The Reverse Repo: Once It's Gone...

Issue 90

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today's Bullets:

Repo vs. Reverse Repo

Filling the RRF

Draining the RRF

Where will the Treasury Turn?

Inspirational Tweet:

With US federal deficits increasing and liquidity for US Treasury bond auctions decreasing, we are likely going to start hearing more and more about the Federal Reserve's Reverse Repo Facility, or RRF.

Some of you may have already heard me talking about it recently, especially in relation to Treasury auctions.

But what exactly is the RRF, how does it work, and why is it suddenly so important to the Treasury?

Good questions, and ones we will answer nice and easy, as always, here today.

So, grab that cup of coffee, saddle up, and settle in for a short Sunday Repo trail ride with The Informationist.

🎯 Repo vs Reverse Repo

First things first. Repo, Reverse Repo: what are they, and what's the difference between them?

In essence, both are overnight lending markets run by the Federal Open Market Committee or FOMC, and all purchases and sales are made by the New York Fed’s Open Market Trading Desk (the Desk). These are called open market operations.

The Repo

A repo is basically a repurchase agreement between two parties. The term can be used in many different types of transactions, but we most often hear it used to describe overnight transactions of US Treasuries.

See, when a bank needs cash to cover short term obligations, it can sell US Treasuries that it holds on its balance sheet to the Federal Reserve (in return for cash) with the agreement to buy them back just 24 to 48 hours later at a slightly higher price.

This is called a Repo or Repurchase Agreement.

The difference between the amount of cash the bank receives and the amount it pays back is calculated to be the discount rate, or the cost of ‘overnight’ borrowing from the Fed.

It looks like this:

OK, so if there is a lack of or need for liquidity in the system, then banks may be looking to loan their US Treasuries to the Fed for cash to cover short-term needs.

Got it.

But what if there is too much cash in the system and banks are looking to generate interest on that cash, but are not able to buy any more US Treasuries, because they are at their internal and Fed-mandated limits?

That's where the Reverse Repurchase Agreement or Reverse Repo comes into play.

The Reverse Repo

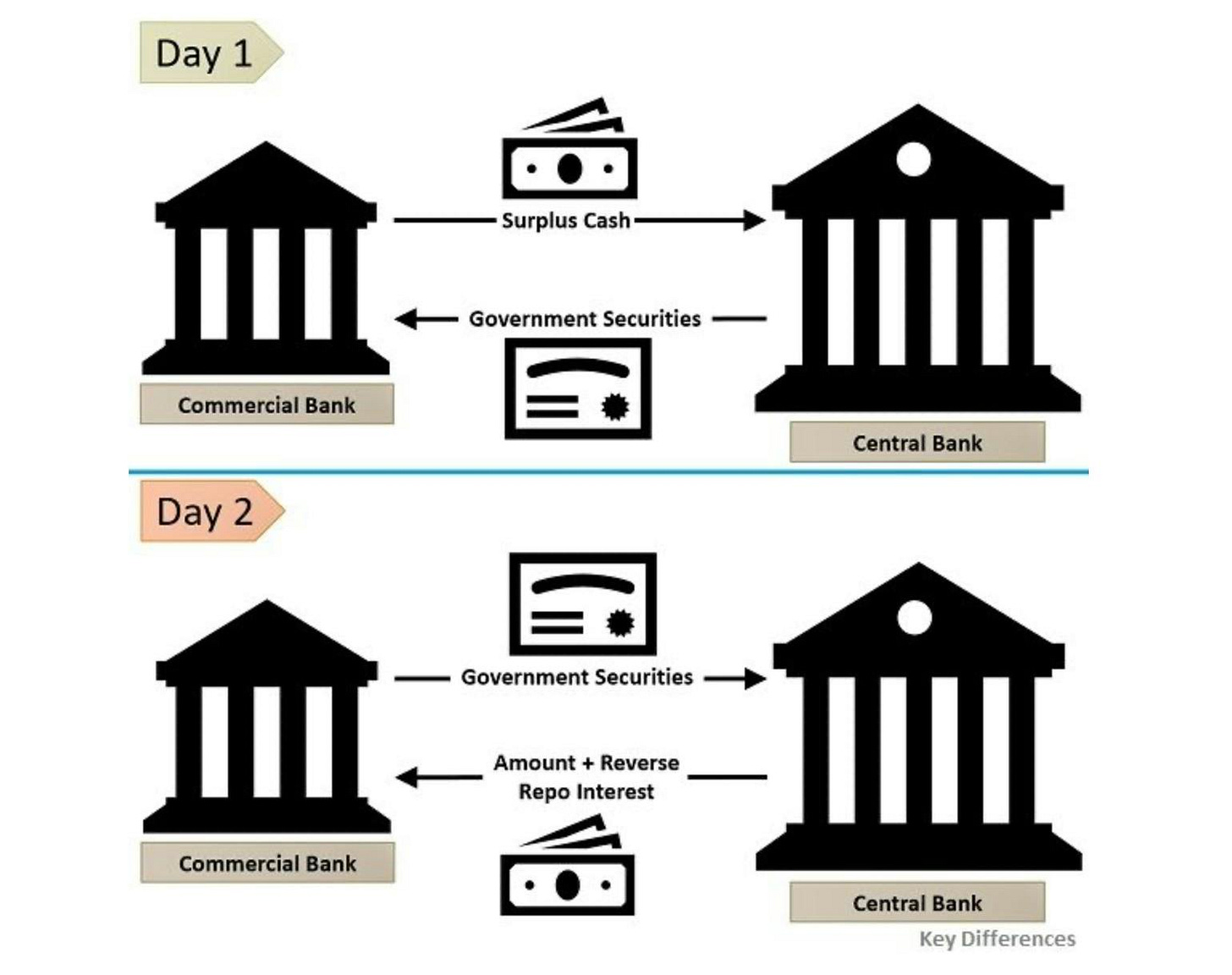

Much like the repo transaction, where a bank sells US Treasuries to the Fed, in a reverse repo, the bank buys US Treasuries from the Fed.

But why would they do this?

Simple. When a bank has too much cash on its balance sheet, it can utilize the reverse repoto generate a rate of return on that cash in the overnight market.

In essence, the bank parks its cash at the Fed.

And so, like a mirror image of the repo, the Reverse Repo looks like this:

An important key here is that the NY Fed sets the Reverse Repo Rate.

And as you can see here, the rate on Nov 17th, was 5.30%.

Remember this number, we will come back to it in a bit.

🔍 Filling the RRF

Another thing you may have noticed recently is that we are hearing precisely nothing about the Repo market lately.

Why?

Because nobody is using it.

The reason for this is that the major banks are not strapped for cash, but rather swimming in it.

And so, all the focus and action has been in the Reverse Repo markets.

But how did this happen? Why are these banks swimming in, stuffed to the gills with, all this cash?

You got it.

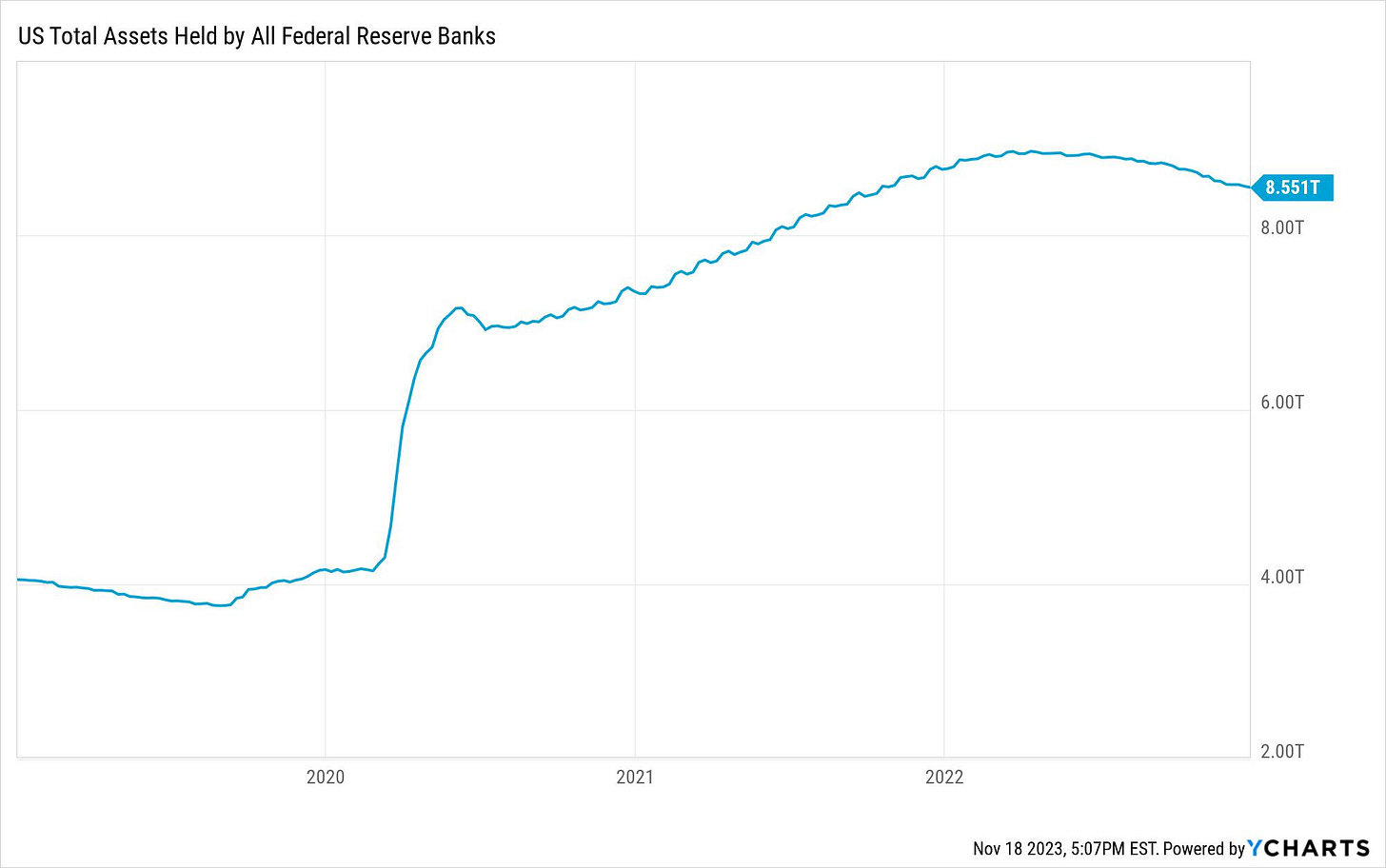

QE (almost infinity) in 2020 and 2021.

See, when the Treasury and the Fed teamed up to enter and 'inject liquidity' into the markets, they hit the banks with something of a cash tidal wave.

Turns out that when you print and purchase over $5.8T of securities from banks and put those securities on your own balance sheet in return for floods of cash...

...you wind up creating massive excess cash balances at the banks, who then in turn, wind up eventually parking it back at The Fed in the Reverse Repo Facility.

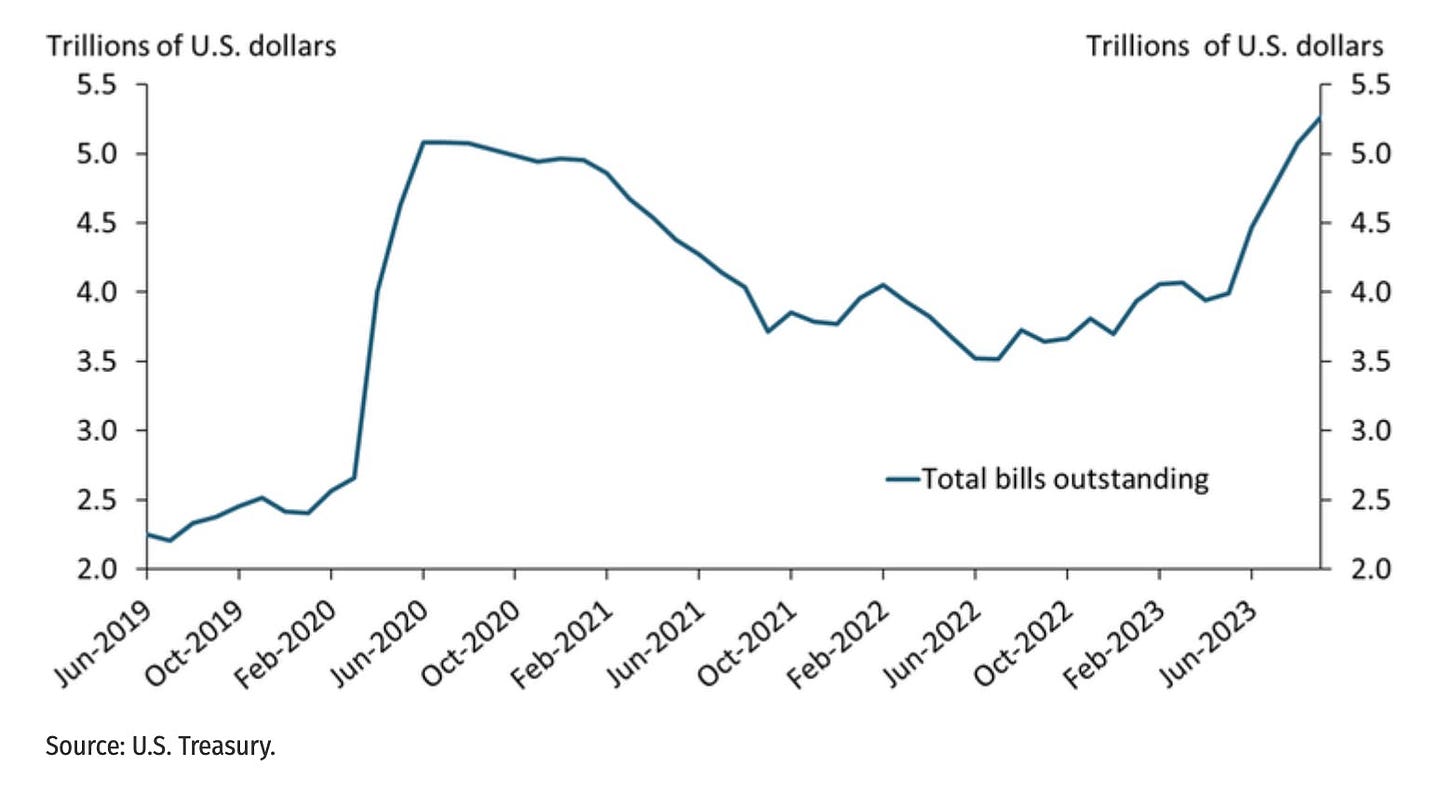

Look at what also happened between 2021 and the end of 2022:

The Fed then pays the bank the current Fed Fund influenced Reverse Repo Rate as a yield on those balances.

Which, as you can see the Reverse Repo Operations Schedule above, was 5.30% (annualized) yield this week.

What a deal!

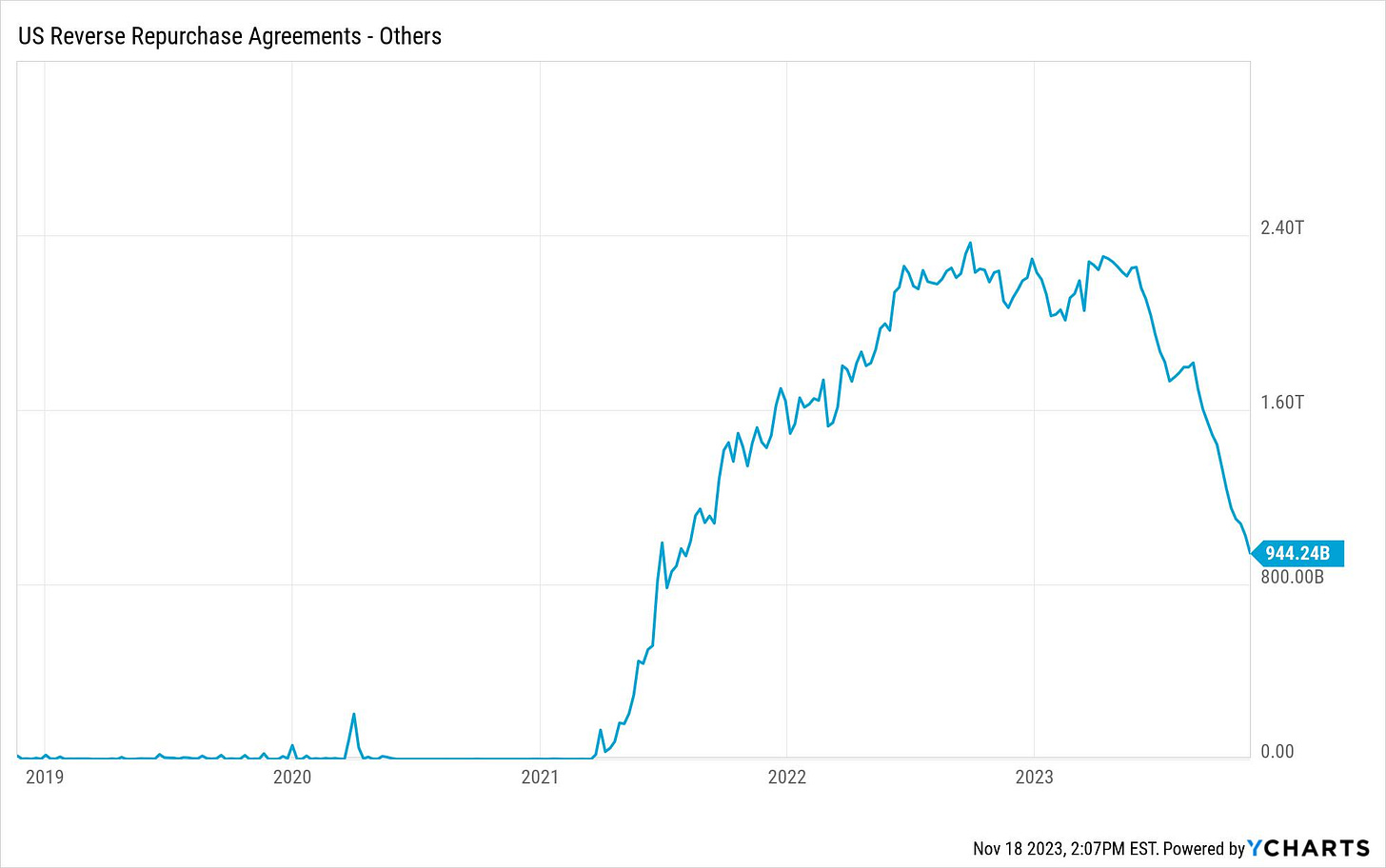

But that $2.4T of Reverse Repo Facility balances has been falling recently and is now down quite a bit.

But why? Where's all the excess cash going?

✍️ Draining the RRF

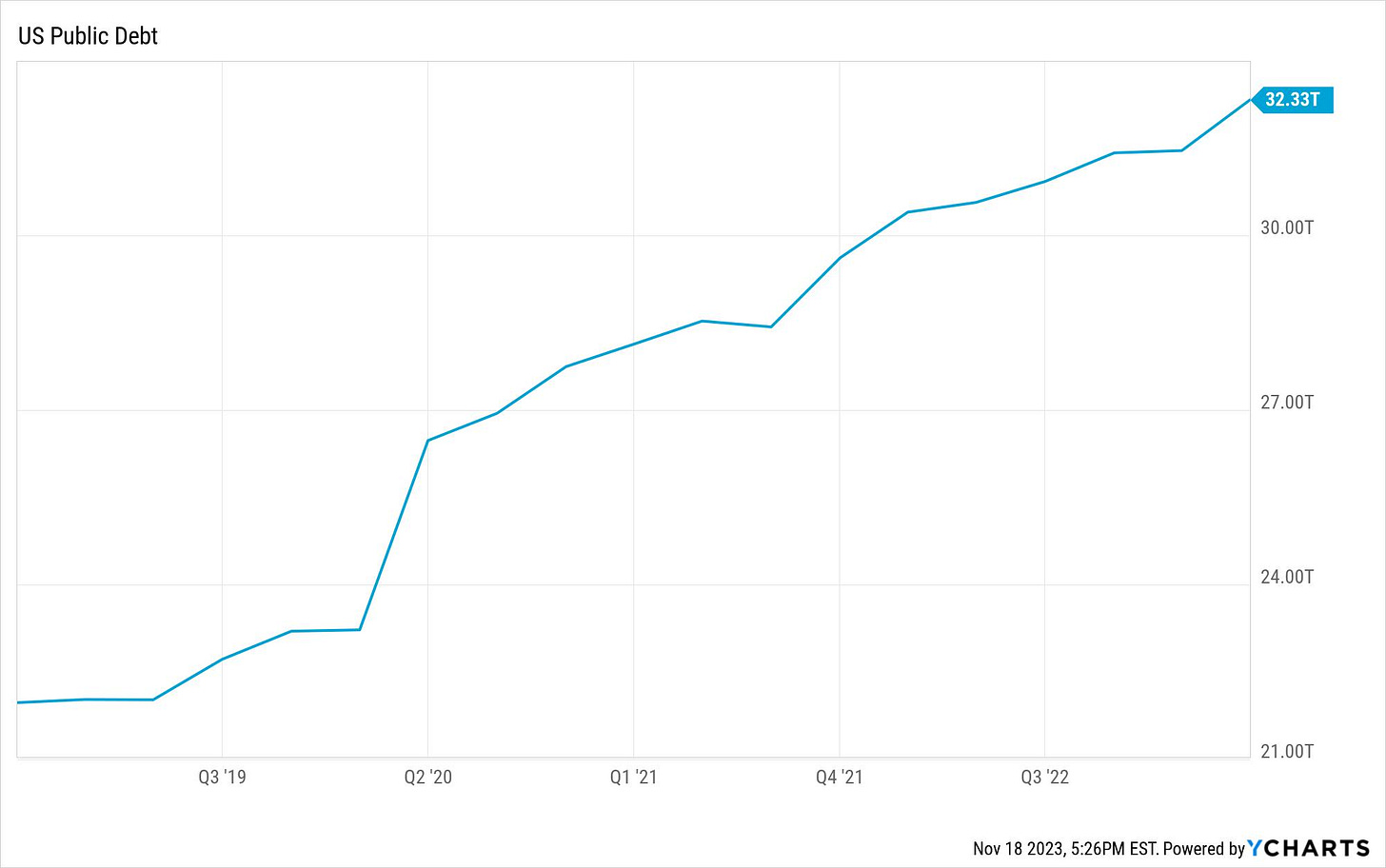

Again, unless you've been completely ignoring all news and media (good for you, seriously), then you've likely also noticed that there's been quite a bit of talk about the expanding US deficit and ballooning US debt this year.

This phenomenon is called the Debt Spiral, and I've concluded that mathematically, we have already entered one. If you want to know more about that you can read it all in a Tweet I posted over a year ago, right here:

Bottom line, the US is spending too much compared to the amount of productivity and taxes it is (read: its citizens and companies are) generating, and this excess spending is causing the need for the Treasury to borrow more and more.

And more.

So, they have been covering the deficit with auction after auction of bonds, just papering over the spending problem.

But because interest rates are now significantly higher than when the Treasury started to flood the market with USTs, they have been leaning hard on the short end of the yield curve.

Notice the steep pickup in T-Bill issuance this past year, surpassing even the shock of March 2020 issuance.

This pivot to the short-term T-Bill auctions serves two purposes.

First, the Treasury doesn't lock themselves into long term high interest loans, ones that would only exacerbate the deficit problem with ballooning interest rate expenses.

And second, they can tease some of that capital back out of the Reverse Repo Facility and into its own coffers again.

So, how are they doing with that plan?

It seems swimmingly well.

In fact, the Treasury has drained about $1.5T from the Reverse Repo Facility in just the last few months.

And the Treasury's recently announced refunding plan reiterated that they would continue to lean on the short end of the yield curve, saying they are comfortable with staying well above the normal ~20% rate of auction of T-Bills versus longer maturity bonds.

In fact, this has effectively been inverted lately, with the Treasury auctioning 70 to 80% T-bills and Notes versus Bonds this past number of months.

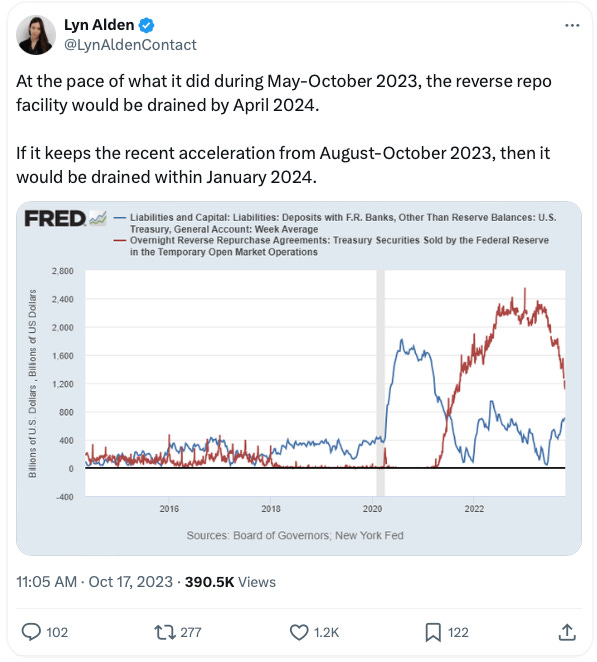

Using the Treasury estimated $1.5T of upcoming auctions between now and the end of the first quarter of 2024, it seems the Reverse Repo will be drained by then.

But if the Treasury keeps the same pace of auctions as the last couple of months, as Lyn Alden points out in today's Inspirational Tweet, the RRF will be drained by January.

Either way, it appears that is the direction the Fed and Treasury are headed, and the RRF will, in fact, soon be back to zero.

But then what?

🧠 Where will the Treasury Turn?

Just because the RRF is drained, doesn't mean the Treasury can stop issuing debt.

Say it with me:

$2 Trillion annual federal deficits.

And likely more when we hit a recession.

Sure, rates ,may be headed lower by then, but where will the Treasury turn for more capital?

Who's going to buy all this stuff?

If you read last week's Informationist, you know that the last Treasury 30-year bond auction was absolutely dismal, signaling a steep drop-off in demand and confidence in long-duration US Treasury debt.

If you want to learn more about that and have not yet read that issue, you can find it right here:

TL;DR: international and institutional demand fell off a cliff this past auction, and the Treasury may have difficulty growing the sizes of auctions necessary to meet demand when they need to move further out on the yield curve.

The way I see it, when the Reverse Repo Facility is drained and the Fed and Treasury can no longer use that excess capital to fund additional debt (i.e., debt beyond what is maturing/being reinvested by bond holders), they have a few 'options' in order to ensure adequate liquidity for the purchase of longer-term Treasuries.

Adjust Capital Requirements The Fed and regulatory agencies could lower the capital requirements for banks. This means banks would need to hold less capital against certain assets, freeing up more funds for investment, including in longer-term Treasury securities.

Modify Collateral Rules The Fed could alter the rules regarding what types of collateral can be used in various Fed lending facilities, which might encourage more purchases of Treasuries.

Tweaking Regulatory Framework Regulatory changes could be implemented that require financial institutions to hold more long-term Treasuries. For instance, regulations could be adjusted to make holding Treasuries more favorable in terms of risk-weighted assets, or changes could be made to the liquidity coverage ratio (LCR) requirements to encourage or require holding longer-term government securities.

Additional options may include some sort of stealth injection of capital into banks or the markets in order to ensure sufficient liquidity for debt auctions.

Think: four letter acronyms like the BTFP or similar programs they can and I expect they will.

Then, of course, we have the upcoming 2024 Treasury Regular Buyback Program. What this is and how it will be used remains to be seen, but this could act as a quasi-yield curve control or stealth QE program, as well.

I personally expect it will.

Any way you cut it, the RRF lifeline is dwindling and soon to come to an end.

Your guess as to where the Treasury turns and what exactly they end up doing is as good as mine, but I am positioning my portfolios to weather various market outcomes from rate and duration risks, accordingly.

Because one thing we can be damned sure of...

The government is not going to stop or even slow down spending any time soon, and they will eventually have little choice but to print more money.

And the Reverse Repo Facility will be filled right back up again.

That’s it. I hope you feel a little bit smarter knowing about the Reverse Repo Market and its functions and feel better prepared to position accordingly.

If you enjoyed this newsletter and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️