The CBO and Taking the Treasury’s Debt Temperature

Issue LIII

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

What’s the CBO report?

Expected receipts

Expected outlays

The (optimistic yet horrifying) result

How to protect yourself

Inspirational Tweet:

Looks pretty bad at first glance, yes? But what exactly is the CBO, and is it really being ‘conservative’, as @zerohedge suggests?

If so, what’s the real picture look like?

We’re going to dig into all that today. So, saddle up and settle in, as we unpack this and more, nice and easy as always.

FYI: for the price of a good double espresso weekly, you get access to all 🧠Informationist posts + the entire archive of articles, and paid subscriber questions always take priority.

🥸 What’s the CBO report?

First off, CBO stands for Congressional Budget Office, the federal agency that provides budget information and economic forecasts to Congress regularly.

Specifically, and most importantly for our purposes today, the CBO recently published its federal budget projections for the next 10 years assuming current tax rates and spending remains largely unchanged.

A few key points from the report summarizes what the CBO expects:

Economic output (GDP) is projected to stop growing early this year and start growing again by second half of 2023

The CBO expects inflation to remain above 2% through 2024 and return to 2% by 2026

Interest rates on Treasury securities are projected to rise further in early 2023 and then gradually fall later this year

The unemployment rate is projected to increase to 5.1 percent at the end of 2023 and decline to 4.5 percent by the end of 2027

Interesting predictions and perhaps a bit rosy for my tastes, considering a few key indicators and the likelihood of the Fed holding rates too high for too long due to sticky types of inflation.

But let’s start by giving the CBO some benefit of doubt and unpack it as we go, shall we?

🤑 Expected Receipts

If you’ve been following me or are a Informationist reader, you likely already know that the federal budget hinges on three main items. We classify these items as either mandatory expenses or revenues.

The mandatory expenses are those that are either signed into legislation and therefore mandatory or contractual, such as:

Entitlements: Social Security, Medicare, or Medicaid,

Defense: long-term spending contracts, ones that must be paid to keep the country secure (this can be debated, of course, but either way, they are pretty much unavoidable, set in stone, so to speak),

And Interest Expense (this is the interest the Treasury has to pay on all that debt they’re piling up on us)—right, not exactly an optional line item.

As for the revenues, they aren’t actual revenues, per se, as the US Government is not in the business of making money, but rather they are in the business of taking money, i.e., collecting tax revenues from all of you (and me).

So, let’s focus on those collections, first.

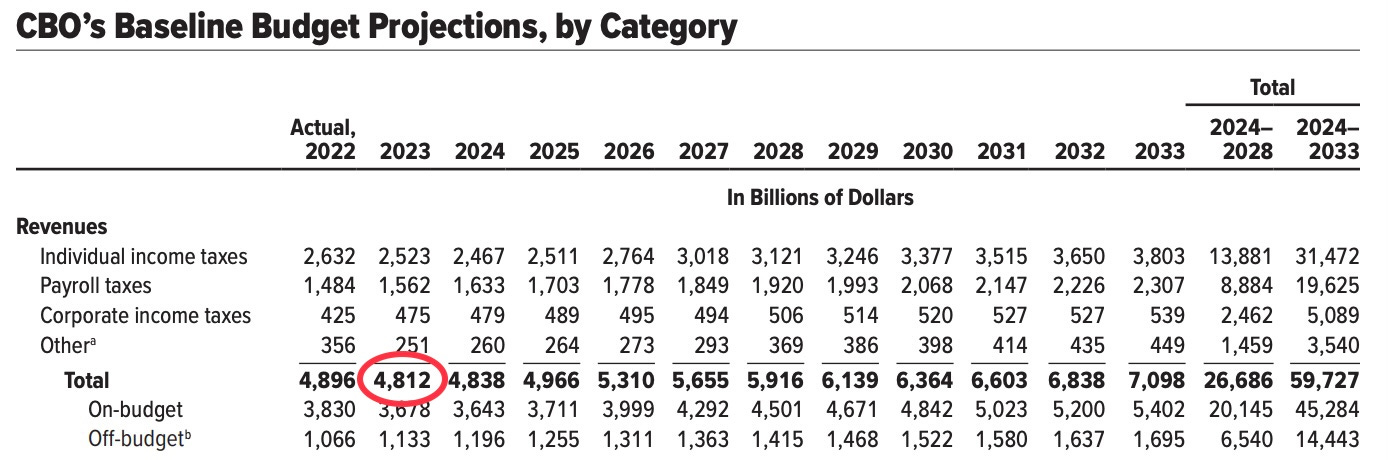

Taking a peek at the CBO’s budget predictions, we see that CBO expects the US Treasury to take in about $4.89T in 2023.

These so-called revenues are projected to increase by over $2T to $7T by 2033, 10 years from now.

That’s an increase of about 47%. Not too, bad, right?

GDP rises, taxes rise. All good.

Right?

Well, let’s not get too excited, because this is just half the picture. And, a subtle little detail here is that the CBO assumes no recessions.

Ever. 👀

This is a bit of a red flag for me. I mean, we know we have economic cycles, pretty much induced and exacerbated by central banks themselves. And as it stands today, we have an extremely high likelihood of a coming recession this year and perhaps into next.

There are many reasons for this, and I won’t dive into those in this letter, but one extremely strong indicator is the yield curve being severely inverted between the 10yr and 2yr US Treasuries.

If you’re wondering what I’m talking about, or need a refresher on that, I wrote a whole article recently explaining yield curve inversions and how they can both indicate and affect the state of the economy. You can check that out here:

Bottom line, recession means lower GDP (productivity). And lower productivity means lower revenues for companies and individuals. Lower revenue leads to lower income. Lower income means?

Exactly. Lower taxes.

So, the Treasury’s revenues—collections—seem a bit fluffy this year and going forward.

OK, then how do the rest of the projections look?

Let’s see…

🤨 Expected Outlays

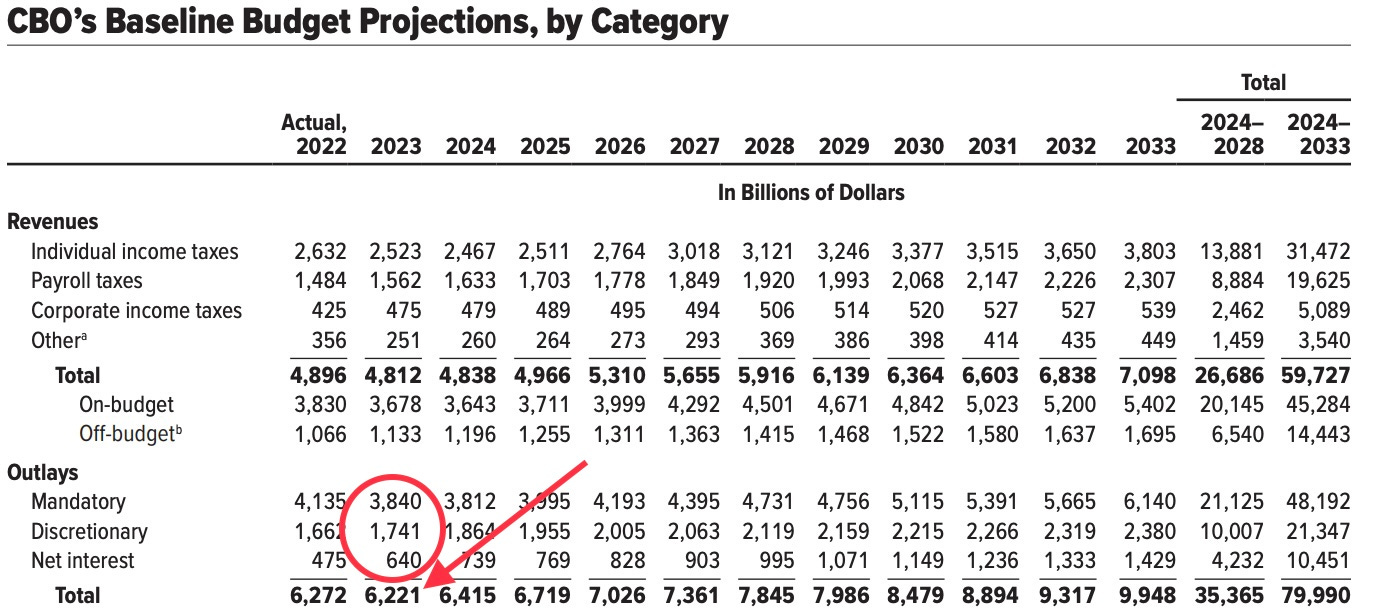

As we said above, the expected outlays—expenses—are mainly entitlements, defense spending, and my personal favorite as of late: interest payments.

How’s it looking, from the CBO vantage?

It appears expenses are coming in a bit heavy, at first glance. I mean, the expected 2023 Mandatory expenses are $3.8T, up quite a bit from what the CBO projected to be $3.6T just last May.

But this increase is largely due to the 8.7% COLA (Cost of Living Adjustment) in entitlements going forward.

Net Interest is also up from the predicted $442B to the now expected $640B in 2023. As many of you already know, some of this was to be expected, as the interest the Treasury has to pay on newly issued debt is far higher than the rates they were paying on the old debt that is maturing right now.

Looking forward 10 years, it appears the CBO expects that expenses are likely going to grow about 60% to about $10T by 2023.

Hold up, you say.

That’s a lot more than the expected rise in ‘revenues’ of 47% in the next 10 years.

Yeah, about that…

Here’s the thing.

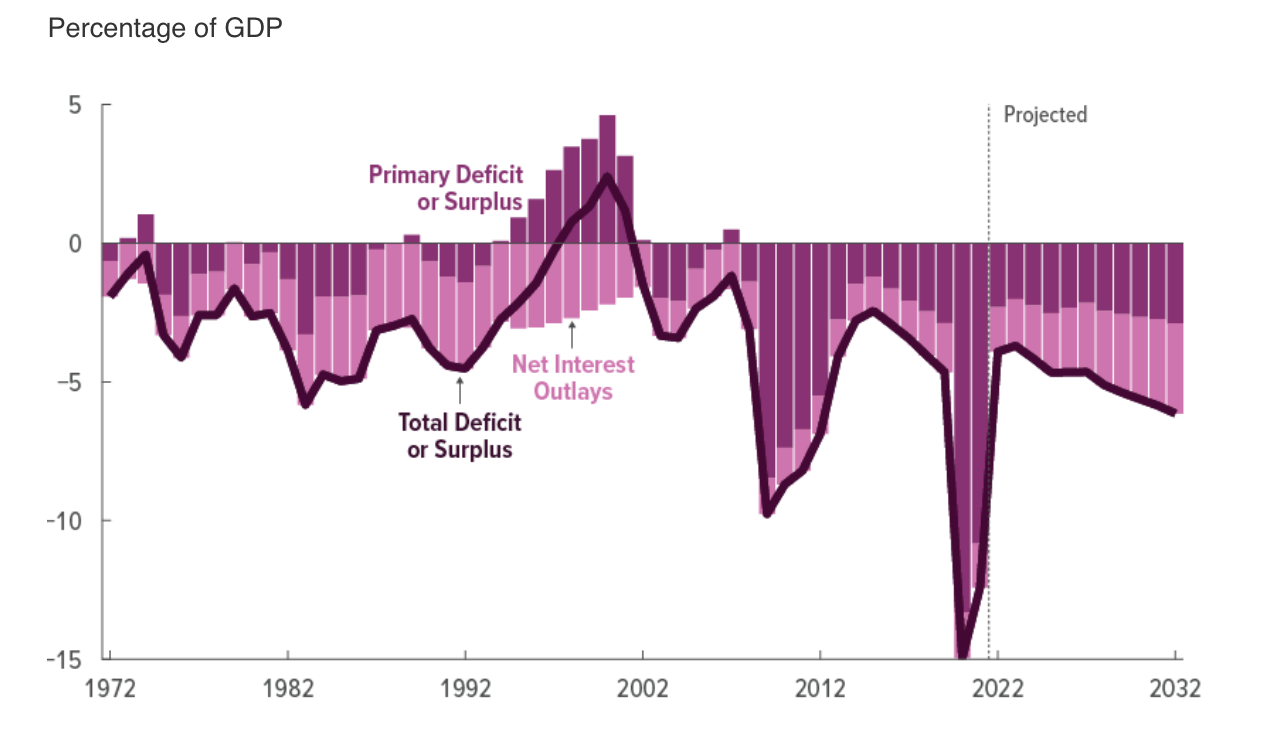

The CBO knows it, publishing a few charts with its budgets, like this one, showing the growing deficit that the Treasury faces:

Oops?

And then there’s this little gem, also put out by the CBO:

Uh, Houston…?

😱 The (optimistic yet horrifying) Result

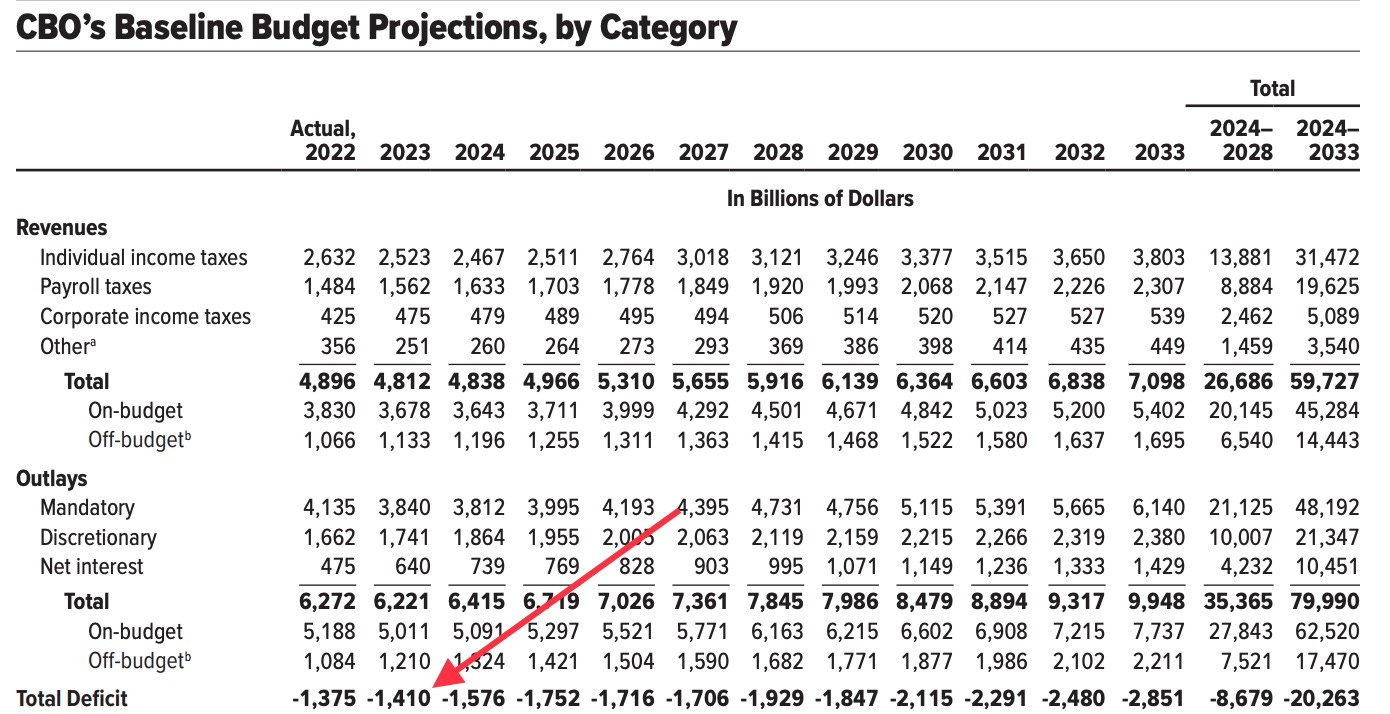

Putting it all together, we can get the full picture of what the CBO predicts over the next decade. And it looks like this:

Now you see why the charts above look so ugly. The CBO expects us to lose more and more money annually, in perpetuity.

I’ve talked about this outlook extensively, but if you’re new around here, you can find the article I wrote about what we call the debt spiral right here:

But wait. It gets better.

The US Treasury released its own report recently that dug into all this and laid out the reality of our current situation in its Executive Summary and 2021 Financial Report of U.S. Government.

The subtitle of the report?

An Unsustainable Fiscal Path

That’s right. The US Treasury outright admitted to the massive fiscal problem the US now faces. So much so, that they put it in the title of their own report.

But wait. They also added a single graphic to the report. One that seemed to be placed in there to absolutely hammer the unsustainable point home.

And hammer it does:

Holy Mother of God.

They actually published this. For the whole world to see. (Hat tip to Lyn Alden for seeing this first and altering me to it).

Wait. I know what you’re thinking. This was a 2021 report published last year. How much worse has this picture gotten since?

Well, the Treasury just announced that it expects to borrow a whopping $932B in the first quarter of 2023.

Why?

In their own words:

The borrowing estimate is $353 billion higher than announced in October 2022, primarily due to the lower beginning-of-quarter cash balance ($253 billion), and projections of lower receipts and higher outlays ($93 billion).

There you go, folks, lower tax receipts and higher spending. This was confirmed by a report this week showing the biggest monthly decline in tax receipts on record in January.

So, at this rate, we will be running not a $1.4T deficit in 2023, but something likely more along the lines of a (well over) $2T deficit in 2023.

So the Treasuries debt temperature this year and for foreseeable future is hot.

Like inferno hot.

The kind that leads to a meltdown.

The debt spiral is on, we are in it, and the Treasury and Fed have little choice but to eventually swoop in and print more, inflate more, monetize more.

All paths lead to inflation.

Why?

Because at this rate, the US will be left with only two choices: print money and buy its own debt, or default. (And I am talking about a real default—not a timing technicality due to debt ceiling posturing—no, I mean where the US haircuts bond owners and either neglects to pay them back or pays them less than they are owed)

Which they will never willingly do.

They’ll just print it all away instead. For as long as they possibly can.

🧠 How to protect yourself

So, what can you do about it? How can you protect yourself from all this printing, all this inflation?

First let’s be clear, every person has their own distinct investment situation. No one strategy fits everyone. It all depends on your liquidity, your earnings, your age, your tolerance for risk, etc.

As for me, I’m lower risk and not a kid. I have plenty of expenses and needs for cash. I also have a long term outlook for my portfolio.

So, now hold a large percentage of my portfolio in cash, as I believe there is a high probability that we enter a recession and the market sells off. So, I am waiting for public market opportunities to present themselves. I am also holding a larger than typical percentage of my portfolio in precious metals, mostly gold and some silver. All of these holdings are either secured in a vault or for my retirement account, I hold ETFs that have audited gold and silver in vaults as claims behind the shares. I am also holding and buying Bitcoin opportunistically in here. I expect more volatility and entry points for all hard monies throughout the first half of the year.

I hope this helps and gives you ideas of what to talk about with your own investment advisor!

As we used to say in hockey when the game started to get particularly chippy or violent, keep your head on a swivel out there.

That’s it. I hope you feel a little bit smarter knowing about the CBO and updated debt outlook for the US Treasury. Before leaving, feel free to respond to this newsletter with questions or future topics of interest. ✌️

Talk soon,

James