💡 The GENIUS Act and How Important Are Stablecoins?

Issue 167

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Stablecoins 101

Why the US Treasury Needs Stablecoins

The GENIUS ACT

Inspirational Tweet:

Stablecoins. Supposedly the ‘future of crypto’ if you ask certain people.

Like perhaps Treasury officials and maybe central bankers.

But what exactly are stablecoins, why are the seemingly so important, and what challenges do they solve for investors and the US Treasury?

Good questions and ones that we will answer, nice and easy as always, here today.

So, pour yourself a big cup of coffee and settle into a comfortable seat for a peek into stablecoins with this Sunday’s Informationist.

🤓 Stablecoins 101

Put simply, stablecoins are digital assets (cryptocurrencies) designed to maintain a stable value over time.

How?

By pegging their price to a reference asset, such as a fiat currency, a commodity like gold, or even a basket of assets.

See, the goal of the issuers of stablecoins is to combine the transactional benefits of cryptocurrencies—fast settlement, programmability, global accessibility—with the price ‘stability’ of fiat currencies.

Before we go any further, let’s first look at the different types of stablecoins out there:

Fiat-pegged stablecoins: These aim to maintain a 1:1 peg with a national currency, most commonly the US dollar. These include USDT (Tether) and USDC (USD Coin)

Commodity-backed stablecoins: Pegged to physical assets like gold (e.g., PAXG, which is backed by physical gold reserves)

Crypto-collateralized stablecoins: These are backed by volatile cryptocurrencies and overcollateralized to account for price swings

Algorithmic stablecoins: These aim to maintain their peg through supply-and-demand algorithms rather than actual physical reserves. (Exactly. TerraUSD (UST), which failed spectacularly in 2022, was a high-profile case of the absurdness of this approach.)

As for our purposes here today, we will be focused on USD-pegged stablecoins and the US Treasury and federal regulatory initiatives around them.

At the heart of their usage, USD-pegged stablecoins serve as digital cash primarily on crypto trading platforms and within crypto ecosystems. They have become key for trading, lending, DeFi applications, and cross-border payments.

Stablecoins like USDT and USDC are used by traders to move funds across exchanges or park assets during periods of uncertainty.

See, unlike traditional banks, which are bound by business hours, liquidity limits, and regulatory challenges, USD stablecoins offer real-time settlement, global accessibility, and integration with smart contracts.

This makes them virtually indispensable for crypto markets which remain open 24/7.

But how reliable are they, really?

That brings us to audits, which verify underlying holdings of these stablecoins.

Circle publicly discloses attestations confirming that each USDC token is backed 1:1 with liquid US dollar assets, including cash and short-dated Treasuries. USDC is audited monthly by Grant Thornton LLP. Because of this, USDC is widely considered the gold standard for transparency in the stablecoin space.

Tether (USDT) has faced harsh criticism for opaque disclosures and past inconsistencies. Although it now publishes quarterly attestations and has promised a full audit, its reserves have included less liquid assets like commercial paper. In 2021, Tether was fined $41 million by the CFTC for misrepresenting its reserves. It remains the most traded stablecoin globally, but with slightly higher reputational risk.

OK, but what happens when investors become concerned with the underlying holdings and stability of a stablecoin?

It ‘depegs’ from the currency it is following.

For instance, when Silicon Valley Bank collapsed, USDC dropped from $1 (even peg to the USD) to $0.87, as investors were worried over the exposure that USDC had to the bank.

USDC / Silicone Valley Bank Breakdown:

As of early March 2023, Circle had about $40 billion in total reserves backing USDC

Of that, $3.3 billion (roughly 8.25%) was held in cash deposits at SVB

When SVB collapsed and was placed into FDIC receivership, markets feared that Circle might not have immediate or full access to those funds

This panic led to a temporary depegging of USDC, dropping to as low as $0.87 on some exchanges before rebounding once the US government stepped in to guarantee all SVB deposits

For those wondering, this meant if you had $100K in USDC, it was suddenly only worth $87K, at least until the US govie stepped in to guarantee the SVB deposits. Then the peg snapped back to par or $1.

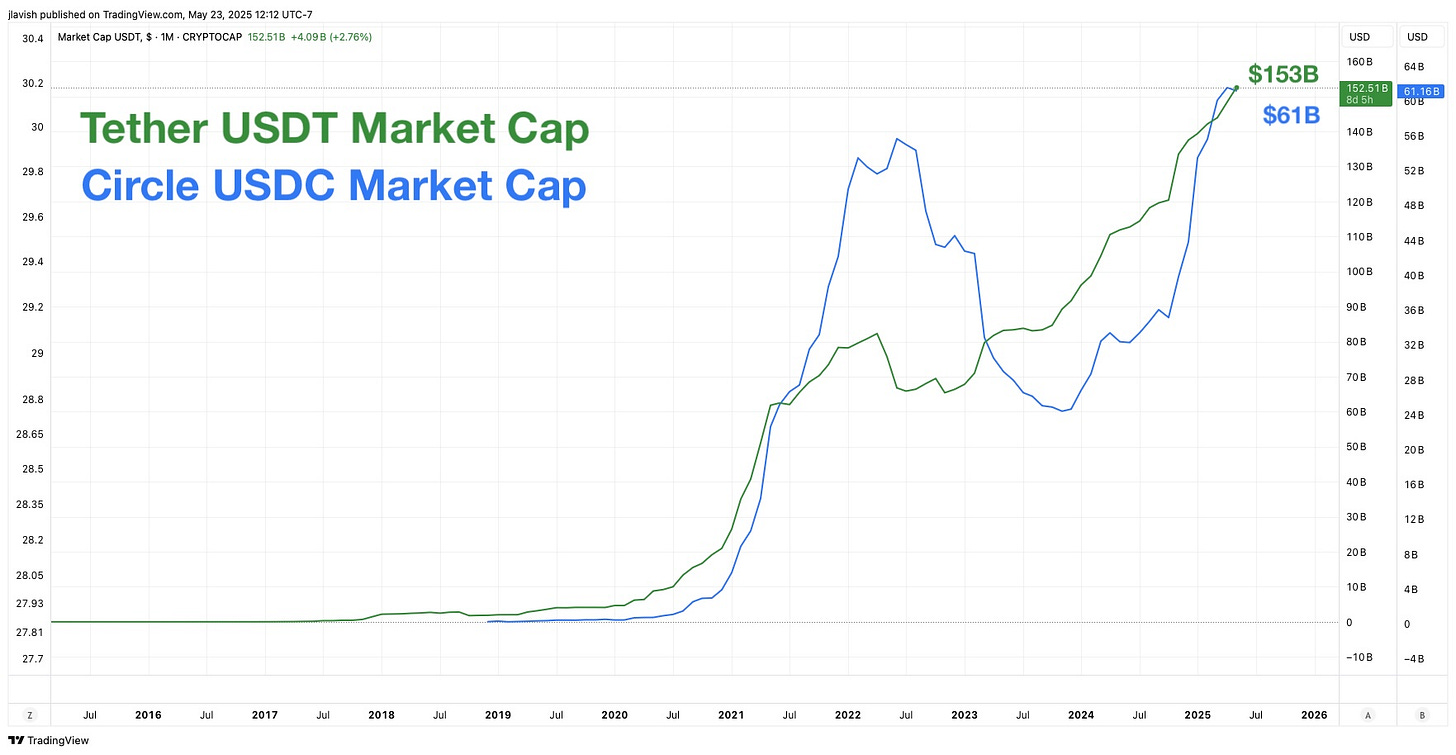

After that, the stablecoin market simply marched ahead, continuing to grow in both importance and size, with USDT and USDC now worth a combined $214 trillion dollars.

This has not gone unnoticed. With this growth, the US Treasury now sees USD stablecoins as a strategic extension of the dollar’s reach.

In short, the Treasury needs stablecoins.

🤔 Why the US Treasury Needs Stablecoins

Put simply, stablecoins can promote the global usage of the US dollar and thereby drive demand for US Treasuries.

See, stablecoins, particularly those pegged to the US dollar like USDC and USDT, function as digital versions of dollars—accessible globally with just a smartphone and an internet connection.

This expands the dollar's reach into regions without robust banking systems.

In effect, stablecoins act as on-chain, permissionless dollars that enable users worldwide to store value, conduct cross-border transactions, and hedge against local currency risk.

This far-reaching demand strengthens the USD as the world’s reserve currency.

As Circle CEO Jeremy Allaire said, “USDC is doing the dollar’s job abroad better than many banks.”

OK great, so that helps the US dollar to be used all over the world, even by those who remain unbanked in far-reaching corners of the globe.

But how does that help the US Treasury?

Simple.