we need to stay on our toes out here and not be fooled into 4X over-priced ribeyes, when there may be a Wagyu filet sitting right there for the taking.

That’s it. I hope you feel a little bit smarter knowing about TIPS and I-Bonds and whether they are a good investment for you. If you enjoyed this newsletter and know someone you think would like it too, please share with them!

And if you are a paid subscriber, leave a comment, answer a comment, join the awesome 🧠Informationist community below!✌️

✌️Talk soon,

James

Any good book recommendations on how the bond market works in totality?

Also, I’d love to see a similar piece on Tbill investing. I private money lend and recently started using Tbills to park my cash between deals. Would love to know your thoughts.