💡 THE TREASURY'S CHECKING ACCOUNT: A Trillion Dollar Liquidity Bomb

Issue 192

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Government’s Checking Account

How We Got to $941 Billion: The Shutdown Effect

The Hidden Quantitative Tightening

The Coming Liquidity Wave

Inspirational Tweet:

Most people don’t pay attention to the TGA.

And honestly, why would they? It’s an obscure three-letter acronym that sounds like bureaucratic plumbing.

But I tend to agree with Milk Road Macro here—the TGA may be the most important macro concept right now.

Here’s why: the TGA has ballooned to just under $1 trillion ($941 billion to be exact), well above its current target of $850 billion, and this excess cash is draining liquidity from markets in real-time.

But what exactly is the TGA, who controls it, and how exactly does it affect what is going on in the market and your own portfolio?

Great questions, and ones that we will answer, along with a whole lot more, nice and easy as always, here today.

So, grab a big cup of coffee and settle into your favorite chair for a look at the Treasury’s checking account, and why it matters more than most Fed policy decisions today, with this Sunday’s Informationist.

Partner spot

Secure your bitcoin’s future—and your family’s peace of mind. Too many heirs lose access to bitcoin because there’s no clear inheritance plan. We’ll show you how to change that.

On Wednesday, Nov 19 at 11:00 AM CT, join Dhruv Bansal (CSO, Unchained), Jeff Vandrew (CFO & CLO, Unchained), and Joshua Preston (CEO, Gannett Trust) for a live fireside chat on how to make your bitcoin legacy secure, simple, and built to last.

We’ll cover:

Transfer on death beneficiaries: A new Unchained feature for designating who inherits your bitcoin and remove uncertainty for your family.

Connections: Our vaults are uniquely built to let you share custody to help your heirs or trusted partners securely recover your bitcoin when it matters most.

Estate planning: How Gannett Wealth Advisors’ expert legal and financial guidance integrates with Unchained to protect your keys and your legacy.

Bring your questions—this conversation is designed to give you clarity on how to make inheritance seamless with real bitcoin, not IOUs.

WHEN: Wednesday, Nov 19 at 11:00 AM CT — online, free to attend.

🏦 The Government’s Checking Account

Most people think about the Federal Reserve as the place where monetary policy happens—rate decisions, quantitative easing, countless statements to the press, and exquisite boondoggles to places like Jackson Hole, Wyoming.

But there is another semi-function of the Fed that gets almost zero attention, despite controlling more liquidity than most policy announcements.

The Treasury General Account.

Or as it’s known in financial circles: the TGA.

Think of it as the US government’s checking account. Just like you have a bank account where your paycheck gets deposited and your bills get paid from, the Treasury has an account at the Federal Reserve where all government money flows in and out.

Simple as that.

When you pay your taxes? That money lands in the TGA.

When the government sends out Social Security checks, pays defense contractors, or funds literally anything? That money comes out of the TGA.

But here’s where it gets interesting—and where most people’s understanding stops.

The TGA isn’t just filled up with tax receipts.

In fact, because the US government runs annual deficits of around $2 trillion (as I’ve covered extensively in previous newsletters), the majority of what fills the TGA comes from bond sales.

This is how it works:

When the Treasury needs more money than it collects in taxes—which is every day that ends in a “Y”—it issues bonds. Treasuries. Debt instruments that investors, banks, and foreign governments buy.

Those bond sales bring cash into the TGA.

So when you see the TGA balance surge from $300 billion to $941 billion, that’s not some miraculous tax windfall. That’s the Treasury issuing hundreds of billions in new debt and parking the proceeds in their checking account.

The cash sits there, waiting to be spent.

This is where the liquidity mechanics get interesting, and where most market participants completely miss what’s happening under the hood.

See, when Treasury sells bonds and builds up the TGA balance, that money has to come from somewhere.

Where?

The banking system.

When a bank or investor buys a Treasury bond, they transfer money from their account at a commercial bank. That bank then settles the transaction by reducing its reserve balance at the Federal Reserve.

Read that again, slowly.

Every dollar that flows into the TGA is a dollar that drains out of bank reserves.

And as I’ve explained in recent issues, bank reserves are the lifeblood of the financial system. They’re what banks use to make loans, settle payments, and maintain liquidity. When reserves fall, the entire system tightens.

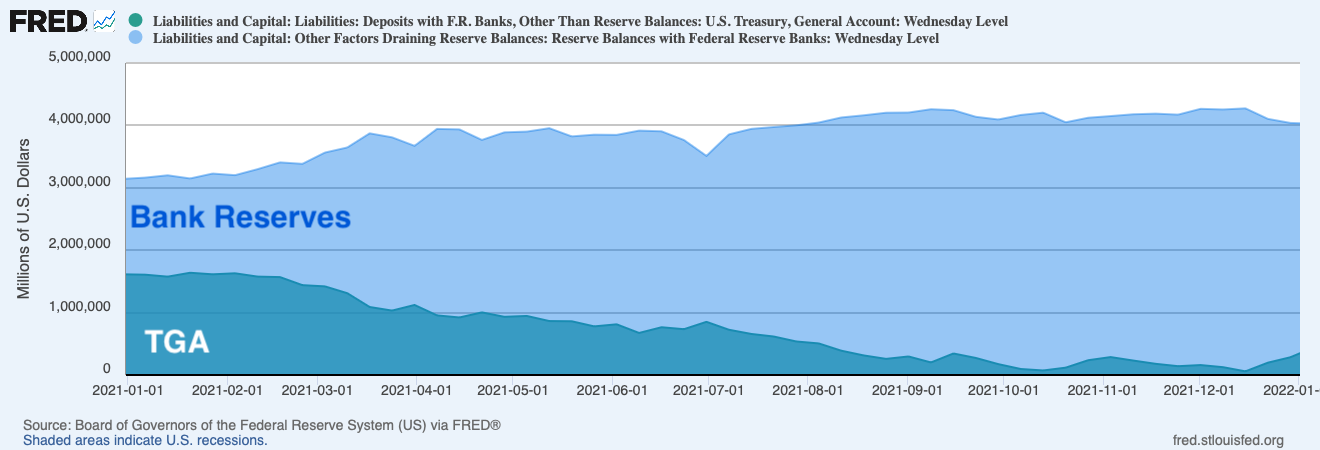

Have a look at this chart:

This is bank reserves over time, and you can see the massive drawdown that happened in 2021-2022. Part of that was QT (the Fed selling bonds that it owns), but another part that few people talk about? TGA movements.

So to be crystal clear about the mechanics:

TGA goes up → Bank reserves go down → Financial conditions tighten

TGA goes down → Bank reserves go up → Financial conditions ease

The TGA is effectively a liquidity vacuum sitting on the Fed’s balance sheet.

And right now? That vacuum just sucked up $644 billion in less than 4 months.

Which brings us to the obvious question: How did we get here?

🙄 How We Got to $941 Billion: The Shutdown Effect

To understand how the TGA exploded from $297 billion to $941 billion, we need to understand what Treasury was supposed to do versus what actually happened.

The Treasury operates with something called a “target balance” for the TGA, which is basically a comfort level of cash they want to keep on hand to manage the government’s day-to-day operations.

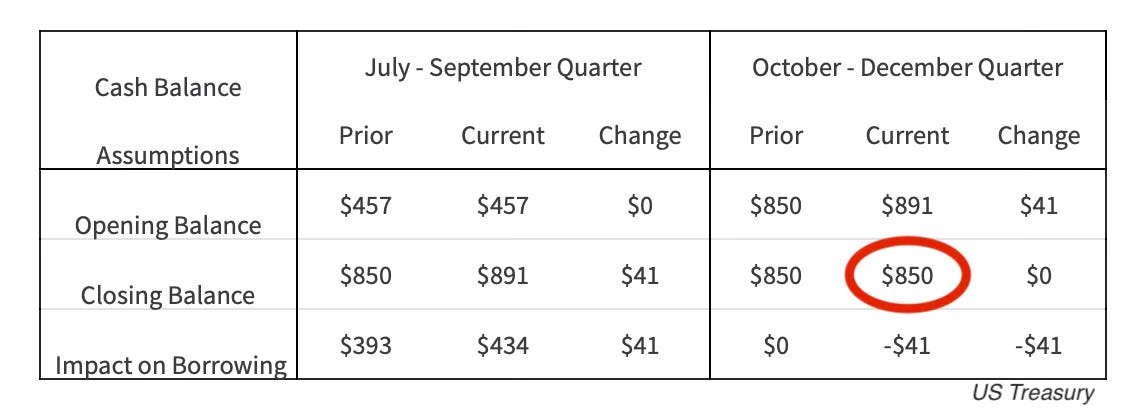

That target? From the latest US Treasury QRA (Quarterly Refunding Announcement):

$850 billion.

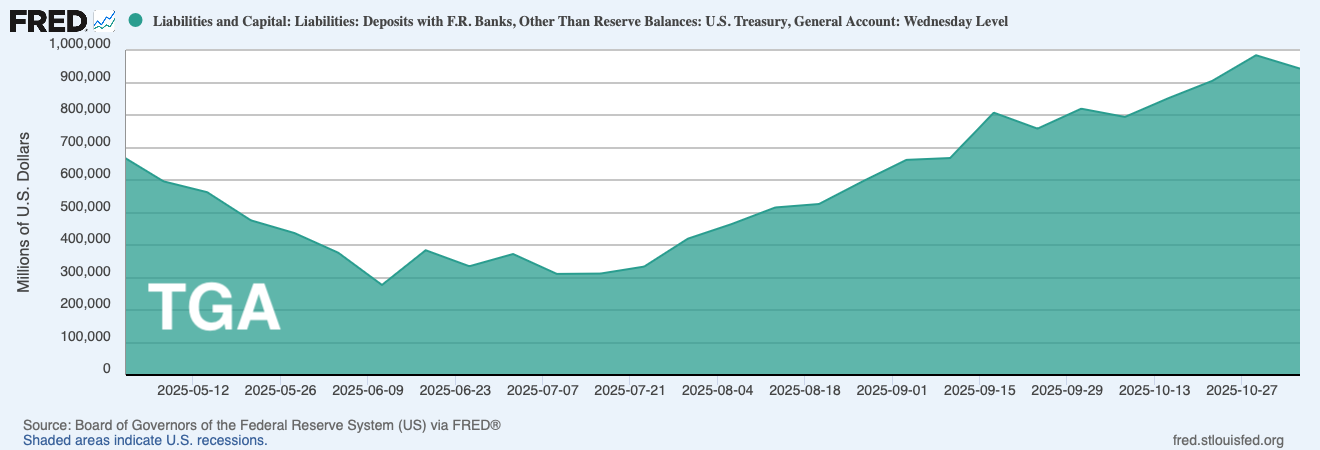

But, look at this chart:

You can see the dramatic climb starting in June 2025. The TGA went from $296 billion to $941 billion in just five months. Way above their $850 billion target.

What happened?

The plan was simple: rebuild the TGA back to its target level after it had been drawn down earlier in the year. The Treasury announced this in their quarterly refunding documents, laying out exactly how much debt they’d issue and when.

But then the unexpected happened.

Well, let’s be honest here.

It wasn’t entirely unexpected, was it?

And unless you’ve been on extended holiday without internet or Twitter, then you know exactly what I am talking about.

That’s right.

In an absurd set of events, the US government (forget the blame here, they all suck IMO) decided to hold the American people hostage and close the government.

See, the government has been operating under something called a Continuing Resolution—this is simply a temporary spending bill that keeps the government up and running, even though Congress can’t pass an actual budget. And when the government operates under a continuing resolution, spending gets constrained.

Not because anyone suddenly discovered fiscal discipline.

But because the CR limits what can be spent and when.

So here’s what played out: