The BTFP Scam

Issue 100

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today's Bullets:

BTFP Basics

The Latest Bank Scheme

Fed's New Plan

What to Watch For

Inspirational Tweet:

To the surprise of many investors and some bankers, the Fed announced the closure of The BTFP program this past week. The facility that gave a lifeline to regional banks after Silicon Valley Bank collapsed. In fact, it has some analysts outright panicking over an imminent meltdown of banks who are still on this 'liquidity lifeline'.

As Joe points out above, there's $167.8b using this facility and $70b of that will expire in just 6 weeks.

What happens to those banks? Will they collapse? Fold in to themselves and then right into one of the big boys: JP Morgan, Wells Fargo, or Citigroup?

If this all has you scratching your head and wondering what BTFP is, what the big deal is, and why you should care, have no fear. We're going to walk through it, nice and easy as always, here today.

So, grab your favorite cup of coffee, and let's wade into Fed waters with The Informationist.

🤓 BTFP Basics

First things first, you may be saying: What exactly is this BTFP you talk about? I know I've seen the acronym thrown around, but I can't recall what it stands for or what it has to do with banks.

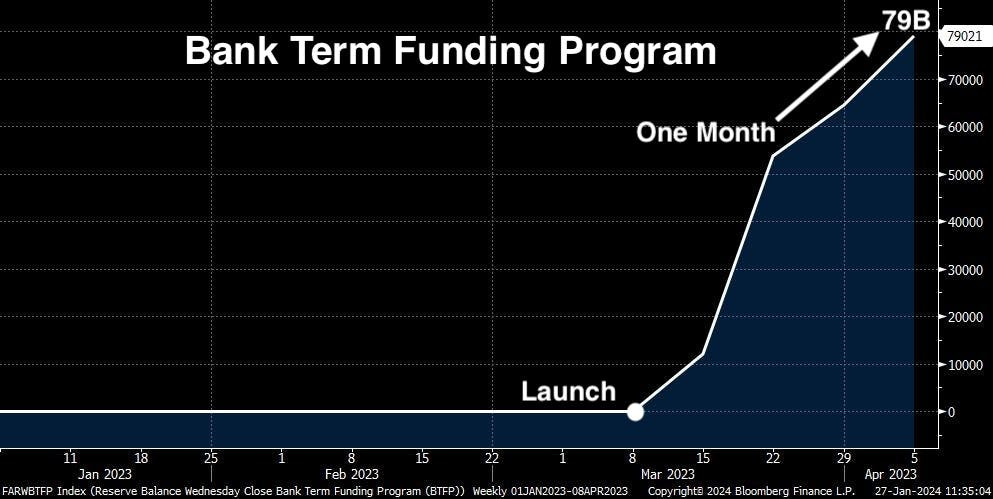

BTFP stands for Bank Term Funding Program. And it was created by the Federal Reserve in March of 2023, after the collapse of Silicon Valley Bank (SVB) and the realization that many banks were under-capitalized due to the crash in Treasury Bond prices.

Remember what happened leading up to this...

Banks bought lots of long-term USTs in their reserves → Fed raised rates at a rocket ship pace → long-term bond prices crashed → bank reserves crashed in value → depositors threatened bank runs → Fed created BTFP to save banks

If you're wondering what the BTFP is and does, I wrote a whole newsletter about that this past spring, summarized in a Twitter/X thread that you can find right here:

For the TL;DR crowd: The BTFP provides liquidity to banks and financial institutions by allowing these institutions to exchange Treasury Bonds for cash and bolster their balance sheets.

Hence, giving the banks ample liquidity in the event of depositors demanding their money back, and preventing another 'run on the bank' like SVB experienced.

The terms of the facility were highly favorable in that the impaired Treasury bonds were exchanged for full face value, rather than market value (eliminating the problem of the bonds—and hence, bank reserves—being worth less after the crash), lower interest rates than available in the open market for borrowing, and complete secrecy to hide any banks that were having liquidity problems.

Remember the secrecy part, it's important.

So, how popular was it?

Due to the nature of the program, we don't know how many banks used it, or who they were/are, however it is safe to say it was a super popular and important tool for numerous struggling banks last spring.

In fact, it's safe to say that the BTFP facility saved some banks by the skin of their ignorant, irresponsible, or just plain reckless little piggy backsides. 🐷

But wait.

Some little piggies didn't need help, but decided to go ahead and feast at the Fed sponsored buffet anyway, embarrassing the Fed (I know, not hard to do these days), but because it's all secret, not embarrassing themselves.

Incredible, but not shocking, really.

So, now to the surprise of many, the Fed is shutting down the program in lieu of another genius idea. We'll get to that in minute.

But first, let's see what these little piggies were up to in the banking world, shall we?

🐷 The Latest Bank Scheme

If you read the thread explaining the BTFP or recall the terms, you'll remember that the BTFP rate the Fed was charging banks was attractive.

Lower than Fed Funds' for most of the program, the BTFP rate was based on the one-year overnight index swap (OIS) rate plus 10 basis points.

Not bad, especially as this rate dropped recently along with expectations of the Fed lowering rates this year.

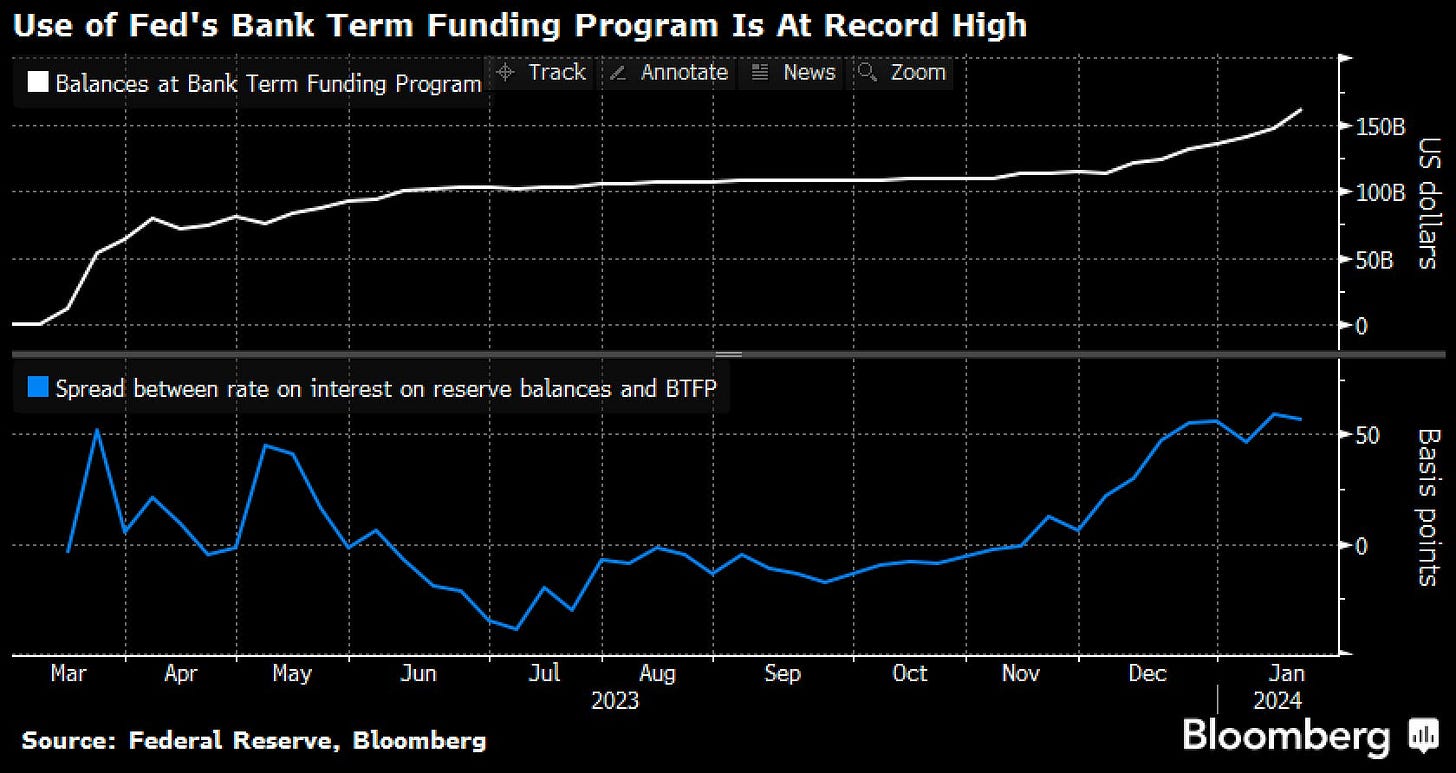

But you see that spike in the BTFP rate at the end of the chart?

That's the Fed closing the bank piggy buffet line down.

Why?

Because, as the 1yr swap rate fell recently, the banks realized that they could now borrow from the Fed BTFP at the low interest rate and then turn around and deposit that money back at the Fed (as reserves) for a higher rate.

Oink Oink.

The BTFP program took flight last month, with banks rushing to play this arbitrage.

The BTFP borrowing ballooned to over $150B, and in response, the Fed spiked the rate by .52% (denoted by the 🐷 in the 2nd chart above), closing the arb, and announced the program was going to expire on the intended March 11th date.

But what about the banks that really need the BTFP in order to remain solvent?

What happens to them?

Have no fear, the Fed cannot allow insolvency, we all know that, and so it has devised a new scheme for banks to join in on.

Though new and join may be the wrong words.

😡 Fed's New Plan

The BTFP was not the first emergency facility that the Fed implemented, of course. There has been another facility, called the Discount Window that's been around for about a century.

The Discount Window allows banks (and other financial institutions) to borrow from the Fed on a short-term basis, in order to meet reserve requirements or address temporary liquidity shortages.

Because of temporary financial shocks, the Discount Window can sometimes plays a critical role in maintaining stability in the banking system, particularly during times of financial stress or crisis.

Like the 1980s Savings and Loan Crisis, 1987 Black Monday, 9/11, The Great Financial Crisis, or the Covid Crash to name a few recent ones.

Seems like we have a 100-year event every five to ten years, doesn't it?

In any case, the Discount Window was pretty important on the above dates and provided enough liquidity to banks to keep the financial system operating 'properly'.

Awesome.

So, why don't banks use it all the time?

Why didn't they just tap away last spring? Use the Discount Window instead of creating a whole BTFP facility?

A few things.

First, they did use the discount window last spring, as you can see here:

And second, as stated in the title of Bloomberg's graphic, the Discount Window is seldom used, and when it is used, it indicates a crisis.

In fact, if you are a bank that uses the facility you are instantly considered a high-risk player in the financial markets. It is not secretive like the BTFP, and it carries a large negativestigma along with it.

You screwed up, took too much risk, didn't manage your assets and exposures properly, and now you have to go to your Fed daddy for a handout, an easy loan.

As a result, banks are reluctant to tap that source.

Think of the stigma like someone using a payday lender or taking an advance on a high interest rate credit card.

If credit agencies pick up on you doing this, and they will, your credit rating is toast.

Same with banks and their little piggy banker friends.

Wilbur: Did you hear Joe borrowed at the Discount Window last night?

Hamm: Eeeewwwwww.

But wait.

The Fed has a plan!

They need to close their BTFP facility on time, to show that there is, in fact, sufficient(ish) liquidity in the financial system and they keep their word.

They can trusted.

Now, in lieu of the BTFP, they will require banks to use the Discount Window regularly, in order to remove the stigma, normalize its use.

If you don't tap the Discount Window at least once a year, your line will be shut down.

Much like a credit card company requiring you to carry a balance for a period of time every year, or else they'll shut down the card, the Fed is doing the same to banks.

If everyone uses the Discount Window regularly, then it will blur the lines of need, obscuring banks' weaknesses, and obliterating the stigma of its use. Normalization of an abnormalaction.

Brilliant.

Let's weaken the credit system by muddying the actual financial strength of many banks, ones that should only be lent to carefully.

It remains to be seen how just much this affects inter-bank lending, etc., but it's certain to have some sort of ongoing and negative effect.

Also, the terms of the Discount Window are not as attractive as the BTFP in a number of ways.

This may impact those struggling banks negatively, make it harder for them to crawl out of their poor risk management dug little piggy troughs.

Some Differences:

Collateral

BTFP: valued at par

Discount Window: fair market value

Interest Rates and Fees

BTFP: Was at an attractive 1yr OIS + 10bp rate

Discount Window: Set above Fed Funds, scaling higher depending on the bank's credit worthiness

Loan Terms

BTFP: 1-year term

Discount Window: typically overnight, longer-term loans sometimes available

Transparency

BTFP: Use is kept completely secret

Discount Window: Supposed to be kept confidential, but word gets around

Key differences that perhaps the Fed addresses with a blanket change or on an individual bank basis.

Either way, it appears this is what they are planning to mobilize when they shut down the BTFP for good. So, no, I do not believe that the expiration of the BTFP will cause a crash or crisis in the banking system.

But what does it mean for liquidity and possible shocks going forward?

What about the next 100-year event that's due to hit in the next few years?

🧐 What to Watch For

First, we all know that the Treasury has been issuing mountains and mountains of debt to facilitate massive spending and deficits coming out of Congress.

This spending and the need for more and more borrowing has been focused on the short-end of the yield curve (T-Bills) in order to soak up the extra cash sitting in the Reverse Repo Facility.

Once that's gone, the Treasury will need a new plan.

All these new plans...

Fortunately, we get a peek into what they believe that new plan will be this coming week.

The US Treasury Quarterly Refunding Announcement (QRA).

This will give us an idea of how much liquidity the Treasury requires and plans to siphon from bank reserves the next few months.

As these fundings play out, we can watch certain rates for clues of stress.

The SOFR rate should stay stable. If this spikes, then we know there is a liquidity shortage and possible crisis at hand.

After the Revers Repo Facility is drained (by end of Feb, is my guess), then we need to watch the Repo rates. If these spike, then this also indicates a liquidity issue.

We saw this happen in September of 2019, as some of you have read in a recent newsletter here.

In the meantime, my plan is to stay well-diversified in my investments and holdings. By spreading the risk into assets I believe will perform well or offset weaknesses in other exposures, I feel quite confident my portfolios can weather any storm.

So, my advice is to:

Stay diversified.

Don't get sucked into the soft landing, or into the AI-rocket moon narrative.

And stay vigilant.

Because remember, pigs get fat, hogs get slaughtered, and little banker piggies are always looking for a way to take your spot in the buffet line.

Don't let them.

That’s it. I hope you feel a little bit smarter knowing about the BTFP and Discount Window and the Fed's plan to ensure financial liquidity.

If you enjoyed this newsletter and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️