💡 Is Wealth Just a Rigged Game of Monopoly?

Issue 194

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Rule 11: The Bank Never Runs Out of Money

The Closed Loop Problem

The Cantillon Effect (How the Game is Rigged)

How to Win When the Rules Are Stacked Against You

Inspirational Tweet:

The government works exactly the same way as Rule 11 in Monopoly. So as long as we don’t run out of pens and paper, there will be no default.

Not too far off the truth, there, Jim.

I mean, there’s been an undeniable frustration about the rich are getting richer and overall sentiment that no matter what most people do, they simply can’t keep up anymore.

But is the system really that broken? Is the game truly rigged?

Well, let’s put it this way: if Monopoly were designed by the Fed today, the banker would start with a money printer, the rules would be a few thousand pages long and too convoluted for any of the players to understand, and the guy who owns Boardwalk and Park Place would also be on the committee that decides when to print more cash.

Rigged would be an understatement.

But what exactly does this mean for you and me? How does this affect your savings, your investments, your own ability to build wealth? And why does it seem like no matter how much you earn, you’re always running just to stay in place?

All good questions, and ones we will answer, nice and easy as always, here today.

So, pour yourself a big cup of coffee, and settle into your favorite seat for a realistic look at the lopsided financial game we’re all playing with this Sunday’s Informationist.

Partner spot

When you look at bitcoin through a long-term macro framework, custody becomes one of the most important structural choices you make.

Durability. Redundancy. Protection from single points of failure.

These are not optional. They are foundational.

This has been Unchained’s focus since 2016.

Unchained is the leader in collaborative multisig custody and bitcoin native financial services. They secure more than $12 billion dollars worth of bitcoin for more than twelve thousand clients.

That means roughly 1 out of every 200 bitcoin sits in an Unchained vault.

The custody model is straightforward.

You hold two keys.

Unchained holds one key.

It is a shared custody design that gives you an institutional-grade security backup while preserving your individual control.

And once your vault is set up, everything builds from there.

You can trade directly from secure storage.

You can access bitcoin collateralized commercial loans with zero rehypothecation.

You can create a bitcoin IRA where you hold your own keys.

You can set up business and trust accounts for long-term planning.

Or opt for the highest level of private-client service, with Unchained Signature, and get a dedicated account manager, discounted trading fees, exclusive access to events and features, and much more.

If you are building a meaningful bitcoin position and want a partner aligned with sovereignty and long-term responsibility, visit unchained.com and use code LAVISH10 to get 10% off your new bitcoin multisig vault. Protect your bitcoin with a structure built for generations.

🎩 Rule 11: The Bank Never Runs Out of Money

Let’s start with Monopoly Rule 11, shall we?

“What if the Bank runs out of money? Some players think the Bank is bankrupt if it runs out of money. The Bank never goes bankrupt. To continue playing, use slips of paper to keep track of each player’s banking transactions—until the Bank has enough paper money to operate again. The banker may also issue ‘new’ money on slips of ordinary paper.”

Read that again. Carefully.

In essence, what it is saying is that the bank can literally write IOUs on scraps of paper and call it money. The game continues. The bank has an endless supply.

Try this with the IRS—sending scribbled IOUs to cover your annual tax bill—and you’ll be arrested.

But when the Federal Reserve does it? They call it “monetary policy” and brag about its merits at their world-class boondoggle in Jackson Hole.

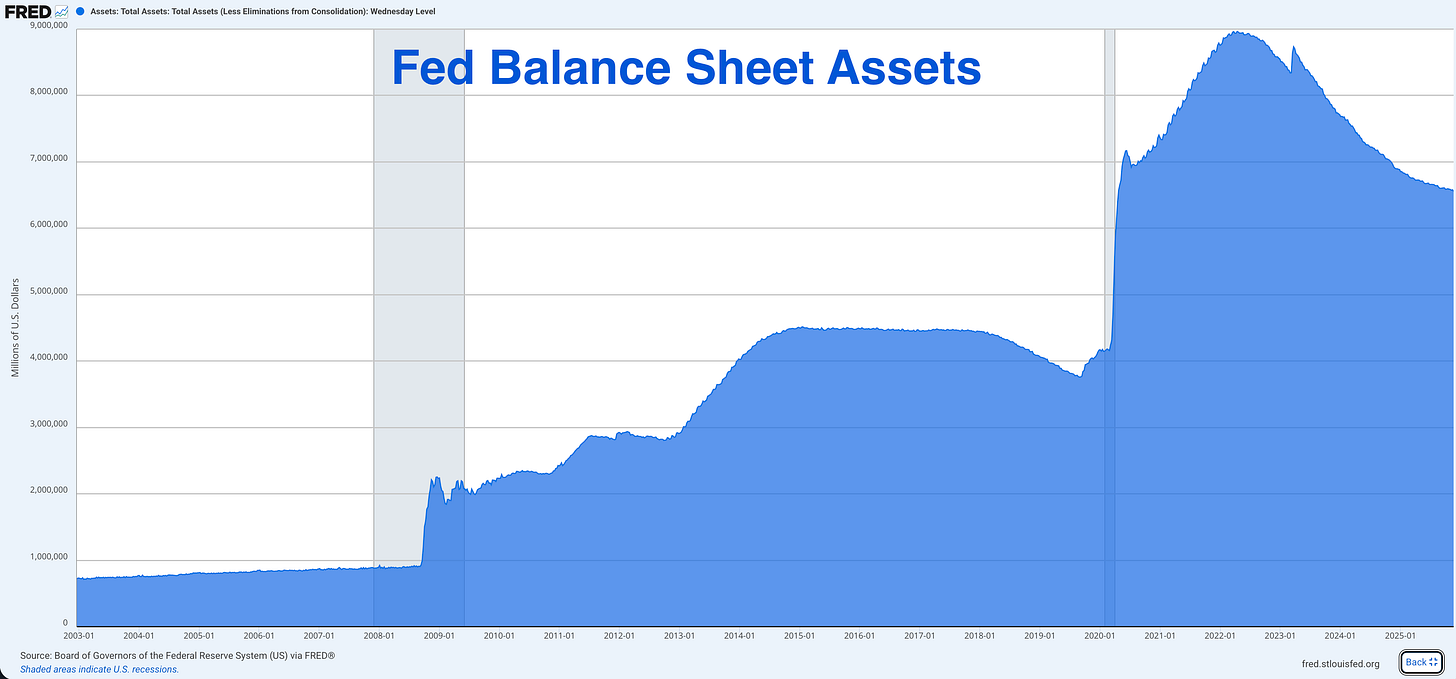

To get an idea just how often they do this at the Fed, here’s a nifty little chart:

Before 2008, the Fed’s balance sheet was around $900 billion. That’s where it had been, more or less, for decades. The Fed held Treasury securities, conducted normal monetary operations, and generally stayed out of the spotlight.

Then came the Great Financial Crisis.

Suddenly, the Fed used their own version of Monopoly Rule 11. Between late 2008 and 2014, they launched three rounds of “quantitative easing”—QE1, QE2, and QE3. By the time QE3 wrapped up, the balance sheet had ballooned to $4.5 trillion.

That’s a 5X increase. In six years. You can see it in the middle of the chart above, a long hump like the back of a dragon.

Pretty severe, you think.

Then COVID hit in 2020, the Fed went into hyperdrive. In just two years, they added another $4.8 trillion to the system, making a total of $9 trillion by early 2022.

That’s the right side of the chart, the part that looks like a dragon’s head.

Let’s put that in perspective. The Fed printed more money between March 2020 and March 2022 than it had in its entire 106-year history before 2008.

$9 trillion. Created from nothing. With the push of a button.

If you’re new around here, you may be asking, how does this work mechanically?

Simple. The Treasury issues bonds—IOUs from the government. The Fed buys those bonds, mainly through primary dealers (fancy Wall Street banks who get first dibs, like JP Morgan, Goldman Sachs, and Wells Fargo).

The Big Boys.

But here’s the thing. When the Fed “buys” these bonds, it doesn’t pay with money it has saved up. It credits the seller’s account with brand new dollars that didn’t exist five minutes ago.

The Treasury gets cash to spend. The Fed gets bonds. And the money supply grows.

It’s Rule 11 with a few extra steps and fancier vocabulary.

The Fed will insist this isn’t “money printing.” They prefer terms like “asset purchases” or “balance sheet expansion” or my personal favorite, “providing necessary liquidity to ensure smooth functioning of financial markets.”

Please.

You know what else ensures smooth functioning? Actual solvency.

Anyway, the point is, the bank cannot go bankrupt. It creates the very dollars it uses to settle its obligations. Just like in Monopoly, the game continues no matter how many slips of paper they need to write.

And Jerome Powell, bless his heart 🖤, will stand at the podium and tell the world with a straight face that the Fed has the “tools” to manage inflation.

While they, of course, are the ones creating it. The arsonist with the firehose. 🤡🔥

🔄 The Closed Loop Problem

OK, so the bank can print unlimited money. Big deal, right? Money is just paper anyway. The whole world runs on IOUs, right?

This is the classic argument of Modern Monetary Theory (MMT): We all owe each other, so what’s the harm?

Let’s go back to the Monopoly board to test this. How many properties are there?

Twenty-eight.

Mediterranean Avenue, Baltic, etc., all the way up to Boardwalk and Park Place. Four railroads. Two utilities. That’s it. The board is fixed. Finite. Nobody is building a 29th property mid-game.

Now, imagine you keep adding money to the game—but the number of properties stays the same.

What happens?

The price of those properties goes up. Not because they got better. Not because demand increased. Not because someone added a pool to Marvin Gardens or another wing in Park Place. Simply because there’s more paper chasing the same assets.

This is asset inflation in its purest form.

And this, my friends, is exactly what has happened in the real economy.

How?

Look at this chart.