The Exploding World of ETFs

Issue 76

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

A Short History of ETFs

ETFs vs. Mutual Funds

ETF Challenges

Exotic ETFs

ETFs for You

Inspirational Tweet:

There’s been a whole lot of talk about ETFs recently, especially in Bitcoin circles regarding a possible Bitcoin spot ETF.

But let’s take a small step back here today and explore the world of ETFs. They’re important for every investor to understand, especially individual investors, and how they can help shape a properly diversified portfolio.

After all, there are some distinct and inherent advantages to the structure of ETFs, specifically when compared to mutual funds.

But, as with anything, there are also some drawbacks and disadvantages of ETFs, too.

If this all sounds overwhelming, have no fear. We’ll unpack and sort it all out for you today, nice and easy as always. So, grab that cup of coffee, saddle up, and settle in for a short journey into the world of ETFs with The Informationist.

Join the Informationist community for access to subscriber-only posts + the full archive, and ask questions and participate in the comments with other awesome 🧠subscribers!

Partner spot

Some of you have been asking recently what I read in the morning for fast, digestible news, and I’m happy to report that my new favorite source, hands down, is 1440.

The folks at 1440 scour over 100 sources every morning so you don't have to. You'll save time and start your day smarter. What more could you ask for?

Sign up for 1440 now and get your first issue, immediately. It's completely free—no catches, no nonsense, and absolutely no BS. I wouldn’t recommend it, if I wasn’t sure you’d love it, too.

Join 1440 for free today.

🤓 A Short History of ETFs

Before getting too deep here, let’s first explore the genesis of ETFs, how they came about.

It all started in 1989, when the investment world witnessed the introduction of something called the Index Participation Shares (IPS).

The purpose of the IPS was to enable investors to invest in the entire S&P 500 index through a single security rather than having to buy individual and properly weighted shares of every stock in the Index themselves.

The IPS was traded on the American Stock Exchange (remember that one?) and tracked the performance of the S&P 500. But the IPS was short-lived.

Because almost immediately, the Chicago Mercantile Exchange and the Chicago Board Options Exchange brought a lawsuit challenging IPS’ validity on the grounds that it was structured too similarly to a futures contract.

The US courts agreed and shut IPS down just a few months after it had been launched.

This however, set the stage for the creation of a different security, one that would pass muster in the courts and survive any further challenges from the CME or CBOE.

And in 1993, the ETF (or Exchange Traded Fund) was born.

Also meant to track the S&P 500, this new security would soon become one of the most traded and widely recognized ETFs in the world.

The SPDR S&P 500 ETF Trust (SPY), commonly known as "Spiders".

The structure now tried and tested, by the early 2000s, we would have ETFs that track not only equity indices but also fixed income, commodities, and international markets. And gold ETFs would become a popular way for investors to gain exposure to the price of gold without holding the physical asset.

After all, it can be challenging to buy and store physical gold bars and coins, and it’s illegal to buy and hold physical gold yourself with money that is in an IRA. Thanks to the government making it illegal to do so—instead, you have to find a custodian bank that offers self-directed gold IRAs, that can also buy physical gold on your behalf, and will then custody that gold in its vaults for you.

Hence, its much easier to buy a gold-tracking ETF in your IRA.

But there are some problems with this strategy, in particular, that we will address later.

Getting back to the ETFs themselves, by the 2010s, we saw the advent of niche market segment focused ETFs, like clean energy or AI-focused ETFs.

Heck, we even have ETFs that tracks the recommendations of Jim Cramer.

We’ll get to those, too.

First, let’s dig into some of the nuts and bolts of ETFs and what makes them unique.

A good way to do that would be to compare and contrast them with a different type of investment vehicle, one which you undoubtedly know a bit about: the mutual fund.

👑 ETFs vs. Mutual Funds

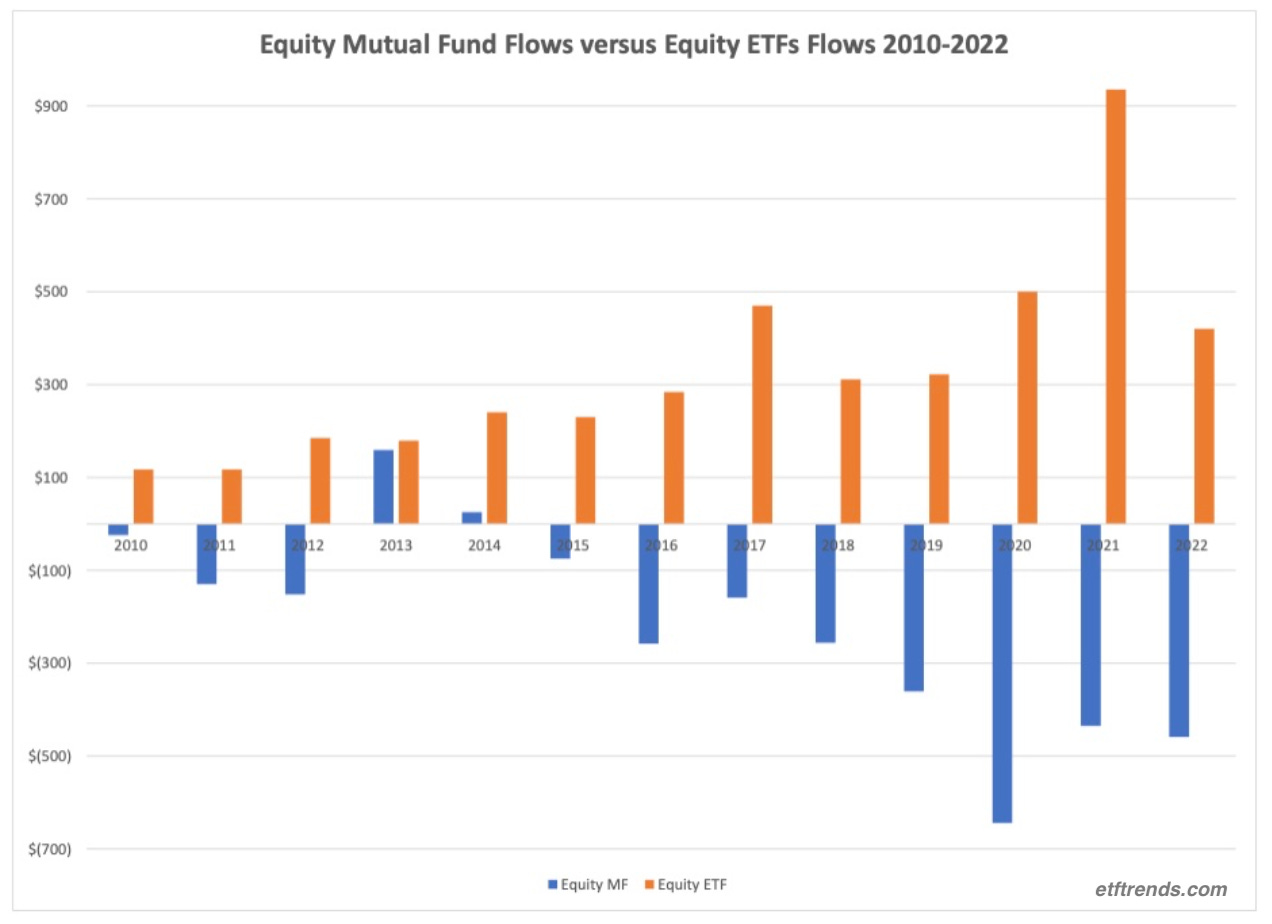

With the rise of all these niches and strategies, ETFs have experienced an absolute boon in capital flows since they were introduced, and particularly in the last decade.

As you can see, as money pours into ETFs each year, a similar amount seems to flow out of mutual funds.

But why?

If mutual funds are also pooled investment vehicles that track indices like the Dow Jones and S&P 500, as well as technology, healthcare, energy sectors, etc. what makes ETFs so different from them?

Mutual funds have been around forever and are a trusted way to invest.

Why is money flowing out of them and into ETFs?

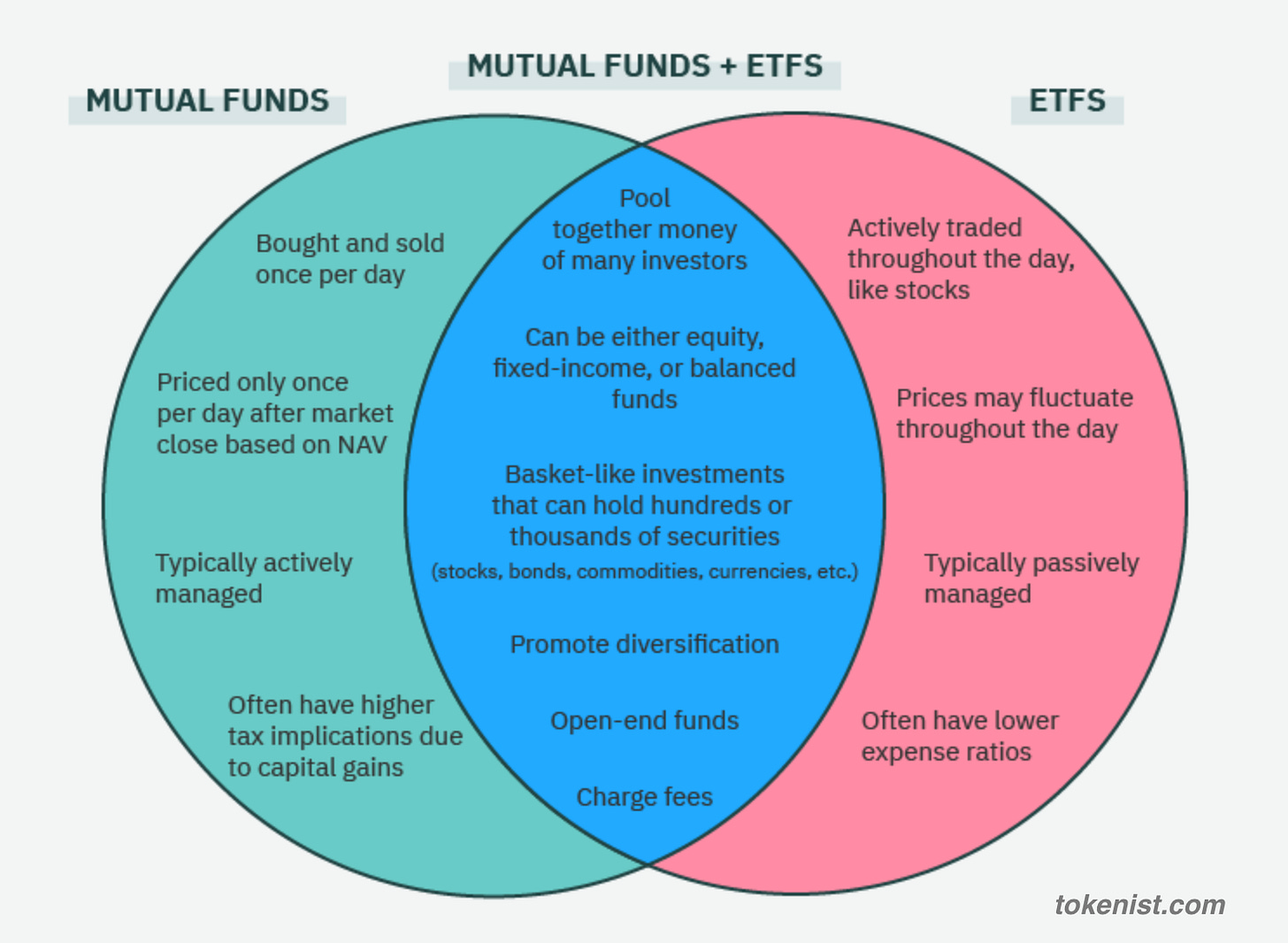

Good questions, so let’s lay it all out in a bullet-point comparison for simplicity:

Trading & Pricing:

ETFs: Traded like individual stocks on major stock exchanges, bought and sold at market prices throughout the trading day

Mutual Funds: Priced at the daily Net Asset Value (NAV), calculated after the market closes, can only be bought through the mutual fund at this NAV or through a broker

Fees & Expenses:

ETFs: Typically have lower expense ratios, especially for index ETFs, though can include brokerage commission when buying or selling

Mutual Funds: Often have higher expense ratios, some include sales loads (front-end or back-end), and others have early redemption penalties

Tax Efficiency:

ETFs: "in-kind" creation and redemption mechanism helps minimize capital gains distributions

Mutual Funds: Can sometimes result in more taxable events, like redemptions that force the fund to sell securities

Dividends:

ETFs: Dividends from underlying holdings are typically accumulated and paid to holders quarterly, like a stock

Mutual Funds: Dividends can be reinvested automatically to buy more shares of the mutual fund

Minimum Investment:

ETFs: the minimum is just the cost of one share (or partial share on trading platforms that offer this)

Mutual Funds: Often have minimum investment requirements, which can be quite high for some funds

Transparency:

ETFs: Most ETFs disclose their holdings daily

Mutual Funds: Disclose their holdings quarterly or monthly, with a lag

Management:

ETFs: Most are passively managed to track specific indices or sectors, but there are some actively managed ETFs

Mutual Funds: Some are passively managed, like index funds, but many are actively managed

Investment Strategies:

ETFs: There are ETFs for nearly every asset class, sector, and strategy, including niche and exotic strategies

Mutual Funds: Offer a broad range of strategies also, but not as niche or specialized as ETFs

Accessibility:

ETFs: Can be traded by any investor with a brokerage account

Mutual Funds: Many are not offered broadly, and can be more difficult to buy through brokerage or retirement accounts

To recap:

Ok, so this makes ETFs seem like a no-brainer.

Cheaper, instant diversification, easier to buy, more tax-efficient, more liquid than mutual funds, and they offer exposure to virtually any area of the market you want. So, what’s the rub? What are the disadvantages of ETFs?

Are there any?

Well, I thought you’d never ask.

🤨 ETF Challenges

The ETFs that often pose the highest challenges are ones that are based on or tracking the performance of an underlying commodity.

Like gold or silver, for instance. But let’s focus on gold today.

Gold ETFs come in two main flavors: physical and futures based.

Gold futures ETFs invest in gold futures contracts, deriving their value from gold's price without holding the physical metal, eliminating storage costs. However, they may face costs and potential tracking errors from rolling expiring contracts, especially in volatile futures markets.

There’s also a question of just how much paper (how many derivatives) can be created, thereby allowing participants to suppress the natural bullion price of gold.

In contrast, physical gold ETFs (aka spot gold ETFs) invest directly in gold bullion, giving investors a tangible asset-backed exposure to gold. This is meant to eliminate the possibility of price manipulation or suppression through paper contracts.

And while a reputable physical gold ETF will typically follow gold’s price more closely than a futures-based ETF, there are still a number of drawbacks, such as:

Transparency and Audit Concerns: Regular audits and inspections are necessary to verify the exact amount of gold held in vaults, and while reputable gold ETFs are audited, there are still concerns about the accuracy and integrity of these audits.

Rehypothecation Risks: You may have heard this big, bad word before, but rehypothecation just refers to the habit of financial institutions using the same collateral (in this case, gold) for multiple purposes—i.e., gold held by an ETF could, theoretically, be lent out or used as collateral for other transactions, leading to potential claims on the same set of gold bars by multiple parties.

oops, which leads to…

Custodial Risk: The physical gold owned by an ETF is often held in the vaults of a few major banks or specialized custodians, and if something happened to one of these custodians or if they face solvency issues, will the gold still be there?

and hence…

Physical Redemption Limitations: Most gold ETFs do not allow average investors to redeem their shares for physical gold. Only certain authorized participants (read: large financial institutions) can do so and often in large quantities (meaning a full gold bar or more). And so, while you have exposure to gold's price, you likely still cannot claim the actual gold.

Storage and Insurance Costs: Holding physical gold incurs storage and insurance costs, which are typically passed on to investors in the form of management fees, which can erode returns.

Tracking Error: With all the above needs and expenses, there might be slight differences between the ETF price and the actual price of gold, which is known as tracking error.

And not to go deep into it here, but it is worth noting that most of the above impacts to spot-gold ETFs would be essentially eliminated for a spot-Bitcoin ETF.

Which makes one wonder why the SEC has thus far refused to approve a spot-Bitcoin ETF, especially as they have approved numerous other far more exotic and strange themed ETFs already.

🤯 Exotic ETFs

Because of the accommodating structure, ETFs can be made for many different types of investment needs or styles, some quite interesting. Let’s take a peek at some of the most exotic ETFs out there.

I can think of a number of them, such as:

Inverse Cramer ETF (SJIM): As many of you know, Cramer has quite the track record as the ultimate contrarian call. I.e., do the opposite of his recommendation, in order to make money. And so SJIM tracks the calls made by Cramer and does the opposite instead. (of course there is a regular Cramer ETF, as well, one that I personally would not recommend to anyone 😬)

Roundhill MEME ETF (MEME): This one tracks an index of 25 stocks that are showing elevated chatter on social media and that have a high level of short interest. Stocks like GameStop, AMC, and Carvana, among others.

AdvisorShares Vice ETF (VICE): This ETF tracks an index of bad habits, like tobacco, alcohol, and gambling. Sounds silly, except most of the underlying companies are considered defensive, meaning they’ll do well regardless of the economic climate.

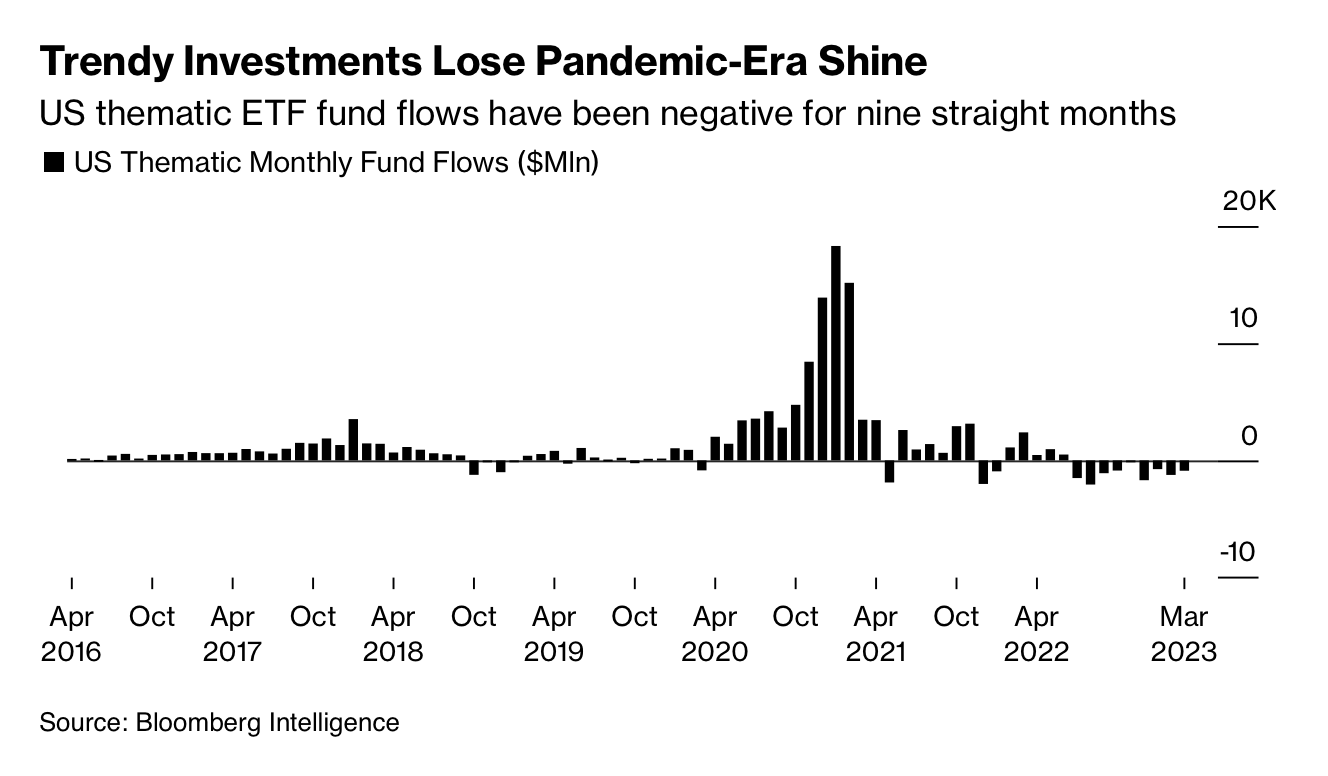

Then there are some ETFs that were never meant to be, such as Generation Z ETF (ZGEN), created to invest in ‘teenager-friendly’ companies, Defiance Digital Revolution ETF (NFTZ), meant to be the world’s first ETF for NFTs, and Next Gen Altered Experience fund (PSY), which sought to invest in companies involved in legally medical psychedelics, ketamine, and cannabis.

All three of these went the way of the dodo bird, however, and are all now extinct.

They are not alone, though, the ETF hype has created and crushed numerous meme-style investment theses.

And so, the best ETF bets for serious long-term investment, and not hype or speculation, are focused on traditional industries and sectors or overall market constituents.

These are the ones I tend to focus on for my own portfolios.

That said, you still have to research specific ETFs to know exactly what you are buying and whether the ETF is offering the exposure you are really looking for with the holdings it maintains.

Still, this is a much simpler and safer approach than trying to assemble a portfolio that mimics an entire ETF or sector yourself.

🧐 ETFs for You

In short, when you block out the noise and focus on the signal, ETFs can provide a fantastic way for the average investor to take advantage of macro-driven strategies, i.e., tactical macro investing.

We all know that the economy operates in cycles—like it or not—and the market follows these cycles, accordingly. Some of the worlds’ best investors pay close attention to these cycles, these patterns, and they invest accordingly.

This is exactly what I do.

Economic expansion, contraction. Inflation, deflation, technological innovation, energy regulation or over-regulation. Interest rate volatility, debt monetization, and money creation.

These are all factors that affect overall markets and certain sectors, specifically.

Problem is, who has time—unless you are Ray Dalio or Warren Buffett, each having teams of analysts and traders and bankers—to research and analyze and due-diligence sets and subsets and singular strategy specific companies?

This is exactly where ETFs come into play.

Low cost, easy to access, easy to trade, ETFs offer instant diversification (a large under-appreciated risk in many portfolios is single-stock risk, BTW), and they allow for individual investors to take advantage of large market swings or overall economic developments.

There are large and small cap ETFs, Growth and Value focused ETFs, US-specific and international equity ETFs, long duration, short duration, super-short duration US Treasury ETFs, AAA or high yield corporate bond ETFs, gold or silver or platinum or even uranium ETFs. Energy or healthcare, or technology ETFs, and many more.

I mean, the days of the 60/40 portfolio are pretty much over. You can no longer just buy an S&P 500 mutual fund with 60% of your capital and US Treasuries with the other 40%, then let it grow for 20 years.

We all saw what happened to long bonds last year, and this destroyed that model.

You have to be a bit more active or diversified in your approach, in my opinion. And ETFs are an excellent way to accomplish this, again IMO.

Which ETFs you use, how you weight them, and how often you change the allocations to them is dependent on numerous factors, including age, liquidity needs, and risk tolerances. But ETFs are an excellent way to access specific diversification in a simple and relatively inexpensive way.

In any case, I hope this serves as a good primer and motivation for you to take a hard look at ETFs and how you may be able to integrate them into your own investment strategy and process.

And like I have been hinting at recently, if you are a paid subscriber to The Informationist, you will soon become an Insider, and this type of tactical strategy is precisely what we will be focused on next.

In the meantime, stay lively and keep your head on a swivel out there!

That’s it. I hope you feel a little bit smarter knowing about ETFs and are ready to start incorporating them into your own investing strategy. Before leaving, feel free to respond to this newsletter with questions or future topics of interest.

And if you are a paid subscriber, don’t forget to leave a comment or answer a comment in our awesome 🧠 Informationist community below!

Talk soon,

James✌️

James,

Can you maybe do an Informationist on how derivatives are used to suppress the price of commodities? You mentioned that in this article; and I also heard that on a Swan Signal podcast this week (may have been you or Max Keiser) that derivatives are used to suppress the price of gold/silver. Would love to know how this works. Thanks!

I am looking forward to the tactical strategy.