💡 Is the Stock Market About to Become a 24/7 Casino?

Issue 197

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What Is 23/5 Trading (And Why Now)?

The $17 Trillion Force Behind the Move

Seven Outcomes You Need to Know

What This Means for Your Portfolio

Inspirational Tweet:

The stock market is on the verge of changing in a way it hasn’t in over a century.

And Wall Street is losing its mind over it.

One major bank’s trading desk called it “literally the worst thing in the world.”

Perhaps that sounds a bit dramatic, but it definitely raises some questions.

Like, who actually benefits from a stock market that never sleeps? And, is this about serving investors better, or is it just all about fees, fees and more fees for you and me?

Well, we are going to dig into this and more today, because this actually will affect you and your portfolio, whether you are on board with it or not.

So go ahead and pour yourself a big cup of coffee, and settle into your favorite chair as we explore what happens when the world’s largest stock exchange decides that eight hours of rest is seven hours too many with this Sunday’s Informationist.

Partner spot

Bitcoin in 2025: A Year in Review—A shifting landscape in law, liquidity, and legacy

Was 2025 just underwhelming, or did bitcoin quietly lay the groundwork for an extended bull run?

Watch and listen to Conner Brown, James Lavish, and Preston Pysh join Unchained for a high-signal breakdown of the forces that defined bitcoin this year.

They’ll cover:

How 2025’s macro and liquidity shifts reshaped bitcoin’s market footing

The policy developments in Washington that carried the most weight

What this year’s inflection points reveal about bitcoin’s long-term direction

If you want clarity on what 2025 really meant for bitcoin—and how to think about the road ahead—this is the event.

It’s all online and free to attend!

🤓 What Is 23/5 Trading (And Why Now)?

Last week, Nasdaq filed paperwork with the SEC to extend trading hours from 16 hours (including current after-hours trading) to 23 hours per day, five days a week.

If approved, the new schedule would launch in the second half of 2026.

Before we get into what’s changing, let’s look at how it works today.

The Current Structure:

Right now, Nasdaq operates three daily sessions during weekdays:

Pre-market: 4:00am to 9:30am Eastern

Regular market: 9:30am to 4:00pm Eastern (the famous opening and closing bells)

Post-market: 4:00pm to 8:00pm Eastern

That’s 16 hours of trading.

Then the markets go dark. From 8pm to 4am, eight full hours, there’s no trading on major US exchanges.

Sure, some off-exchange venues like Blue Ocean ATS allow overnight trading for those who really want it. But these are small, super illiquid, and most investors don’t even know they exist.

For all practical purposes, US equity markets sleep from 8pm to 4am.

The New Structure:

Under Nasdaq’s proposal, here’s what changes:

Day session: 4:00am to 8:00pm Eastern (same window as today, just consolidated into one session)

Maintenance break: 8:00pm to 9:00pm Eastern (one hour for clearing, testing, and settlement)

Night session: 9:00pm to 4:00am Eastern

The trading week would kick off Sunday at 9pm and wrap up Friday at 8pm.

That’s 23 hours a day, five days a week.

One hour of rest. That’s it.

Good Lord.

The opening bell at 9:30am and closing bell at 4pm would remain, but they would be more symbolic than functional. And the trading action around them? That looks to be nothing like before.

How?

Well, let’s have a peek into the history of US exchanges first, shall we?

First of all, official market trading hours on major exchanges like the NYSE and Nasdaq have barely changed in over 100 years.

If you’ve even seen the movie Wall Street with Michael Douglas and Charlie Sheen, then you know that, traditionally, trades were placed in person on trading floors by brokers scribbling orders on paper. When I was a clerk on the floor of the NYSE in 1994, this is exactly how we did it.

Chaos. Mayhem. Absolutely physically exhausting.

Markets closed because humans needed to go home and rest. The closing bell wasn’t merely symbolic. It was logistical. And back in the old old days, someone had to feed the horses.

Flash forward, and telephones eventually replaced shouting across the floor. Then computers replaced telephones. Now algorithms execute millions of trades per second without a single human involved.

And yet, somehow, we’ve kept the same basic schedule that made sense when Teddy Roosevelt was president.

The machines don’t need sleep. The question is: do we? Or more precisely, do the exchanges care whether we do?

And why is this happening in 2026 and not 2006 or 2016?

Three reasons, and only one of them is about you.

First, the plumbing is finally ready. The Depository Trust and Clearing Corporation (DTCC), the central hub that settles stock trades, is scheduled to roll out 24-hour clearing for equities by the end of 2026. Without that infrastructure, extended trading would be a mess of unsettled trades and counterparty chaos.

Second, the competition is heating up. The New York Stock Exchange announced its own plans for 22-hour trading earlier this year, with initial SEC approval already in hand. Cboe Global Markets is also pushing into extended hours.

Bottom line, Nasdaq can’t afford to sit on the sidelines here.

Third, and this is the big one, there’s $17 trillion worth of demand knocking on the door.

But we’ll get to that in a moment.

First…

Not everyone is celebrating.

Wells Fargo’s trading desk sent a note to clients that called it “literally the worst thing in the world,” arguing it “single-handedly gamifies the stock market even more than it has already become.”

Ouch.

Their concern? Liquidity. Or rather, the lack of it.

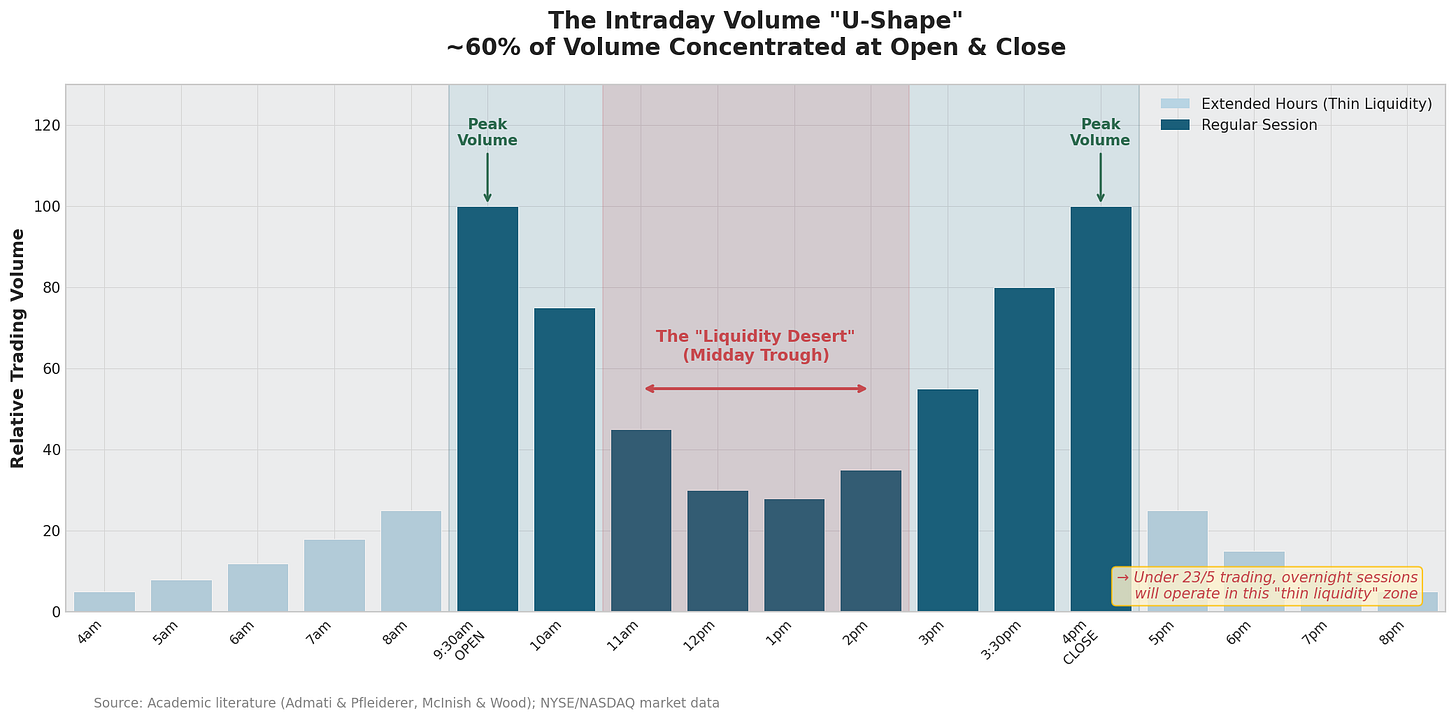

See, most trading volume already clusters around two windows: the market open and the market close. That’s when institutions are most active, when spreads are tightest, and when price discovery actually works.

Look at this chart.

Called the “U-shape” pattern, it’s one of the most well-documented phenomena in market microstructure research. Volume spikes at the open, drops during the middle of the day, then spikes again at the close.

Stretching trading hours doesn’t magically create more liquidity. It just spreads the existing liquidity thinner across more hours.

As Wells Fargo put it: “Most of the complaints that I hear on market structure are about how bad volumes are as most comes in around the open and close. And the industry move is to then elongate the trading day even further? This makes no sense at all.”

Good point.

But here’s the thing: this isn’t realy what Wall Street wants.

It’s about what $17 trillion of foreign capital wants.

Let’s talk about that, because it is critical to the equation and will undoubtedly impact US investors, too.

🧐 The $17 Trillion Force Behind the Move

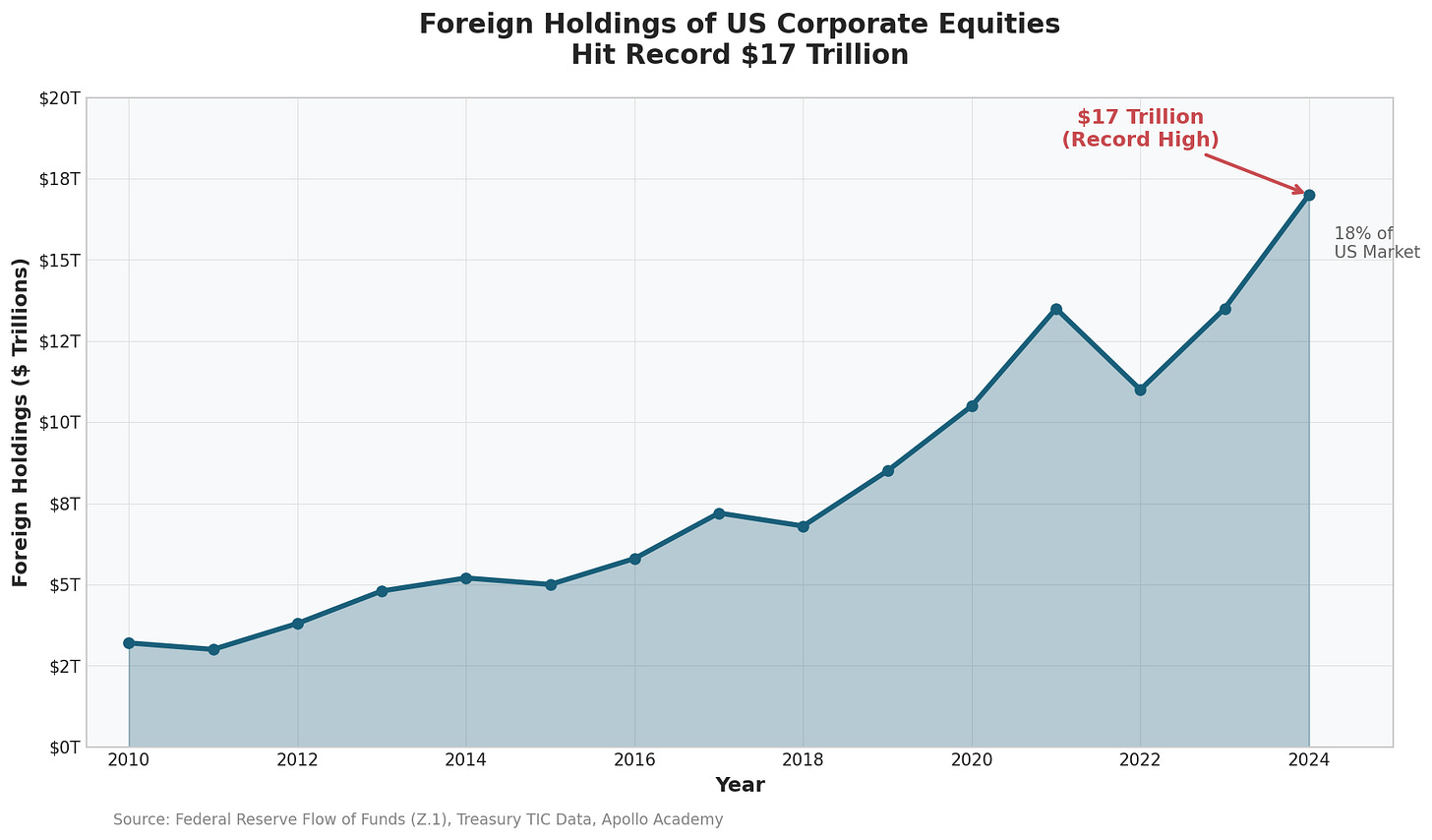

Here’s a number that may explain exactly what’s driving this continued move to extending more and more hours of trading in US markets: foreign investors now hold approximately $17 trillion in US equities.

Not total foreign investment in all US assets. Just stocks.

According to the latest Treasury data, foreigners now own about 18% of the entire US stock market, a record high. And that number has been climbing steadily for years.

Now here’s the question that answers why Nasdaq is doing this: what do those investors want?