💡 Is the US Treasury Insolvent?

Issue 121

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The CBO and its Report

‘Revenues’ and Mandatory Expenses

Reality Check

Protecting Yourself

Inspirational Tweet:

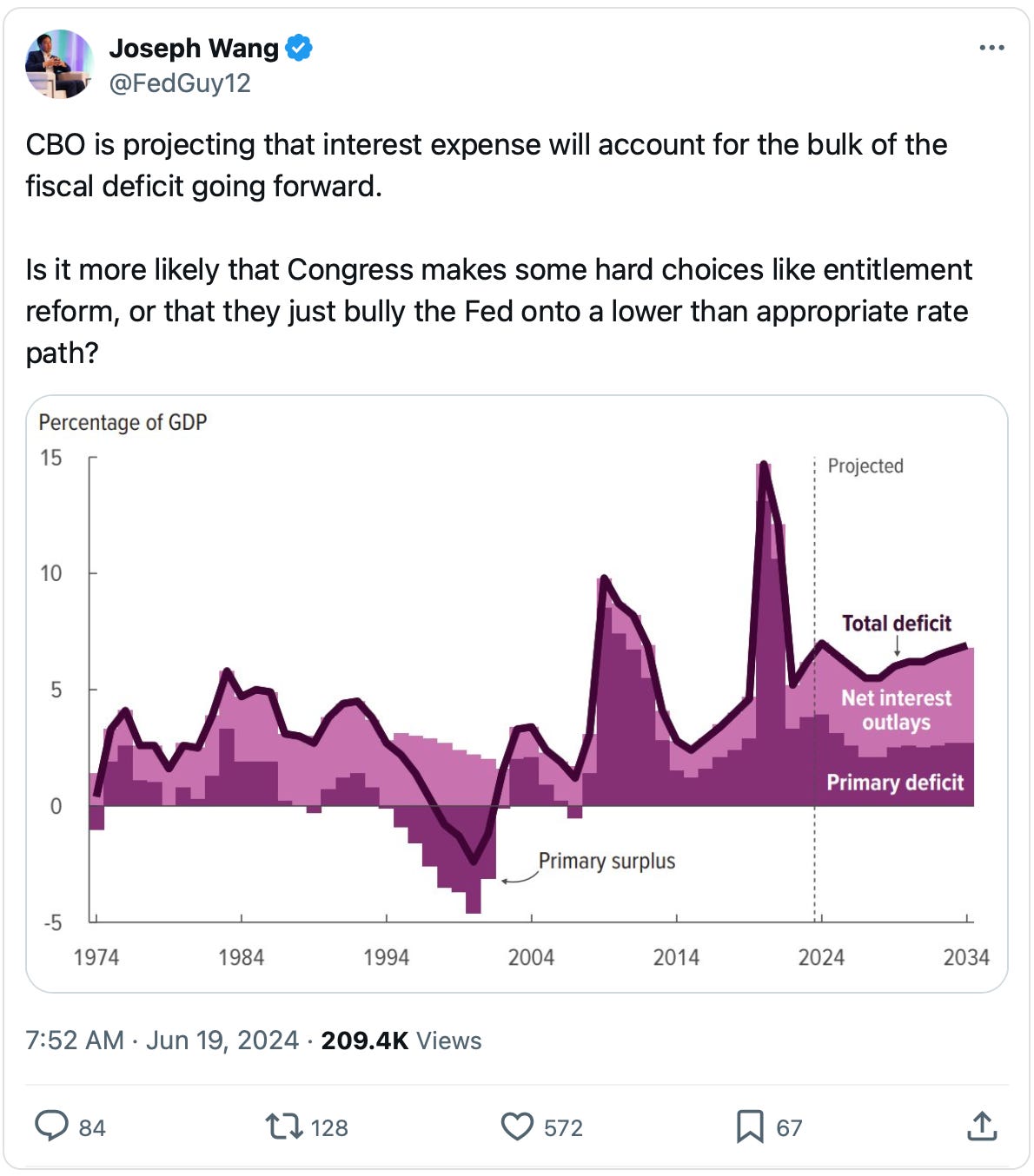

Choices choices. As Joseph Wang (@FedGuy12 on Twitter/X) puts it here, Congress increasingly finds itself in a difficult financial position.

Because as deficits grow, causing federal debt to grow, this only causes the interest expense on that debt to grow, too. It will eventually overtake the largest budget item, Social Security, and become the primary annual expense for the US.

So, what do they do?

And perhaps more importantly, is there anything they can do to stop this eventuality?

Or is the US Treasury (the financial arm of Congress) already insolvent?

If this has your head spinning with questions and confusion, don’t worry. Because we are going to unpack the US fiscal problem, nice and easy as always, here today.

So, pour yourself a nice hot (or a summer iced cup) of coffee and settle into your favorite chair, as we dive into the deficit with The Informationist.

🤓 The CBO and its Report

To get out of the gates straight, let’s be sure you know who the players are in this whole fiscal deficit and spending game.

First, we have Congress who sets policy and the annual federal budget. They enact legislation that dictates spending and budgets.

We also have The White House, who—with the simple stroke of a pen—enacts other measures, which adds to the deficit and debt (think: ‘Student Debt Relief’).

Next, we have The Treasury, who is not responsible for the budget, but is the enabler in this game, the one who facilitates all the borrowing and spending. Like an accountant, broker, and banker (and perhaps drug dealer) all rolled into one.

The Fed makes a cameo here with all its monetary manipulat—er, policy—attempting to manage the ups and downs of the economy.

And finally we have the Congressional Budget Office, the star of today’s show.

Also known as the CBO, the Congressional Budget Office is the federal agency that provides budget information and economic forecasts to Congress regularly. The CBO recently published its federal budget projections for the next 10 years.

As you may have already guessed, these projections don’t look fantastic.

In fact, they look downright ugly.

How?

🧐 ‘Revenues’ and Mandatory Expenses

Just like a regular company or business, Congress has both revenues and expenses.

The revenues come by way of productive citizens, through the collection of tax revenues.

How much are they expecting to take in this year?

$4.9T. Wow. That’s plenty of cash to cover all the expenses, right?

Right?

Not so fast.

Though $4.9T may sound like a lot of money to you and me, we have to remember that this is Congress we’re talking about here.

Like an entitled teenager with Daddy’s Platinum Amex Card, Congress is on a perpetual spending spree.

Let’s first see how much they have committed to funding. The Mandatory Expenses.

You know, the ones signed into legislation and cannot be skipped or skirted.