💡Is The US Becoming an Emerging Market?

Issue 184

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Vanishing Middle Class

The Cantillon Effect

Will (read: Can) The Fed Fix This?

Protect Yourself From The Fed

Inspirational Tweet:

We hear it all the time now: “The rich are getting richer!” And, “I can’t keep up!”

We’ll talk about the chart that Geiger Capital shared in a moment, but the question is, how bad is the problem, really? Is the US truly headed the way of Argentina and Brazil?

Are the wealthy truly becoming that much wealthier?

Or is it just all a misperception and that the middle and lower classes are also getting wealthy, just not as fast?

Good questions and ones that we will answer, nice and easy as always, here today.

So, pour yourself a big cup of coffee and settle into your favorite and most comfortable chair for a simple wealth analysis with this Sunday’s Informationist.

Partner spot

Bitcoin Has Crossed the Rubicon

This extended $75k–$110k range has a lot of people wondering if the bitcoin bull run is exhausted—if we’ve already had our so-called blow-off-top. But what if the on-chain evidence tells a totally different story? For some strong answers, join my good friend James Check (Checkmate of Checkonchain) and Connor Dolan for a data-driven discussion on what a maturing bitcoin market means for the road ahead.

James Check will break down:

Institutions reshaping the cycle: ETF flows and institutional allocator demand setting higher floors

Chopsolidation: why time-pain in the $75k–$110k range signals resilience, not exhaustion

Conviction on display: heavy distributions absorbed while long-term holders remain in control

As a preview: On-chain metrics show bitcoin has crossed the Rubicon—from a nascent store of value into a true institutional-grade asset class. This session will help you understand what that means for this bull market and beyond—and how you might position yourself appropriately.

When: Tuesday, September 30th at 3PM CT — online, free to attend.

Register now for early access to a new on-chain metrics report from Unchained and Checkonchain here:

I’ll be there listening, I hope you will be, too.

😶🌫️ The Vanishing Middle Class

Now, about that chart from Geiger Capital. Let’s stop for a moment and look at it one more time.

Really look at it.

What is it telling us, and why is it so important?

In short, it is saying that the top 10% of Americans now drive 50% of all consumer spending.

Half.

That's up from about a third in the early 1990s.

Notice how the line was relatively stable, even getting better during the early 90’s. Then something changed. The line starts climbing through the late 90’s, with a notable acceleration after 2008, and once again after 2020.

So, in just three decades, we've seen the concentration of spending power shift so dramatically that we're essentially living in two different economies.

One economy is flush with cash, traveling, bidding up assets, and living their best life. The other is struggling to make rent, living hand to mouth, and wondering why everything feels harder than it did for their parents.

But here's where it gets truly disturbing. The wealth side of this equation:

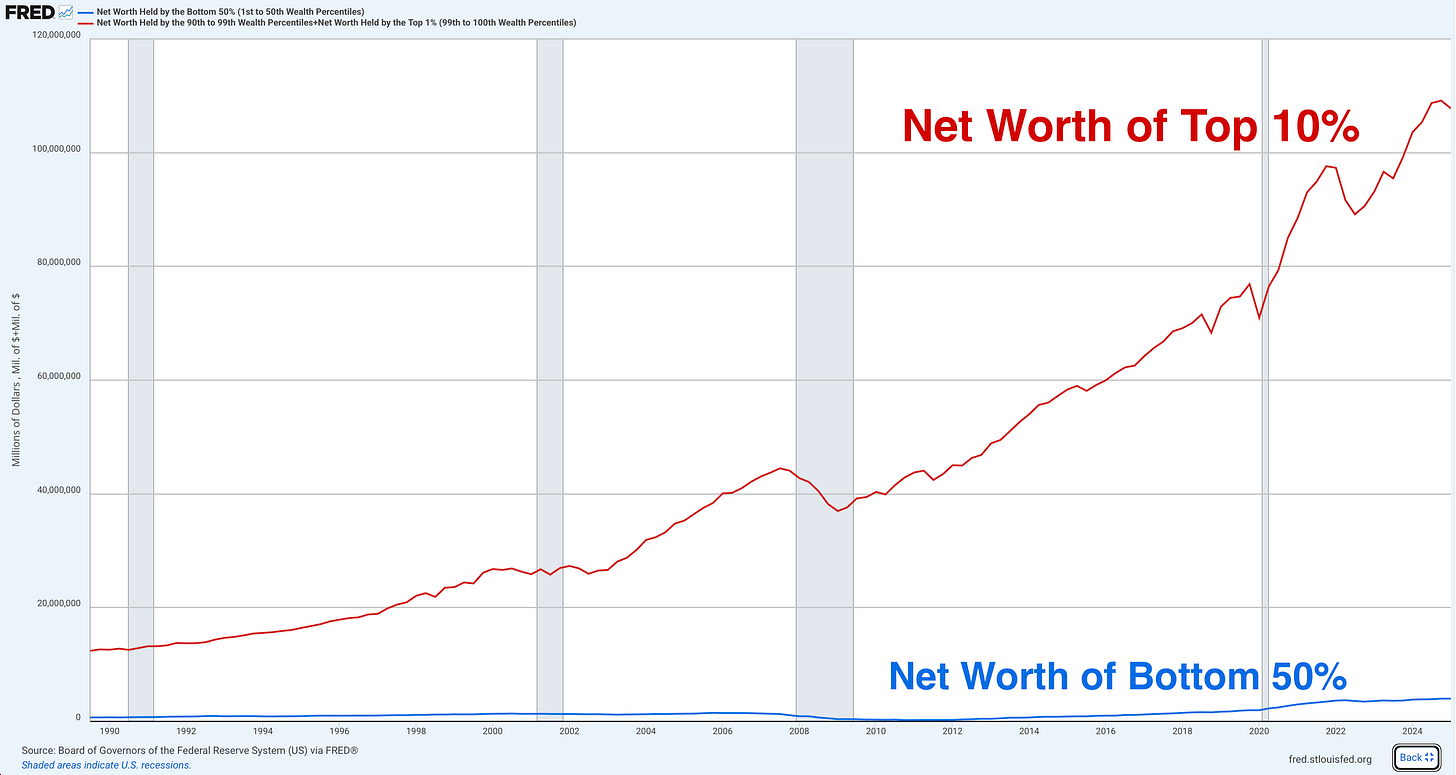

I’ve shown this on podcasts recently, but let’s look at it a bit more closely today.

Look at that gap. The red line (top 10%) has gone from about $12 trillion in 1990 to $108 trillion today.

The blue line (bottom 50%)? It grew from $700 billion to about 4 trillion.

Your typical PhD economist would argue, that’s great! Their wealth is up almost 6-fold! Modern Monetary Theory is working!

Not so fast, my slick economist friends. Let’s look at it from another angle, shall we?

Let’s assume there are 342 million people in the US. And that blue line of wealth is spread across the bottom 50% of those people, or 171 million people.

And so, from 1990 to today, on average, each of their ‘wealth’ grew from about $4K to $24K.

A gain of almost $20K, each.

Mr. PhD: See? I told you they were doing great!

Right. Now let’s calculate the top 10% share.

And when. we do that, we see that their wealth grew from $350K per person in 1990 to $3.2 million per person today.

A gain of $2.9 million.

Each.

In comparison, the bottom half of America has essentially no wealth. Not enough to even buy a car. And we wonder why younger people can’t afford houses.

But wait, it gets worse. Much worse.

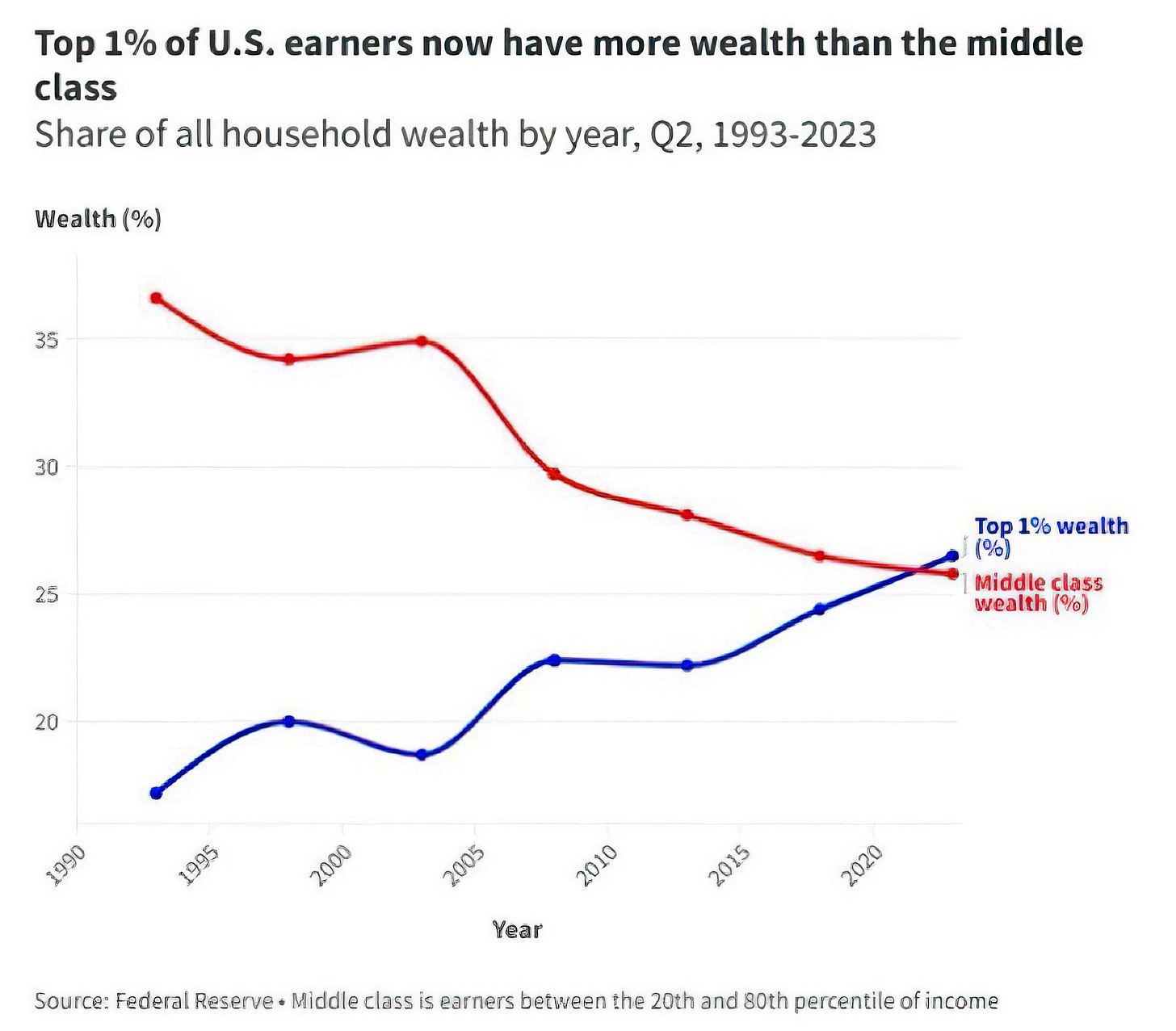

This chart stopped me cold.

See where those lines cross around 2022? That's the moment the top 1% officially owned more wealth than the entire middle class (20th to 80th percentile).

Back in the good old days of 1993, the middle class held 37% of wealth while the top 1% had 17%.

Today? The 1% sits at 27% while the middle class has crashed to 26%.

The 1%—roughly 3.3 million Americans—now control more wealth than 200 million middle-class Americans combined.

You could fit the entire 1% in Los Angeles and they'd own more than everyone living from Pittsburgh to Vegas.

This isn't normal. This isn't healthy. But most importantly, this isn't an accident.

😡 The Cantillon Effect

The reason that the rich keep getting richer while everyone else struggles to stay afloat?

A simple economic phenomenon called The Cantillon Effect.

Some of you have heard me talk about this before, and for those who have not read about it or just want a refresher, I wrote a whole newsletter that you can find right here:

For the TL;DR crowd: The term comes from Richard Cantillon, an 18th-century economist who figured this whole thing out 300 years ago.

The Cantillon Effect is beautifully simple: When new money is created, the people who get it first benefit the most.

I.e., whoever is closest to the money spigot.

For instance: When the Fed ‘prints money’, where does it go first? To banks. To financial institutions. And consequently, to people who own assets.

By the time that money trickles all the way down to regular wage earners, prices have spiked. Their own purchasing power is already diluted.

Sound familiar?

I’m not just talking about the US and other developed countries in the last couple of decades, I’m talking about our not-so-distant-almost-neighbors.

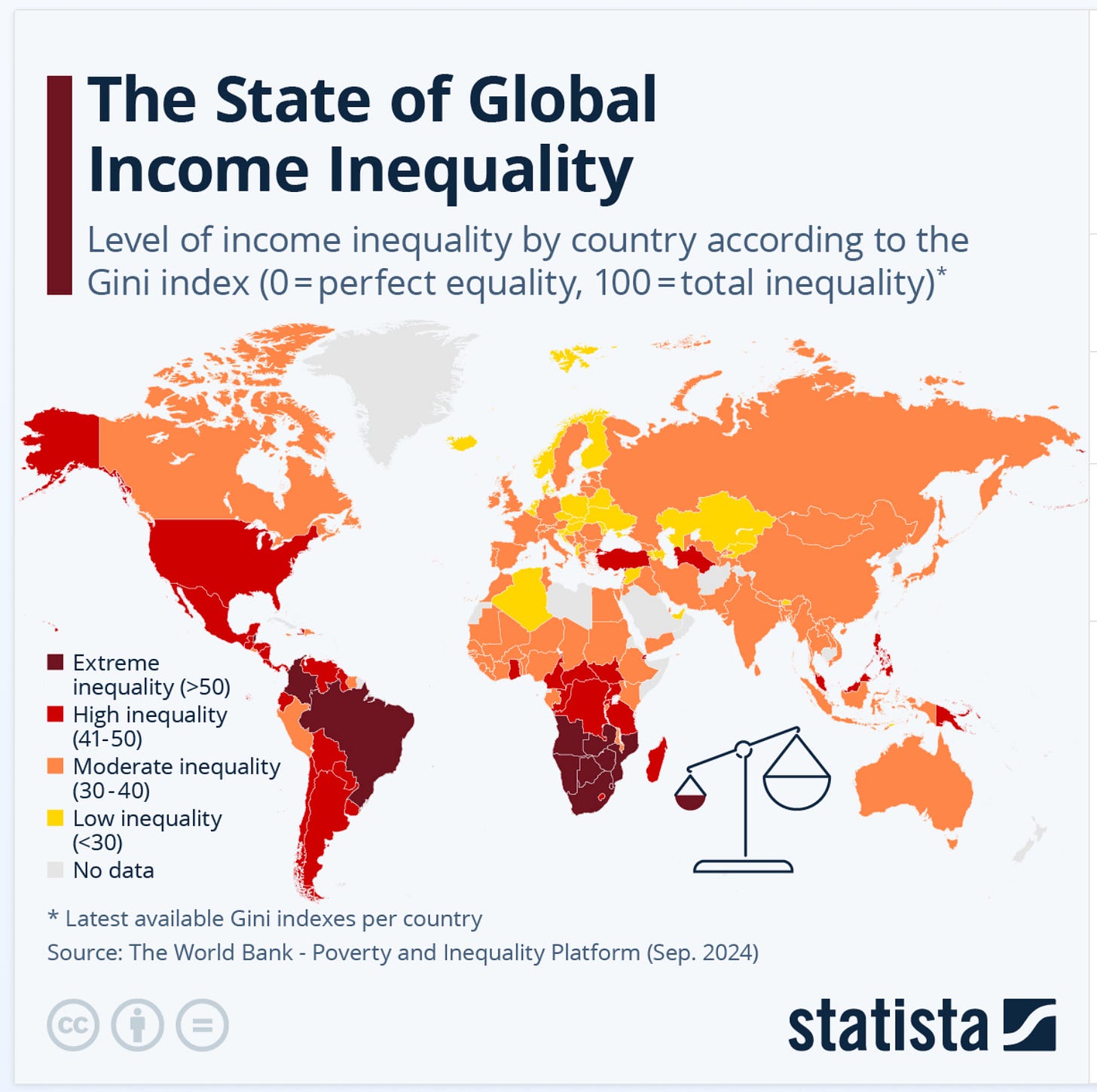

Look at this map:

See that dark red coloring South America (and much of Africa)?

These are countries with extreme inequality—Gini coefficients over 50.

We won’t get into the Gini coefficient here today, but just know that the higher the number, the worse the separation of wealth.

Now peek back at the United States.

We're sitting at 41.5, firmly in the "high inequality" camp, rubbing shoulders with... wait for it... Mexico, Chile, and Argentina—not to mention Turkey and Zimbabwe.

Heck, we're more unequal than Russia. More unequal than China and even Iran.

Soak that in for a moment.

In other words, we are all but sprinting toward the same wealth distribution as the worst of emerging markets.

In fact, if we stay on the same fiscal path, we will soon have the inequality of Brazil with the debt of Japan and the money printing of Zimbabwe.

What could possibly go wrong?

The Cantillon Effect on steroids has all but turned us into a financial banana republic. The only difference between us and actual emerging markets is that we are the holders of the world's reserve currency.

So we can print ad nauseam.

And this is what happens when we do:

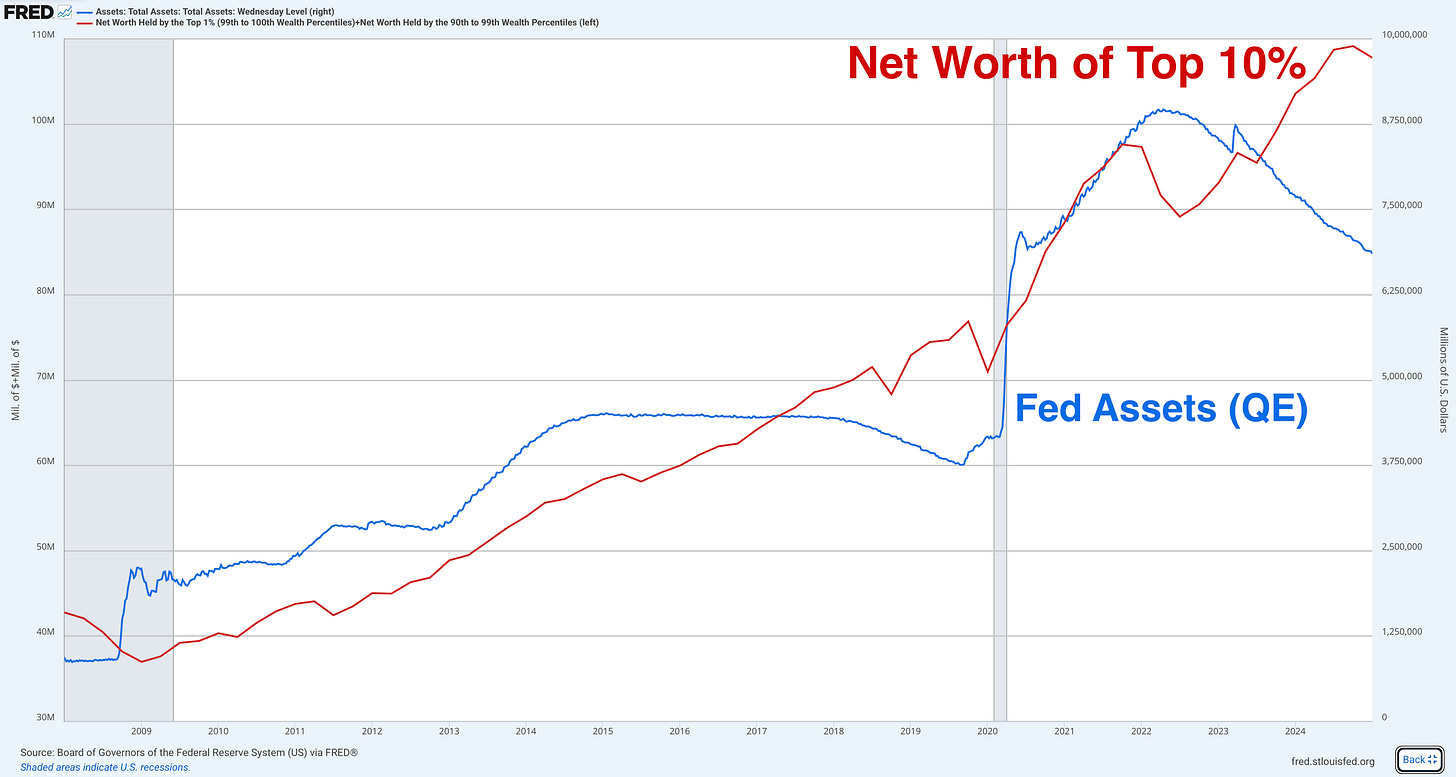

This chart should be in the Monetary Crime Museum. The red line is the top 10%'s net worth. The blue line is the Fed's balance sheet (aka how much money they've printed to buy bonds and other assets).

Look at that correlation.

From 2009 to 2022, the Fed's balance sheet exploded from $1 trillion to $9 trillion. The top 10%'s wealth? It more than doubled. When the Fed started shrinking its balance sheet in 2022, what happened? The wealthy took a hit (temporarily anyway).

This is the Cantillon Effect in, er…full effect..

The Fed prints money, uses it to buy bonds, which pushes down interest rates and inflates asset prices. Who owns 89% of stocks? The top 10%. Who owns most of the real estate? The top 10%. Who owns basically nothing?

The bottom 50%.

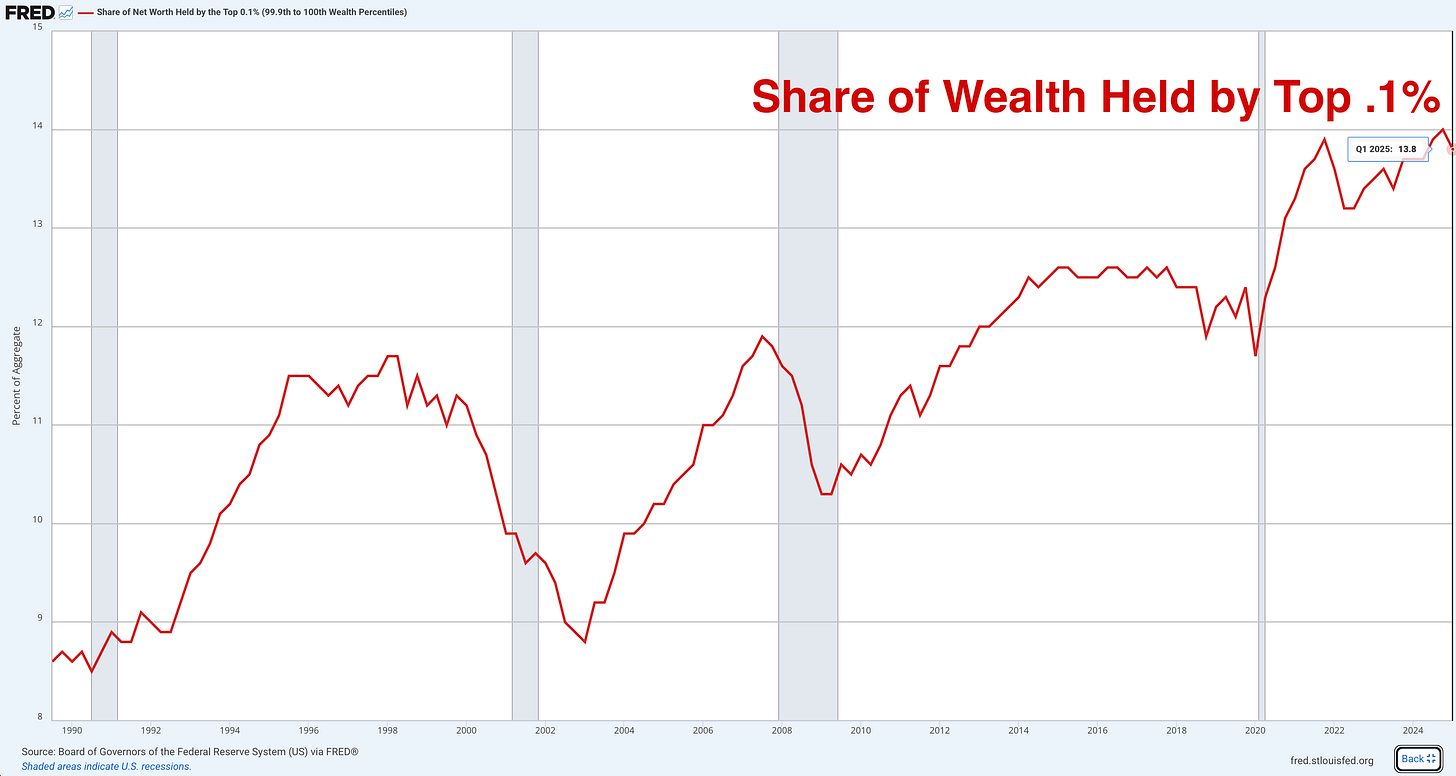

To see just how powerful and sickening the Cantillon Effect is, look at the Top .1% (that’s point one percent for those reading quickly).

You are reading that correctly. The top 0.1% now owns almost 14% of all wealth in the US.

That's 342K people owning more than 1/7th of the entire wealth in American.

To put it bluntly, the Fed didn't create wealth—they just redistributed it. From savers to borrowers. From wage earners to asset owners. From the middle class to the wealthy.

And they did it with a straight face while telling us it was for our own good.

They are ‘working for the American people’, as Powell said more than once in last week’s press conference.

On that.

🤣 Will (read: Can) The Fed Fix This?

Short answer: No.

Long answer:

Why they can’t fix what Congress keeps breaking (and will break again):

The US now owes $37.5 trillion in debt (and climbing by $1 trillion every 100 days)

is running $2 trillion annual deficits (and getting worse)

pays $1 trillion of interest on debt each year (more than our entire defense budget)

has zero political will to cut spending (political suicide for career politicians)

Which leaves the US with four options:

Austerity (virtually impossible—politicians spend money to help get themselves elected…forever)

Raise Taxes (also politically unpopular—and even taxing the rich and/or companies leads to lower productivity and hence tax revenue and you end up in the same place but with a worse economy)

Hard Default on US debt (won't happen—it would end American hegemony overnight)

Debasement of the currency (Ding Ding Ding! We have a winner!)

They will always choose door number 4.

Think about the math for a second. With $37.5 trillion in debt and blended interest rates of 3 to 4%, we're paying $1.2 trillion a year just on interest. That's before we spend a dime on defense, Social Security, Medicare, or literally anything else.

The only way out? Debase the currency. Inflate the debt away. Make those $37.5 trillion worth less in real terms by making dollars worth less.

It's not a conspiracy. It's not a theory. It's just math.

And here's the truly insidious part: The more they debase to manage the debt, the worse inequality gets.

The Fed knows this. Powell knows this. They all know this.

But they're trapped.

The debt math demands more printing. The political structure prevents any real solutions. So they'll keep pulling the only lever they have—the one that makes the problem worse.

In the next decade, here's what the math says will happen:

US debt will hit $70+ trillion (doubling roughly every 10 years)

Annual deficits will reach $4+ trillion (as interest costs spiral)

The Fed balance sheet will explode to $20+ trillion (they'll call it QE5 or some other acronym)

The dollar will lose 50% of its purchasing power (optimistically)

They'll say it's temporary or it's transitory. They'll say it is necessary to ‘ensure financial stability.’

And they will choose slow-motion default through debasement.

Every single time.

🤠 Protect Yourself From The Fed

We obviously cannot fix the system, but as many of you have heard me say before, we can protect ourselves from it.

How?

Simple: own assets, not dollars

If the Fed is going to debase the dollar by 40-50% over the next decade (and the math says they have to), then every dollar in your savings account is nothing more than a melting ice cube.

The Fed is explicitly trying to destroy its value—that's not a bug, it's the main tactic they use to help the Treasury manage the debt.

As dollars lose value, assets appear to rise in value. But in reality, they are just the mirror image of the deflating dollar.

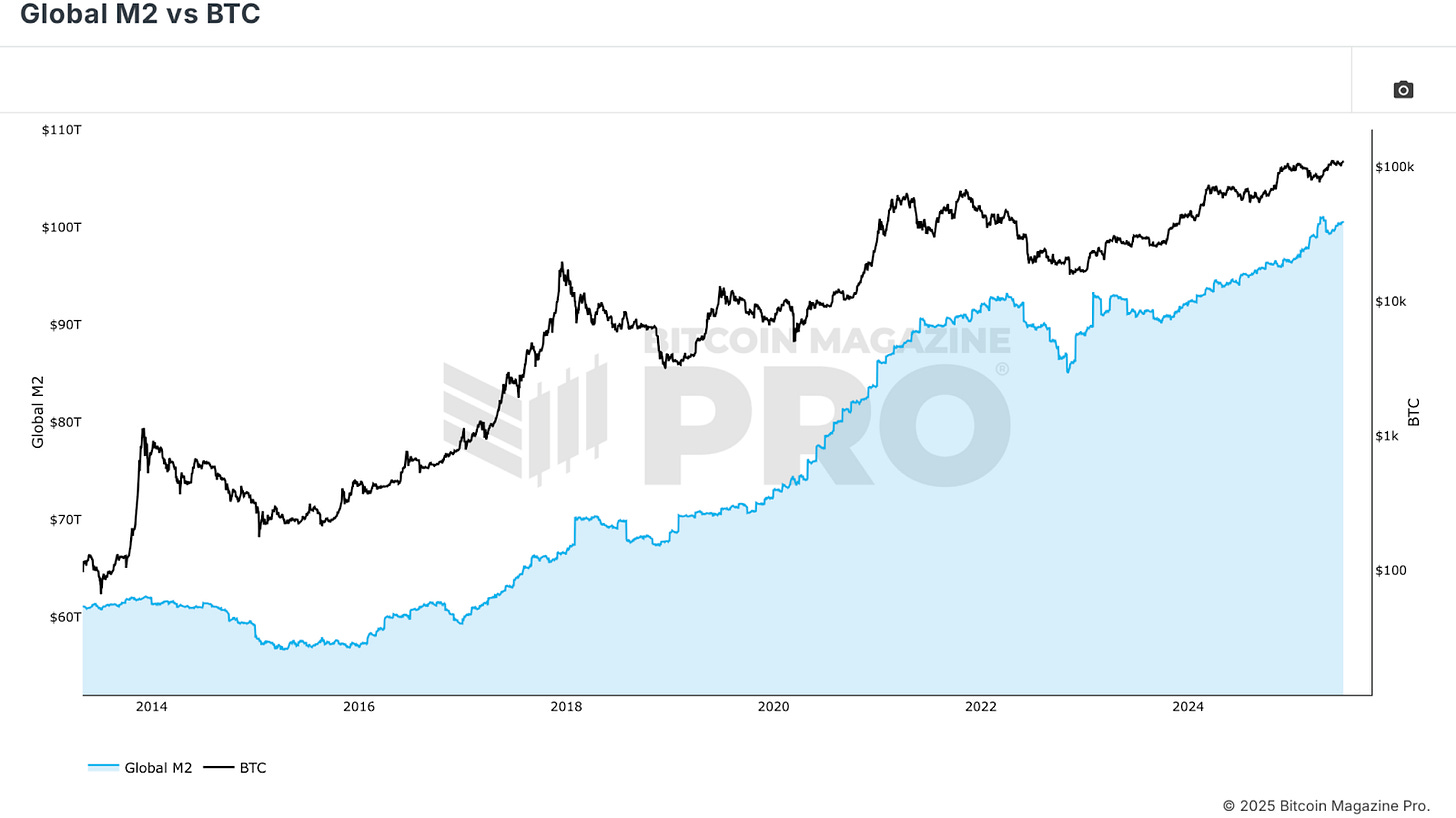

Like so:

The global scoreboard of debasement.

See that blue line representing global M2 money supply? It's gone from $60 trillion to over $100 trillion in just over a decade. That's $40 trillion of new money created out of thin air.

Yet Bitcoin (the black line) tracks it almost perfectly.

That's not a coincidence. When money supply expands, hard assets rise in value.

But like I said, it's not that these assets are getting more valuable—it's that fiat currencies are getting weaker.

This is one of the reasons we have seen gold on an absolute tear recently.

Gold has protected wealth through every currency debasement in thousands of years of use.

When Rome debased the denarius, gold held its value. When Weimar printed marks into oblivion, gold held its value. Since Nixon closed the gold window in 1971, gold has gone from $35 to $3,700.

Gold isn't a great investment. It's fiat insurance. It's an asset that protects you from senseless governments spending and debasing.

And based on the math we just covered, they're soon to lose their minds worse than ever.

But look at back at that chart again. Bitcoin isn't just tracking M2—it's outpacing it. That's because Bitcoin isn't just digital gold—it's something entirely different. It's the world's first truly scarce digital asset that cannot be debased, cannot be physically confiscated (if held properly), and cannot be stopped.

While gold protects your purchasing power, Bitcoin has the potential to exponentially increase it.

Why?

Because it's still in the adoption phase.

As we like to say in the Bitcoin investor circles, it's still early. The world is just now starting to catch on to the central bank infinite fiat money printing schemes, and how absolutely scarce digital money is the ultimate asset.

Bitcoin is volatile because it's young. But its monetary policy can't be changed by any government, any central bank, any emergency. There will only ever be 21 million Bitcoin.

In contrast, there can (and will) be infinite dollars.

What do you think happens to Bitcoin when global M2 goes from $100 trillion to $200 trillion over the next decade?

Math says that Bitcoin will be worth well over $1 million per coin.

It’s no secret—unless you are super new around here—that I favor Bitcoin over all the other hard assets out there, even gold (though I do own gold, too).

That said, for those who like being diversified beyond gold and Bitcoin, and are wondering what else could be good stores of value, it’s pretty simple.

You want to own things that can't be created out of thin air:

Real estate (they're not making more land)

Other Commodities (especially those with utility)

Productive cash generating businesses (especially ones that are recession-proof)

And even Art and Collectibles

Whatever you do to protect yourself, the most important thing to do is lengthen your investing horizon.

Huh?

I mean, stop thinking about next week or month, or even next quarter. Starts thinking in years. And if you are younger, decades.

This allows you to weather the volatility of the adoption phase in Bitcoin, the rise and fall of gold or other assets with recessions and/or market drawdowns.

Look, the growing American wealth separation isn't an accident—it's a direct result of our monetary system. Every time the Fed prints, the gap widens. Every "emergency measure" becomes repetitive. Every "temporary intervention" becomes permanent.

The systematic transfer of wealth from the many to the few, facilitated by money printing and the Cantillon Effect.

The way I see it, we have two choices:

Stay on the wrong side of these charts and watch our wealth evaporate

Position ourselves correctly and preserve (or grow) our purchasing power

Remember: this isn't about getting rich quick. It's about not becoming poor slowly.

The Cantillon Effect is real. The wealth concentration is accelerating. The Fed will print until the printer fails.

And then, they will just buy a much, much

MUCH

larger printer.

If you are like me, you will not struggle to fight the Fed or the markets or even interest rates.

Not enough time for any of that.

No.

Instead, you will simply position accordingly.

That’s it. I hope you feel a little bit smarter knowing about the growing separation of wealth in the US and how to protect yourself agains the Cantillon Effect.

If you enjoyed this free version of The Informationist and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️

James, IMHO this is one of your Top 10 articles. It's easy to read. The logic is easy to follow. The conclusions are simple and straight forward. I maintain a 'Bitcoin Primer' PDF I share with friends and co-workers when the topic arises. This article will now accompany that.

Thanks, James. A very good reminder of why we bitcoin, in times when it seems to be going flat sidewise.