💡 The BLS Random Number Generator Strikes Again

Issue 182

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What is the Birth-Death Model?

Fiction Friday: The Numbers Behind the Numbers

The Fed's Data Dependency Disaster

The Only Investment Thesis That Matters

Inspirational Tweet:

Well, well, well. The employment numbers came out and, sure enough, they looked a little extra baked for my personal liking.

The culprit, once again, seems to be the Bureau of Labor Statistics (BLS) Birth-Death Model, or what James Thorne here calls the ‘BLS random number generator’.

Nailed it, James.

But what exactly is the random number, er…Birth-Death Model anyway, what does it have to do with employment, and, most importantly, how did it affect the latest report?

All good questions, and ones we will answer—along with some others—nice and easy as always, here today.

So, pour yourself a big cup of coffee and settle into your favorite seat for a look into the chemistry of the BLS in this Sunday’s Informationist.

☠️ What is the Birth-Death Model?

Let's start with the basics, because understanding this is crucial to understanding why Friday's number is more along the lines of fiction (or perhaps fantasy) than reality.

First, despite the strong suggested imagery, the Birth-Death Model has nothing to do with human births or deaths whatsoever.

Nope. It’s just the super boring mathematical estimate of business formations and closures.

But here's the problem: Every month, thousands of new businesses open.

Pizza shops, tech startups, consulting firms, landscaping companies. These businesses hire people. But they're not in the BLS survey yet because they literally just started existing.

Meanwhile, other businesses are closing.

The restaurant that couldn't survive the latest minimum wage hike. The retail store that lost to Amazon. The startup that ran out of venture capital.

These corporate ghosts might still be in the survey even though their employees have already packed their nifty little cardboard boxes and been shown the door.

So what does the BLS do?

They use what is known as an ARIMA model (AutoRegressive Integrated Moving Average) to estimate how many jobs these invisible businesses are creating or destroying.

If it sounds like voodoo economics, it’s because, well, it is voodoo.

Think about the absurdity here. We're counting jobs at businesses that:

We can't survey (they don't exist yet)

Using patterns from years that included a pandemic

With response rates that have collapsed to historic lows

In an economy that's structurally different from the model's training data

I mean, what could possibly go wrong???

It's like trying to predict the Dallas Cowboy’s playoff chances by looking at their record from in 2020.

Well, that might actually be accurate. Never mind.

The point is that the model has a few fatal flaws, in my humble opinion.

See, the Birth-Death Model makes several assumptions that made sense in 2019 but could be seen as delusional today:

Assumption 1: Business formation patterns are stable over time.

Reality: We had the most business closures in history (2020), followed by the most business formations in history (2021-2022), followed by the fastest rate hiking cycle in 40 years.

Assumption 2: The relationship between GDP and employment is consistent.

Reality: AI and automation are breaking this relationship in real-time. Companies are growing revenue while cutting headcount.

Assumption 3: Historical seasonal patterns still apply.

Reality: Remote work significantly altered seasonal patterns. Summer hiring? Holiday retail surge? Those patterns are no longer the same.

Assumption 4: Survey respondents are representative of non-respondents.

Reality: The businesses responding are likely the stable ones with HR departments. The struggling small businesses? They're too busy trying to survive to fill out government surveys.

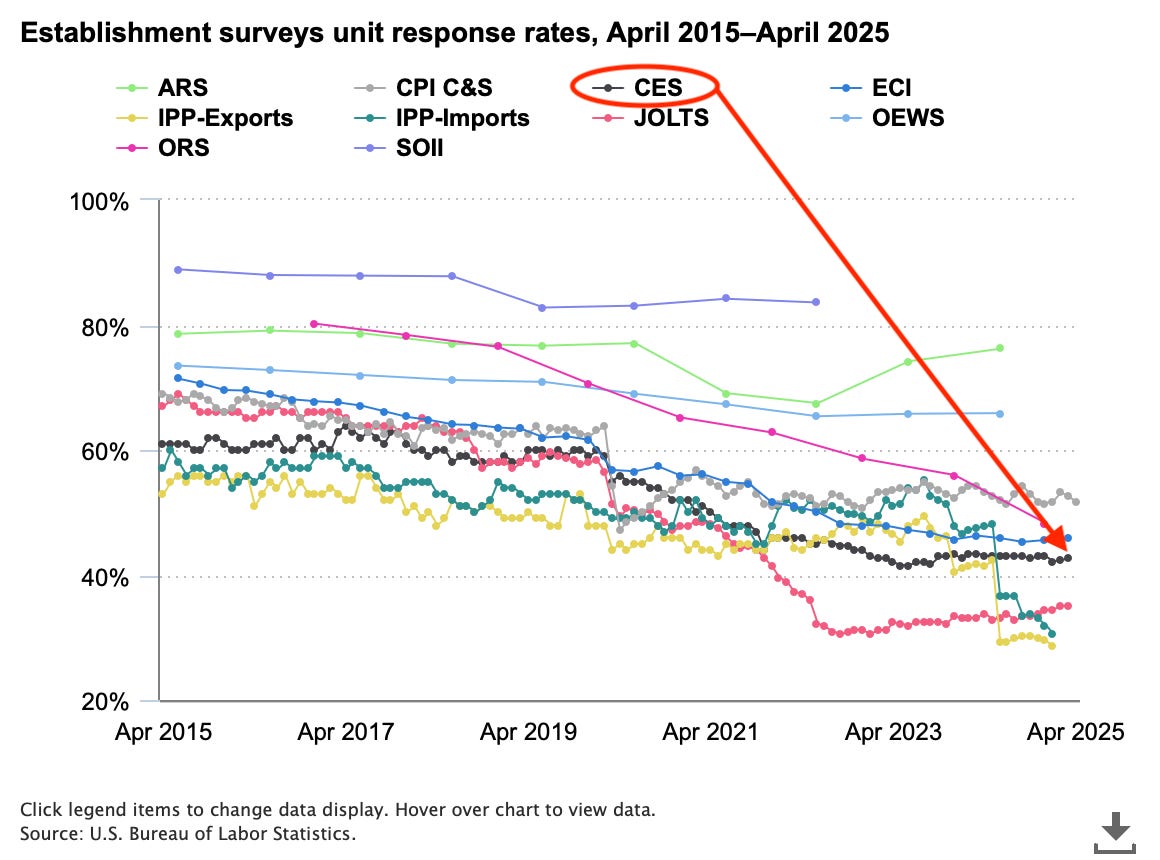

Take a look at this chart, paying close attention to the black line:

What do we notice?

That the Current Employment Statistics (CES) survey response rate has crashed from around 60% in 2015-2019 to just 43% today.

But here's what makes this even more troubling and hard to lean into for accuracy: The CES only surveys about 651,000 businesses out of approximately 33 MILLION businesses in the United States.

A little bit of math:

Total US businesses: ~33 million

Businesses surveyed: 651,000 (that's 1.97% of all businesses)

Response rate: 43%

Actual businesses responding: ~280,000

That's 0.85% of all US businesses

In essence, we're making monetary policy decisions affecting $27 trillion of GDP based on responses from less than 1% of American businesses.

I mean, imagine if:

Your doctor made a diagnosis after examining only 0.85% of your body (that's like checking one fingernail and declaring you healthy)

An election was called based on counting 0.85% of votes (that's like calling the presidential election based on one neighborhood in Tulsa)

Your GPS only knew about 0.85% of the roads (remember the old Apple Maps 😅)

The NFL declaring a Super Bowl champion after watching 0.85% of the season (approximately just the first quarter of Week 1's Sunday afternoon games)

In other words, I’m not really sure you can call this a reliable set of statistics.

But it gets worse.

Which businesses are in that 651,000 sample? And more importantly, which ones actually respond?

Who's In The Sample:

Large corporations with HR departments

Established businesses with government contracts

Companies that have been around long enough to be noticed

Businesses in traditional industries the BLS understands

Who's NOT In The Sample:

The new food truck that started last month

The AI startup in someone's bedroom or garage

The gig economy (Uber drivers, DoorDash, etc.)

The Bitcoin company incorporated in Wyoming

Most businesses less than a year old

Who Actually Responds (the 43%):

Companies with dedicated compliance staff

Businesses that depend on government contracts

Large corporations with regulatory requirements

The "good students" who always fill out forms (You know exactly who I am talking about from grade school here)

Who Doesn't Respond:

Small businesses drowning in inflation

Startups focused on survival

Companies about to fail

Businesses that don't trust the government

Anyone too busy actually running their business

So, we're not just getting data from 0.85% of businesses. We're getting data from the wrong 0.85%—the stable, compliant, traditional businesses that aren't representative of the dynamic economy.

Sure, we are getting some, but we may be completely missing everything that actually matters.

Let me repeat: we’re making central banking, investment, and business decisions relying on survey responses from less than 1% of businesses, adjusted by a model trained on pre-pandemic data.

Let’s be honest, it's not just broken, it's downright delusional.

🤥 Fiction Friday: The Numbers Behind the Numbers

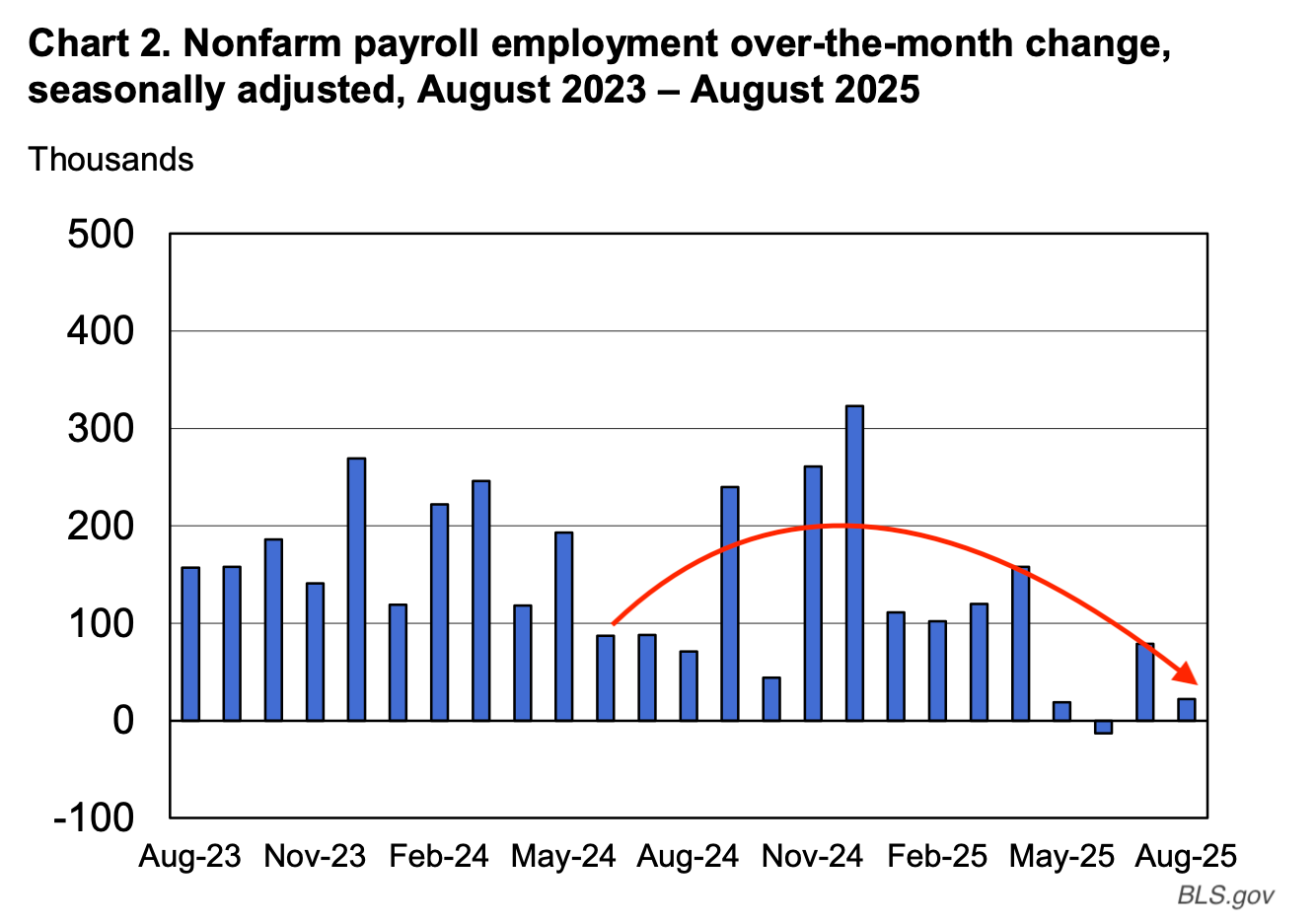

With that context—a survey of less than 1% of businesses, with a 43% response rate, adjusted by a model trained on ancient history—let's look at what this BLS magical mushroom mystery tour produced on Friday.

The Raw Damage:

Nonfarm Payrolls: +22k (Expected: 75k)

Private Payrolls: +38k (Expected: 75k)

Manufacturing: -12k (even worse than the -5k expected)

Government: -16k (yes, DC is still cutting)

Three-Month Average: An anemic 29k

Not good.

Here's the real kicker: The Birth-Death Model added 90,000 jobs to the not-seasonally-adjusted data in August.

Without our statistical seer cooking up a pot of ARIMA stew, we would have had negative job growth of -68K.

Good golly, Miss Molly. 😬

But that’s not all.

Let's talk about the revisions, because this is where the fiction starts becoming absurd.