✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today's Bullets:

What is a Pivot?

Pivots and the Market

Pivots and Unemployment

Pivots and Gold

Inspirational Tweet:

If you were paying attention to the markets last week, you likely heard a fair amount about Fed Chairman Jerome Powell and his press conference. Specifically, how he hinted that the Fed was not only done raising rates for this cycle, but likely going to lower them a number of times next year.

The markets reacted favorably (read: ecstatically) across the board, with the S&P 500 and NASD both ending up over 2.5% for the week and reaching new highs for the year.

Both look to be headed for new all-time highs, in fact.

Makes sense, right? If the Fed stops raising rates and in fact loosens monetary policy, then this is good for markets, right?

Money is cheaper and easier to come by, right?

Well.

Not so fast there, partner. Historic data may beg to differ on a few fronts there.

So, grab that cup of coffee, saddle up and settle in, as we wind our way around that hair-pin turn called The Fed Pivot. But have no fear, we'll do it nice and easy as always today, using some big 'ol charts, Informationist style.

😏 What is a Pivot?

First things first, what exactly is The Fed Pivot?

Put simply, when the Fed has been using tightening monetary policy, it means it has been raising interest rates and/or selling assets it owns off its balance sheet (known as quantitative tightening or QT).

When it stops raising rates, this is known as a Fed Pause.

The Fed may or may not continue selling assets (QT) during the pause phase.

To date this year, it has continued selling while keeping rates paused.

A full pause would mean that The Fed is not just lowering rates, but it has also stopped QT.

Once the Fed starts lowering rates again, this is known as the Fed Pivot.

A full pivot, would mean that The Fed is not just lowering rates, but it has begun QE again, buying Treasuries and other bonds and assets in the open market.

This phase has come to be known as the Fed Put.

Also referred to by some as Cowbell, it signifies the market 'needs a little more, as it is lacking' (please see the famous SNL Skit about 1970s rock music for more context).

In other words, The Fed overdoes it, makes a mess of things.

Again.

The vicious Fed monetary policy (read: money manipulation) cycle.

So, where are we in this cycle today?

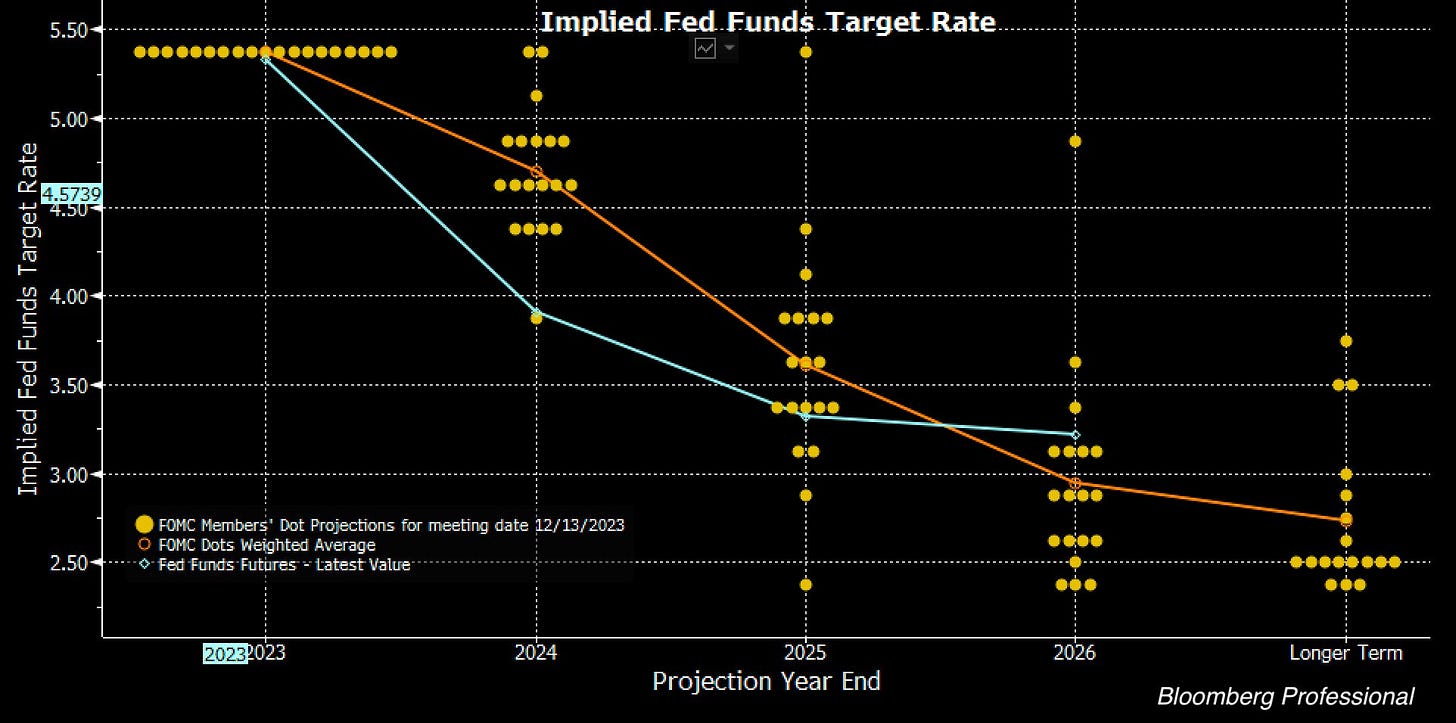

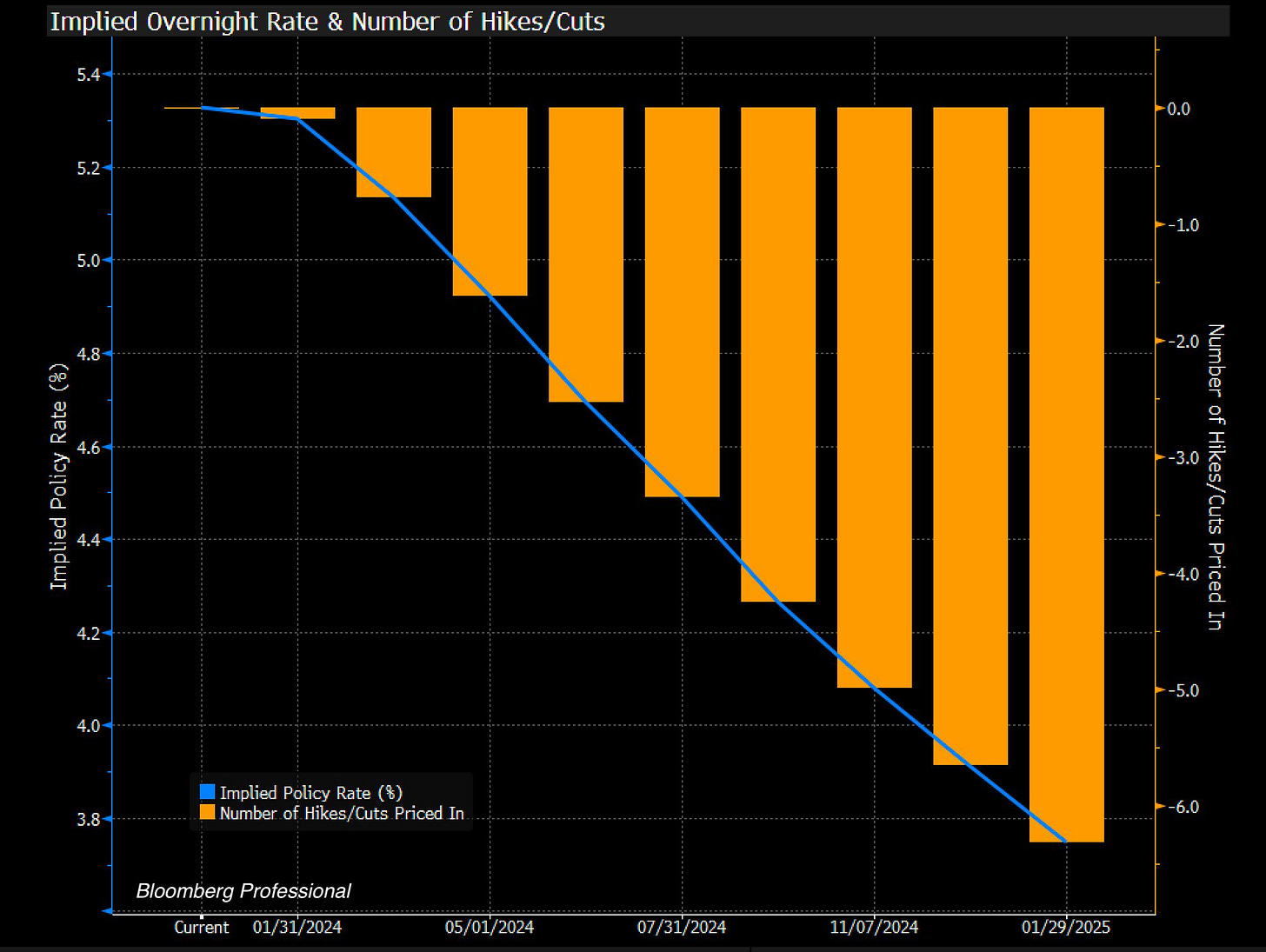

Well, as we said above, Powell indicated that, according to the Fed Dot Plot, Fed officials see about 3 rate cuts in 2024, taking the Fed Funds Rate from 5.5% down to 4.7%, or so.

If you have never seen this Dot Plot before and are wondering how to read it, I wrote a simple thread about it earlier this year, that you can find here:

Back to the current Dots, basically each dot is a projection from each Fed official, showing where they think rates will be by year-end of the next few years.

After Powell showed the Dot Plot and made his comments, the market rallied hard for the next two days, causing the fed to began to backtrack.

And so, we got conflicting signals out of various Fed officials, walking back the statements that Powell made, apparently trying to temper market expectations.

Raphael Bostic, President of the Atlanta Fed, said 'he sees just 2 rate cuts in 2024', and NY Fed President Williams says the Fed “isn't really discussing rate cuts."

The chart above also includes the Fed Futures estimate, or what the market thinks (Blue Line). As you can see, the market is estimating that rates will be closer to 3.9%, and is pricing in 5 to 6 rate cuts by the end of 2024.

What a mess, indeed.

Nonetheless, if we take the Fed at its word, that they are in fact finished raising rates and will soon be cutting them, what does it mean for the markets?

And what does it tell us about the economy, at least historically?

😱 Pivots and the Market

To put it bluntly, Fed pivots are not good signals for markets.

In fact, Fed pivots have been downright ominous developments for markets, historically.

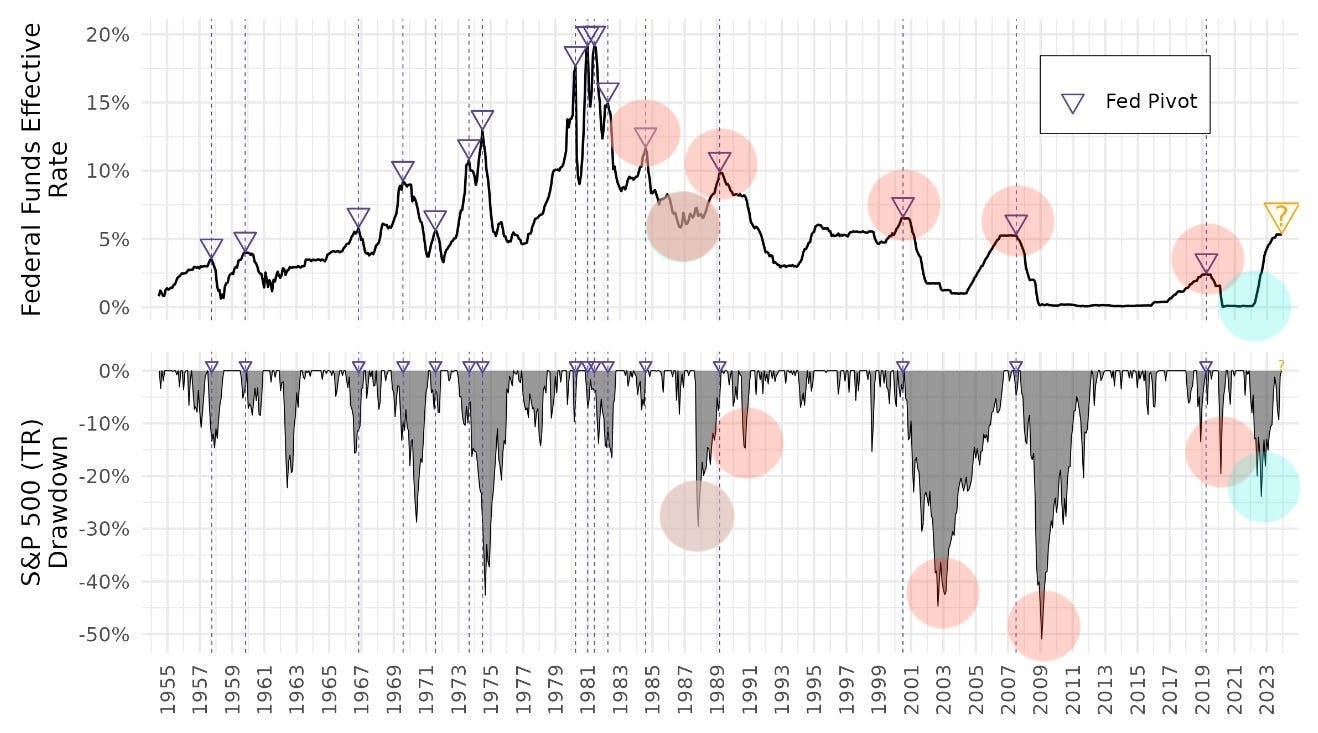

Take a look at this chart that Michael A. Gayed, CFA (@leadlagreport on Twitter/X) published recently. I added the red and blue circles for discussion here.

First, while it is often useful to go back and look at the 1970s and early 1980s for clues and understanding of Fed policy and lagging effects, you can see that the Fed was simply all over the map back then, raising and lowering rates more often than you may touch your thermostat over the same period.

Fed Chairmen Arthur Burns and Paul Volcker quick at the draw with their Fed rate whips.

Up-down-up-down-up-up-up-down-up-down-down.

No wonder they had a credibility problem.

Moving into the late 80s, though, we see a much more deliberate process with Greenspan and his successors. And whether or not this was more effective is up for debate, especially with the introduction of Cowbell, er...QE.

Nonetheless, we see that in 1989, 2001, 2008, and 2019, in particular, every single time the the Fed pivoted and started to lower rates, the market had major drawdowns of 15%, 45%, 50%, and 20%.

Yikes.

Interestingly, in 1987 to 1989, after the Fed started to lower rates again, it took years for the crash of Black Monday to occur, and you can see how the Fed was moving rates actively just before that.

Plenty of uncertainty.

Moving to today, the blue circles show how the drawdown occurred this past year, after the Fed began raising rates aggressively.

Something to note, this seems to mirror a few of the rate raising cycles back in the 1970s.

A time when inflation was raging out of control.

Interesting.

But what about the economy? What does a Fed pivot indicate there?

Let's peek at that next, specifically unemployment.

🤬 Pivots and Unemployment

I have been saying for a while now, and if you read The Informationist regularly or follow me on Twitter/X, you have undoubtedly heard me say it or seen me post about it.

Ad nauseam.

But if not, I will say it once again for all the newcomers:

The unemployment rate in and of itself is an abysmal indicator of a coming recession.

In fact, every single recession is marked by the onset of a spike of unemployment, not preceded by it.

Let me make that even more clear.

Unemployment spikes after and only after a recession has already begun.

But what about when the Fed pivots and begins lowering rates?

Does that give us an indication that unemployment is about to pick up?

It seems clear that plotting the Fed Funds rate against the unemployment rate, we can see a clear and unmistakeable correlation between the Fed lowering rates and the unemployment rate spiking, (orange lines) soon thereafter, right into recessions (red shaded areas).

It was, once again, messy in the 1970s and early 1980s, as the Fed seemed to lower rates only after recession had set in, three times.

But by the late 1980s, a solid pattern emerged.

Fed lowers rates → recession begins → unemployment spikes

Every. Single. Time.

And though, 2019 was a mess in and of itself with the mandatory lockdowns and disastrous job losses, the pattern remained the same...

The only question is: will it repeat on 2024, once again?

🤩 Pivots and Gold

A logical question would then be, if we do have a recession, a steep drawdown in the markets, with bond yields dropping, where should one put money in the event of another drawdown or selloff?

What happens to gold, in these pivots?

Is this a safe haven for when monetary policy loosens? Money flows easier again?

Good question.

Looking at the chart below, we see a few clear indications, especially recently.

Back in the 1970s, after Nixon took the US dollar completely off the gold standard, gold ripped over 5X from that first main pivot in 1974.

Perhaps it had overextended itself, as it fluctuated mostly between $350 to $450 per ounce for the next two decades. There are many reasons for this, including its relationship to oil/USD and the brewing 2000 Internet Bubble.

But once the bubble popped, gold came back into favor as a true store of value, rising over 2X after the 2000 pivot, and then another ~3X after the 2007 pivot.

This happened again after the 2019 pivot, with gold almost doubling since then.

The big factor, has clearly been the introduction of Fed-driven M2 monetary expansion.

Money printer go brrrrr.

Gold seems to sniff this new reality out quite readily, and I fully expect it will again in this next cycle. In fact, I think it already has begun.

After all, who wants to hold long-duration US Treasuries when the principal is paid back with dollars that are worth a fraction of what they were when you lent them to the US government?

Wouldn't you rather hold an asset that is a store off value, rather than a destroyer of it?

Exactly. Me too.

And though it is too new to show any definitive historical evidence, I expect that Bitcoin will do the very same, perhaps rising in multiples of what gold does during this next cycle.

Bottom line, whether or not the Fed pivots and lowers rates in March or June or October of next year, one thing is extremely clear:

The Fed always overstays its welcome.

It always either raises too high or holds too high for too long, using lagging indicators and looking at employment for clues.

This ultimately causes a recession.

Every. Single. Cycle.

Problem is, the markets are now highly conditioned to and leveraged for stimulus.

They have come to not only expect it, but with the massive deficits the US government in particular is running, the Treasury now needs it, too.

The Treasury needs inflation, not deflation.

How else are they going to deal with this?

And this is exactly why I personally hold significant amounts of gold and Bitcoin in my portfolio.

And I'm not a long-term holder of long-term Treasuries.

That’s it. I hope you feel a little bit smarter knowing about Fed Pivots, what they mean, and what they may indicate for markets.

If you enjoyed this newsletter and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️