Will Student Loans Crush the Consumer?

Issue 70

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

State of the economy

State of the consumer

Student debt reality

Impact to the economy

Inspirational Tweet:

With the Supreme Court ruling this past week that student loan payments need to resume at the end of August, this post from Genevieve now seems prescient.

Politics aside, let’s pretend for a moment that the current administration loses its fight and student loan payments resume by this fall.

How negative will the resumption impact be on the economy?

There’s lots to point to and dig through here, but I’ve boiled it down to a number of key charts and graphics to determine the state of the consumer.

So, grab that cup of coffee and settle in for some eye-candy today, as we break it down nice and easy, as always.

Join the Informationist community!

Get access to subscriber-only posts and the full archive

Ask questions and participate in the comments with other awesome 🧠 subscribers!

🧐 State of the economy

Starting at 100k-feet, let’s first check the pulse of the economy as a whole. How is Powell’s inflation fight going, and where’s the economy headed in the near term?

Let me first stress that all the data here and projections—even near-term—assume that we do not have a credit event. One that is severe enough to lock up the bond markets and tip off a cascade of bankruptcies.

An entirely possible (if not probable) event, considering the Fed’s actions and stance.

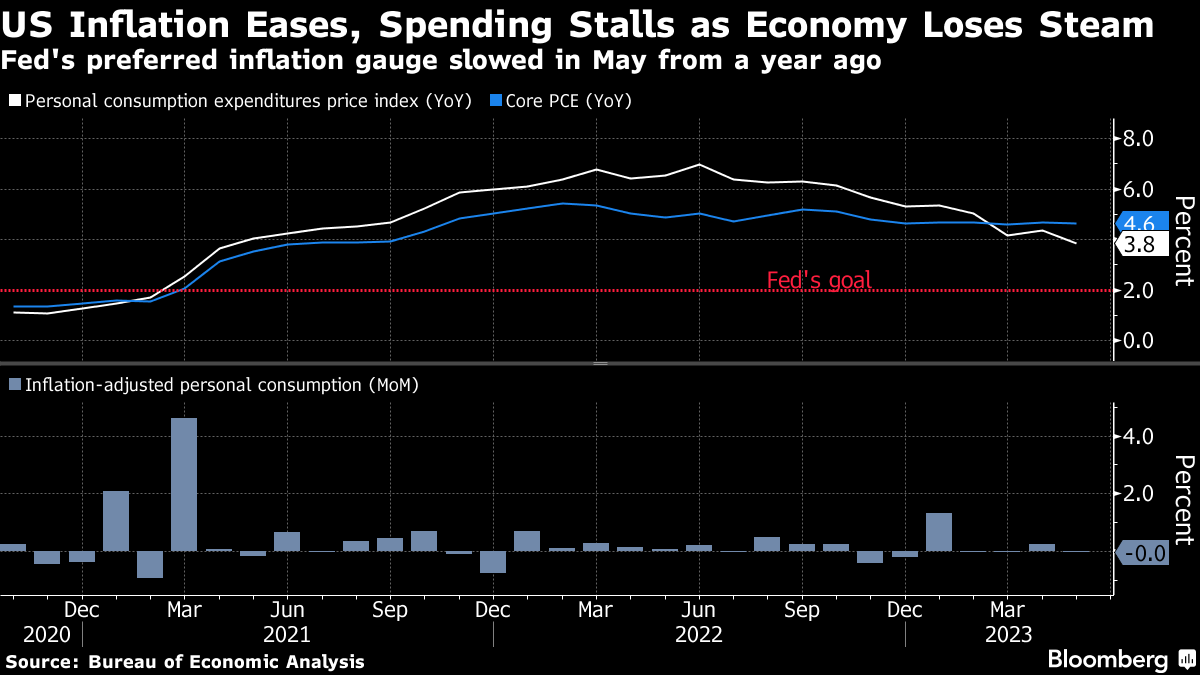

In any case, looking at the recent data, we see that the Fed is—slowly but surely—winning its battle with inflation. But notice the inflation adjusted personal consumption number at the bottom.

Friday’s PCE data (the Fed’s preferred measure), showed a complete halt in real consumer spending from the prior month. Zero point zero.

What’s more, this week’s GDP and GDI numbers showed a large divergence, something that typically points to an incoming recession.

If you want to understand the relationship between GDP and GDI, I covered that much deeper in a recent newsletter that you can find here:

TL;DR: When Gross Domestic Product and Gross Domestic Income diverge, it means the cost to produce goods is becoming increasingly larger than income generated from that production.

Not good.

In any case, we’ve been talking about the high likelihood of a recession soon, though nobody can predict when, exactly.

So, let’s check on the consumer itself, see strength of their position today.

🫣 State of the consumer

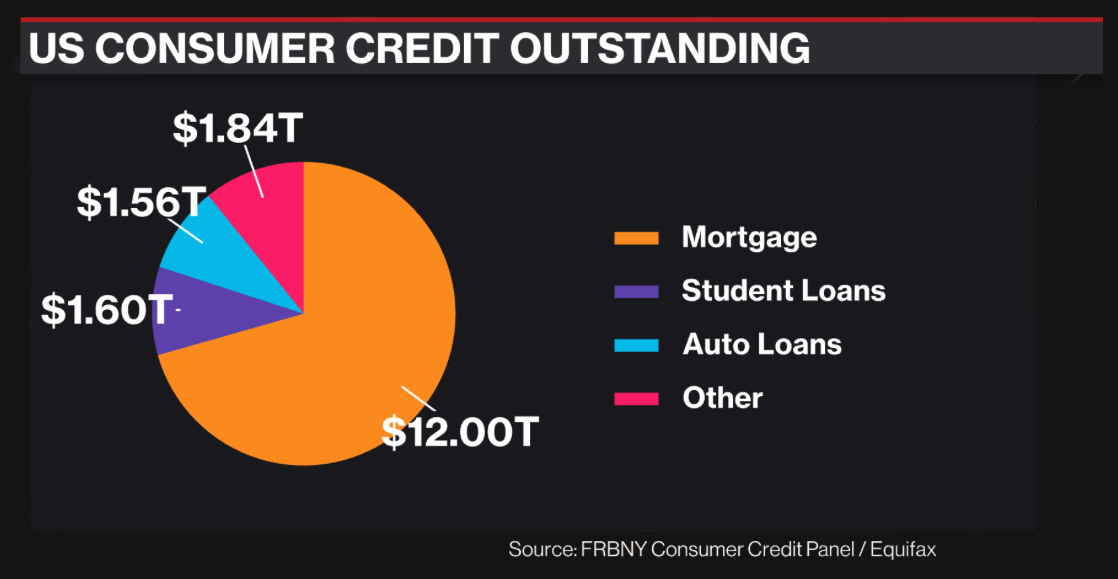

It seems we can’t talk about the state of any sector of the economy these days without talking about the amount of debt in that sector. Be it the Treasury, Fed, corporations, banks, or consumers—the entire world is swimming in debt.

And it’s only getting worse.

Breaking these debt balances down, we see that the student loan debt balance is actually larger than auto loans and almost as big as everything else added up.

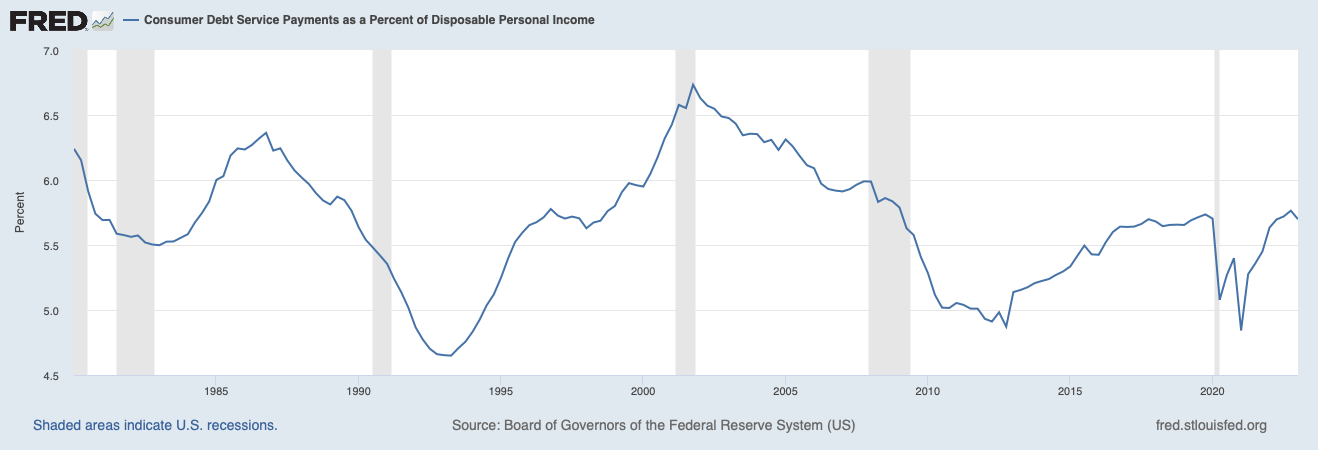

OK, so there’s a lot of debt, so what.

Payments on that debt as a percentage of disposable income is still pretty low.

While that may be true, this is a measure of all consumer payments vs all income.

When we dig in a little further, we see a slightly different picture, one that suggests some consumers are becoming much more stretched and stressed than others, and so delinquencies are increasing for certain types of loans.

As Genevieve pointed out above, delinquencies for student loans are virtually zero, as they’re still on hold. But we’ll get to those in a minute.

First, see how credit card 90-day delinquencies (blue line) are increasing?

This lagging number may have something to do with this (credit card interest rates):

Well, that escalated quickly.

One of the problems is that when stretched for cash, in a ZIRP (Zero Interest Rate Policy) environment, consumers have often turned to their home as a source of capital. And through cash-out mortgages or home equity lines of credit, they could tap that equity.

Problem is, with high interest rates and banks tightening loan standards, many of these consumers are now left with nowhere to turn. Loan originations (new loans) have dropped off a cliff this past year.

Digging deeper, who owes all this student debt? Who are the 40 million consumers who have had three years of payment reprieves? And how are they doing today?

😵 Student debt reality

No surprise, the majority of student debt is owed by 18 to 40-yr olds.

And since they don’t have a lot of credit card debt, all is good, right?

Well.

The reality is, this collective age group (light blue and red lines) is clearly becoming financially stressed and on the way to distress or default.

Right when $1.8T of student loan payments may suddenly be turned back on.

According to the Fed, the average monthly student loan payment pre-pandemic was $393. If that age group is already missing payments on credit card bills, where’s that money going to come from?

🤓 Impact to the economy

If we go back to first principles, the average consumer wants to do all they can to avoid damaging their credit—i.e., missing payments.

Especially federally backed loan payments.

But an increasing percentage of this demographic is late on credit card payments already. So, the likely outcome is a simple decrease in spending by these consumers.

Likely in retail and consumer discretionary sectors (clothes, electronics, etc.) as opposed to staples, that are necessary—like groceries and toothpaste).

Will this spending slowdown devastate the economy like some politicians claim?

No.

Rather, the slowdown will be skewed to mostly businesses and brands that are overly exposed to the young demographic. Fashion, restaurants, certain auto brands, travel and AirBnBb, etc.

But will the overall spending slowdown tip the economy into a recession?

Not likely.

And so I’m sticking with my current investing game plan, not stressing over the student loan situation.

If you don’t know my plan, please read some recent newsletters to see.

Because I’m far more worried about a rash of layoffs or a major credit event, either of which could send us tumbling into the recession abyss.

So, keep your head on a swivel out there, and keep your risks in check.

That’s it. I hope you feel a little bit smarter knowing about the student loan situation and how to think about it in relation to your own investing.

Before leaving, don’t forget to leave a comment or answer a comment in our awesome 🧠 Informationist community below!

Talk soon,

James✌️