The Trillion Dollar Coin: Genius or a Joke?

Issue XLVIII

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

The ever-increasing debt ceiling

Has the US ever defaulted?

The Trillion Dollar Idea

Will the debt ceiling ever be solved?

Inspirational Tweet:

If you’ve been paying attention to the news this past week, you have been hearing rumblings about a looming political battle over the so-called debt ceiling. And that, according to Treasury Secretary Janet Yellen, we technically reached that ceiling on Thursday. Finally, you may also have heard the idea of minting a trillion dollar platinum coin resurface.

But what the heck do they have to do with each other? And is this idea of a trillion dollar coin for real or is it just a politician fantasy? Is the White House really going to send troops to the Fed to make it happen?

Let’s unpack all this, nice and easy as always, shall we? So, grab a cup of coffee and settle in. We have an interesting morning ahead of us here.

Starting with the debt ceiling.

🤯 The ever-increasing debt ceiling

So, what exactly is the debt ceiling, and if we’ve already reached it, then we need to move it or we face imminent default, right?

Right?

First, let’s clear up a few things.

The debt ceiling is the total amount of debt that the US Treasury is authorized to issue. See, Congress sets the overall limit and allows the US Treasury to operate within the guidelines of the Congressional Budget and that limit. If the US needs to borrow more money, so be it. The Treasury issues bonds, as they see fit. And they can keep issuing bonds of various maturities and amounts all they way up until they reach that total limit.

And we just hit the limit. Again. This time at $31.4T dollars.

A good friend and brilliant macro-mind, Dr. Jeff Ross (@VailshireCap on Twitter—if you somehow don’t yet follow him, you should) recently described the federal debt ceiling like ‘a canopy of clouds in the sky above; they appear to be a ceiling, but in reality they’re just like a smoke cover that you can pass right through’.

Well said, Dr. Jeff. I may steal that. 😉

To wit, we have raised the debt limit 22 times from 1997 to 2022. Yep, we’ve raised the limit 22 times in 25 years.

Let that sink in for a moment.

OK, so now that we’re all on the same you’ve-got-to-be-kidding-me-with-the-endless-and-reckless-spending-of-the-US-Government page, let’s dig into the mechanics a bit.

Don’t worry, we’ll keep it simple for our exercise here today.

Hitting the ceiling does not yet make the US default on its debt. The reason is, Yellen and the Treasury can make some decisions on what payments and investments it can put on hold until all this ceiling business is resolved.

She can take extraordinary measures, as she stated on Thursday.

Specifically, the Treasury will divert funds for absolutely necessary needs (like making interest payments on federal debt) and withhold payments elsewhere. Like regular investments into the Civil Service Retirement and Disability and the Postal Service Retiree Health Benefits Funds. These cover the retirement benefits for federal employees and US postal workers.

And these two extraordinary measures—er, steps… will hold off the breach of the debt limit until approximately June, according to Yellen.

And if they do somehow breach, Congress can temporarily grant the Treasury the ability to borrow more, at least until the major issue is resolved (as if it will ever be…🤡).

In any case, what it now comes to is a showdown between the two American political parties. The Republicans and the Democrats.

With the Republicans in control of the US House of Representatives and the Democrats in control of the Senate and the White House, we have a brewing debate and probably a bit of a street fight ahead of us.

Though, let’s be real, it’s mostly for show and yes, political theater.

We all know the government will resolve enough of their differences to pass a budget and/or move the ceiling, yet again.

The key here, though, may be that Kevin McCarthy had a heck of a time being named Speaker of the House, and he was forced to concede a few promises to some Republican holdouts. And so, after 15 votes and the agreement that he wouldn’t pass raising the debt ceiling without significant spending cuts, McCarthy was finally named Speaker.

If he breaks this promise, he will most certainly be ousted as Speaker.

Problem is, the White House and Democrats have already said they refuse to negotiate.

Oh those silly politicians and the games they play with everyone’s freedoms and money.

Question is, if the knuckleheads in DC continue to hold strong in their positions and we march into June without a resolution, can the US actually default for real at that point?

Has the US ever defaulted on their debt? That would mean calamity for not just the US, but likely the developed world, wouldn’t it?

Good questions. Let’s knock those off one by one next.

☠️ Has the US ever defaulted?

To put it simply, yes. The US has defaulted on their debt before.

Back in 1979, we were in the midst of a similar debt limit showdown in DC. Congress backed the Treasury right up against the clock and barely raised the limit in time.

Problem is, this was 1979 and the government relied on word processors and paper checks to make interest payments. This, plus an inordinate number of individual investors in T-Bills made it all but impossible for the Treasury to act in time.

Get the check actually printed and mailed.

I do have to ask why the Treasury didn’t just print them ahead of time, put them in envelopes and stamp them, in anticipation of a resolution. But hey, it’s the government we’re talking about here, and there are no rewards for exceptional work in DC.

In any case, the default was temporary and technical, really. The bond holders were made whole for the additional interest to cover the small delay and all was back to normal again.

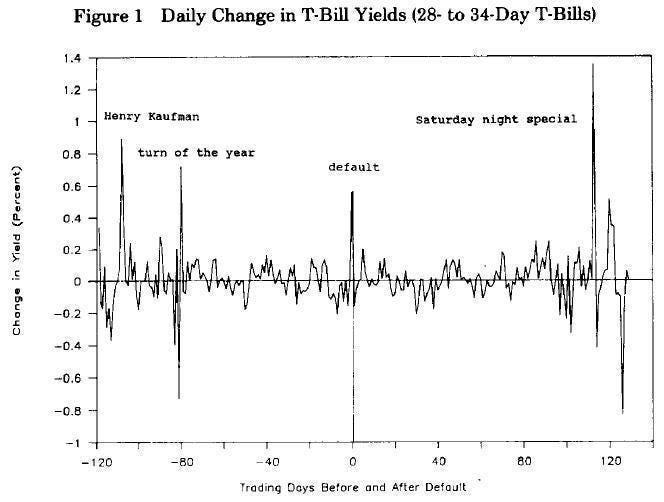

Even so, it sent a bit of a shock wave through the US Treasury market that year. In fact, T-bill interest rates increased ~60 basis points after the first default and remained elevated for several months.

And if you think the markets believe this could never recur—after all, the Treasury IT department surely has this all down to an art by now, doesn’t it?—think again.

Just check out the current CDS market for US government debt.

As you can see, the spread, or price per contract, has risen considerably this year, spiking this past few weeks.

In fact, investors are now paying upwards of 35.57 basis points or $35,570 per $10 million of US Treasuries, just as protection against a default.

These are supposed to be risk-free bonds. The safest investment in the world!

Uh huh.

There is no such thing as risk-free.

Why? Because we have a bunch of clowns at the helm, suggesting that we do something absolutely laughable before the entire world, like creating a trillion dollar coin to solve the debt ceiling crisis.

No, this is not a joke. People as prominent as two former Directors of the US Mint, Philip Diehl and Ed Moy are actually suggesting we do this.

🤡 The Trillion Dollar Idea

Many people attribute the idea of a trillion dollar coin to The Simpsons, as the fictional account of President Truman printing a trillion dollar bill to help reconstruct post-war Western Europe.

And why not give credit to The Simpsons? I mean they did predict Walt Disney buying 20th Century Fox and Donald Trump becoming President.

In reality though, the idea for the Treasury to mint a coin and send it to the Fed to pay off debt was first popularized by presidential candidate Bo Gritz in 1992, where Bo would actually hold up a five-inch sample coin during his stump speeches.

Spolier alert: Bo was not elected.

However, the whole concept actually gathered some steam in 2011 as a potential alternative to raising the debt ceiling, and then in 2012, when we were up against the limit again. This time, economist Paul Krugman endorsed the idea extensively in op-ed pieces for the NY Times. 🙄

Luckily, it was rejected in 2013 by Treasury and Fed officials.

And here we are in 2023, the noise of a trillion dollar coin echoing around us once again.

Here’s the simple explanation of it all.

The Treasury has the authority to print metal coins (i.e., gold and silver), in denominations restricted to amounts of $50, $25, $10, $5 and $1.

Gold 1 ounce coins are typically minted as $50 American Eagles, but as we know, they’re actually worth the equivalent of their 1 ounce of gold in the market, or about $1,900 today. The $50, then, is symbolic only.

That said, there is a loophole that carves platinum out of this restriction and would allow the Treasury to mint a platinum coin in any denomination.

$100, $100,000, $1 million, a billion…

Why not a trillion? 🤑

Little more than a parlor trick, the sleight of hand procedure would go like this:

The Treasury commissions the Mint to create a $1 trillion platinum coin,

The Treasury then deposits the coin at the Fed, where it would sit on their books as an asset,

The Treasury then uses the Fed’s money supply and bank reserves to spend up to $1 trillion against said asset

Once the debt ceiling situation is resolved, the Treasury issues enough debt to cover the money it ‘borrowed’ against the coin, withdraws the coin, and melts it back down, thereby destroying it.

A few things to note here.

First, this would not give the Treasury the ability to just spend $1 trillion on anything it likes. Yellen isn’t getting a new Ferrari or beach house, and the US Navy isn’t getting a few new fighter jets on the side.

The loophole would only allow the Treasury to meet its obligations under the current Congressionally approved budget.

Again.

Political theater. DC good ‘ol boy tomfoolery. Bally-hoo.

But make no mistake. The world would sit up and pay close attention with this kind of silliness.

The state of our Treasury and budget process would be called into question.

There would be an electromagnetic microscope aimed at the US Treasuries and their ultimate legitimacy.

When will they print another one? Why not print ten more? Thirty-one more? Pay off the federal debt in total?

Ferraris and beach houses for everyone!

Of course this is absurd and couldn’t really happen, but you get my point. The process would be reduced to a side show or a circus act.

Which is why the Fed is likely to balk. As is Janet Yellen and the Treasury.

They would rather invoke the 14th Amendment which basically allows for debt to be issued by the Treasury without question and then resolved later.

And now you may be asking, so why even have a debt limit at all?

🤨 Will the debt ceiling ever be solved?

Some politicians would rather just eliminate the debt limit altogether. Eliminate the showdowns, the political theater, Congressional games.

Why not?

After all, we find ourselves in this exact same spot every few years. And unless Congress raises the limit to astronomical level, we will find ourselves here again sooner and sooner each time.

The answer, it’s all about perception.

The fact is, the US has already entered what we call a debt spiral. If you have never heard that term, or want to know more, I wrote all about it in 🧠The Informationist a number of months ago. You can find that article here:

TL;DR: The US operates at a deficit and must continue to borrow to meet the annual shortfall, which continues to increase with endless spending and higher interest rates on Treasuries, only perpetuating and exacerbating the problem.

The dreaded debt spiral.

And since I wrote that piece, the situation has only gotten worse, with the US annual interest expense on debt doubling in the last few months.

Which helps bump us right up against the debt ceiling again.

So you may ask, if we just keep raising it anyway, why put ourselves in the position to possibly default?

Well.

That is exactly where we are headed.

Do you see how it all unravels now?

But politicians are looking at this from the wrong angle. They’re focused on limits to spending when they should be focused on the limitless manipulation of money. The constant printing and quantitative easing.

The expansion of the money supply.

Because sooner or later, the entire world is going to wake up to the fact that the US Dollar is worth little more than the paper it is printed on. The US Government guarantee, its good faith backing, will be worthless.

And because of this, the US Treasury will be seen as a risky asset.

Why?

Because the longer your money is tied up in USTs, the more money will be printed to allow the US to avoid default, the less each dollar will be worth when you are paid back in 10, 20, 30 years.

It’s called a negative real rate of return. And the more the money supply expands and inflation remains persistent, the less people will want to own bonds denominated in them. And so, this is why the Fed is so intent on lowering inflation—or at least the perception of it (ICYMI, the CPI calculation changing yet again—maybe we will talk about that next week).

For now, the Fed and the Treasury are squarely focused on keeping the perception of US Treasury Bonds as the safest investment in the world alive.

If we abolish the debt limit altogether, we basically concede to the world that we have given up trying to control our spending. We have given up the fight against printing and expanding the money supply and inducing further inflation.

In other words, even we have given up on the US Treasury as the global reserve asset.

That sad fact is, we’re headed squarely in that direction anyway. It may be a long way off yet, but that is our ultimate destination.

And this is why I hold and continue to buy hard monies like gold, silver, and Bitcoin as my ultimate long term stores of value.

Not US Treasuries.

And not Platinum. 😉

Reminder for free subscribers:

After next Sunday, only paid subscribers will get this newsletter weekly. Also, paid subscriber questions will take priority, and they’ll occasionally get a few other cool benefits, such as the macro bonus I sent this past week. Going forward, free subscribers will receive The Informationist only once a month.

🙏 Early supporters who subscribe in the next two weeks get 33% off for the first year — just $100, or $10/month ✌️

That’s it. I hope you feel a little bit smarter knowing about debt limits, political theater, and trillion dollar coins now.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you’ve found The Informationist to be valuable, or just want to support the work I’m doing, consider subscribing. It would mean a ton to me.

✌️Talk soon,

James