US Treasuries: The Big Downgrade

Issue 75

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

Credit Ratings

History of US Debt Ratings

Fitch: Fair or Unfair

Are US Bonds Worthless Now?

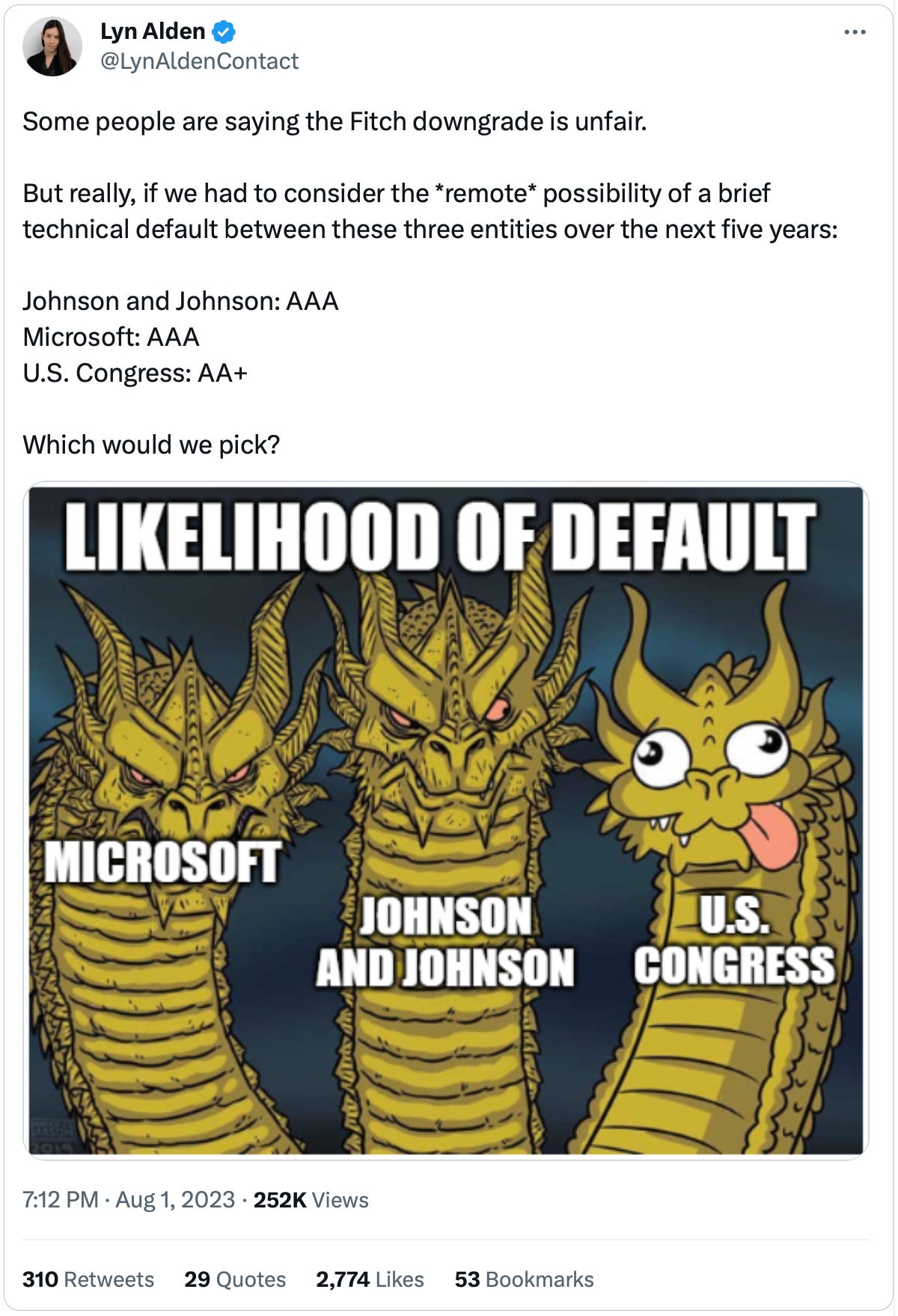

Inspirational Tweet:

If you were watching the news, reading Twitter, or even flipping through TikTok this week, then you likely heard about the latest drama surrounding US Treasury Debt.

Namely, the US Treasury ratings downgrade from Fitch.

But what exactly is a debt downgrade, why does it matter, and what does it say about Treasury debt? Are US bonds really riskier than some company debt out there, as Lyn suggests above?

If this all has you scratching your head and wondering which way is up these days, no worry. We’re going to unravel the knot, nice and easy as always, to get you some answers today.

So grab that cup of coffee, saddle up, and settle in. It’s Informationist time.

Join the Informationist community for access to subscriber-only posts + the full archive, and ask questions and participate in the comments with other awesome 🧠subscribers!

Partner spot

Some of you have been asking recently what I read in the morning for fast, digestible news, and I’m happy to report that my new favorite source, hands down, is 1440.

The folks at 1440 scour over 100 sources every morning so you don't have to. You'll save time and start your day smarter. What more could you ask for?

Sign up for 1440 now and get your first issue, immediately. It's completely free—no catches, no nonsense, and absolutely no BS. I wouldn’t recommend it, if I wasn’t sure you’d love it, too.

Join 1440 for free today.

🧐 Credit Ratings

First things first, before we get ahead of ourselves, let’s review exactly what these so-called credit ratings are and how they work.

Just like credit agencies review and score individuals’ credit-worthiness, similar agencies do the same with companies and countries, by giving them a rating. And as you know, a poor credit score can negatively impact your ability to borrow money, i.e., get a car loan, mortgage, or a credit card.

Companies face a similar challenge, in that a poor rating can affect their ability to issue bonds (borrow money) at attractive rates to maximize profits (or sometimes, to just keep operating).

And much like consumers have three credit agencies to deal with, bond issuers also have three main agencies judging them. In the US, we have Standard and Poor’s, Moody’s, and Fitch.

They each use their own grading systems, as such:

In this system, a score of AAA means an entity is considered a Prime borrower with the lowest risk to lenders. This score is reserved for the strongest countries and just a handful of companies at any time.

And the equivalent of a consumer sub-prime rating for bonds is when a sovereign or company falls below BBB-. At this rating, they have fallen below Investment Grade by the ratings agencies and are considered junk grade.

Make no mistake, credit rating calculations and determinations are intricate and complicated. Accordingly, these formulas can vary widely between types of entities and companies being rated.

For instance, a bank rating may rely heavily on debt to equity ratios, book values, and quality of deposits, while a technology company rating may focus on book to sales ratios and inventory turns.

Additionally, external factors are also taken into consideration for the scoring. If a separate entity or government agency impacts the overall business of the entity being scored, then that is also considered. And so, the credit quality of all related parties become a factor in the final scoring.

If you’re interested in the actual process and methods of each of the agencies, they publish them periodically and specifically for each of the different types of companies or entities they research. You can find the methodology reports on the ratings agencies’ websites.

As an example, and apropos to today’s discussion, here’s a table that shows the process Fitch uses to rate sovereign debt:

Notice the inputs that are important to determining the sovereign entity score. Things like gross government debt/GDP, broad money supply, consumer price inflation, government interest as a percentage of revenues, etc.

But when it is all said and done, each credit scoring agency boils it down to three letters or less to give a super fast indication of an entity’s credit quality for investors.

And these letters often make the difference between the ability for a company (or country) to issue debt at a rate that is sustainable for that entity’s income and balance sheet.

OK, so now that we have the ratings landscape set, where does the US stand in all this?

🎩 History of US Debt Ratings

Historically, the US has been considered one of the world's most creditworthy countries, with top ratings from the major agencies. In fact, the US enjoyed a Prime rating from all three agencies throughout the 20th and into the 21st century.

That all changed, however, after the Great Financial Crisis in 2008, as massive money printing and debt expansion prompted greater scrutiny of national economies and debt loads.

Still, the U.S. maintained its AAA rating.

That is, all the way up to the 2011 debt ceiling crisis.

See, per usual, federal debt had been approaching the ceiling—back then, a mere $14.3 trillion limit. 🙄

A storied history of US debt ceiling raises:

Once again, Congress needed to raise the debt ceiling in order to avoid a potential default. But the debate over whether and how to do so became highly contentious between Republicans, who controlled the House of Representatives, and Democrats, who held the Senate and the presidency.

This all may sound familiar, but we will get to that in a moment.

Negotiations continued for several months, with both sides using extensive gamesmanship. As a result, the entire investing world became concerned that the US would default on its debt for the first time since 1979.

*Note: In 1979, Congress came to an debt ceiling agreement so late that it caused a technical default on US debt that delayed payments on interest and maturing debt, creating opportunity cost and portfolio challenges for investors. Investors were eventually made whole, but only after an extra few weeks and plenty of confusion.

Fast forward back to 2011 where, at the very last minute, the two sides settled on a solution, raising the ceiling by $900B.

Still, the damage had been done.

Just a few days later, one of the major agencies, Standard & Poor's (S&P), downgraded the US credit rating from AAA to AA+ for the first time in history.

S&P cited political brinkmanship which indicated governance and policymaking were becoming less stable and effective. And even though a technical default was avoided, the budget battle exposed deep political divisions and resulted in economic and reputational costs for the US.

Which brings us to 2023.

This past spring, the US once again found itself bumping up against the debt ceiling, after having to borrow more and more to cover growing deficits. And as a result, the US proceeded to edge right up to the brink of default.

Again.

Sounds familiar, yes? Near perfect echoes of 2011, in fact.

Budget deficits requiring excessive borrowing? ✅

Split House/Senate/White House? ✅

Contentious budget battle? ✅

A last second solution? ✅

Perhaps most importantly: A result of higher spending leading to higher deficits? ✅

I wrote all about the budget showdown and possibility of default in The Informationist a few months ago. If you haven’t seen that yet and want to read more about the situation, you can find it here:

Bottom line, one of the major ratings agencies—Fitch this time—took a long, hard look at the US debt situation, the probability of the government entering another debt battle soon, and the possibility of another technical default in US Treasuries, and joined S&P in their downgrade.

The significance, is that the US is now only Prime rated by one agency, Moody’s, and so it can no longer claim Prime status.

The US has officially been downgraded to High Grade, and its credit-worthiness, according to the collective rating, is lower than some companies based here in the US.

Oops.

😭 Fitch: Fair or Unfair

But is this fair? Is it accurate?

Well, when you consider the entire situation, holistically, it begins to make sense.

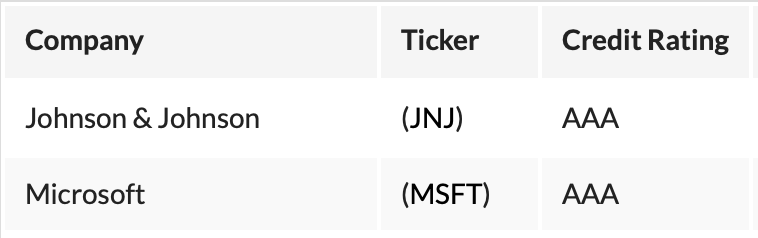

If we look at the highest rated companies, they are:

That’s it. Just two, JNJ and MSFT.

And without getting deep into their balance sheets, we see that JNJ’s interest coverage ratio is ~20X and MSFT is ~48X.

This means that each company makes far more in earnings (20 to 50X) than it owes in interest each year. This, plus all the intellectual property and assets that each company has on their balance sheets, plus a host of other factors, make them the highest rated companies in the US.

In other words, the likelihood of either company defaulting on their debt is pretty much nil.

That would lead us to the argument that, well, since the US issues debt in its own currency, it would never really default either.

At least not a hard default, where it refuses to pay or forces a haircut on what it owes.

But let’s go back to the criteria that the ratings agencies look at to make their determinations for sovereign ratings. Remember the inputs:

Gross government debt/GDP, broad money supply, consumer price inflation, government interest as a percentage of revenues, among others…

We all know that US federal debt to GDP is ballooning, now over 120%, the broad money supply has increased tremendously since 2020, with the Treasury and Fed collaborating to ‘print’ over $7 trillion in under two years, plus CPI inflation has been relentlessly high.

And finally, the US is on track to spend $970 billion of interest on its debt, this year alone—making the interest coverage ratio ~4.7x. However, when subtracting out mandatory expenses of entitlements, etc. and defense contracts, that coverage ratio plummets to below 1X.

In other words, if the US government was a business listed on the NYSE, it would be considered a zombie company, unable to generate enough income to pay its debts.

But getting back to the point above. So what, the US will never default. It will just print its way out of any interest payment hole.

Two things:

This just exacerbates the problem—especially with the Fed holding interest rates high to battle the ensuing inflation from…?

You got it. Point number two: excessive money printing, which causes inflation, which debases the underlying currency to the bonds themselves.

In other words, when you lend the US money, the dollars you get back at the end of the term are worth far less than the ones you lent at the start.

This is called a continuous and perpetual soft default.

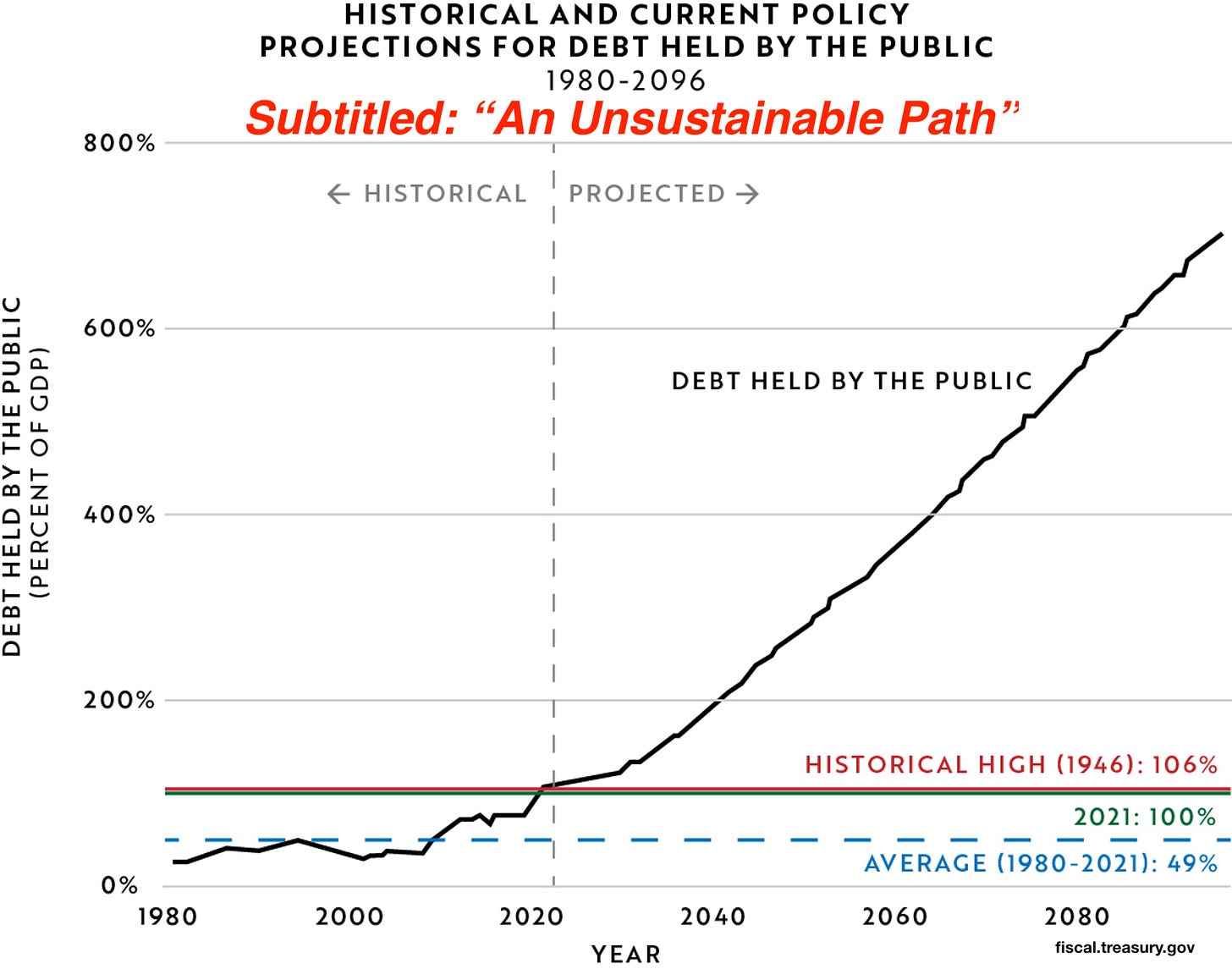

Because the USD is no longer pegged to gold, and because Congress and the Executive Branch are not ever kept in financial check, the Treasury as much as admits the mathematical problem, even putting it in print for everyone to see:

And the ratings agencies know this, too.

Will the US Treasury make good on its promise to pay you back all the dollars you lend it? A near 100% probability.

Will those dollars be worth far less than when you lent them to the US? Also, a near 100% probability.

And there’s the rub. While the dollars you lend are safe, they are worth less when you get them back.

Of course, the same argument could be made with JNJ and MSFT, as they are both denominated in USDs. But the difference is the technical default likelihood, where either company misses payments, causing a disruption in your investment strategy.

Because the US must issue more debt to pay off old debt (the drawback to operating in a perpetual deficit), it must continuously raise the debt ceiling to make good on its promises.

And this, is not always a 100% certainty.

At least not on time, anyway.

🤨 Are US Bonds Really Risky Now?

Let’s get something straight. I do not believe all US Treasuries are currently high risk.

Are they a risky investment long-term? Yes, I believe long bonds (10 years and up) are for a number of reasons, notwithstanding the last chart pictured above. And they are also subject to considerable interest rate risk that could impact the price of long maturities significantly.

But shorter maturities (1mo to 3yrs) are still some of the safest investments out there, especially in lieu of cash. Plus, at north of 5% yields, they currently generate a respectable return vs just holding naked cash.

This is why I still hold high interest yielding, fully FDIC+ insured cash, plus short term USTs in my portfolio. There are a number of reasons for this, and as I have hinted in the last couple of weeks, I’ve been working hard on a new feature that I am rolling out in the very near future.

And we will get into much more detail on all of that soon. So, please stay tuned!

That’s it. I hope you feel a little bit smarter knowing about credit ratings and the US debt situation. Before leaving, feel free to respond to this newsletter with questions or future topics of interest.

And if you are a paid subscriber, don’t forget to leave a comment or answer a comment in our awesome 🧠 Informationist community below!

Talk soon,

James✌️

Thank you for that ! That's so valueable...

Can’t wait for this new feature. Thanks James.