💡 Are Swaps Ringing a Warning Bell?

Issue 178

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What Are Swaps?

What Are Swap Spreads?

What Are Current Swap Spreads Telling Us?

What to Watch For Next — And What If Swap Spreads Go Super Negative?

Inspirational Tweet:

When looking for clues to the health of the debt and Treasury markets, one of the main places that pros look at is the swaps market.

This can sometimes be a super important clue.

We’re not talking about the typical CDS market, a la The Big Short, but rather the spreads between swaps and physical securities.

Huh?

Trust me, this is important stuff, and you will want to at least get a simple understanding of what we are talking about today.

But don’t worry, we will unpack and explain it all nice and easy, as always, for you.

So, pour yourself a big ol’ cup of coffee and settle into your favorite seat for a look behind the swap spread curtain with this Sunday’s Informationist.

🤓 What Are Swaps?

First things first, let’s get you back up to speed on swaps and the important aspects of what ones we are discussing today.

For those of you who have been following me for a while, you know I like to talk about these things semi-regularly, so you may already have a handle on the swaps market.

If not, or if you just want a little refresher, here are some articles you can check out to get you all warmed up.

TL;DR: At the most basic level, swaps are just private agreements (legal contracts) where the parties agree to swap one exposure (risk) for another.

Simple as that.

I’ve traded thousands of swaps in my career, typically to avoid currency exposures, by swapping out the risk of the fluctuation of a foreign currency to remain in US dollars instead.

You may recall that in the case of the Great Financial housing crisis, CDS (Credit Default Swaps) were used to swap the risk of a tranche of debt (a bunch of homeowners’ loans all rolled into one bond) defaulting on its collective mortgage payments. Owners of the debt could get insurance on the default of that debt by buying CDS ‘insurance’.

Those are both examples of niche swaps, though, the less common type.

The most common type—and the one most relevant here today—is called an interest rate swap.

In an interest rate swap, there are two legs (sides to the swap):

The fixed leg – One party agrees to pay a fixed interest rate for the life of the swap.

The floating leg – The other party pays a variable interest rate, which resets periodically based on a benchmark (today, that’s almost always SOFR in the US—it used to be LIBOR).

Here’s how it works.

Imagine a hedge fund (Party A) agrees to pay a fixed rate of 3% each year, while a bank (Party B) pays SOFR, which may be 2.8% today, but will reset regularly. The payments are netted so only the difference changes hands each period.

Read that again slowly.

The hedge fund will pay 3% fixed interest per year on an amount of money, and the bank will pay a floating rat (currently 2.8%). They net out the difference, and in this case, the hedge fund will pay the bank .2% annually.

Why would they do this?

The primary purpose of swaps is risk management.

See, perhaps the hedge fund has an obligation that is a floating interest rate, but wants to make it fixed, to lock in its exposures and/or limit its downside.

So, the hedge fund with the floating-rate exposure enters into a swap to pay a fixed rate instead, locking in predictable interest costs. The pension fund with long-term fixed liabilities might do the opposite—receiving fixed payments and paying a floating rate—to better match its cash flows.

Asset managers and hedge funds also use swaps to fine-tune interest rate exposure without buying or selling physical bonds, which can be costlier, less flexible, and less tax efficient.

The key players in this massive market are commercial banks, investment banks and swap dealers, pension funds, insurers, asset managers, hedge funds, and large corporations.

All together, they form the base for one of the most important pieces of the global financial plumbing.

See, the US interest rate swap market is enormous — in certain maturities, it is even more liquid than the underlying Treasury market.

How big of a total market are we talking about here?

The swap market is not just big, it is colossal.

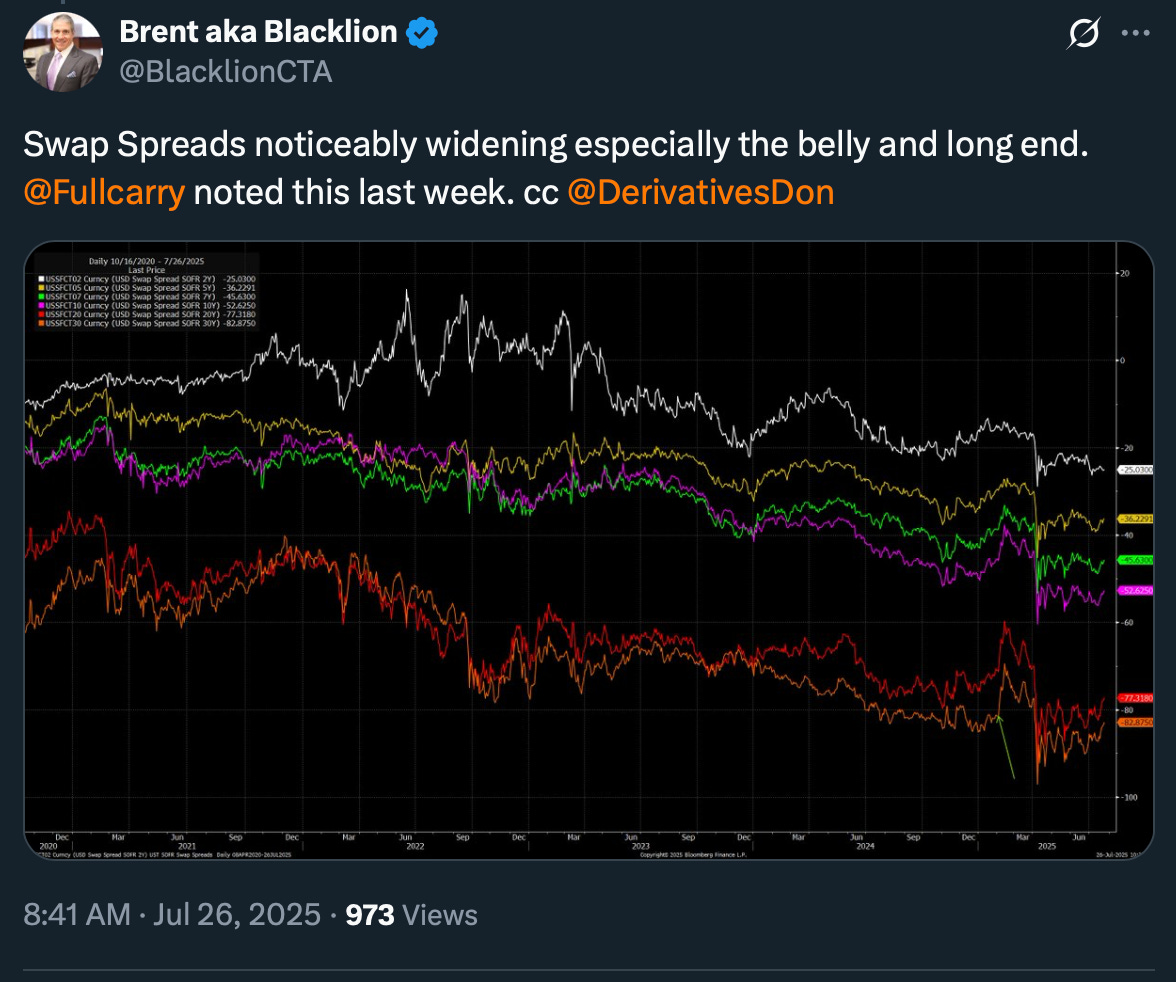

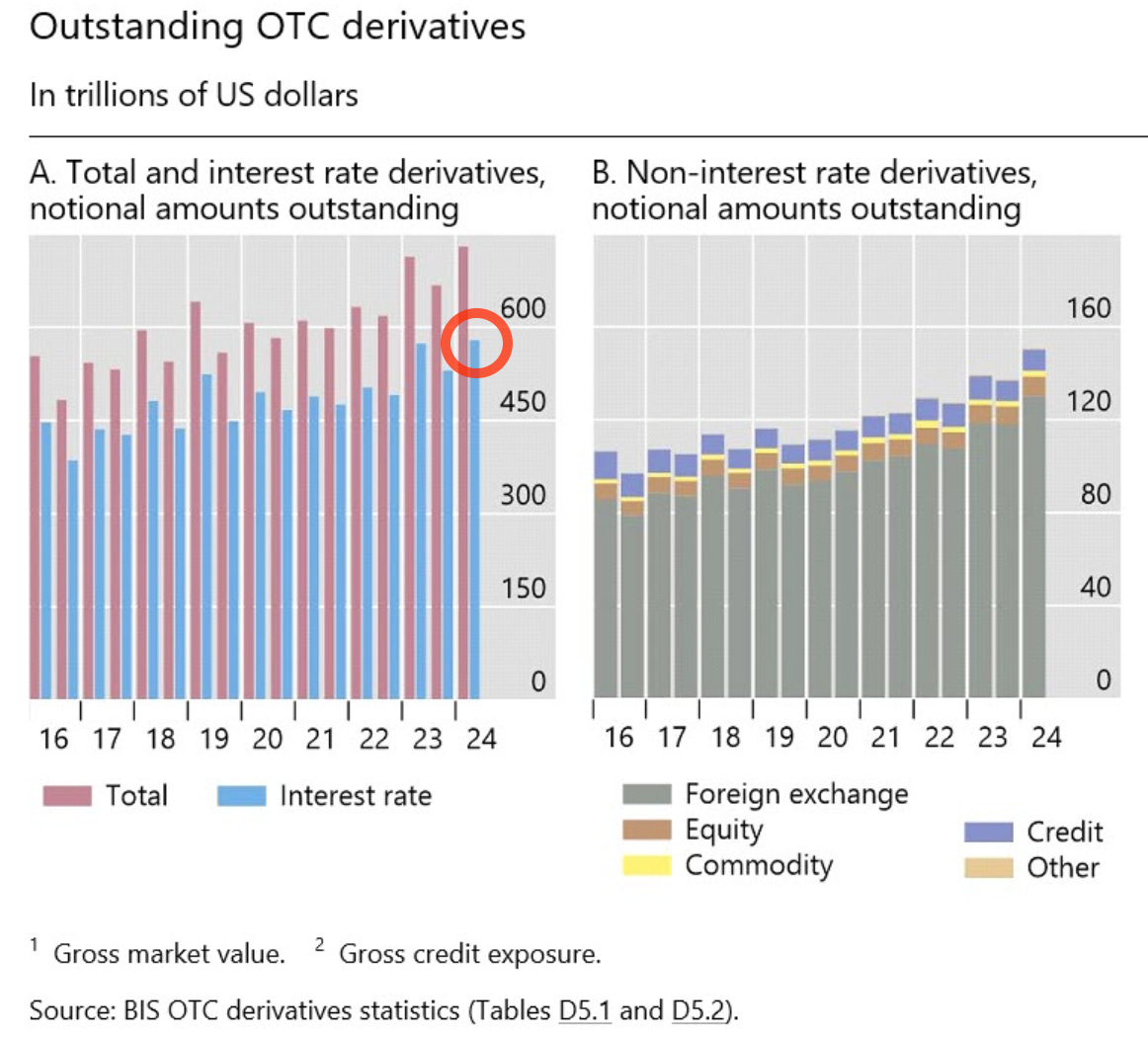

According to the Bank for International Settlements (BIS), the global over-the-counter (OTC) derivatives market had roughly $730 trillion in notional outstanding by mid-2024, as seen in the tallest red (Total) bar below.

And interest rate derivatives had risen to around $579 trillion (red circle on the blue bar above).

And so, swap rates are routinely used as benchmarks for pricing corporate debt, mortgages, and structured products. Major changes in swap rates can signal shifts in credit risk, liquidity conditions, and expectations for Federal Reserve policy.

In short, swaps are not just derivatives — they are a pillar of infrastructure that allows trillions of dollars of interest rate risk to change hands every day, keeping global fixed-income markets functioning smoothly.

And this is where swap spreads come into play.

🤓 What Are Swap Spreads?

Now that you’ve got the basics of swaps down, let’s talk about swap spreads — the part of the market that pros keep a close eye on for clues about the health of the financial system.

At its simplest, a swap spread is the difference between the fixed rate in an interest rate swap and the yield on a US Treasury security of the same maturity:

Swap Spread = Swap Fixed Rate − Treasury Yield (same maturity)

In other words, if the 10-year swap fixed rate is 3.20% and the 10-year Treasury yield is 3.00%, the spread is +0.20% (or +20 basis points).

Now you may be asking, why on earth do we care about this number in the first place?

Good question, and a super important one. Let’s tackle that next.