💡The Reverse Repo Reaper

Issue 140

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Repos and Reverse Repos

Current State of Affairs

The Worry

Cowbell Incoming

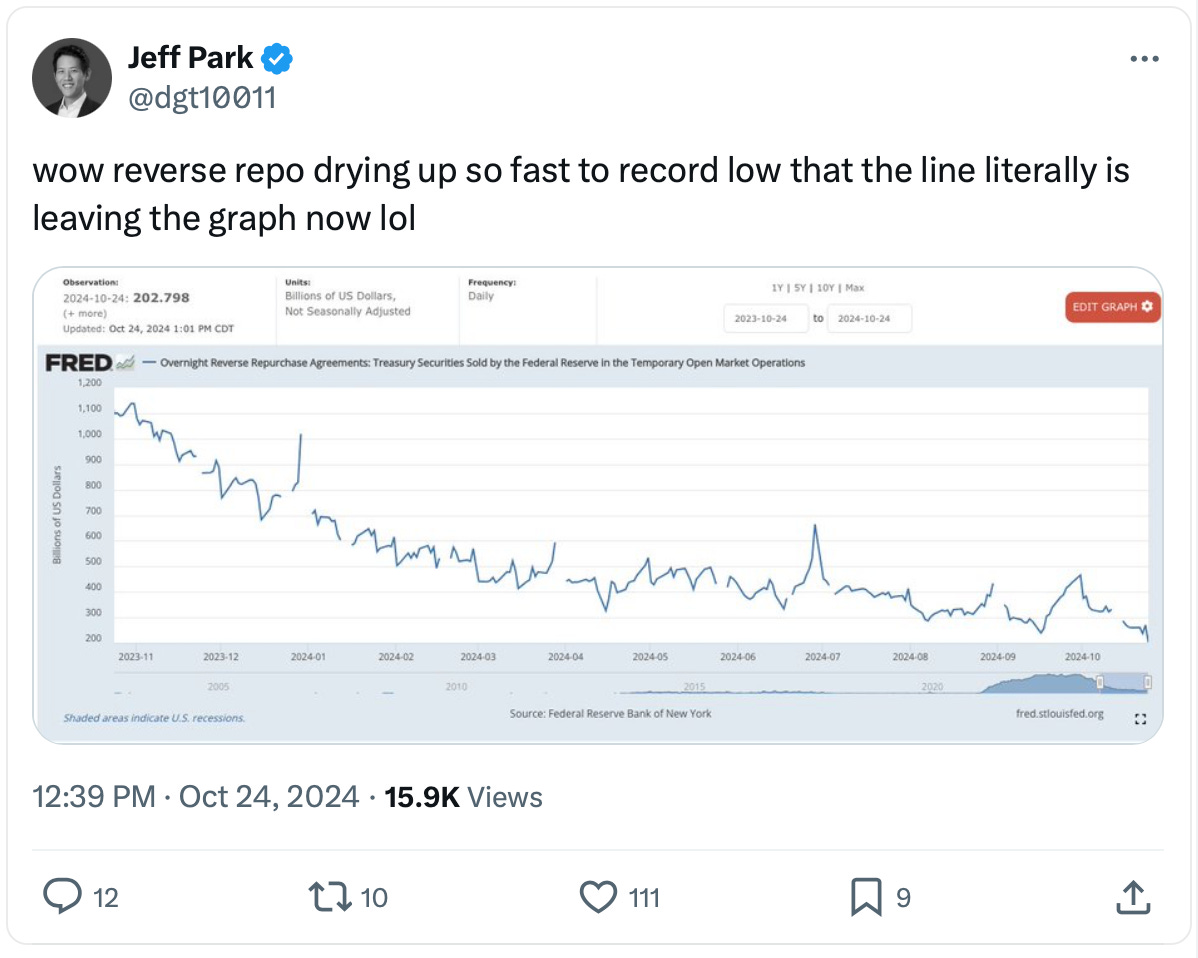

Inspirational Tweet:

Brace yourself. We are going to start hearing a lot of experts and pundits weigh in on concerning developments in the world of the repo markets.

Specifically the Reverse Repo Facility and how it is being drained down to zero.

But Jeff Park on Twitter/X is a smart guy and he likely knows all too well what is going on and what it means.

For those of you who are new to the Fed liquidity game and/or don’t just sit around and pontificate on this stuff—and why would you, amiright?—have no fear.

Because we are going to unpack the situation of the Reverse Repo and its implications, nice and easy as always, here today.

So, grab a big mug of your favorite coffee and ease into a comfortable chair for this Sunday’s Informationist.

Partner spot

America's Most Secure Mobile Service

Really quickly and before we start, I cannot stress this enough. If you’re not protecting yourself from cyber attacks and SIM-swaps, you’re at serious personal risk these days. After seeing four of my colleagues go through the nightmare of SIM-swaps (someone literally taking control of your phone from afar)—identifies stolen, bank accounts compromised, emails hijacked, social media held for ransom—I knew I was at risk, too.

So, I switched to a service called Efani, and it was super easy and seamless. It feels just like being with Verizon or AT&T, but I can rest easy knowing that my phone is ultra-secure. My colleagues learned the hard way, but now we’re all on Efani, and I couldn’t be happier. I honestly wouldn’t share this with you if I didn’t completely believe in the service myself. Whether you use Efani or something else, please don’t wait until it’s too late to protect yourself.

And if you choose Efani by using the link below, you get $99 OFF.

The Efani SAFE plan is a bespoke cybersecurity-focused mobile service protecting high-risk individuals against mobile hacks, providing best in class protection with 11-layers of proprietary authentication backed with $5M Insurance Coverage. Don’t wait. Protect yourself today.

🤓 Repos and Reverse Repos

Keeping it super simple, let’s review the repo and reverse repo facilities. I’ve written about these before, but will cover them here quickly for you. If you remember all this, feel free to skip ahead.

Both facilities were established by The Fed to promote ‘smooth market functioning as needed’ (Read: during periods of market stress).

In essence, both are overnight lending markets run by the Federal Open Market Committee or FOMC, and all purchases and sales are made by the New York Fed’s Open Market Trading Desk (the Desk). These are called open market operations.

The Repo

A repo is basically a repurchase agreement between two parties, and for today’s purposes, this agreement involves US Treasuries.

See, when a bank desires cash to cover short term needs, it can sell US Treasuries that it holds on its balance sheet to the Federal Reserve (in return for cash) with the agreement to buy them back just 24 to 48 hours later at a slightly higher price.

This is called a Repo or Repurchase Agreement.

The difference between the amount of cash the bank receives and the amount it pays back is basically the repo interest rate fee.

It looks like this:

And so, if there is need for liquidity in the system, then banks may be looking to swap their US Treasuries to the Fed for some quick and cheap cash.

Simple, right?

But what if there is too much cash in the system and banks are looking to generate yield on that cash, but need short-term liquidity and cannot just buy Treasuries with it?

That's where the Reverse Repurchase Agreement or Reverse Repo comes into play.

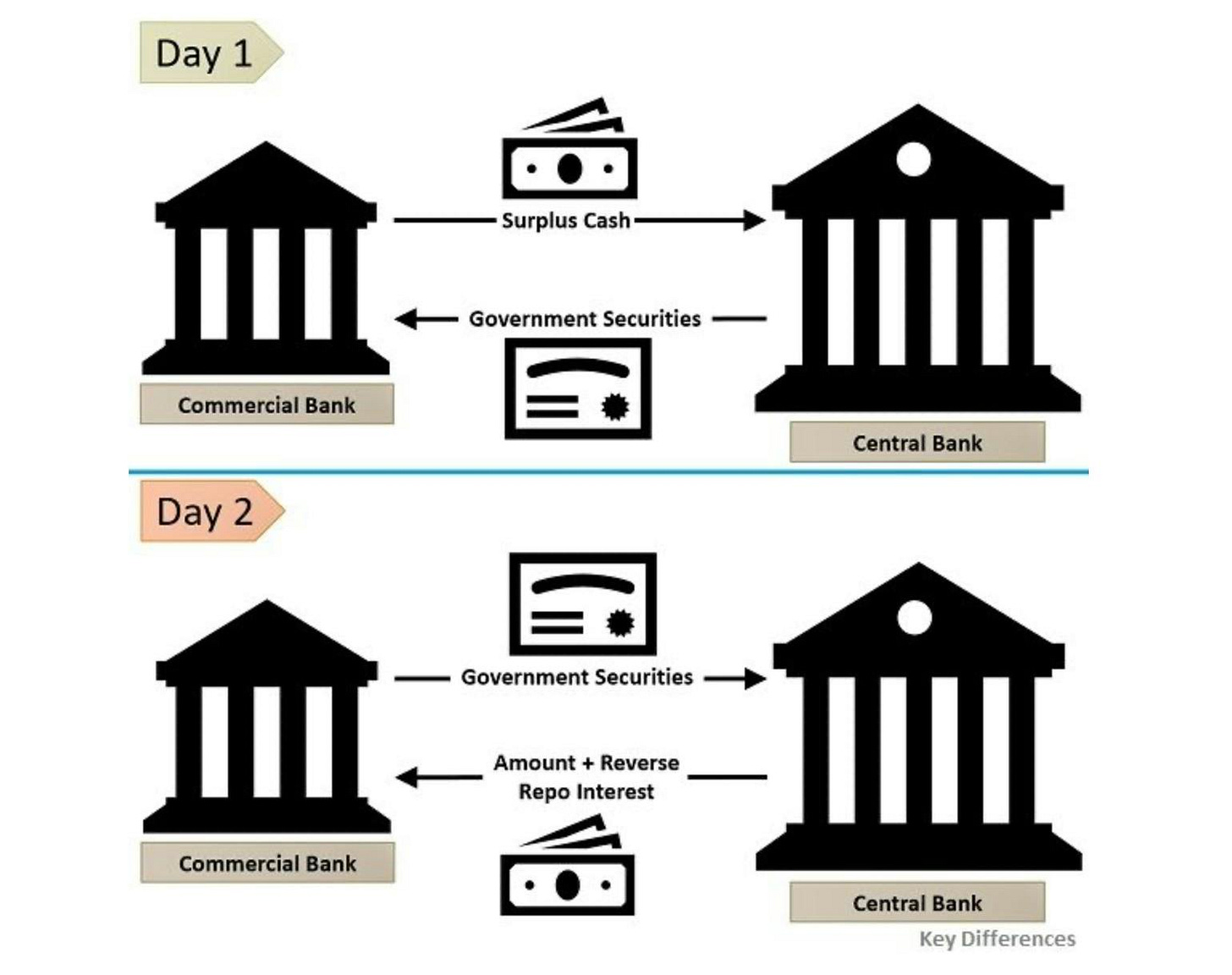

The Reverse Repo

Much like the repo transaction, where a bank sells US Treasuries to the Fed, in a reverse repo, the bank buys US Treasuries from the Fed.

And why would they do this?

Well, when a bank or brokerage has a bunch of cash on its balance sheet, it will look to generate some return on that cash. And so, the vast majority of this activity is from money market funds. You know, the savings account-like security that your investments sit in at Fidelity or Schwab when they are in ‘cash’.

A perfect mirror image of the repo, the Reverse Repo looks like this:

An important note here is that the NY Fed sets the Reverse Repo Rate, and as you can see, it is typically close to the Effective Fed Funds Rate. The current RRF rate is 4.8%.

The money market fund will park cash at the Fed and give you some, but not all, of the 4.8% of interest it earns. It keeps a little for itself, calling it the expense ratio.

What a deal.

But you remember how I said these facilities were created to ensure smooth market functioning, i.e., times of market stress? As in periodically?

Yeah, well in 2021 The Fed decided to create Standing Facilities, whereby the repo and reverse repo windows would always be open.

Cool.

🧐 Current State of Affairs

See, the reverse repo was initially created in 2013 after the First Great Money Print of the Great Financial Crisis. And banks and wealthy investors, awash in cash, sloshing around in it like pirates in their treasure chests, directly or indirectly parked all that cash at The Fed.

$400 billion of Cantillon-effect created booty. 🏴☠️💰

But that was a pittance compared to the mountain of excess liquidity created during Covid which led to.$2.4 trillion of excess cash parked at the Reverse Repo Facility.

And ever since that spike of liquidity, the Treasury has been teasing the capital out of the Reverse Repo and into short-term Treasuries, or T-Bills.

Why?

Because the US government is running massive deficits and instead of locking in high interest rate long-term debt for the last three years, it has been issuing more and more and more T-Bills to cover the spending gap.

The Treasury has basically been playing chicken with interest rates, betting they will go down before they have to dump tons of longer-term paper on the market.

Looking at the RRF balances now, you can see how much the Treasury has drawn out.

That’s right, having soaked up over $2.2 trillion and now there’s only about $155 billion of excess liquidity left in the reverse repo.

So, where did it all go? Have money markets been drawn down, causing the exodus from the RRF? Cash headed into the stock markets? Into gold?

Looking at the record-level balances of money market funds, I’d have to say, no.

Money markets are simply opting for higher yields in short-term USTs, T-Bills, compliments of Janet Yellen and the Treasury.

So then, what’s the problem? Why is anyone concerned?

🫣 The Worry

There is no problem, per se, yet.

But there is one looming on the horizon.

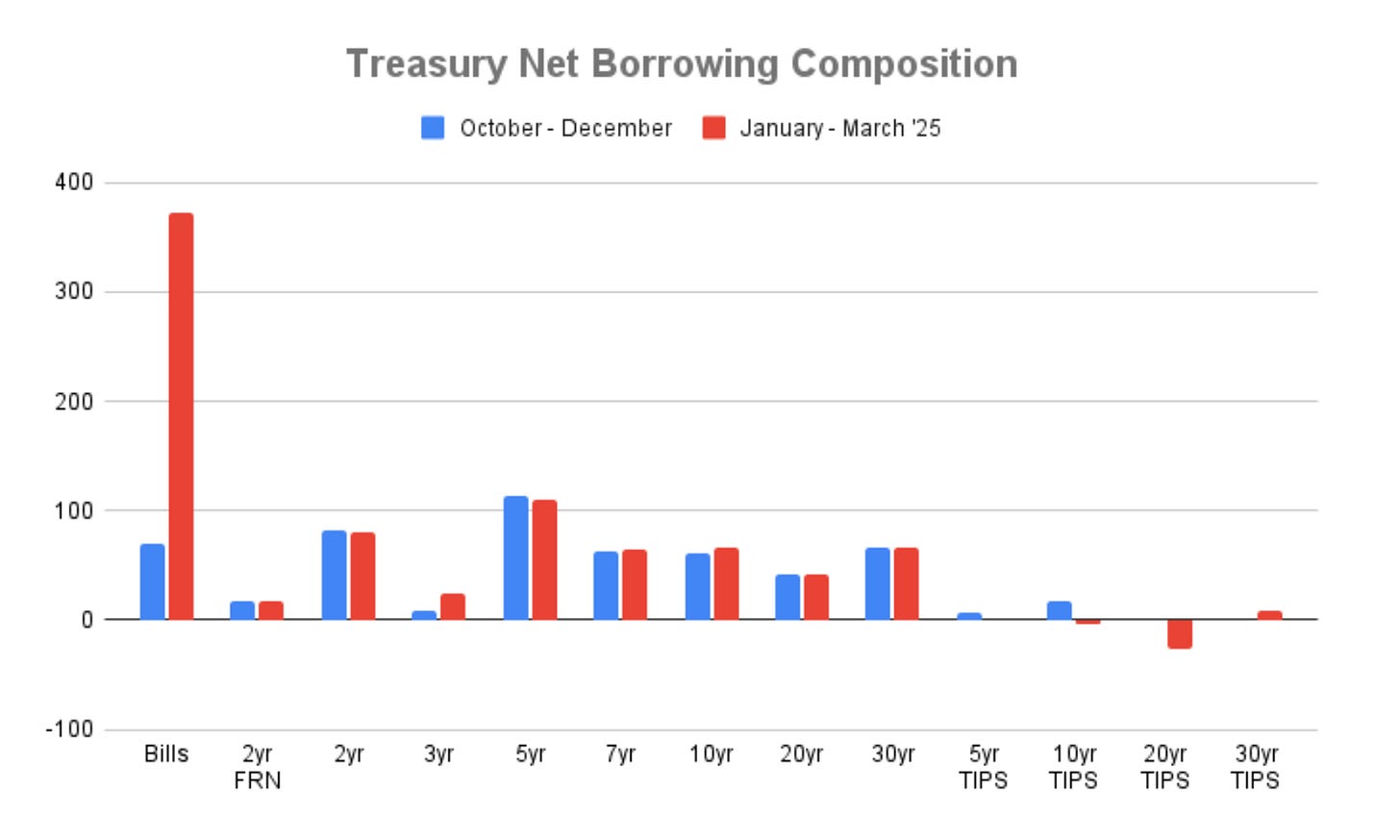

See, the Treasury just announced its Quarterly Refunding (QRA) this past week, and it was a doozy.

Over the next quarter, the Treasury plans to:

spend $186 billion from the TGA (Treasury checking account)

issue $546 billion more USTs

And in Q1 of 2025, the Treasury plans to:

fill the TGA back up to $850 billion (by adding $150 billion back)

borrow an additional $823 billion

That’s a step up to $1.4 trillion of additional borrowing over the next six months.

Here’s the composition of that borrowing:

See the problem? (hint: the tall red line on the left)

Right. The Treasury plans to soak the market with a stack of T-Bills in early 2025.

Why would they do this?

To kick the duration can down the road, of course.

Let me explain.

Premise: The government is currently running $2T+ deficits, in the time of a non-recession. We have an election coming that neither party can really do much about the deficit spending right away. And so, the madness will continue, whether or not the economy holds up this year.

The bond market knows this—it knows the insane rise of US debt will only continue.

If you’ve been watching the long-term Treasury rates since the Fed lowered the Fed Funds Target Rate in September, you know that investors are a bit unsettled.

Rates did not go down, but in fact, they rose since then. A lot.

Here’s the 10-Year UST:

And mortgage rates are back over 7%. 😱

But why?

Because the bond market knows that the Treasury is just kicking the can down the road and will soon have to dump a heap of 10 to 30-year USTs on the market.

It will eventually have no choice.

And so investors are unwilling to take the risk that the yields go up in their face when this relentless borrowing happens. They are getting ahead of the game here, demanding rate premiums.

🐮 Cowbell Incoming

One of the main components of this rate premium is expectation that there will be more inflation.

And why not?

The Fed already lowered rates .5% and is signaling that it is likely to lower them again this month.

The economic data is murky, with storms negatively affecting unemployment on one hand but relentless government spending and hiring positively affecting the same numbers.

With the Fed lowering rates as the economy stumbles along sideways, yet inflation remaining sticky above 2%, we could very well see a resurgence of not just asset, but also consumer inflation.

The Fed has an eye on those employment numbers of course, but also a few other data points.

Like bank liquidity.

Remember that the Fed is still conducting QT (quantitative tightening) by letting bonds mature off its balance sheet and not replacing them. It’s not a ton of liquidity we are talking about, just $25 billion per month, but the continuance is significant.

When will it stop this QT?

I believe when the last $150 billion of RRF is soaked up and then the bank reserves fall to $2.9T, that’s the end of QT. Maybe before that.

These are numbers quoted by the Fed itself, by the way. They want to ensure there is enough market liquidity to soak up the wave of bonds that are coming.

Here’s the current status of those reserves:

We are within the stated nervous-nelly zone of 10% to 12% of GDP. And so I expect Powell to end the QT program soon.

Then, once this level dips below $2.9T, all bets are off. The 10-Year UST rates will likely spike up over 5% or higher, and there will be a whole new acronym created by the Treasury and the Fed, a la the BTFP program, that will be little more than outright QE or quasi yield curve control.

And if this invokes the sound of the money printer firing up, you would be right.

Money printer go brrrrrrrr, once again.

And to be ready for this, I wouldn’t have money in long-term bonds.

No, as for me—which many of you already know all too well—I’m opting for hard money, like gold, silver, and Bitcoin.

Forget this melting fiat stuff. It’s for the ones who can just create it out of thin air.

No thanks.

That’s it. I hope you feel a little bit smarter knowing about the repo and reverse repo facilities and how it may affect you and your investments.

If you enjoyed this free version of The Informationist and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️

Terrific note today, James - especially appreciated the note of work from Jeff Park on Twitter/X. I also enjoyed your breakdown of the reverse repo facility and how it affects the U.S. Treasury market. Keep up the great work - here’s hoping your next trades are profitable ones!

Great stuff James. Thanks much.