💡 Should Bitcoin Be in Your Portfolio?

Issue 147

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Reasons of ‘No’

Actual Reality of Bitcoin in Portfolios

Risk-Adjusted Advantage

Drawdown Delusions

Undeniable Momentum

Inspirational Tweet:

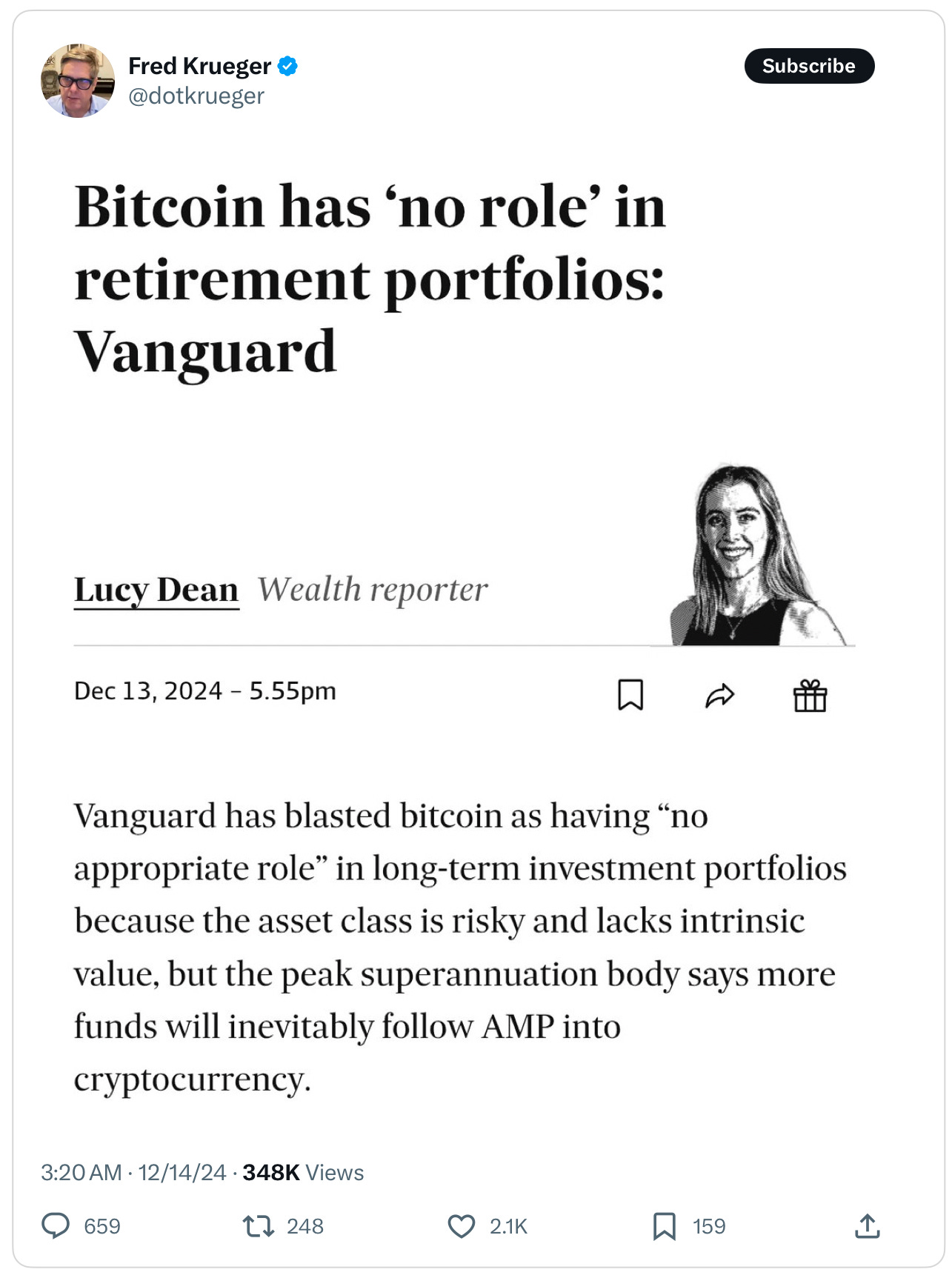

Just when you thought Vanguard couldn’t position themselves more diabolically against Bitcoin, they publicly and emphatically double down against the emerging asset.

Shocking. No, really.

So, let’s step back, take a look at some of the arguments against Bitcoin and look at how it would have impacted a typical portfolio over the last decade, shall we?

Look at facts, and ignore the, well…ignorance instead.

And though we will list a bunch of data here, have no fear, because we will unpack all of them and their purposes and significance nice and easy, as always.

So, pour yourself a big cup of coffee and settle into a comfortable seat for some portfolio talk today with The Informationist.

🙄 The Reasons of ‘No’

The first fear that almost always manifests in an article or conversation about Bitcoin seems to be ‘volatility’.

It’s so volatile, it’s scary. It’s “dangerous”.

Let’s unpack that for a moment.

Volatility means the asset’s price moves up and down sharply, rapidly, and sometimes violently.

This means that the value of the asset can change on a dime, on a whim, creating a massive fluctuation in your investment value.

And so, yes, if you are using Bitcoin as a checking account for your near-term cash needs (not advisable), then this can not only be scary but it can be dangerous to you and your liquidity needs.

It may cause you to miss paying a bill or worse, buying food.

While this is absolutely true in the case of Bitcoin, we have to step back and open the lens a bit.

First, Bitcoin is meant to be a store of value asset, much as you would store money in an investment like real estate or gold. And just like these investments, Bitcoin is not meant to act as a place to store your money for short-term needs.

Second, because of this volatility, Bitcoin gives investors the ability to opportunistically add to the asset allocation on drawdowns. If you have extra cash that you have no short-term needs for, then Bitcoin has been, hands-down, the best performing store of value for the least decade.

Volatility in a rising asset is a positive.

Let me say that again.

Because volatility creates optionality (the option to buy or sell on these violent moves), this makes it more valuable.

OK, but what about the price now? It’s over $95K as I write this, and so it means you probably missed your chance, right? It’s too late?

I n a word, no.

We will cover this concept more at the end of this letter, but suffice to say that Bitcoin has a long, long runway ahead of it to keep growing and solidifying itself as a separate ‘store of value’ asset, and it will continue to demonetize gold as a form of digital upgraded gold.

And lastly, another fear I hears being vocalized lately is that ‘the only reason Bitcoin is rising now is because Trump and other politicians are pushing it.’

Ok, this is categorically false.

The reality is that we have a number of catalysts that have been a huge positive for Bitcoin in particular, and these were underway long before Trump won the election last month.

While the new administration is far more positive toward crypto and Bitcoin than the current one, this has only accelerated the trajectory in the short-term.

In reality, Bitcoin was always going to continue to grow and be adopted by institutional investors, be added to their portfolios.

And so, despite Vanguard doubling down on the fear narratives of Bitcoin being a ‘worthless token’, the reality is that more and more investors are wondering if it should be added to their portfolios.

Let’s have a look at that next.

🧐 Actual Reality of Bitcoin in Portfolios

As many of you know, the typical long-term portfolio that investment advisors and portfolio managers have fallen back on is the classic 60/40 portfolio.

You know, 60% of the portfolio in stocks and 40% in bonds.

The thinking here is that the portfolio would grow with the added risk and returns of the stock portion of the portfolio, and volatility and risk would be tempered with the bond portion of the portfolio.

Yeah, we all know how that worked out in 2021 to 2023. 😱

In any case, we will use this as our benchmark portfolio to do some analysis on adding Bitcoin as an investment, a separate asset alongside the stocks and bonds.

And to do this, we will use a nifty and powerful tool created by Raphael Zagury called the Nakamoto Portfolio Model.

In particular, will look at adding a 1%, 5%, and 10% allocation of Bitcoin to the 60/40 portfolio and see what impact that has on overall risk and returns of the of the portfolio.

OK, let’s have a peek. Here are the details and data of the impact over the last 10 years: