💡 Liquidity (QE) Is Coming

Issue 152

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Where We Have Been

The Fed Just Fibbed

Where We Are Going

How to Protect Yourself (And Even Benefit From It)

Inspirational Tweet:

Liquidity. The lifeblood of financial assets and top of mind for just about any investor who is paying attention these days.

But what exactly is Global Liquidity? How is it measured? And what does it mean for assets like stocks, bonds, gold and Bitcoin?

We will answer all these questions and more, including how to protect yourself from the inflation that is caused by all this liquidity.

But have no fear, we will do it nice and easy, as always.

So, pour yourself a big cup of coffee and settle into your favorite chair for this Sunday’s venture into the waters of market liquidity with The Informationist.

🤔 Where We Have Been

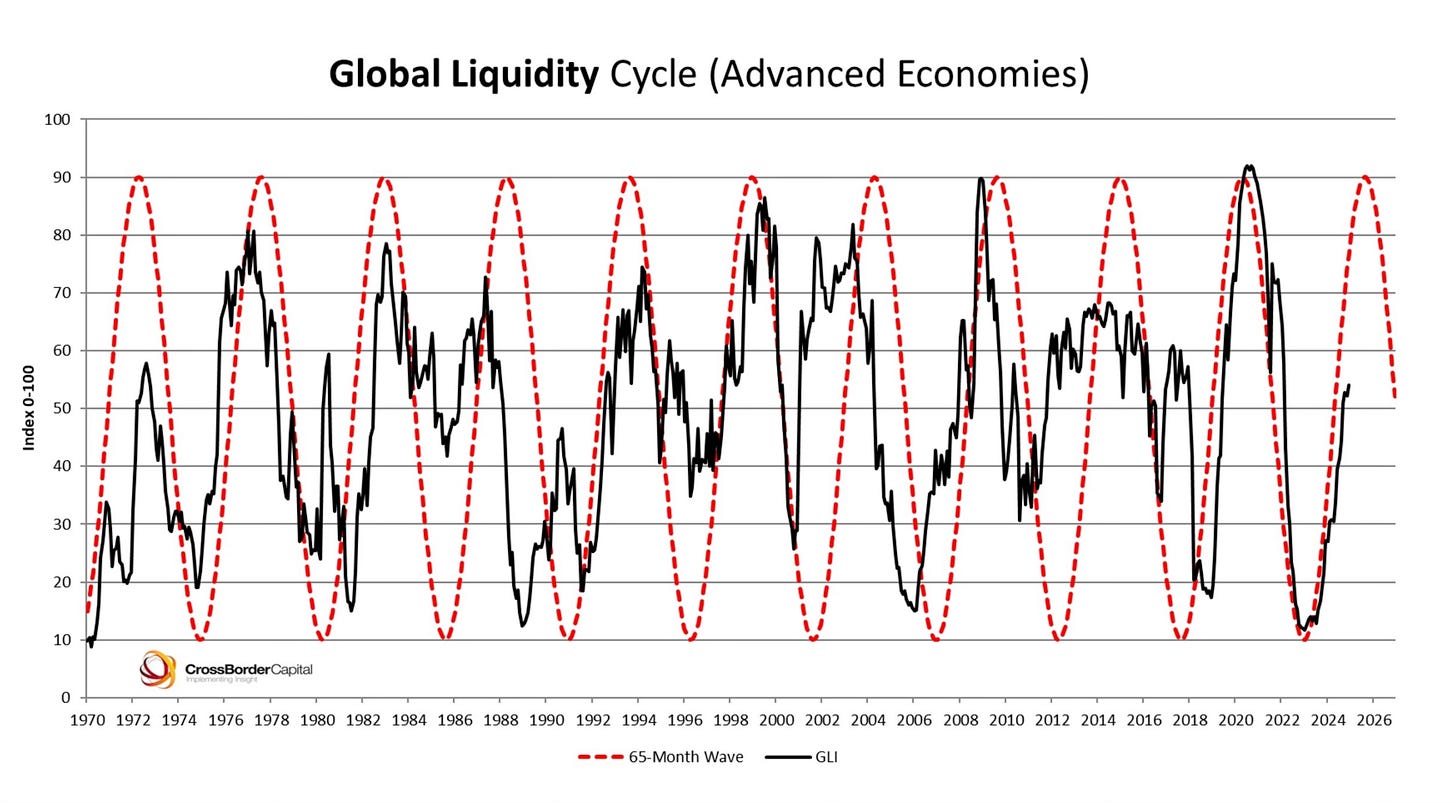

Before we move forward, I should note that the chart in Joe McCann’s Tweet above, as well as a few of the ones I will reference here today, can been attributed to none other than Michael Howell, a world-renowned expert on defining and measuring market liquidity and author of the Substack newsletter called Capital Wars.

This is a fantastic newsletter that I read religiously and highly recommend you do so, as well.

In any case, I had a unique opportunity to speak with Michael last night, live on Substack. In that conversation, we talked a lot about the subjects we will cover here today, as well as some others.

My aim here is to give you even more context and a better understanding of the nuances and dynamics we discussed last night. This is super important stuff, in my opinion, and you would be well served to understand it better.

On that, if you missed the live version and would like to have a listen or a look, you can find the entire conversation right here:

On the subject of liquidity, though, let’s first define exactly what that is.

Global Liquidity, is basically the total amount of money available in the global financial system that can be easily accessed and used for investments.

Most people assume M2 is an adequate measure, as this includes cash, checking deposits, and easily convertible near-money assets.

But Howell uses a broader definition than just central bank money (like M1 or M2). He includes:

Central bank reserves: money banks hold at the central bank, which can be quickly turned into loans

Bank credit: Loans and credit provided by commercial banks to consumers and businesses

Shadow banking: Non-bank financial intermediaries that provide services similar to traditional banks (think: hedge funds, money market funds, etc.)

Cross-border flows: Capital moving between countries, influencing exchange rates and financial stability

As for the factors affecting this definition of global liquidity, there are a few key ones that Howell focuses on, and one, in particular, he uses that most investors don’t.

Factors include:

Monetary Policy: Central banks’ moving interest rates and executing quantitative easing/tightening (lower rates and QE increase liquidity, while higher rates and QT reduce it)

Banking Sector Health: The willingness and ability of commercial banks to lend money (healthy banks lend more, boosting liquidity)

Cross-Border Capital Flows: Foreign investment in domestic markets (like bonds and equities) adds to liquidity, while outflows (capital flight) can drain it

Shadow Banking Activity: The size and risk appetite of non-bank financial intermediaries (like hedge funds—when they’re active, they add to the pool of available credit, aka liquidity)

Currency Exchange Rates: Stronger local currency can attract foreign capital, while weaker currency might push capital out, and this affects local liquidity

Regulatory Environment: Rules around lending, capital requirements, and market activities (like Dodd-Frank or Basel III) can enhance or restrict liquidity

Bond Volatility : Bond volatility affects the repo market (where institutions use bonds as collateral for short-term funding), and high volatility reduces the value of bonds as collateral, making borrowing more expensive and reducing liquidity in the financial system

This last factor, volatility, is a key part of how Howell measures liquidity, and most investors don’t include in their calculations, as it is hard to quantify its effects on the repo market and overall liquidity.

In any case, let’s peek at where global liquidity has been, according to Howell.

As you can see, liquidity seems to have bottomed out in late 2022/early 2023 and has been on the rise recently.

This makes sense, as the Fed (the most influential and largest central bank in the world) stopped raising rates and began lowering them late last year. Also, they lowered QT (selling bonds in the open market, which removes liquidity) from $60B per month to a mere $25B per month, a relatively inconsequential number in the scheme if things.

And finally, the Fed created the BTFP, a facility that gave banks liquidity after the Silicon Valley Bank collapse in early 2023. Which is a factor in the rise in liquidity beginning at that time, as you see in the chart above.

Incidentally, if you want to understand the BTFP more thoroughly, I wrote a whole newsletter about it when the crisis occurred. You can find that here:

And the Treasury has also chipped in to help liquidity by creating a new program, the ‘Regular Treasury Buyback Program” where they buy older, less liquid bonds in the open market, in order to facilitate better liquidity.

Janet Yellen insisted numerous times that this is not QE, but it is hard to argue that it isn’t, as this buyback program is literally the definition of enhancing liquidity.

But let’s check in on the Fed and see what they have to say about liquidity, where it stands, and what we can expect from the central bank in terms of enhancing or restricting liquidity in the near future.

🤥 The Fed Just Fibbed

So, this past week, the Fed had its most recent policy meeting and press conference, detailing the current policy stance.

First, the Fed unanimously voted to keep rates steady at 4.25% to 4.50% target range.

In the press release and the conference, Fed Chair Jerome Powell gave a cautious stance, which was neither overly dovish nor hawkish.

Powell stated that the current policy stance is "very well calibrated" to balance the achievement of the Fed's dual mandate of maximum employment and stable prices. He said that the Fed is not in a hurry to adjust its policy stance, emphasizing the importance of proceeding cautiously.

But then, most important to us and our exercise today, when asked about the Fed continuing QT and the level of bank reserves, Powell said:

"So, the most recent data do suggest that reserves are still abundant. Reserves remain roughly as high as they were when runoff began. And the Federal Funds Rate has been very steady within the target range. We track a bunch of metrics and they do tend to point to reserves being abundant."

He said abundant, twice.

A flat lie.

Here’s the thing.