💡 The Great London Gold Crisis

Issue 153

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What is the London Gold Vault?

Sovereign Demand for Gold

Why is Gold Being Withdrawn from London?

The True Crisis: Paper Gold

Bitcoin: The Superior Alternative

Inspirational Tweet:

Today’s Tweet is less inspiration and more observation, as it seems to have not only struck a nerve with both gold bugs and Bitcoiners, but it raised a whole bunch of questions.

Like, what is the London Gold Vault? Whose gold is stored there? What is the crisis exactly? And is it all caused by what’s known as ‘paper gold’?

And rather than answer each of these piecemeal in the thread, I figured I would tackle all of it right here.

And we’ll do it nice and easy, as always.

So, grab a big cup of coffee and settle into a nice comfortable seat for a deep (but not too deep) dive into the Gold Vaults of London with The Informationist.

🏛️ What is the London Gold Vault?

London has pretty much been the center for gold trading for centuries, with the Bank of England creating vaults all the way back in the 1600s.

See, in 1694, the Bank of England began storing gold reserves to support the young but growing British economy. And by the 19th and 20th centuries, London had established itself as the dominant gold trading hub, with massive vaults to accommodate international reserves.

During World War II, London became a secure location for European countries to store their gold reserves and protect them from Nazi seizures. France, Belgium, the Netherlands, etc. sent their gold to the Bank of England.

Long after the war, London’s reputation as a trusted custodian continued and it solidified itself as the world's premier gold trading center.

Today, more than 8,000 tons of gold is stored in London high-security vaults, the most notable being the Bank of England (BoE). Other big vaults are run by HSBC, JP Morgan, and Brinks.

But whose gold is it?

Good question. These banks hold the gold for:

Central Banks & Sovereign Wealth Funds: Countries use London as a neutral storage hub for gold reserves

Exchange-Traded Funds (ETFs): Funds like the SPDR Gold Shares (GLD) that store gold in vaults as per their share agreements

Bullion Banks & Institutional Investors: Major financial firms use the vaults for trading and liquidity management

Private Investors & High-Net-Worth Individuals: Some super high net worth people use the London vaults for their personal gold storage

Bank of England’s Role in Gold Custody

The BoE holds more than 400,000 gold bars, approximately 310.29 tonnes, which is worth over $450 billion today. BoE vaults are primarily used for sovereign and institutional reserves rather than retail.

In fact, they brag all about it on their website landing page:

Problem is, they have had something of a run on the bank lately, and they are struggling to not just meet demand for withdrawals, but their centuries old reputation as the pre-eminent solution for safe storage of gold is now at severe risk.

We will come back to that and what exactly is going on there, but first let’s visit the reasons for all these central banks to even own gold in the first place.

🎩 Sovereign Demand for Gold

As you know, gold has been a stable and reliable store of value for centuries.

For instance, an ounce of gold will buy the same amount (or more) of goods that it has over the centuries, like hundreds of loaves of bread or a fine tailored men’s suit, etc.

And so, countries hold gold in their list of assets in order to help stabilize their currency or maintain their wealth.

Gold is generally inversely correlated to the US dollar. When the value of the dollar declines, gold typically increases in value. This helps central banks to protect their reserves during periods of market volatility.

Also, countries use gold to settle trade imbalances or as collateral for loans. Holding gold reserves can enhance a country's creditworthiness.

So who holds all this gold?

That’s right, the US owns more than double the amount of gold than any other sovereign.

Surprised?

I know what you’re thinking. After all this alleged grifting being uncovered by DOGE and the USAID scandals, one has to wonder if there really is this much gold in the US vaults.

When’s the last time we audited Fort Knox, for instance?

An unnerving answer is 1953, over seven decades ago. AND only ~5% of the stockpile was tested for authenticity.

Good thing we abandoned the gold standard just two decades later…🙄

In any case, do you notice who else is on that list?

You got it, three of the BRICS countries are listed: India, China, and Russia.

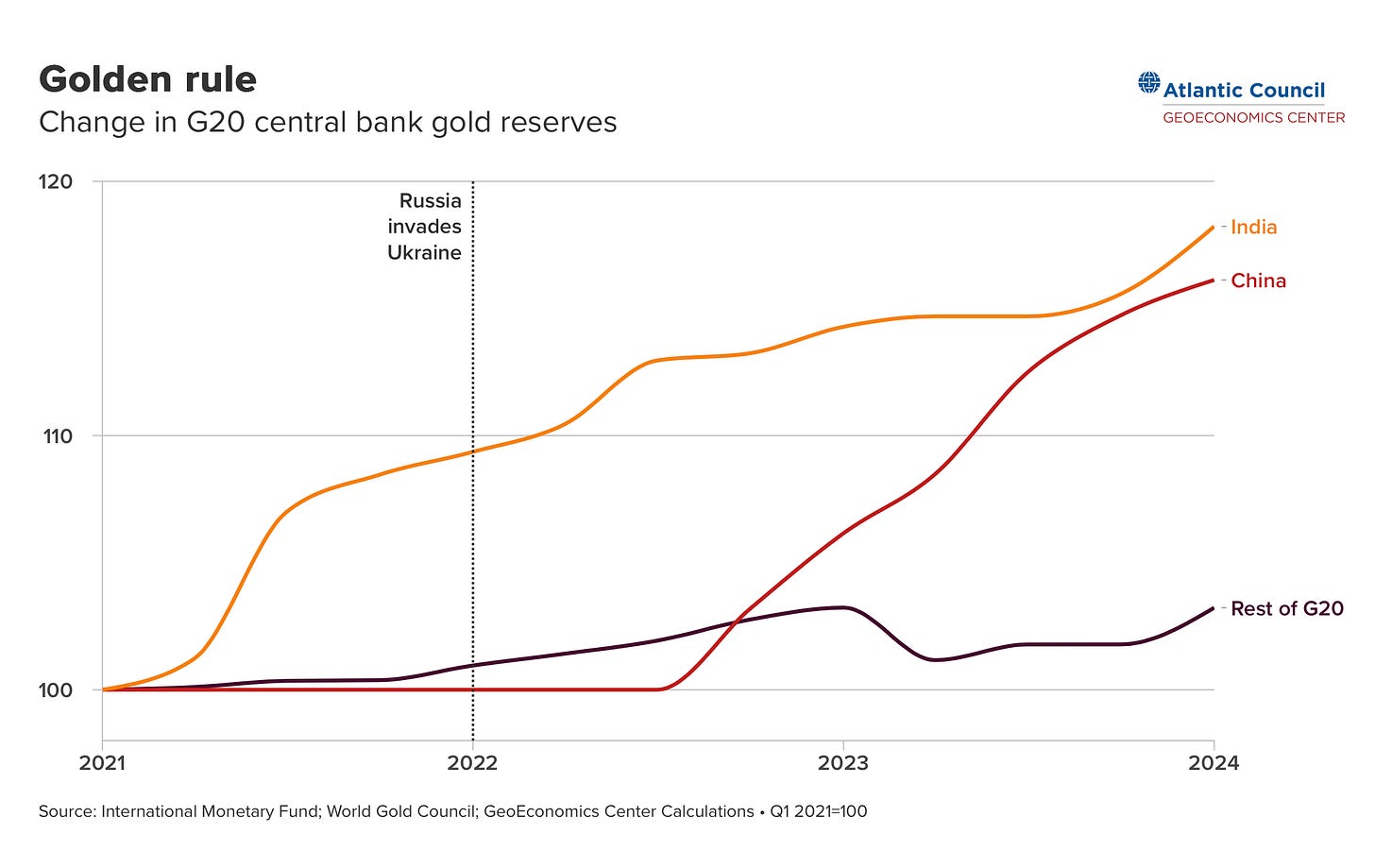

Two of these countries have been aggressively adding to their gold stores recently.

Why?