💡 Is the Fed Doing Stealth QE?

Issue 171

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

QE and the Fed

SOMA Activity

QE Is Coming

Inspirational Tweet:

QE. “Not QE.” Stealth QE.

So, which is it? Or are they all wrong?

There has been immense confusion lately on Fin-Twit about the latest moves by the Fed, particularly during US Treasury official auctions.

Some influencers are claiming that the Fed has been buying US Treasuries from the, er…Treasury…during recent auctions. And activity at the 20-year auction last month set off a vicious debate on X.

But what are we talking about anyway, and who is right? What is the Fed doing? Are they doing so-called ‘quantitative easing’? And if so, why? Or why not?

If this all sounds confusing and foreign to you, have no fear, as we are going to unpack all of it, nice and easy as always.

So, pour yourself a big cup of coffee and settle into a super comfy seat for a peek behind the Fed curtain with this Sunday’s Informationist.

🤓 QE and the Fed

Let’s start with the basics, shall we?

Quantitative Easing (QE) is the policy tool the Federal Reserve turns to when traditional interest rate cuts are no longer enough.

This is where the Fed purchases financial assets — primarily U.S. Treasuries and agency mortgage-backed securities (MBS) — to inject liquidity into the financial system.

How?

By pressing a button and printing more money.

The actual logistics are oversimplified here, but the concept is really as simple as that.

But QE is not just about buying bonds. It’s about changing the structure of financial markets, shifting risk preferences, and reinforcing forward guidance. And understanding how QE works — and what it isn’t — is critical to cutting through the noise today.

A Quick QE Primer

QE (and expansion of the money supply) is used by the Fed to:

Lower long-term borrowing costs by reducing yields on Treasuries and MBS

Encourage lending and investment by making risk-free assets less attractive

Boost asset prices to create a wealth effect and support consumer confidence

Ease financial conditions and increase the availability of credit

Unlike rate cuts that function through short-term interbank lending, QE works by altering the supply-demand dynamics of longer-duration securities, compressing term premiums, and encouraging investors to move further out on the risk curve.

How it actually works:

The Fed buys Treasuries and MBS from primary dealers in the open market.

The Fed pays for these assets by creating bank reserves — a digital form of base money (the money printing).

This expands the Fed’s balance sheet and simultaneously increases reserves held by commercial banks.

The result? An increase in the monetary base, a drop in long-term yields, and pressure on asset prices to reflate.

These newly created reserves are not “lent out” directly to consumers, but they do enable more lending by the banks.

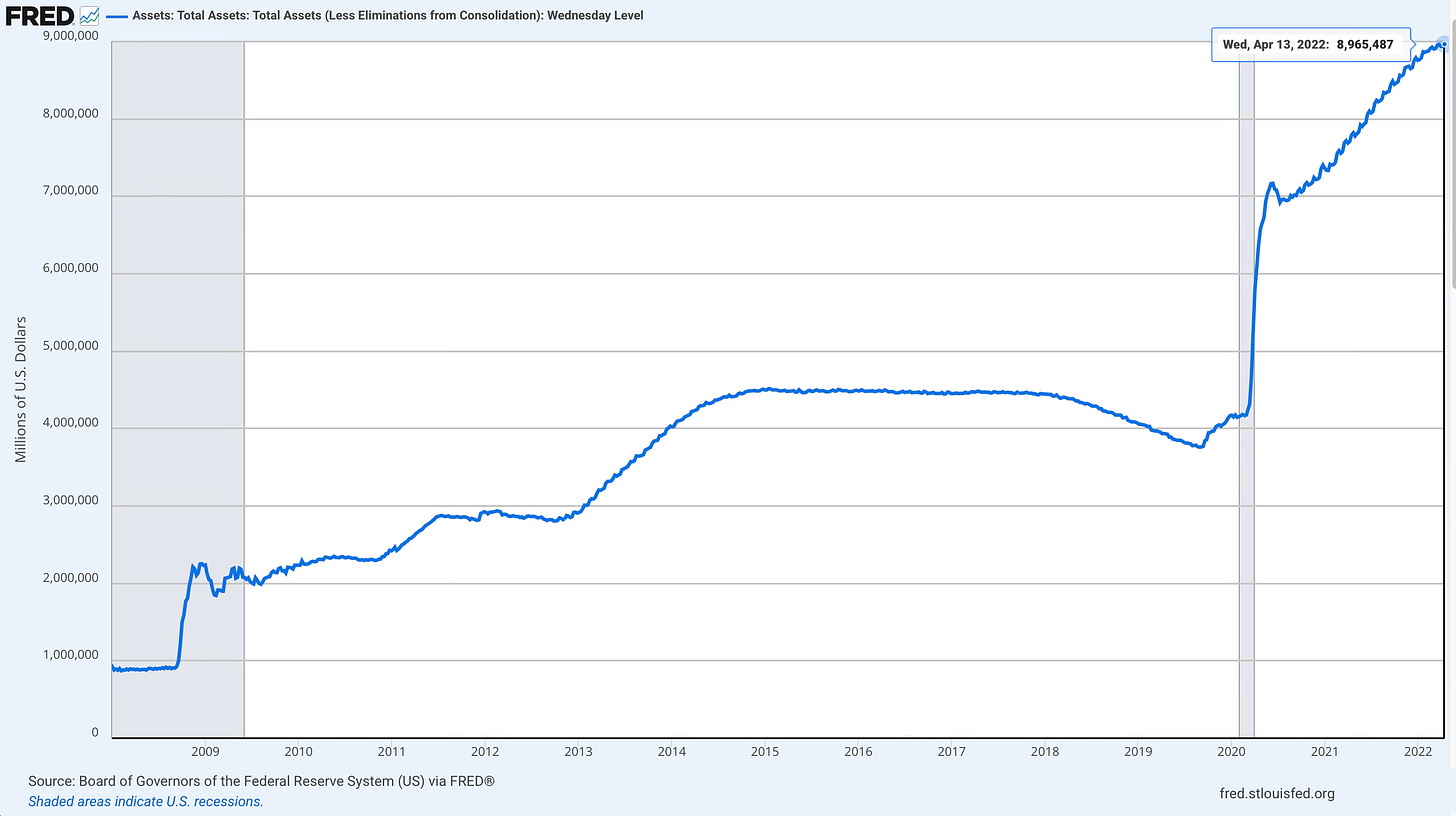

Here’s the Fed Balance Sheet from 2008 (The Great Financial Crisis) through 2022 (Covid QE):

We notice a spike in 2008 of over $1T, where the Fed ‘saved the bond markets’ (US Treasuries and Mortgages) by printing money and buying them in the open market.

Then we notice another massive spike in the assets between late 2019 and mid 2022.

That QE was to the tune of over $5 trillion. 🤯

And then the Fed placed them all on their own balance sheet. Brilliant.

According to the Federal Reserve Act, the Fed has a dual mandate:

Maximum employment

Stable prices

So where does QE fit into this? In fact, it seems that QE works in opposition to the second mandate of ‘stable prices’, as printing money and purchasing assets in the open market only inflates those assets and adds money into the system, which…?

You got it, causes inflation.

At some point, the Fed somehow decided that it also has a role of stabilizing the bond market, too.

And so, a third (unstated) mandate has emerged:

3. Financial market stability

And now, QE has become the Fed’s go-to tool when markets seize up — whether during the Global Financial Crisis in 2008, the eurozone debt flare-ups in 2011, the repo crisis in 2019, the COVID crash in 2020…

Or even with stealth programs under acronyms like the BTFP (Bank Term Funding Program) during the Silicon Valley Bank implosion of 2023 and the pending meltdown of all regional banks.

And so, QE has become not just a stimulus tool, but a crisis backstop (now nicknamed The Fed Put on Wall Street) and expected action to save the financial world from exuberance, undue risk, and irresponsibility.

As a result, these programs collectively grew the Fed’s balance sheet from ~$900B pre-crisis to over $8.9 trillion by 2022.

And markets responded accordingly (see the rate of change on an Index of 100):

Fed prints money → asset prices rise

And, of course, consumer goods prices rise, too:

And because the QE impact on consumer inflation began to rage out of control, the Fed stopped QE and began what is known as QT, or Quantitative Tightening.

I.e., shrinking its balance sheet by letting securities mature off its balance sheet, or with outright selling.

The current QE program is to let $25 billion of USTs mature monthly, without replacing them through additional purchases.

This means the Fed is not actively selling assets, but allowing their holdings to passively decline.

The goal: tighten financial conditions without raising rates even further.

However, there’s a wrinkle — if redemptions exceed these caps, the Fed will reinvest the excess principal.

And that brings us to all the confusion as of late.

🧐 SOMA Activity

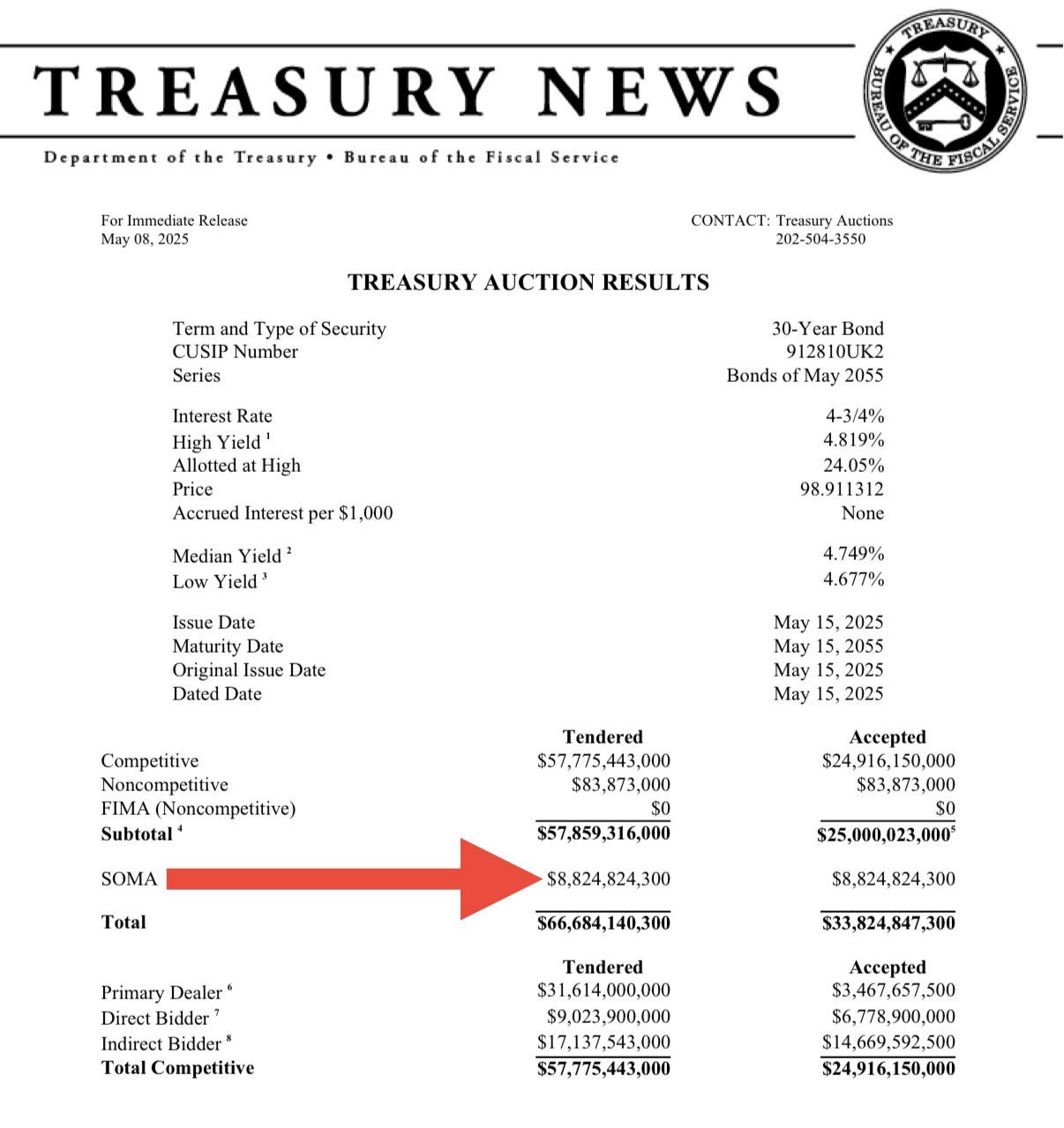

Another Treasury auction and another barrage of X posts exclaiming ‘QE’, ‘Not QE’ (sarcastic way of saying, ‘Yes QE’) and ‘Stealth QE’.

And a big red arrow pointing at what is known as SOMA activity.

Bold red arrows. Panic captions. And lots of “told you so” from the stealth-QE crowd.

But let’s pause for a moment and think this through logically.

Like intelligent investors.