💡 Is “Paper Bitcoin” Killing the Price?

Issue 204

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Paper Bitcoin Question

Paper vs Physical

The Basis Trade

What Actually Happened?

The Gold Precedent

Investment Implications

Inspirational Tweet:

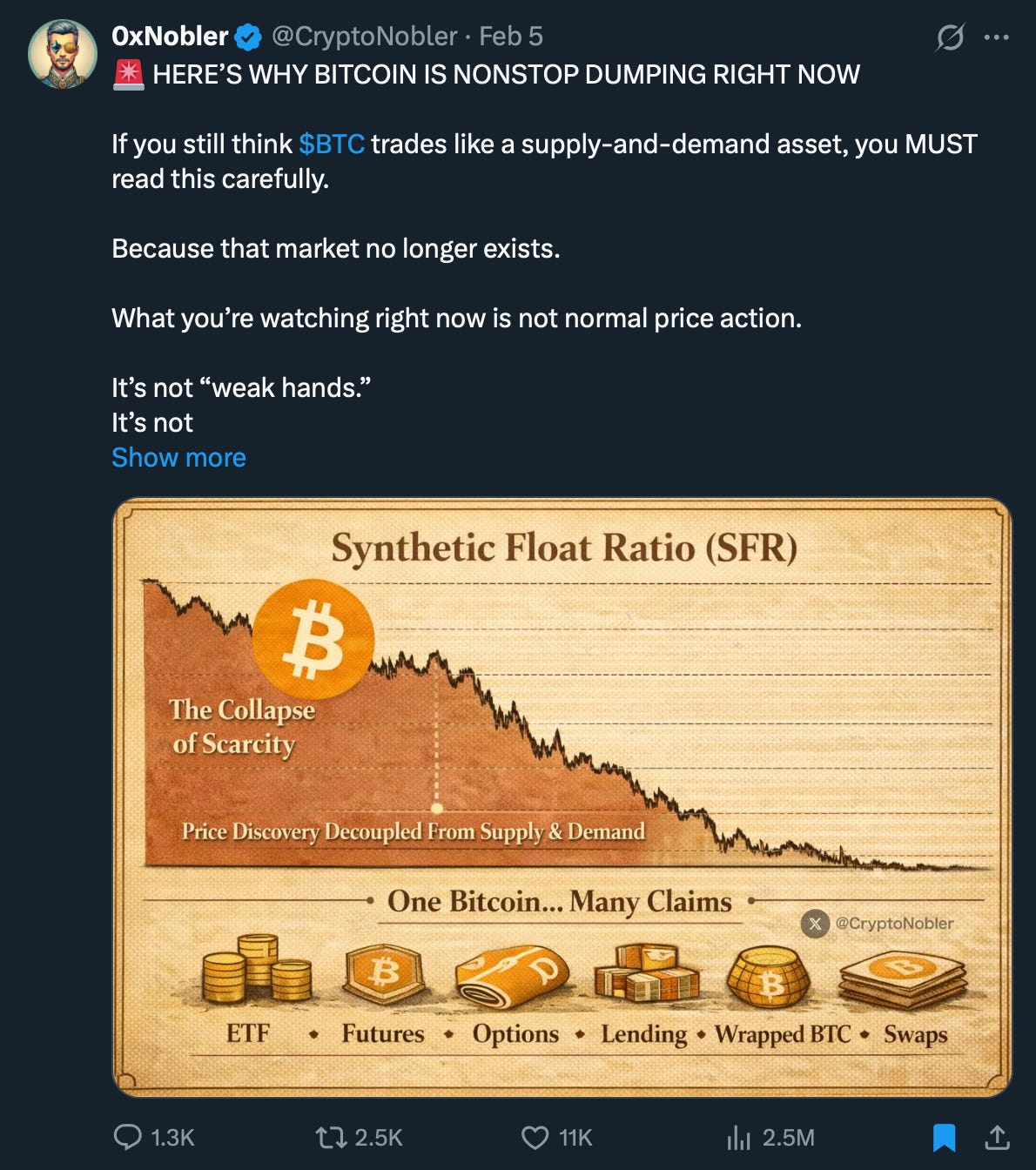

If your timeline looks anything like mine this week, you’ve seen some version of this argument everywhere.

“Paper Bitcoin is destroying price discovery.”

or maybe,

“One Bitcoin, many claims.”

And my favorite…

“Wall Street broke Bitcoin.”

And I honestly think this is a conversation worth having.

After all, Bitcoin has been steadily dropping for months, from $125K to $60K. It’s been rough to say the least.

When moves like that happen, people want answers. And the “paper Bitcoin” narrative offers a clean one: Wall Street created too much synthetic exposure, and it’s suppressing the real price.

Parts of that are true.

The question is, which of these products create exposure without touching actual coins, and can derivatives actually affect short-term price discovery? Negatively and/or positively?

Great questions that deserve serious consideration and answers, ones that we will sift through, nice and easy as always, here today.

So, pour yourself a big cup of coffee and settle into your favorite seat for a look into the world of paper Bitcoin with this Sunday’s Informationist.

Partner spot

The cracks in the foundations of money are becoming harder to ignore. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk.

In my latest report, The Debasement Trade, I walk you through:

Why debasement is structural, not cyclical

How inflation and financial repression challenge familiar portfolios

Why gold tends to move first—and bitcoin often moves further

Download the report here:

📰 The Paper Bitcoin Question

Let me show you two numbers.

As of mid-January, spot Bitcoin ETFs held approximately $120 billion worth of actual Bitcoin in cold storage. Remember, because they are spot ETFs, these funds are required to hold real Bitcoin equal to the value of their shares.

When money flows in, they must go and buy actual coins on the open market.

Real coins. Really purchased. Locked away.

And that’s just the ETFs. Billions of dollars worth of Bitcoin trade on exchanges like Coinbase and Binance every day, held by individuals and institutions alike. But since the ETFs report their holdings publicly, they give us the clearest window into institutional physical demand.

As for non-physical Bitcoin, in January derivatives markets carried roughly $125 billion in open interest across futures and options. These are much of the paper claims everyone is talking about.

Paper claims on an asset that has a hard cap of 21 million coins.

Paper claims exceeding all the ETF physical holdings.

And it gets wilder from there.

See, in the same month, Bitcoin derivatives were trading at roughly $196 billion in volume vs. spot BTC trading about $26 billion. That’s a 7.5-to-1 ratio.

In other words, for every dollar of real Bitcoin changing hands, seven and a half dollars of paper Bitcoin were trading alongside it.

So when people ask whether “paper Bitcoin” is affecting price discovery, the answer is obviously yes. At that scale, how could it not?

But here’s the thing.

Not all of that paper works the same way. Some products, like the spot ETFs, require actual Bitcoin to be purchased and held. Others, like CME futures, never touch a single satoshi.

And one of them, a massive trade most people have never heard of, explains a huge chunk of the ETF outflows (money leaving the Bitcoin ETFs) that made headlines all through January.

Understanding which is which changes how you read every headline about this selloff.

The “record shorts.” The ETF outflows. The liquidation cascades. All of it looks different once you see the mechanics underneath.

How?

Let’s walk through each of them, one by one.