The Laffer Curve and Do Lower Taxes Work?

Issue 126

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Reaganomics

The Laffer Curve

Controversy & Criticism

Biden/Kamala Proposal

Inspirational Tweet:

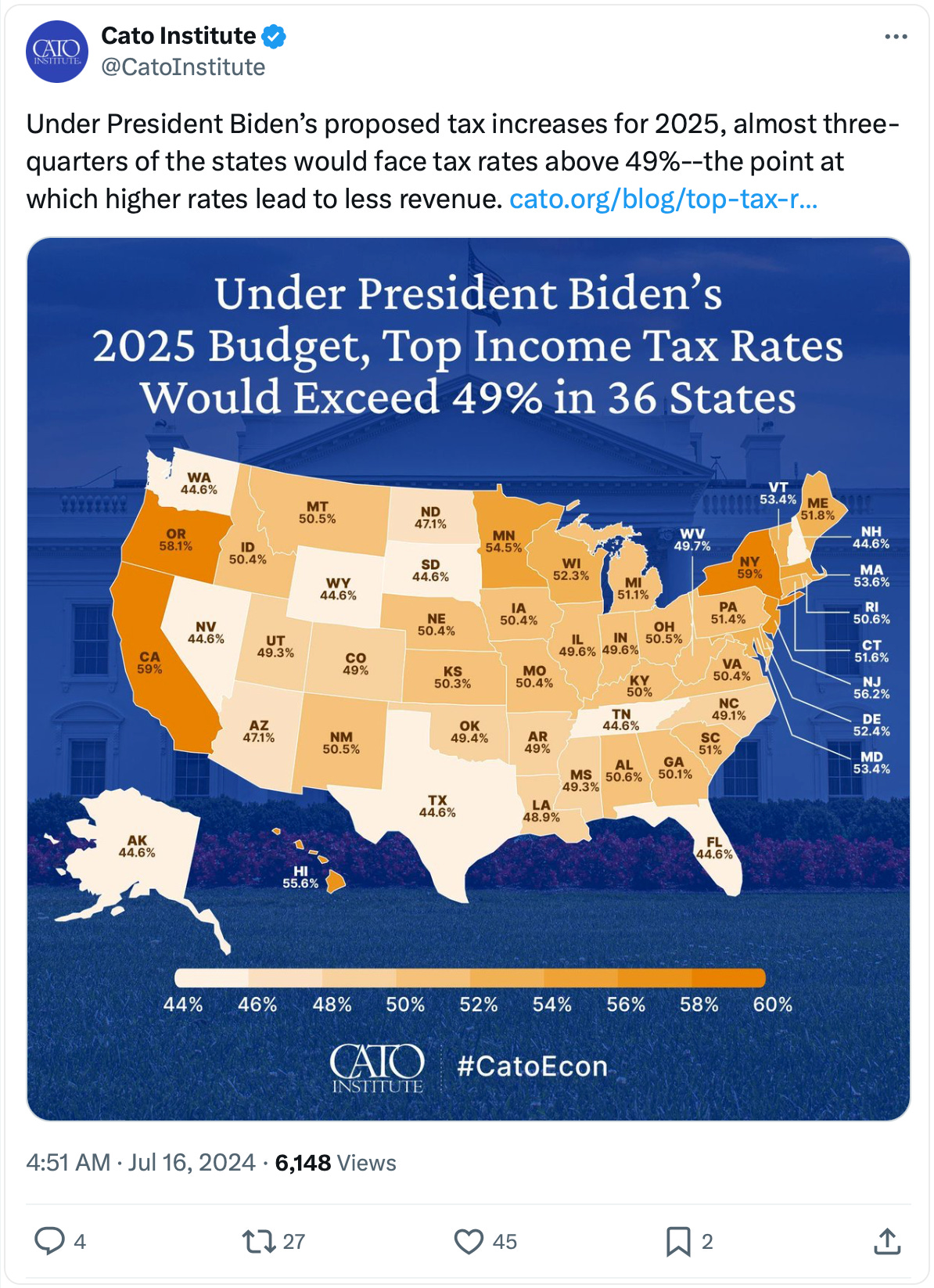

While we still do not know what the presumptive Democratic nominee for President Kamala Harris’ tax and budget proposal will be, it is a fair assumption that it will fall in line with Biden’s original thinking and proposal.

Either way, however, taxes will likely be a heavily contested point of debate in the coming months.

“Tax the rich!” They say, “Tax greedy corporations!”

The question is, does hiking taxes actually raise long-term government revenues?

The Laffer Curve suggests, Yes. Critics of the Laffer theory say, Not really.

Well, what’s the answer?

If you don’t know what the Laffer Curve is, or are too young to remember Reaganomics, aka ‘Voodoo Economics’, have no fear.

Because we are going to unpack and answer all this, and more today, nice and easy as always.

So, grab your favorite mug of coffee and settle into a comfy seat for this Sunday’s edition of The Informationist.

🤩 Reaganomics

If you’re a kid of the 80’s era, then you likely remember this scene from Ferris Bueller’s Day Off, where the teacher is speaking about ‘Trickle-down economics’.

He refers to the term with a nickname.

What the heck does it mean though?

See, during a famous 1980 Republican primary debate, George HW Bush used the term "voodoo economics" to criticize Ronald Reagan's suggestion that significant tax cuts could lead to increased government revenue.

This was the core principle of Reaganomics, aka ‘Trickle-down economics’.

The basic premise behind Reaganomics was that tax breaks that would benefit corporations and wealthy would, in turn, “trickle down” and eventually benefit everyone.

Taking a page out of Herbert Hoover’s playbook from the Great Depression, Ronald Reagan sought to use income tax cuts to stimulate the economy.

The rich have more and it trickles down to the poor.

Or so goes the theory.

You may also hear of this type of policy referred to as Supply-side Economics.

A part of this type of policy often includes reduced regulations along with those tax cuts.

The theory goes on to suggest that with more profits in the corporate sector, companies would in turn use these profits to upgrade technologies, expand profitable business lines, spend on research and development of new business lines, and hire more people.

Also, wealthy earners would have more disposable income to spread around the retail sector, buying more goods and services.

This would all lead to a boost in the overall economy.

The result of all this added productivity?

You got it, higher GDP and more tax revenue for the government.

And this can all be explained and shown with a nifty little chart call the Laffer Curve.

🤓 The Laffer Curve

An American economist, Arthur Laffer spent the bulk of the 1970’s and early 80’s as an economics professor at the University of Chicago and USC, as well as Pepperdine.

During that time, he presented his ideas regarding lowering taxes to raise revenues to President Gerald Ford’s staff.

Then, as President Carter was reeling from high inflation and geopolitical conflict, Laffer started to advise Ronald Reagan on the matter.

He developed what is now widely known as The Laffer Curve.