💡 What are US Treasuries Telling Us?

Issue 139

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Expected Move

The Actual Move

What is Happening?

How You Can Deal With It

Inspirational Tweet:

If you’ve been paying attention to markets lately, you’ve noticed gold has ripped to an all-time high and stocks continue to make and bump around all-time highs, too.

None of this would be shocking after the Fed lowered rates, except for one thing, bond prices have been falling, making the yields go higher.

Huh? Is Kobeissi right? Is the market broken?

If this has you shaking your head, stay with me. This stuff is actually not that confusing, and it is super important for your investments. But don’t worry, we are going to unpack and demystify it all, nice and easy as always, here today.

So, pour yourself a hot cup of coffee and settle into your favorite seat for a peek behind the US Treasury yield curtain today with The Informationist.

🤔 The Expected Move

You market veterans already know that The Fed started lowering rates recently. In September, they moved the target Fed Funds rate down .5%, from 5.38% to 4.88%.

As such, we would expect that, since the economy appears to be chugging along in many areas, especially the service sector, that stocks would rally off the news.

And why not? If the economy is not in a recession, lower rates just means cheaper capital and higher margins for companies to operate. Also, gold may move higher on the prospect of lower yields available and just in case a recession does ensue.

And we would also expect bonds to rise in value, making yields fall, in concert with the Fed moves. Investors, looking for protection from the overall market and a little more yield, would buy longer term US Treasuries in a flight to safety.

Called a Bull Steepener, this move in the yield curve would make all yields fall in anticipation of further cuts from the Fed, with shorter term yields falling faster than the longer term ones.

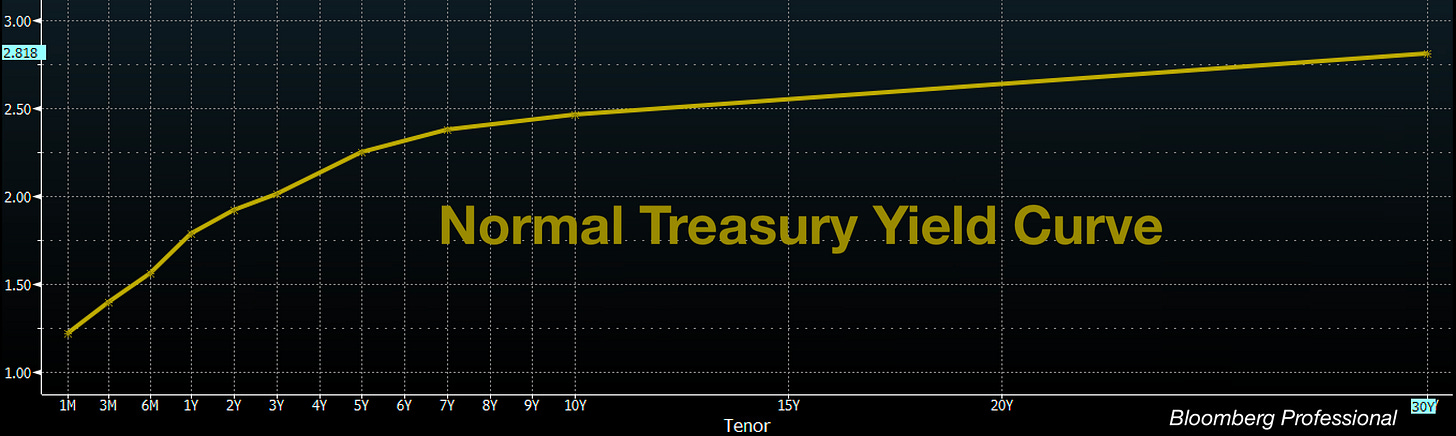

And the resulting curve would become normalized, where long term yields are higher than short, creating something like the yellow yield curve below:

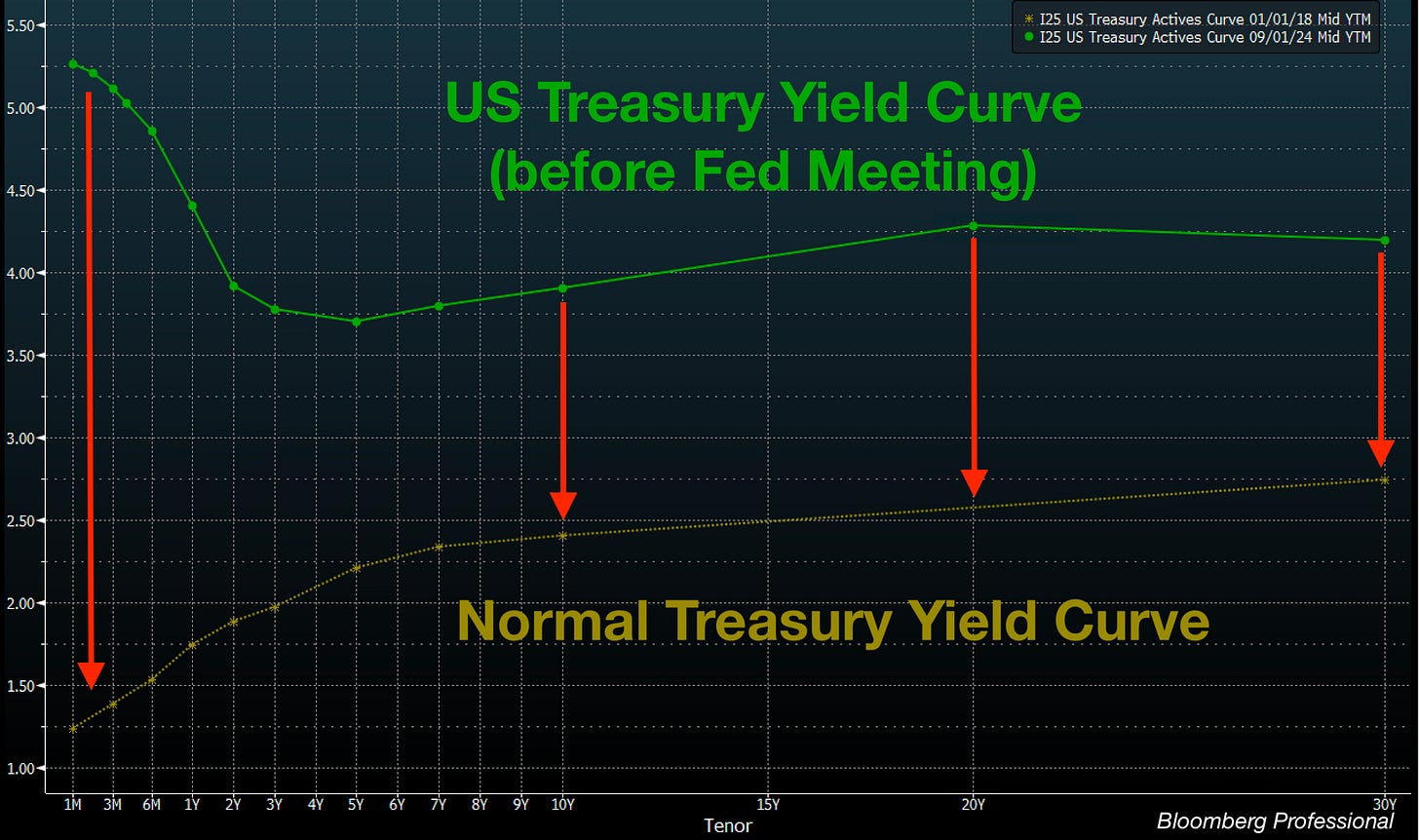

And looking at the rates before the Fed Meeting in September, the expected move would eventually make the yield curve move, like so:

See, yields have been much higher on the short end, as the Fed has kept rates high in order to head off inflation. And with the market expecting a slowdown in the economy, rates have stayed low on the longer end.

In other words, investors expected rates to come down, so they bought longer-term bonds in anticipation and a bit defensively. (Remember, the US Treasury has long-standing as the premier flight-to-safety asset in times of uncertainty or recession).

But this is not what has happened since the Fed made its move last month.

And so, the actual move US Treasuries have made has confounded some investors and economists alike. So what happened?

😮 The Actual Move

Put simply, instead of yields moving lower across the board, yields of longer bonds (10-year and longer maturities) didn’t fall at all. In fact, they rose. 🤯

Look at the actual move of the yield curve, in contrast to the expected move above: