The Fed, The Treasury, The White House…Who's Really in Charge of the Economy?

Issue 79

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

White House Hype

Treasury Nightmare

Fed Fantasies

The Rub

Inspirational Tweet:

We’ve been hearing macro narratives for over a year now:

‘The US Treasury is taking on too much debt’, ‘The Fed is raising rates too high and will have to stop before they break the Treasury’, and meanwhile, The White House takes credit for ‘battling inflation’, ‘solving the debt ceiling crisis’, and seems to believe we will somehow avoid a recession altogether.

Spoiler Alert: A recession is coming. Brace yourself.

But that’s not what we are talking about today. Rather, we’d like to answer the question:

Who the heck is in charge of all this, anyway?

I mean, does The Fed really have to stop raising rates? Is the Treasury going to push this country into an accelerated debt spiral?

And can the White House actually engineer a Goldilocks scenario of a soft landing and save the American people from economic and financial pain?

Lots to unpack, I know. But we are going to get it all as straight as we can here, nice and easy as always, today. So grab that cup of coffee and settle in for The Informationist.

Join the Informationist community for access to subscriber-only posts + the full archive, and ask questions and participate in the comments with other awesome 🧠subscribers!

🤥 White House Hype

Let’s get this one out of the way first, as sometimes it is the loudest channel on the economic front these days.

It’s also the noisiest.

If you listen to the White House (regardless of which political party is in the Oval Office, BTW), you would think the President is able to pull all the strings necessary to effect the necessary changes that will positively affect the economy.

Inflation easing?

Well, it was the Inflation Reduction Act, of course. 🙄

Debt ceiling ‘solved’?

Well, this was a master stroke of political diplomacy, genius negotiation skills out of the Biden administration, of course.

Full Employment? Gas prices easing? Recession averted?

White House. White House. White House.

When did the Oval Office turn into the Big Top Tent of a three ring circus, anyway? The grandstanding, the showmanship, the cheap snake-oil salesman bravado?

FFS, what happened to actual leadership, and, wait for it…

Dignity.

Reality check, Mr. President (again, I don’t care if you’re Republican, Democratic, Libertarian, completely non-party affiliated):

Full employment? Tremendous and egregious M2 money supply expansion maaaaaaaay have had something to do with this.

And of course, that same M2 expansion has caused the inflation problem.

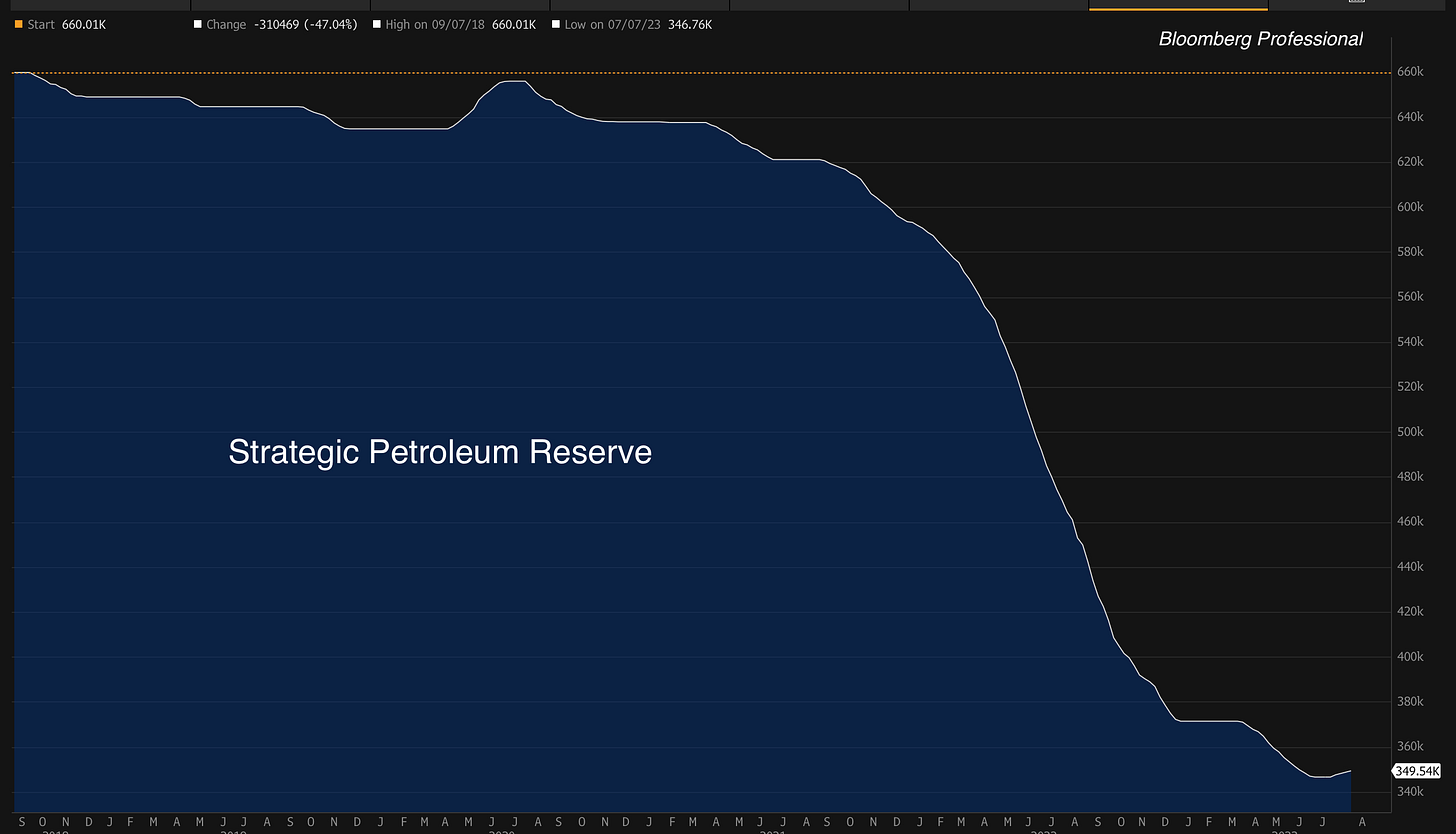

Gas prices easing? OK, yes, you can take some credit for this one—but you also have to take credit for this:

Who needs emergency energy supplies, anyway? They can be used to buy votes with the supplies instead.

And avoiding a recession?

If a miracle occurs and we do in fact avoid a recession, it would have little to nothing to do with White House policy. Though they would take all the credit, make no mistake.

The fact is, we are highly likely to enter a recession in the US soon, and when we do, who can we then expect the White House to place blame on?

The Fed, of course.

Yeah, that sign hasn’t been in the Oval Office for decades.

🤬 Treasury Nightmare

Back to reality here, another center of focus, though not by their choice, is the US Treasury.

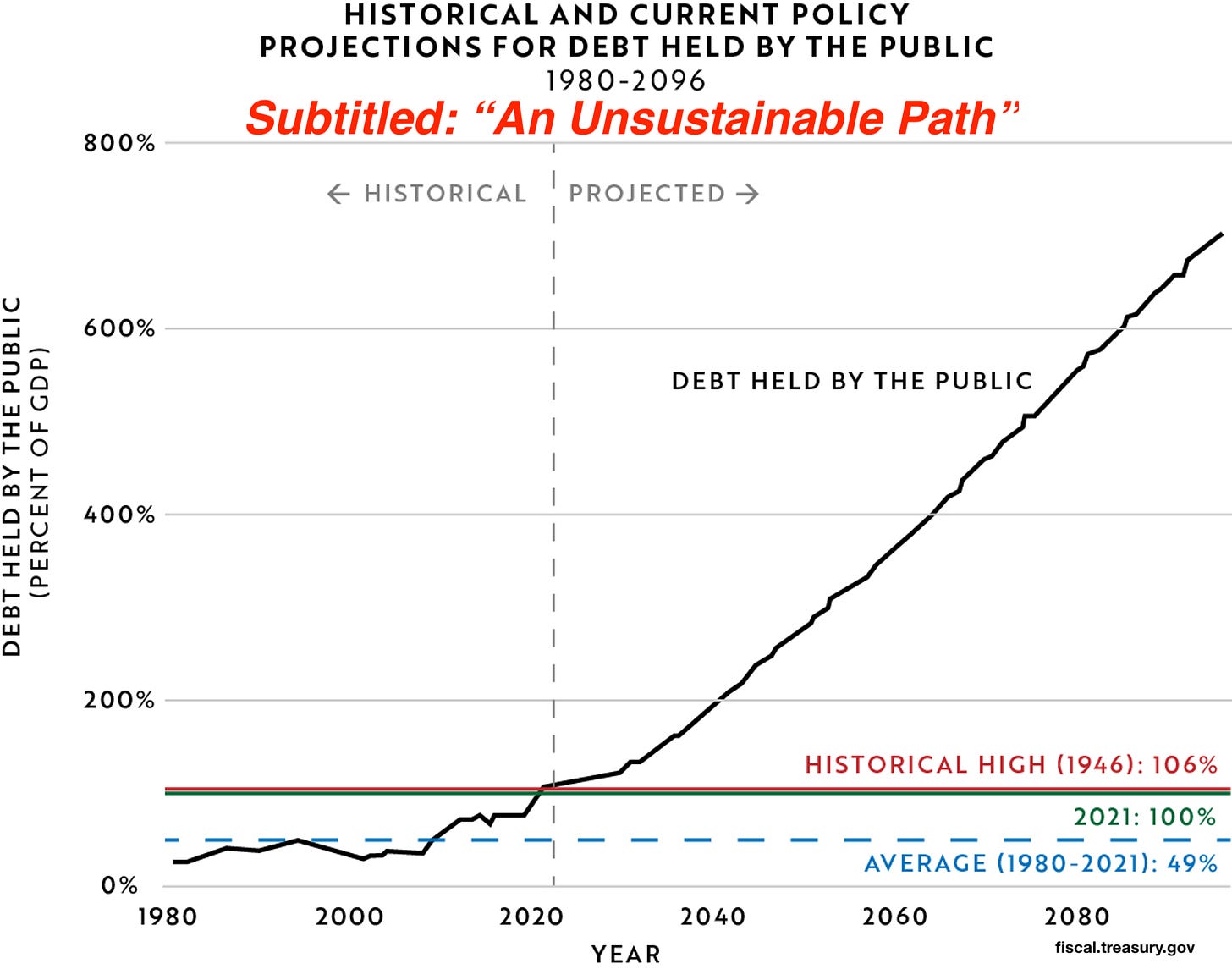

Plenty of talk, and for good reason, about the US Treasury running up the US federal debt, ballooning the total to over 120% of GDP.

Let’s face it, if you’ve been following me, you know all too well that the US has entered what we call a debt spiral. If you don’t know what I am talking about or want a refresher, you can read all about it here:

and here:

TL;DR: The US Treasury is borrowing so much, issuing so much debt, that it has no choice but to borrow more, just to finance that debt. As the interest expense rises from additional borrowing, the Treasury is just forced to borrow more.

It has entered a debt spiral, from which it cannot escape.

In fact, the interest alone on federal debt is approaching $1 trillion this year.

That’s right, more than the US spends on its military, which is about $800 billion annually.

I mean, what is the Treasury thinking, right?

Well, here’s the thing.

The Treasury’s responsibility is not to set the budget. It is not to decide how much to spend and borrow.

The US Treasury has one main function: to facilitate the budget that is set by US Congress and all spending that is approved and put into motion by the Executive Branch (ah, yes, but don’t expect the White House to take responsibility for exacerbating the debt problem anytime soon).

This is one of the main reasons the Treasury puts out periodical reports about the State of the Treasury and includes charts like this:

This appears to be a warning signal meant for Congress.

Look, the Treasury could have done some things better, for certain. I mean, they could have issued longer duration paper back when interest rates were hovering near zero. This way, they would not have to borrow so much at yields north of 5% when retiring debt that is yielding just 1 or 2%.

But who can blame them, when the Fed said that they expected rates to stay low for a long long time. That inflation was just ‘transitory’.

Remember that one?

Another main charge of the Treasury is to be certain that the US Treasury market remains liquid and orderly (this is a function of the first charge—making sure they facilitate the budget—because without a functioning Treasury market, the entire financial system breaks down.

And so, another mistake they made?

Teaming up with The Fed to print money and monetize its own debt in the form of Quantitative Easing (QE), to the tune of ~$6.4 trillion in two years.

And this tremendous expansion of the money supply (M2) has undoubtedly caused a significant amount of the inflation.

But wait, isn’t inflation good for the Treasury?

Why yes, in fact, it is.

Remember, inflation helps the Treasury debt problem, in that GDP rises in nominal terms (not inflation adjusted), and so past debt is paid down with cheaper future dollars.

But wait again. Doesn’t the Fed want to stop inflation?

Why yes, indeed it does. But there’s a catch.

😬 Fed Fantasies

One of the narratives we’ve been hearing for a while now is that the Fed has raised rates too high, too fast this past year, and they are causing problems for the US Treasury now, as we described above.

The narrative continues, saying that the Fed must stop raising rates before it breaks the Treasury, by causing interest payments on all that debt to balloon to levels that are simply not sustainable.

And while it may be true that the Fed raising rates so high is now creating challenges for the Treasury, make no mistake, the Fed is not concerned with the Treasury’s interest expense problems.

Let me be clear: Powell and the Fed’s job is not to balance federal spending with taxes, manage the ballooning debt, or be concerned with the possibility that interest payments on all that debt could someday (at this rate, someday soon) become the largest line item on the entire federal budget.

Remember, the Fed is charged with two main responsibilities, the dual mandate, as it is called:

1) maximum employment, and

2) price stability

Nowhere in those two mandates does it read: keeps interest rates low enough for the US Treasury to borrow as much as it needs and to ensure that interest payments do not grow so large that it accelerates the US Treasury debt spiral.

Let’s look at Powell’s words from Jackson Hole, just last week:

"Two percent is and will remain our inflation target. We are committed to achieving and sustaining a stance of monetary policy that is sufficiently restrictive to bring inflation down to that level over time."

and,

"We are prepared to raise rates further…and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective."

Two percent.

That is his target. The target that was set so many years ago, as we discussed in last week’s Informationist.

Period.

Now, if we have a massive deflationary downturn in the economy, or, more likely in the near-term, a credit event that threatens instability, then yes, the Fed will pivot.

It will stop selling US Treasuries (and mortgage backed securities) off its balance sheet (i.e, pause Quantitative Tightening), and it will lower rates.

Price. Stability.

This price stability is simply defined as two percent perpetual inflation.

The Treasury wouldn’t mind more, and it can’t stand less. But that is of no concern to Powell. And so, unless he receives a new mandate (whether explicit or implied by the powers to be), that will remain his target.

This, of course, is quite possible—maybe even probable at this point—where the target slides up to north of 3%.

But not yet.

Now you may be saying, but what about the first mandate? The one about maximum employment.

This implies the Fed will stop raising rates if employment numbers falter.

Ah, but remember this quote from Powell:

"If we overtighten then we have the ability with our tools to support economic activity.”

QE. Lowering rates. Stimulating the economy.

No problem.

The Fed knows it can always stimulate the economy, and so the Fed would rather err on over-tightening than make the mistake of allowing inflation to spiral upwards and out of control.

Regardless of the Treasury’s little interest expense problem.

😒 The Rub

Here’s the thing, though. If Powell and the Fed over-tighten, strangle the economy into submission and hence, recession, they risk causing widespread illiquidity in the markets, especially the US Treasury market.

And as we all know, the US Treasury cannot have that.

In fact, the entire global financial system is beholden to a liquid and orderly US Treasury market.

If the Treasury market fails, the entire system fails.

And so, the Treasury will press that button again, depositing trillions of dollars onto the Fed balance sheet, and the Fed will re-enter the market and buy US Treasuries (and other securities), like they did on 2020 and 2021.

Thereby causing?

You got it. More inflation.

Three Ring Circus.

Congress overspends and deficits widen → US Treasury forced to issue debt to cover deficits → eventually markets are disrupted/economic meltdown → Fed buys US Treasuries to stimulate economy → inflation soars → Fed raises rates to battle inflation → US Treasury interest expense soars → Deficits widen more → Treasury borrows more → Fed rate raises cause recession or credit event → Fed buys US Treasuries to keep market liquid → and it all starts again…

The reality is that the entire fiat money system is broken and no-one entity or branch is in charge.

Politicians across the board are incentivized to spend, spend, spend, in order to buy, buy, buy votes to be re-elected. This includes The White House, Congress, and the Senate, and it includes both political parties.

If you don’t believe me, check out the debt ceiling being raised over and over and over again, ad nauseam, by both parties for decades now:

Meanwhile, the Treasury must find a way to keep markets liquid and facilitate all this spending—ensuring confidence in US Treasuries.

And during all this, the Fed is mainly charged with keeping inflation (and deflation) in check—ensuring confidence in the US dollar.

So, if you want to blame anyone or anything, blame the system itself.

But one thing you can be sure of, there will be persistent, continuous, unending inflation. The only question is how much and how fast does the US dollar (and other fiat currencies, for the matter) debase and become worth less over time?

Which begs the question, what the heck do you do with your money while all this is going on?

I’ve said it many times before, my answer is to have a significant percentage of my own net worth in hard monies, like gold, silver, and Bitcoin.

And also in hard assets like real estate, and rare assets like coins and artwork.

The balance of my portfolio is diversified in a mix of securities that are easy to allocate and adjust to market movements and economic cycles.

This is something, as I have alluded to recently, of which I am going to be sharing the details with you very soon. So, please stay tuned as we work out the platform and what is to come!

That’s it. I hope you feel a little bit smarter knowing about the Federal financial system and have a better idea of how it all works. Before leaving, feel free to respond to this newsletter with questions or future topics of interest.

And if you are a paid subscriber, don’t forget to leave a comment or answer a comment in our awesome 🧠 Informationist community below!

Talk soon,

James✌️

Another great educational piece, James! I passed it along to some of my family members as well.

James,

I've been meaning to ask this for a long time, but keep forgetting (Old age!). Generally speaking the markets like to use historical metrics for the evaluation of "where we are". For example, using the P/E number to determine whether or not the market is expensive, or a good value. But since M1 and M2 money has expanded into historical highs, don't we have to increase our normative metrics to account for that expansion? Perhaps this would be a good topic for you to cover in the next informationist? Your thoughts.

Mark R. Link