💡 Is the US Already in Recession?

Issue 159

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What are the Conference Board and NBER?

What Is the LEI Saying?

LEI Peak Signal

Timelier Signal

Diffusion Index Signal

The “3Ds” Rule Signal

Bottom Line

Inspirational Tweet:

Hold up, hold up.

Are we already in a recession?

A lot of Americans would say yes—hence the overwhelming vote for a change this past election. Yet, the market’s not sure—uncertainty has been ruling stocks, Bitcoin and even gold this past month or so.

And then there’s the NBER which hasn’t said a word.

But who is the NBER, and how would they know? What do they have to do with the Conference Board and its LEI?

All good questions and ones we will answer, nice and easy as always, today.

So, grab yourself a nice big cup of your favorite coffee and settle into a comfortable chair for a peek behind the government data curtain with this Sunday’s Informationist.

🤓 What are the Conference Board and NBER?

"One forecasts the storm. The other writes the history book."

To understand if we’re in a recession, you first need to know who tracks the data and how they define it.

The Conference Board & the LEI

The Conference Board is a non-profit think tank founded in 1916, widely known for its business cycle research.

Its Leading Economic Index (LEI) is a composite of 10 forward-looking data points that tend to move ahead of the broader economy.

In short, it’s designed to predict economic turning points.

In fact, since 1973, the LEI has accurately forecasted every single US recession—typically signaling 6 to 12 months before one begins.

We will get into the LEI itself in a few moments. First, let’s look at the NBER. See what that’s all about.

The National Bureau of Economic Research (NBER), founded in 1920, is a private, non-profit, non-partisan research organization based in Cambridge, Massachusetts and is funded through a combination of grants, donations, and academic partnerships—not directly through the US government.

Code for government funded, of course, as government grants have accounted for a around 80% of NBER’s annual operating budget in recent years.

But most importantly, NBER is the organization that officially declares U.S. recessions.

How?

Unlike the “two quarters of GDP” rule, the NBER looks at broader indicators: real income, employment, production, and sales.

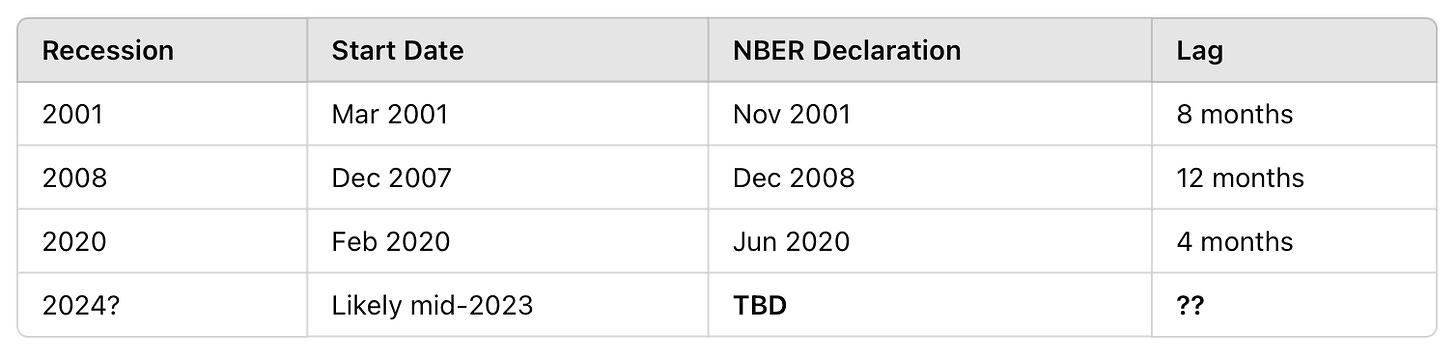

One key point is, emulating any good government-non-governmnet agency, NBER declares recessions months after they start—only when the decline is confirmed and widespread.

Notice the last line there? That little TBD?

Yeah, let’s talk about that.

🧐 What Is the LEI Saying?

"Ten signals. One powerful warning system."

First, what exactly is this Leading Economic Indicators signal, or LEI for short, comprised of? What makes it supposedly so accurate?

The 10 Components of the LEI:

OK, great. Looks like a lot of pertinent info in the LEI, assuming the numbers, surveys, and reports are all accurate.

So, what is the LEI telling us today? We got a peek into a conclusion in today’s Inspirational Tweet. But what else is the LEI saying?

What’s the full story?

To get that, all we need to do is see what the Conference Board itself is saying. Get it straight from the horse’s mouth, so to speak.

In a report the CB just recently published we get some serious insight into their thinking and the reality of what is going on in the economy.

Boy oh boy, is it juicy.

And not in a good way.

Let’s dig into the four main indicators the CB likes to use as signals of a recession.

📉 Signal #1: The LEI Peak

The LEI typically peaks months before the broader economy does. When the index stops rising and starts falling, it's one of the earliest signs of a coming downturn.

Historically, it peaks 11–12 months beforea recession officially begins.

And so, where has the LEI been vs where it is now?

What we see is that the LEI has declined for 23 consecutive months. Historically, that kind of prolonged decline has always preceded a recession.

In February 2025, it fell again to 101.1, down 1.0% over the last six months.

As the CB itself said itself in the report:

“On average, the LEI level peaks 11–12 months ahead of a peak in the business cycle... The most recent data show that the LEI peaked in February 2022 and has been trending downward since then.”

— Conference Board

Recession indicated.

What about the next signal?

📉Signal #2: The Timelier Signal

When the 6-month growth rate of the LEI falls more than 4% (annualized), it's a strong signal that economic momentum is deteriorating.

In other words, if the index falls about 2% over a 6-month period, that translates to a -4% annualized rate—and a red flag would triggered.

Got it. How’s it look on the chart?

Oops.

Looks like the 6-month growth rate of the LEI fell below zero in May 2022 and deteriorated further to -6.3%—well beyond the historical threshold.

This kind of sharp, sustained drop has preceded the last three recessions—and this latest drop is worse than the median historical downturn.

Key Rule: A drop of more than 5% from the LEI’s all-time high has historically meant a recession is in progress 100% of the time.

From the Conference Board:

"When the US LEI falls more than 4 percent over a span of six months, it enters recessionary territory. According to the latest available data shown in Chart 2, this rate of change is at -6.3 percent, signaling an increasing likelihood of a recession"

— The Conference Board

Great. But that’s only two of the four main indicators the CB looks at with the LEI.

What other indicators do they see?