💡 What is a SPAC?

Issue 165

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What Is a SPAC?

As a SPAC Investor

High Profile SPACs

Bitcoin SPACs - A New Twist

Inspirational Tweet:

If you’ve been paying attention to the Bitcoin investment world recently, then you’ve likely heard the big announcement with Cantor Fitzgerald and the term SPAC.

But what is a SPAC, and why and how are CEP and Twenty One, a Bitcoin company using them?

Excellent questions, and ones we will answer today, as well as many others. But have no fear, because we will do it all quickly and easily, as always.

So, grab yourself a big cup of coffee and settle into a nice comfortable seat for a peek behind the IPO and SPAC curtain in this Sunday’s Informationist.

On the Agenda:

Join me Thursday, May 15th at 9 am - 12:30 pm PT on The Confident Investor where you'll discover proven strategies for tax optimization, passive income generation, 401K diversification, and comprehensive asset protection.

This webinar has already helped thousands of investors protect and grow their wealth in today's volatile market. Learn practical techniques you can implement immediately to potentially reduce your tax burden, create reliable income streams, and better secure your financial future. Perfect for professionals and experienced investors looking to take their portfolio to the next level.

🤔 What Is a SPAC?

If you are from Upstate NY, then the acronym SPAC means Saratoga Performing Arts Center, a sprawling concert venue near my childhood hometown, where we saw bands like Eric Clapton, Grateful Dead, Crosby Stills & Nash, Def Leppard, Bon Jovi, and tons of other classic rock and hair bands when growing up.

Ah yes, a simpler time.

But for everyone else, SPAC likely means something quite different.

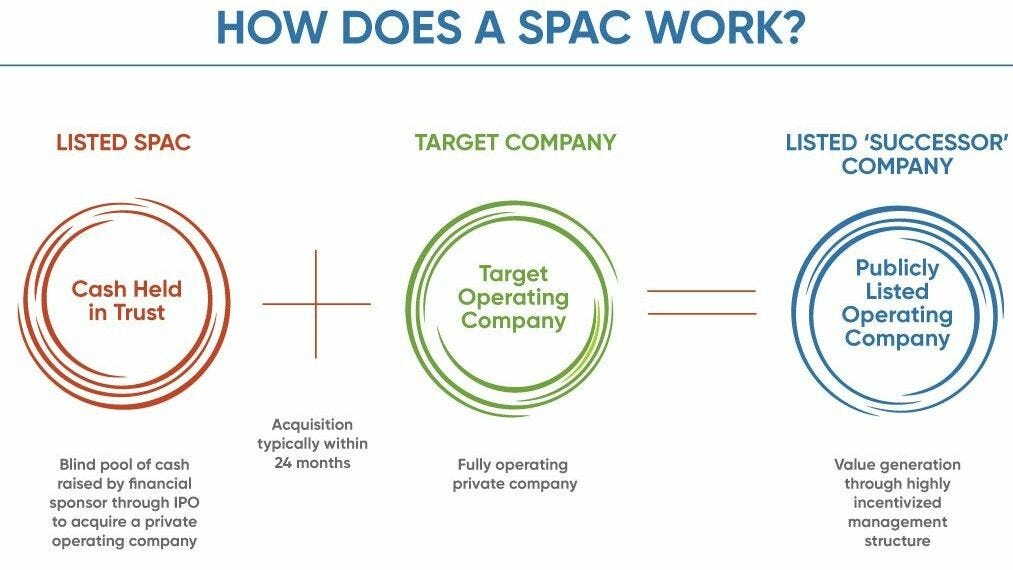

For them, SPAC is short for Special Purpose Acquisition Company, a type of investment vehicle that lets a company go public without using the traditional IPO process. Instead of launching with a product or service, a SPAC goes public as a blank-check company, meaning it raises money with the intention of finding a private company to buy later.

But to understand how SPACs work and why they use the process they do, let’s break up the various aspects of a SPAC into bite-size pieces for easy understanding.

Going Public Without a Business

Sponsors—often experienced investors, executives, or even celebrities—create a SPAC and take it public (issue shares in an IPO, or Initial Public Offering). At this point, the SPAC has no operations and no target company lined up. Its only goal is to raise money and then find and merge with a private business.

The IPO and Trust Account

The SPAC raises money through the IPO, typically at $10 per unit. Which includes:

One share of common stock, and

A fraction of a warrant (e.g., 1/3 or 1/4), which gives the right to buy more stock later at a set price (often $11.50).

The money raised goes into a trust account held in US Treasuries or T-Bills, like a money market account. This money can only be used for one of two things:

Funding the future merger/acquisition (business combination), or

Returning the cash to shareholders if no deal is completed in time (usually within 18–24 months)

Sponsor Incentives – The “Promote”

To get their stake (aka, a nice big slice of the IPO cake 🍰), sponsors invest a small amount of money—often just $25,000—in exchange for "founder shares." These shares will then convert to common shares once a merger happens.

How big of a slice, you ask?

Well, Founder Shares usually make up 20% of the total equity after the IPO.

This practice is called the "sponsor promote," and it's how sponsors can catch massive returns if the post-merger company performs well.

PIPE Financing (Extra Funding)

To help complete larger deals, SPACs often raise more money through what's called a PIPE—Private Investment in Public Equity. Think of this like an add-on IPO, or a top-up in money raising, where investors buy new shares with new money.

The Merger (aka De-SPAC)

Once a target is found and the deal terms are set, the SPAC:

Files required disclosures with the SEC

Holds a shareholder vote

And if approved, merges with the target company.

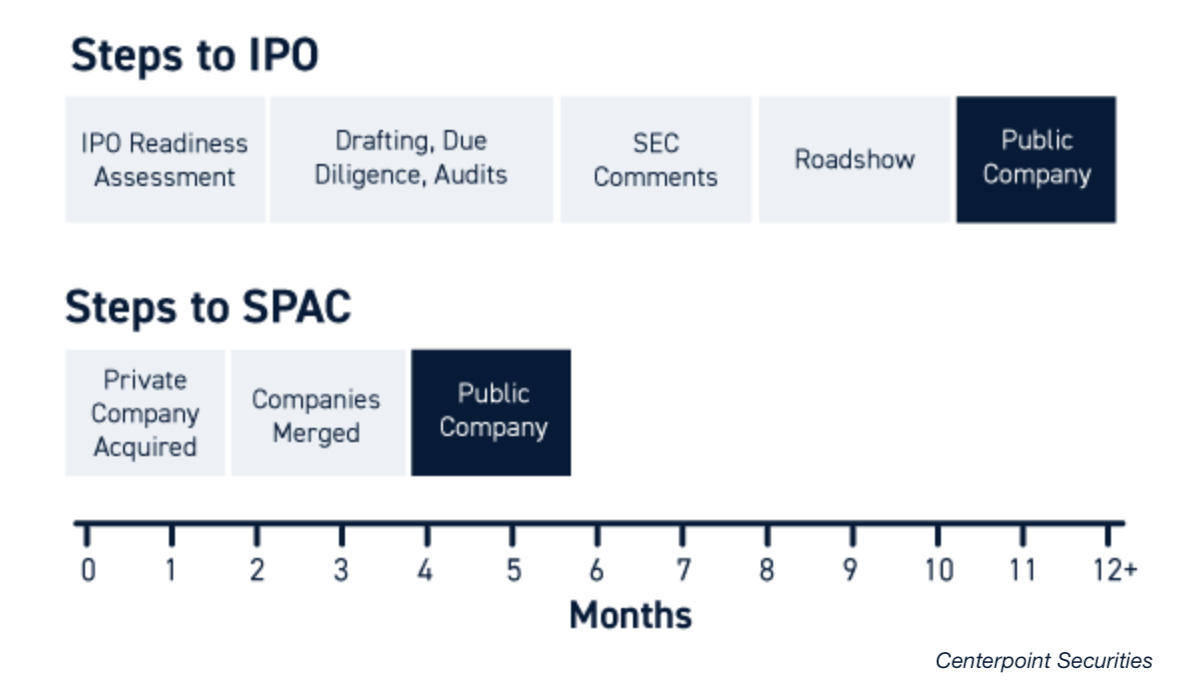

This process can take roughly 3 to 6 months, depending on the complexity of the merger and the company being purchased by the SPAC.

Once completed, though, the SPAC ticker symbol changes to the ticker of the new company (referred to as the NewCo on WallStreet), and the private firm is now publicly traded under that new ticker.

The SPAC essentially disappears.

Now you may be asking, why use a SPAC instead of a traditional IPO or PE Route?

Simple. SPACs offer speed, flexibility, and public capital access to the sponsors, as well as that nice big chunk o’ cake 🍰 they are accustomed to taking.

It’s faster than a traditional IPO, which can take 12+ months with multiple rounds of legal and regulatory hurdles

Unlike private equity, sponsors don’t raise funds privately first and then hunt for deals—they just go public, raise money upfront, and then deploy it when ready

They can also market future projections, which traditional IPOs can’t legally do. This makes SPACs attractive to early-stage companies with visions of grandeur

OK, great, that’s how a SPAC looks for the sponsor, but what about the investor? Why would they so readily give 20% of the investment to a sponsor? What’s in it for them?

🤑 As a SPAC Investor

For investors, SPACs present a unique opportunity that offers the ‘safety’ of cash with the potential upside of a startup.

How it works for the investor: