💡 What is Gold Telling Us (About Bitcoin)?

Issue 185

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Gold & Bitcoin vs M2: The Divergence

M2 Short Term Reading Flaw?

A Better Measure

Putting it All Together

Inspirational Tweet:

If you have been on Twitter/X lately, then you are well aware of all the angst and growing frustration in the Bitcoin ‘community’ in regards to recent weakening price action.

Especially in contrast with the strong price action of gold.

So, what exactly is going on here? Why is gold moving higher and leaving Bitcoin behind? Is this a structural break in a historical pattern?

Most importantly, if you own Bitcoin, should you be worried?

Great questions, and ones we will answer, nice and easy as always, here today.

So, pour yourself a big cup of your favorite coffee and settle into a comfortable seat for a simple investigation of gold versus Bitcoin with this Sunday’s Informationist.

Partner spot

Bitcoin Has Crossed the Rubicon

This extended $75k–$110k range has caused some to wonder if the bull run is exhausted. But what if the on-chain evidence tells a totally different story? Join James Check (Checkmate of Checkonchain) and Connor Dolan for a data-driven discussion on what a maturing bitcoin market means for the road ahead.

James Check will break down:

Institutions reshaping the cycle: ETF flows and institutional allocator demand setting higher floors

Chopsolidation: why time-pain in the $75k–$110k range signals resilience, not exhaustion

Conviction on display: heavy distributions absorbed while long-term holders remain in control

On-chain metrics show bitcoin has crossed the Rubicon—from a nascent store of value into a true institutional-grade asset class. This session will help you understand what that means for this bull market and beyond—and how you might position yourself appropriately.

Tuesday, September 30th at 3PM CT — online, free to attend.

Register now for early access to a new on-chain metrics report from Unchained and Checkonchain here:

🤔 Gold & Bitcoin vs M2: The Divergence

Let’s get right to it today, shall we?

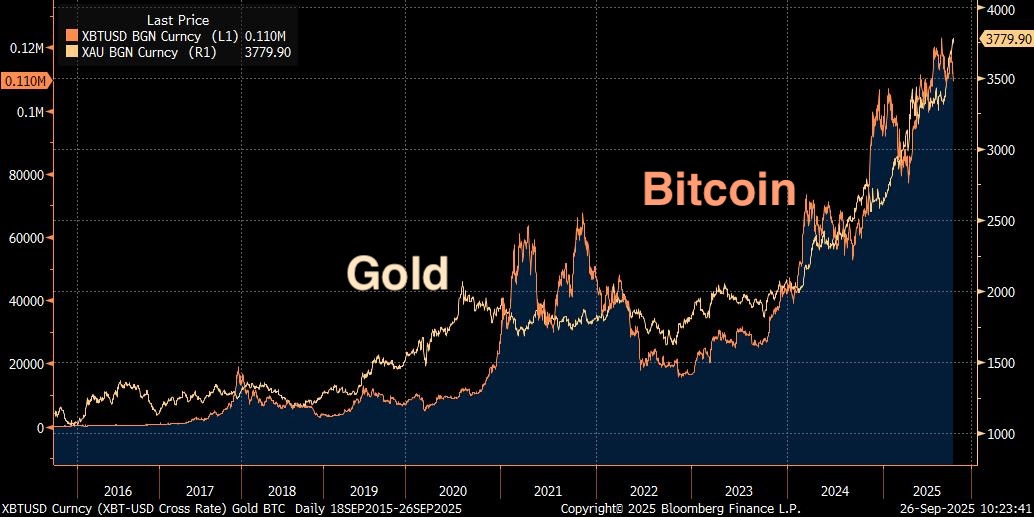

To start, let’s look at this chart:

The long-term view since 2015 overall shows quite strong correlation. Though Bitcoin displays more volatility, both assets climb together, tracking each other beautifully year after year.

But now zoom into 2025.

See that divergence?

Gold (the yellow/white line) has been on an absolute tear since August—making new all-time highs, up and away.

Bitcoin?

It had a rough first quarter, recovered in Q2, hit new highs in Q3, but the overall year shows it clearly lagging gold’s relentless climb.

This has Bitcoin skeptics like Peter Schiff doing grandstands and fake victory laps (yet, again), with Tweets like this:

Of course, four years ago, he also posted this gem:

Don’t tell Peter, but Bitcoin is up approximately 10X since then. 🤡

In any case, it does have some actual investors nervous and wondering what exactly is going on lately.

Especially when we take it a step further and plot each asset against the global money supply, M2.

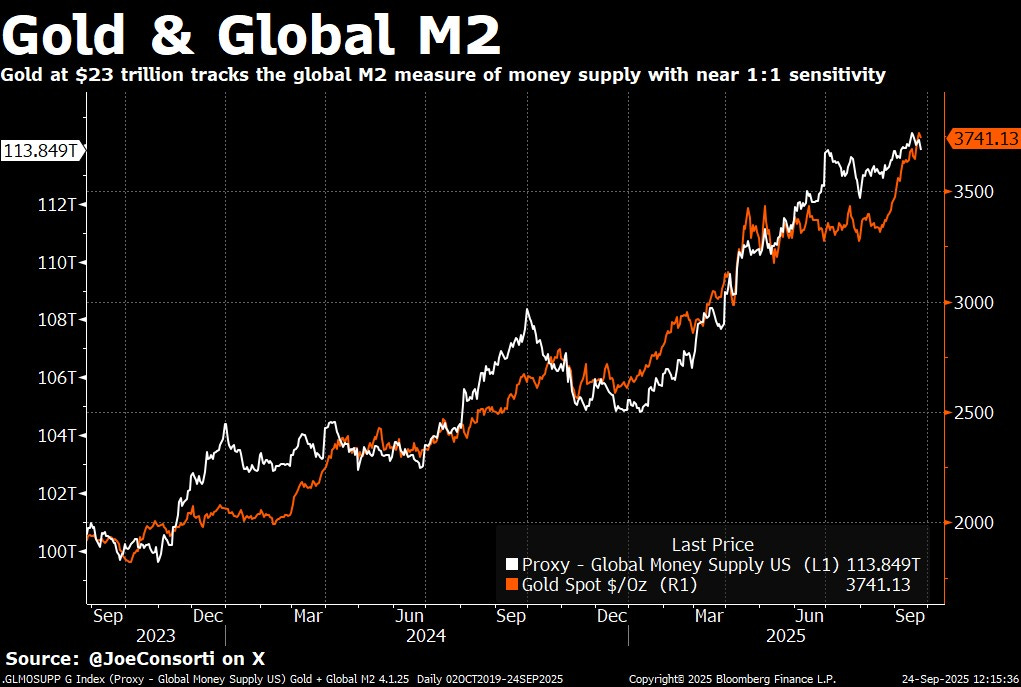

Thanks to my friend Joe Consorti (@joeconsorti on X) for plotting the next two charts:

What we see here is that gold at ~$3800 is tracking global M2 money supply (now at $113.8 trillion) with near 1:1 sensitivity. The correlation is super tight.

When M2 expands, gold goes up. When M2 flattens, gold consolidates. Almost mathematical.

**Note: if we were to plot it on a slight lag, it would be even tighter.

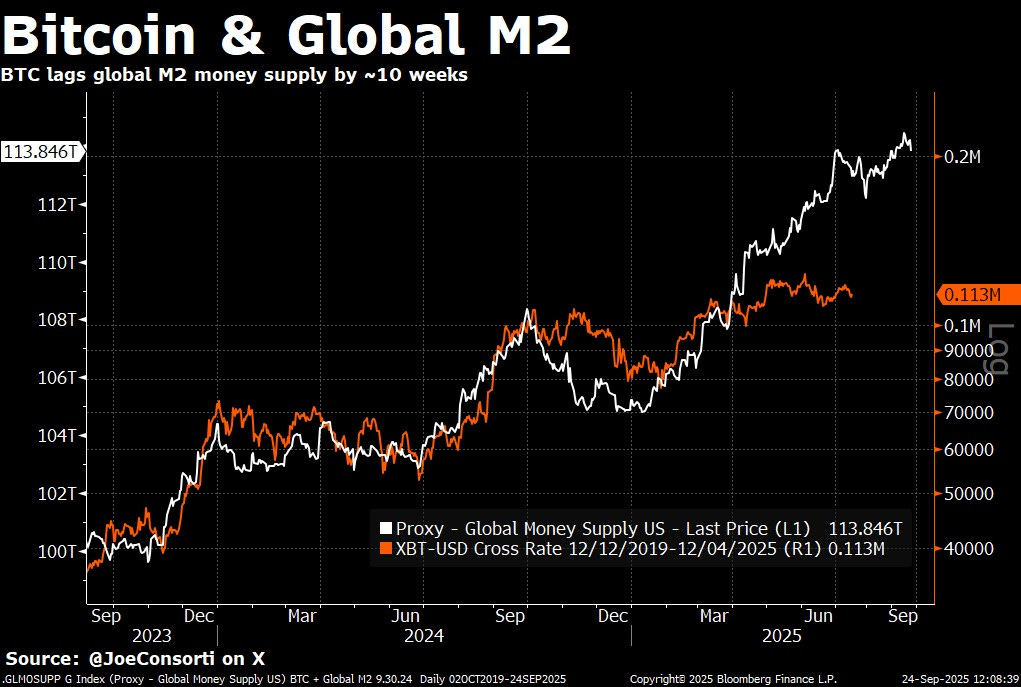

Now look at Bitcoin versus M2, where Joe does plot with a lag:

We can see here that if we offset Bitcoin by 10 to 12 weeks, the correlation to M2 is similarly strong. This isn’t new. Bitcoin has lagged M2 by roughly this amount for years.

So when M2 expands in one period, Bitcoin responds about three months later. Not immediately. Not same-day. Three months.

But here’s the problem: since July, this relationship appears to have broken down. M2 has continued trending higher, but Bitcoin has been moving sideways instead of following its usual pattern—even with the lag.

Why?

No, Bitcoin is not ‘broken’, and it certainly hasn’t failed, like Schiff wants you to believe.

The answer may be hidden noise, distorting recent M2 readings. But even with that noise, gold has stayed on course, and Bitcoin has not.

Why?

🤨 M2 Short Term Reading Flaw?

OK, so what’s really going on here?

The simple answer: Gold has an extra buyer that Bitcoin doesn’t.

Over the last three years, foreign central banks have been accumulating over 1,000 tonnes of gold annually—more than double the 400-500 tonnes they bought in the prior decade.

Make no mistake, this a structural shift, not a blip.

And the buying has only has accelerated recently.

Who exactly is buying?