💡 What Happens When a Currency Dies?

Issue 201

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Iran’s rial in real time

What kills a currency

The escape hatch

Why this matters to you

Inspirational Tweet:

Bitcoin just traded at 104 billion Iranian rials.

Read that number again. One hundred and four billion.

Now look at that chart. See that vertical line on the right side? That’s not Bitcoin mooning. That’s a currency dying.

We’ve talked about hyperinflation before. Back in Informationist Issue 63 (seems like forever ago, now), I walked you through the history. Weimar Germany, Zimbabwe, Venezuela. The causes, the warning signs, and what you can do to protect yourself.

But that was theory. Case studies from dusty history books.

This? This is happening right now, as we speak. And the data coming out of Iran over the past few weeks is a masterclass in what it actually looks like when a currency dies, and where people run when it does.

So what exactly is happening over there? How did the rial collapse so fast? And why should you, sitting comfortably here in the US, care about a currency crisis half a world away?

All good questions, and ones we will answer, nice and easy as always, here today.

So, pour yourself a big cup of coffee and settle into your favorite seat for a real-time case study of currency death with this Sunday’s Informationist.

One note before we dive in: what's happening to ordinary Iranians right now is heartbreaking. Families watching their life savings evaporate. People in the streets out of desperation. But I'm not going to make this political or opine on sanctions, regime change, or US foreign policy. That's not my lane. What I am going to do is show you the mechanics of how a currency dies. Because those mechanics are universal, and they hit closer to home than you might think.

Upcoming Appearances:

The Age of Debasement

The cracks in the foundations of money are becoming harder to ignore. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk.

On January 28 at 1PM CST, join me in this online event as I present my latest report, The Debasement Trade, and take live Q&A.

Hosted by Unchained, this event will cover:

Why debasement is structural, not cyclical

How inflation and financial repression challenge familiar portfolios

Why gold tends to move first—and bitcoin often moves further

Wednesday, January 28 at 1PM CST — online, free to attend.

🇮🇷 Iran’s Rial in Real Time

Late December 2025. Tehran.

The head of Iran’s central bank, Mohammad Reza Farzin, abruptly resigns. Protests erupt in the streets of Tehran, Isfahan, Shiraz, and Mashhad. The Iranian rial smashes through 1.48 million to the dollar on the black market.

And most of the world barely notices.

But here’s the thing. What happened in Iran isn’t just another emerging market blowup. It’s a textbook case of how currencies actually die. And if you understand what happened there, you’ll understand a whole lot more about what could happen anywhere.

Let me show you what I mean.

First, the numbers. According to Iran’s own Statistical Center, point-to-point inflation hit 52.6% in December. Food prices? Up 72% year over year. Medical costs? Up 50%.

And we thought the Fed was bad…Good Lord.

A little context: the academic definition of hyperinflation is 50% per month. And it appears Iran just hit that threshold.

But tell that to the grandmother in Tehran watching her life savings buy a fraction of the groceries it did six months ago.

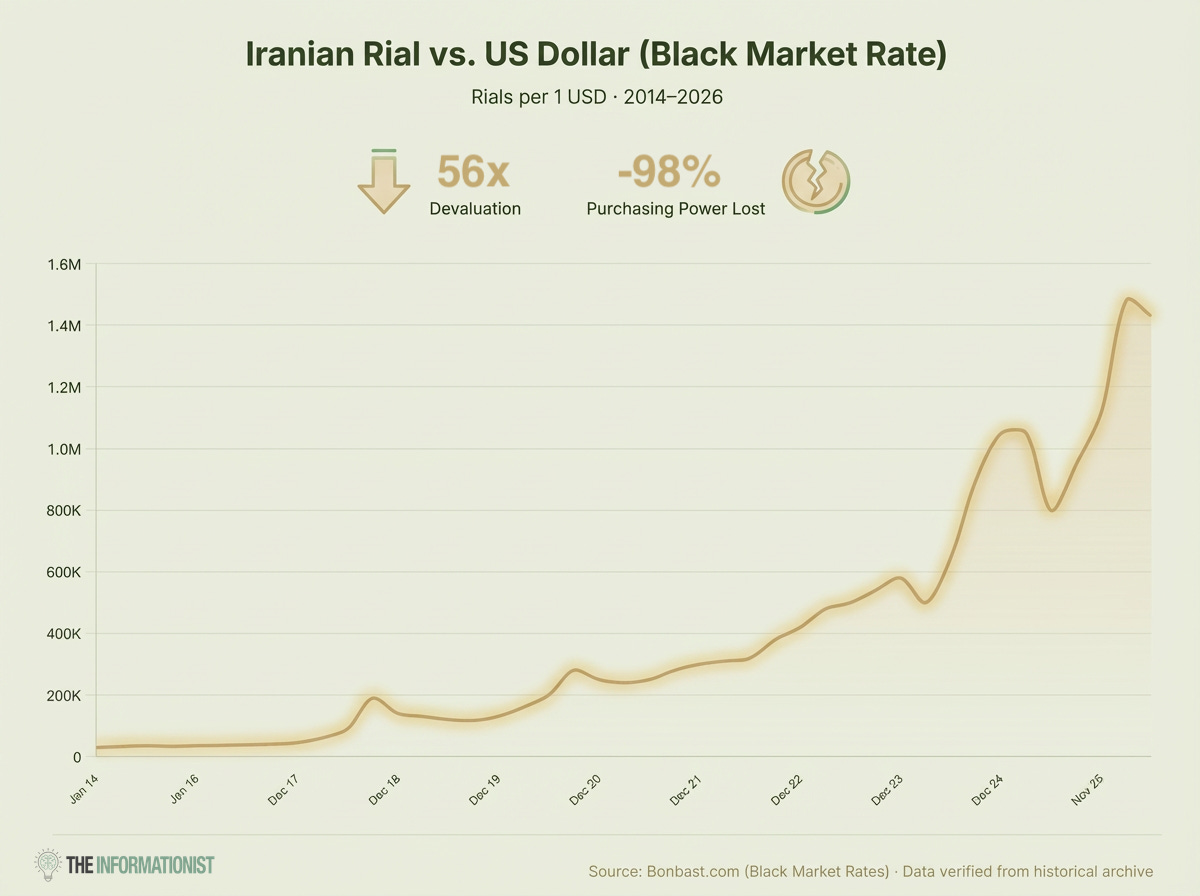

Here’s a chart of the rial on the black market:

See that acceleration on the right? That’s the past three years. The rial has been in an accelerating death spiral, losing over half its remaining value as the collapse picked up speed.

But here’s where the story gets juicy.

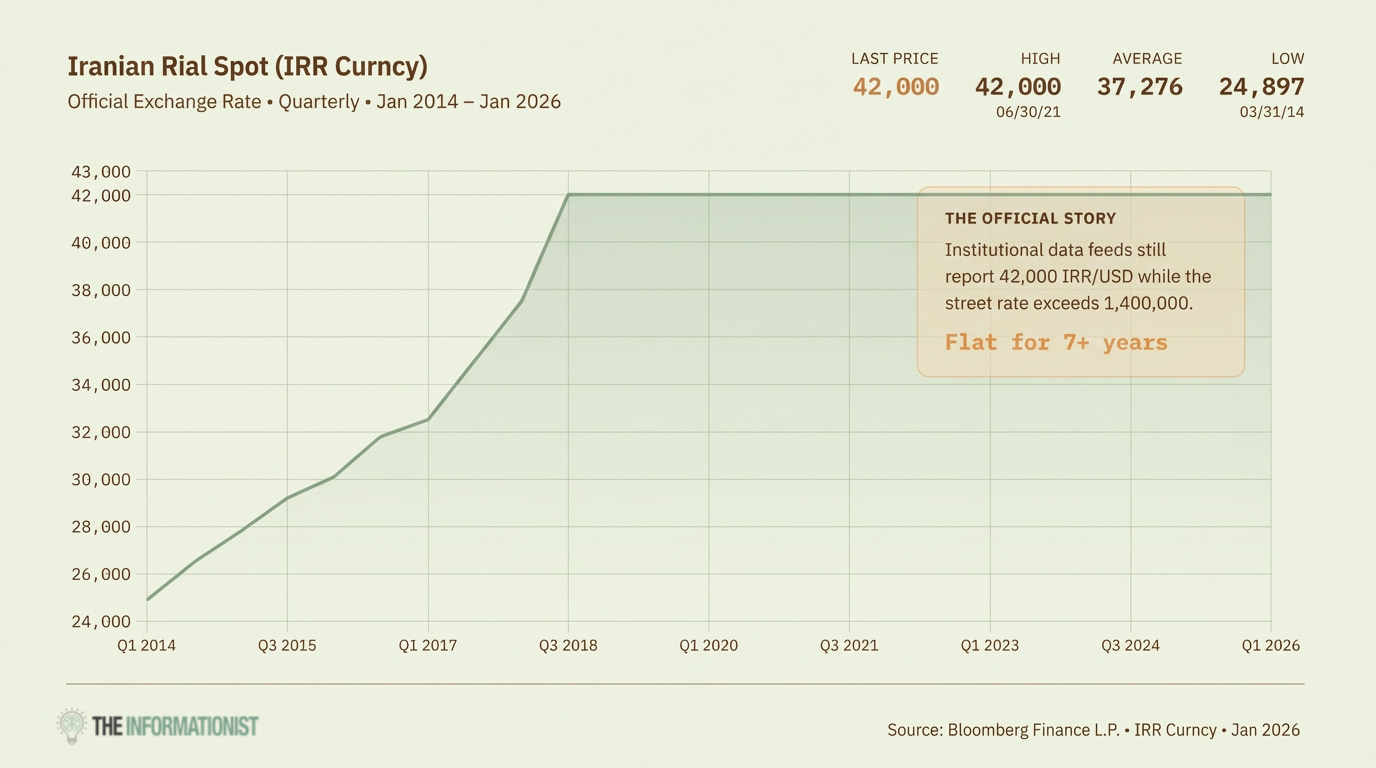

If you looked at the official exchange rate over this same period, you’d see something bizarre. A flat line at 42,000 rials per dollar. Just sitting there. Unchanged. For years. While the black market rate climbed relentlessly higher.

42,000 official. 1,400,000 real.

That’s not a gap. That’s a canyon.

So what was going on?

Back in April 2018, as the rial was sliding and protests were erupting over prices, Rouhani’s government created what’s called the “preferential rate.” They fixed the dollar at 42,000 rials for essential imports like food and medicine.

The stated goal was to shield ordinary Iranians from the pain of sanctions.

The actual result? The greatest arbitrage opportunity in the history of arbitrage opportunities.

Think about it. If you’re a connected insider with access to the official rate, you buy dollars at 42,000 rials and sell them on the black market for 600,000. Then 800,000. Then a million. You’re printing money. Legally.

And who had access to this magical money machine?

The Islamic Revolutionary Guard Corps (IRGC) and their connected cronies. The IRGC has long dominated Iran’s economy, and according to Chainalysis, they now control roughly half of Iran’s crypto flows too. The guys who profited from the arbitrage scheme figured out digital assets as well.

Shocking, I know.

Meanwhile, ordinary Iranians watched food prices double while their wages stayed flat. The 42,000 rate was supposed to help them. Instead, it made the connected rich and everyone else poor.

The rate became fiction. A lie the government told everyone while insiders looted the country.

But it all caught up to them eventually.

In late December, Governor Farzin resigned. The government announced it was abandoning the preferential rate system entirely. And the collapse accelerated.

Seven years. The 42,000 fiction held for seven years while reality diverged further and further. Then one day, it snapped.

And *poof*

The rial went up in smoke.

So what actually kills a currency? What turns a slow decline into a death spiral?

🪦 What Kills a Currency

OK, so we’ve seen what happened in Iran. Now let’s talk about why it happens.

You might think the answer is obvious: sanctions, money printing, corruption. And sure, Iran had enough of those to plant a banana republic garden.

But here’s what I’ve learned studying every major currency collapse of the past century, from Weimar to Zimbabwe to Venezuela to Lebanon:

The thing that actually kills a currency is loss of confidence.

That’s it. That’s the whole game.

Money printing doesn’t kill currencies. Argentina has been printing for decades. Still standing. Deficits don’t kill currencies. Japan’s debt-to-GDP ratio makes the US look fiscally responsible. Yen still works. Sanctions don’t kill currencies. Cuba’s been sanctioned since 1962. Peso still circulates.

All of those things are pressures. They erode trust. They weaken the foundation. But currencies can survive enormous pressure for a very long time.

As long as people still believe.

What kills a currency is the moment when enough people decide, all at once, that they need to get out right now.

Let me show you exactly how it works.