💡 Is The Fed About to End QT (and Start QE Again)?

Issue 148

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Current Status of Bank Reserves

Current Status of the Reverse Repo Facility (RRP)

Current Status of the Fed’s Balance Sheet

When Do the Fed and Treasury Get Nervous?

Is It Time for QE?

Inspirational Tweet:

Bank reserves are dropping sharply and the Reverse Repo Facility is almost empty.

Does this signal the end to the Fed’s QT program, where they stop shrinking their own balance sheet, as @KobeissiLetter suggests above?

And why should you even care?

All good questions and ones we will tackle one by one today, nice and easy as always.

So, pour yourself a nice big cup of coffee and settle into your favorite comfortable chair for this Sunday’s edition of The Informationist.

🧐 Current Status of Bank Reserves

This has all happened before, of course. Bank reserves drying up and an ensuing liquidity crunch in the debt and capital markets.

If you recall the fall of 2019 (yes, just before the Covid debacle), credit markets suffered what was called a Repo Rate Spike, where the overnight rate for banks to borrow money from each other (by using US Treasuries as short-term collateral for that cash) skyrocketed.

See, US bank reserves had fallen to $1.5 trillion, too low to meet both regulatory requirements and the liquidity needs of the banking system.

As a result, the overnight repo rates spiked—as high as 10%—and disrupted the broader funding markets. The Fed was forced to intervene by injecting liquidity through ‘emergency repo operations’ and later resumed expanding its balance sheet by purchasing Treasury bills to ‘restore stability’.

I.e., Quantitative Easing or QE.

That’s right, QE had begun six months before Covid lockdowns.

In any case, this is why markets are tuned into the bank reserve levels and keeping an eye on them and overall liquidity.

And where do they stand now?

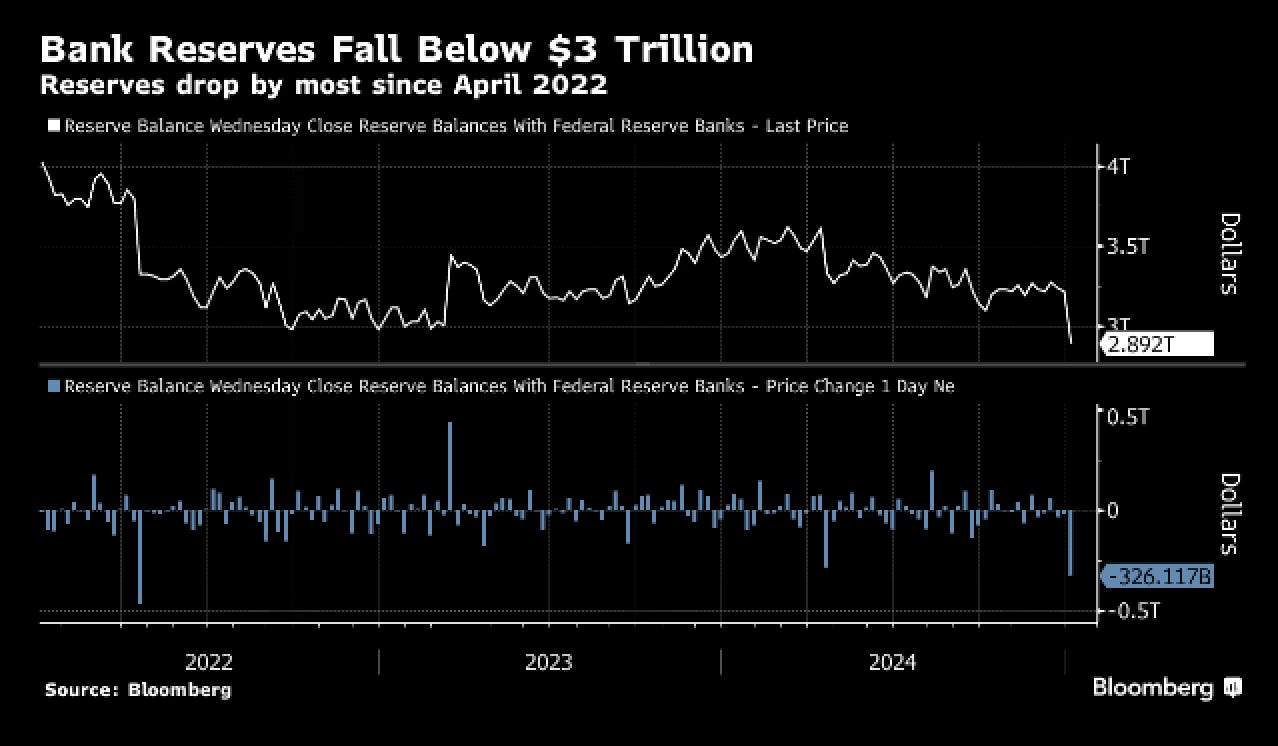

As of last week, reserves dropped to $2.89 trillion, the lowest level since October 2020.

Uh oh.

The decline of $326 billion in a single week was the largest weekly drop in over two and a half years.

Though year-end fluctuations are often because of balance sheet plumbing, the scale of this drop suggests a number of reasons, such as year-end balance sheet adjustments.

How?

Banks often reduce reserves at year-end to meet regulatory requirements, such as the Fed’s Liquidity Coverage Ratio (LCR) and internal measures.

Also, the decline coincides with a sharp increase in balances at the Reverse Repo (RRP) facility, which jumped $375 billion between Dec. 20th and Dec. 31st before then falling by $234 billion on Jan. 4th.

These kinds of moves often signal movement of cash to safer holdings as banks cut back on balance-sheet intensive activities.

OK. How does this compare to 2019?

In 2019, during the repo market crisis, the level of reserves was approximately $1.5 trillion. At that time, U.S. nominal GDP was around $21.4 trillion.

This pushed the 2019 bank reserves down to be approximately 7% of GDP.

With GDP currently at $29.5T today, and bank reserves down to $2.89T last week, the reserves currently represent approximately 10% of GDP.

But this is not the only factor that will determine the liquidity profile of the banks, as far as the Fed is concerned.

Remember, there was no reverse repo facility to speak of back in 2019, and the RRP represents excess liquidity in the system.

So, let’s peek in on that next.

🤔 Current Status of the Reverse Repo Facility (RRP)

As many of you know from reading my work, the Fed’s RRP facility has become a major tool for managing short-term liquidity.

Back when the Fed and Treasury printed trillions of dollars, many of the excess liquidity got ‘parked’ in the RRP through money market funds, etc.

It has been draining lower ever since, however, as the US Treasury piles on trillions and trillions of dollars of debt and soaks up the excess liquidity from the RRP by issuing attractive rates on short-term T-Bills.

Where does it stand?