Recession Cancelled? Hello, Fiscal Dominance

Issue 107

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today's Bullets:

The Fed and Monetary Policy

The Treasury and Fiscal Policy

Who is Winning?

Inspirational Tweet:

Many investors and economists, myself included, fully expected a recession to hit the US by late 2023.

But that didn't happen. Mea Culpa.

Instead, we've seen a resurgence of inflation and an easing of financial conditions.

But how can this be? I mean, The Fed raised rates at a breakneck pace, hiking them to levels that would certainly be restrictive and cause the money supply to decrease, especially with ongoing QT and the Fed actively removing money from the system.

So, what gives?

The Treasury (or more specifically, the government itself). That's what gives. A ton and ton of liquidity back into the system through massive deficits and exhibiting Fiscal Dominance.

If this sounds confusing or daunting to understand, have no fear.

Because we are going to unpack this dichotomy, piece by piece, and in clear and simple terms, as always.

So, grab your favorite of coffee and settle in for an easy financial Sunday morning with The Informationist.

🤔 The Fed and Monetary Policy

First things first. The plumbing and inner workings of the US financial system are exceedingly complicated (by design) and incredibly difficult to fully understand and interpret. That being said, the exercise today is to remain super simple and to the point. Boil it all down to the basics, the essence.

If this stuff really jump starts your engine, then I suggest you give Conks (@concodanomic on Twitter) a follow. He breaks this stuff down and goes into painful details of the inner workings of The System. Among the best at that.

Onward.

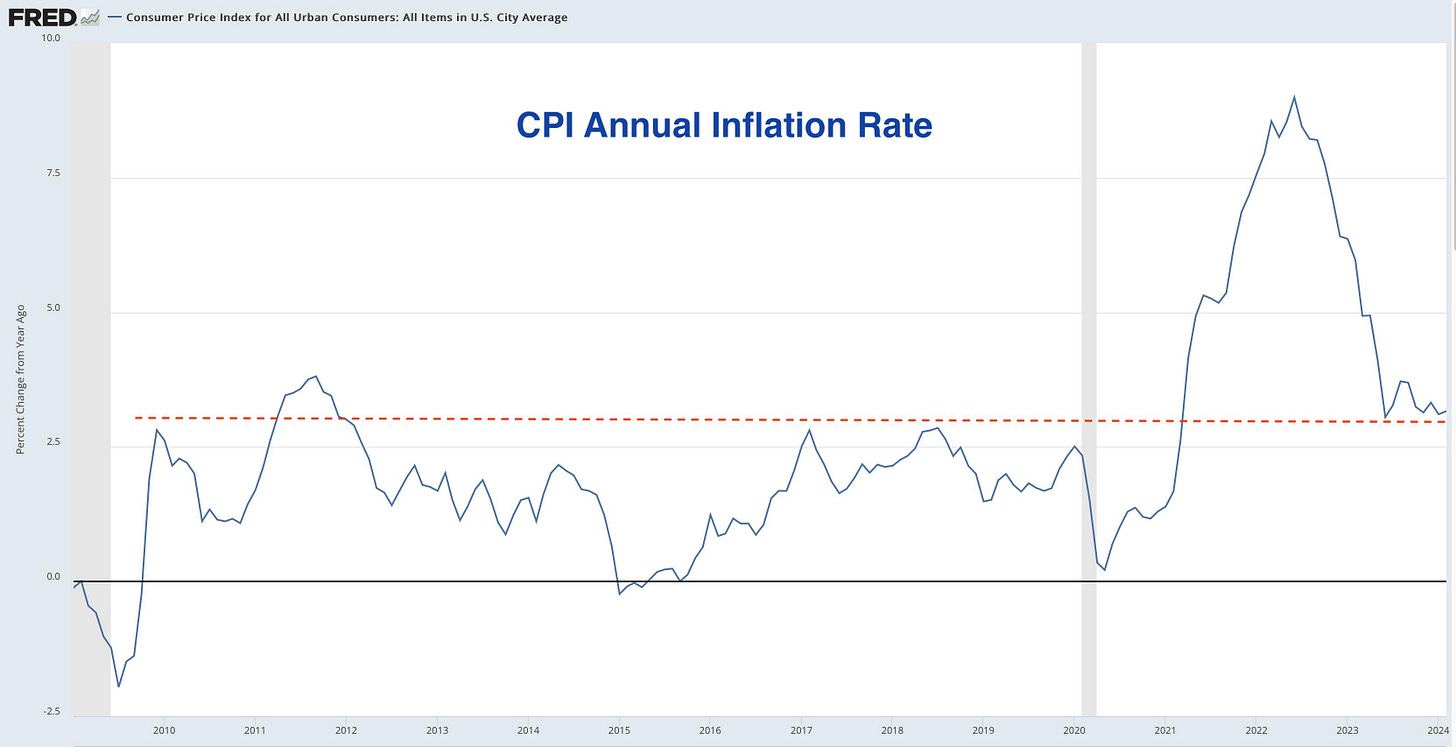

We've talked about The Fed quite a bit around here lately, and how they have been actively battling the onset of inflation since 2022.

Remember, the Fed has two stated goals:

Price stability (i.e., a constant target of 2% inflation)

Full employment

In reality, their mission is to allow for perpetual inflation (and even encourage it) but to keep it under control, so as to not have spikes of severe inflation, like we've seen in recent years.

When this happens, The Fed attempts to control the money supply and access to capital without upsetting the economy. Without causing a recession, which would disrupt that second goal of full employment.

Spoiler alert: this basically never happens. The Fed always overshoots, the economy goes from boom to bust, and consumers experience a recession.

As for the tools to accomplish these goals, The Fed has two main tools in the Fed Shed to basically control the flow of money in and out of the system:

1) Interest rates: by raising rates, they make money more expensive, and so borrowing is reduced, and by lowering them vice versa.

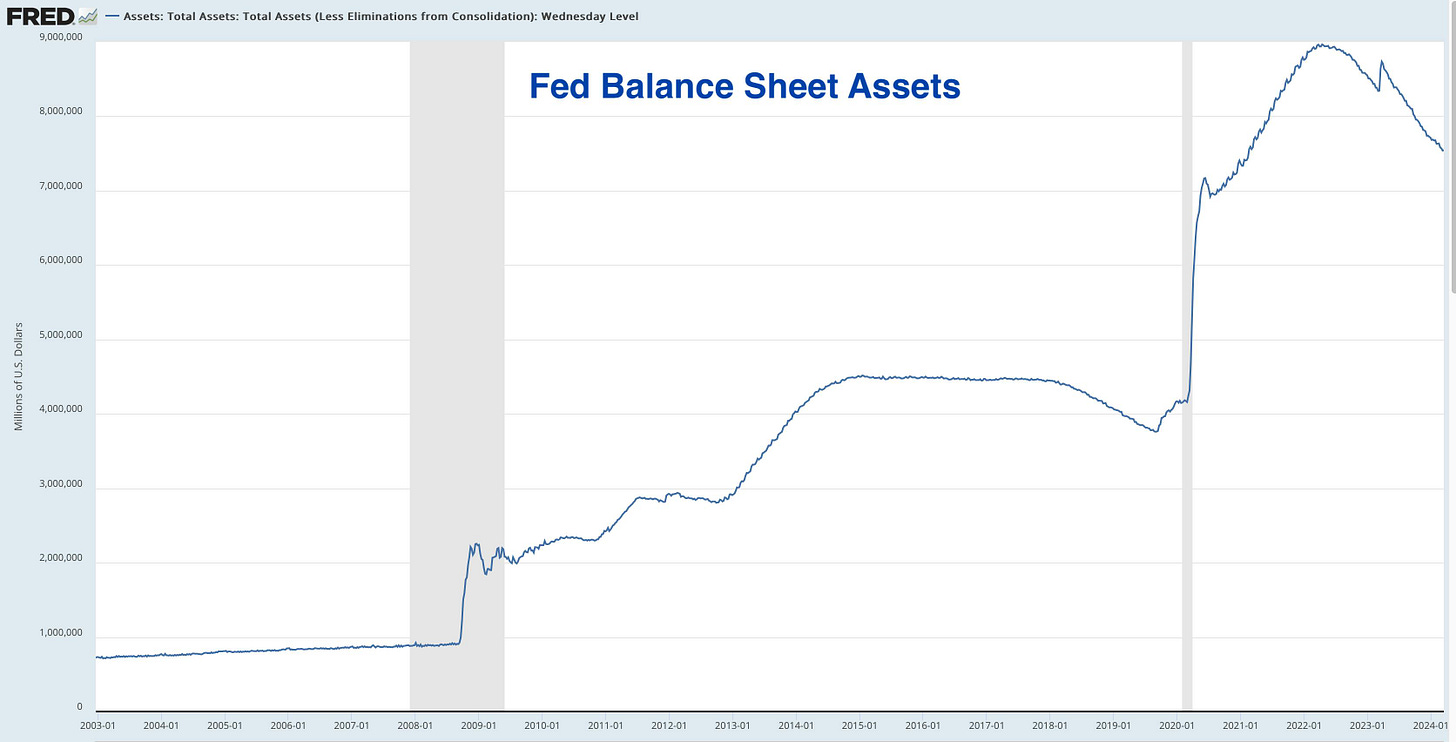

2) Quantitative policy: you may recall that in quantitative tightening (QT), The Fed sellsassets (US Treasuries and mortgage backed securities) off its balance sheet, which removesmoney from the system. And in quantitative easing (QE), The Fed buys securities in the open market, thereby adding money into the system.

In response to the onset of a huge spike in inflation from Covid stimulus, The Fed raised rates over the last two years and has then held them steady.

By doing this, they disincentivize borrowers from borrowing more and reduce the profitability for companies who are already borrowing at variable rates.

In theory, and all else held equal, this should reduce the amount of money in the system, and thereby slow or reduce inflation.

The other main tool The Fed has in its Shed is the quantitative tool, and in this case QT.

And you can see that The Fed has been (modestly) reducing its balance sheet by selling USTs and mortgage back securities in the open market, and (mostly) allowing bonds to mature off its books without replacing them with new bonds.

So, all this interest rate raising and tightening of money supply with QT should be working wonders on inflation, right?

Well, it had been working wonders, yes.

Up until the middle of last year, 2023, the rate of inflation had been decreasing.

Not to be confused with de-flation, this dis-inflation just means that prices are still rising, just not as fast as before.

And, unemployment has ticked up slightly, but not drastically. At least not yet.

But now we are starting to see inflation bottom out here. Stuck at around a 3 to 3.5% annualized rate.

Why did it stop, and how is that even possible?

If you listen to The Fed, they are all but ready to run a victory lap and start lowering rates this year.

To make access to money easier, cheaper.

And we will get to that in a moment, but first, let's dig into the why on inflation sticking here at north of 3%.

Let's talk about fiscal policy.

😵💫 The Treasury and Fiscal Policy

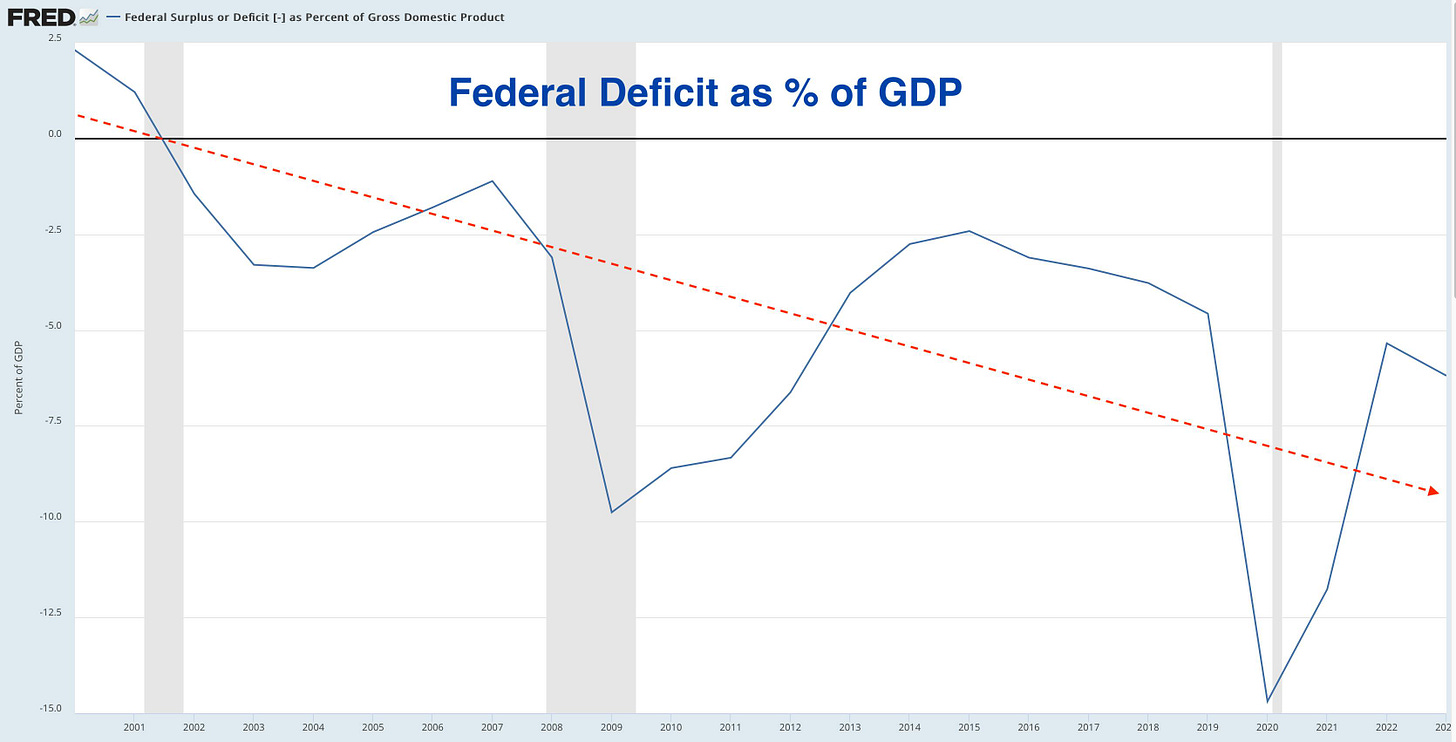

As many of you have heard me say, ad nauseam, our fiscal policy here in the US (and in most developed nations) is n shambles.

We spend and spend and spend and spend and spend (THE DEFICIT).

And when we bump up against the limit of our spending (THE DEBT LIMIT), we merely change the laws and...

keep spending.

We won't get into the debt spiral today, as most of you already know all about it. For those of you who are new around here and want some context, I wrote a simple thread on Twitter last year, detailing the situation we are now in. You can find that here:

Bottom line, we are running massive deficits, to the tune of ~$2T annually right now.

At the current run rate of $2T, the deficit is approximately 7.1% of the total GDP of $28T.

What is remarkable about this is that we are doing it at a time that the economy is not even in recession.

And a solid portion of that excess spending is simply adding liquidity to the economy.

The Inflation Reduction Act? Adds spending to infrastructure and pockets of R&D, among other programs, and of course, let's not forget about Defense spending, upwards of $850B this year, that they admit to and account for. Add in social security increases and boomers retiring into easy benefits, and it begins to look like stimulus coming out of Washington.

So, that's right, folks, the fine people in DC have figured out a way to stimulate the economy even while The Fed tries to restrict it.

It must be an election year.

In any case, this is why so much of the recent economic data is either conflicting, or showing an economy that's just bustling along.

The big question is, how long can this go on for, and who is really winning, The Treasury (government) or The Fed?

🫣 Who is Winning?

To bring this all together, let's take a peek at a few charts that demonstrate just how restrictive or loose the combined forces of monetary and fiscal policy have been lately.

First up, the Bloomberg Financial Conditions Index, which shows how restrictive or loose financial institutions have been with lending and access to capital. Negative numbers are restrictive and positive are loose. Negative readings here show a restrictive environment, and positive numbers show an easier access to capital.

Well, well. We can see that policy was severely restrictive right at the moment of lockdowns, then restrictive again when The Fed started raising rates and instituting QT in mid 2022.

But then we can see a clear move higher this past year, as conditions loosened after the whole SVB debacle and collapse.

In fact, at 1.128, we are just about as loose in lending, as we have been in the past 25 years.

Wow.

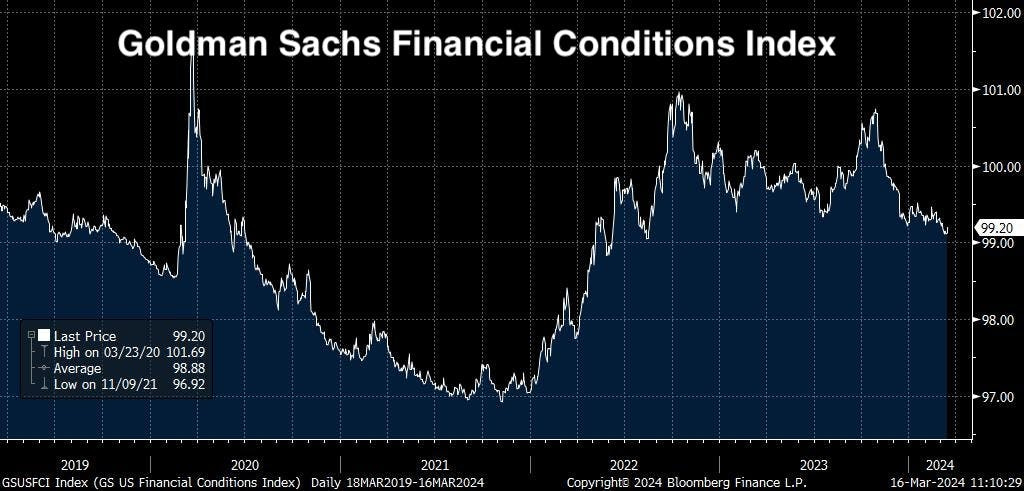

Let's now turn to the Goldman Sachs Financial Conditions Index, a similar measure which includes borrowing costs, exchange rates, and equity moves. The lower the number in this index, the looser the conditions.

Not quite as dramatic historically, but this also shows that conditions have substantially eased since the middle of 2023, much like the Bloomberg Index.

How about The Fed itself? What are they showing?

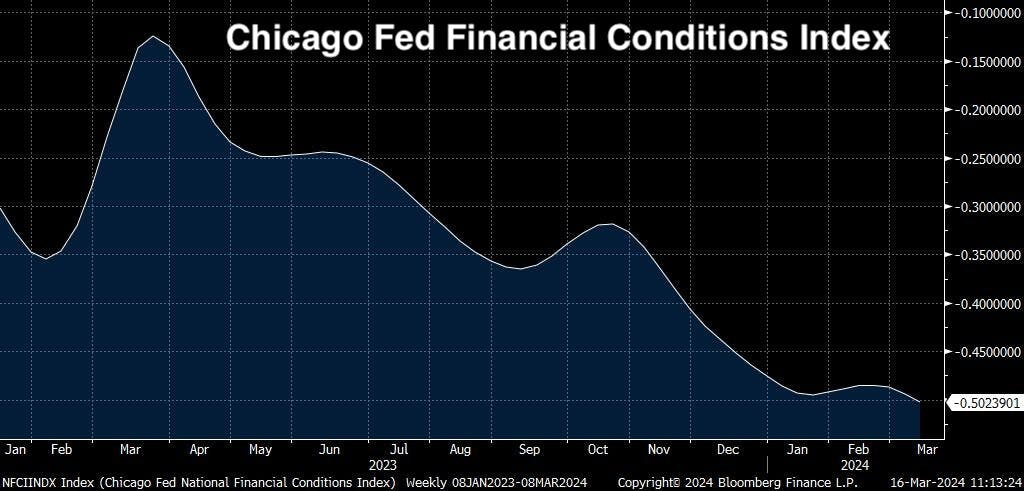

Well, looking at the Chicago Fed Financial Conditions Index, we seem to have a trifecta of loosening.

In the Fed's words: The NFCI provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems.

Positive values in the NFCI mean tighter conditions, and negative means looser.

No mistaking this one, looser it is.

I mean, way looser.

So, this, my friends, may be why the M2 money supply that had been falling (though modestly at best) from 2022 and into 2023, has now stopped falling completely. It has flatlined.

Why?

Because banks are lending, which creates money, and this has been stimulating the economy at the very expense of The Fed's tools attempting to restrict it.

And so, as you can imagine, we are seeing pockets of the economy that are entering or are deep in a recession. These are sectosr that are highly interest rate sensitive and are suffering the wrath of The Fed tools.

Think: Commercial Real Estate and other interest rate sensitive sectors.

Meanwhile there are sectors in the economy that are doing just fine. Even quite well, in fact.

Think: Travel and Leisure or Infrastructure-related sectors,

These sectors have benefitted from the Great Spending of DC. The huge deficits are stimulating, feeding them.

Many people ask, how long can this go on for? And that's a topic for another newsletter.

But now you at least understand the forces at work here.

And why you are not going crazy. That the White House, The Fed, and The Treasury are, at best, a three-ring circus.

At worst, they're three captains fighting over the direction of the Titanic.

And we know all too well how that story ends.

That’s it. I hope you feel a little bit smarter knowing about monetary and fiscal policies and how they are affecting the economy.

If you enjoyed this newsletter and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️