💡 Is Microsoft About to Buy Bitcoin?

Issue 141

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Shareholder Voting 101

Microsoft’s Situation

Bitcoin Treasury Landscape

The Biggest Treasury of All

Inspirational Tweet:

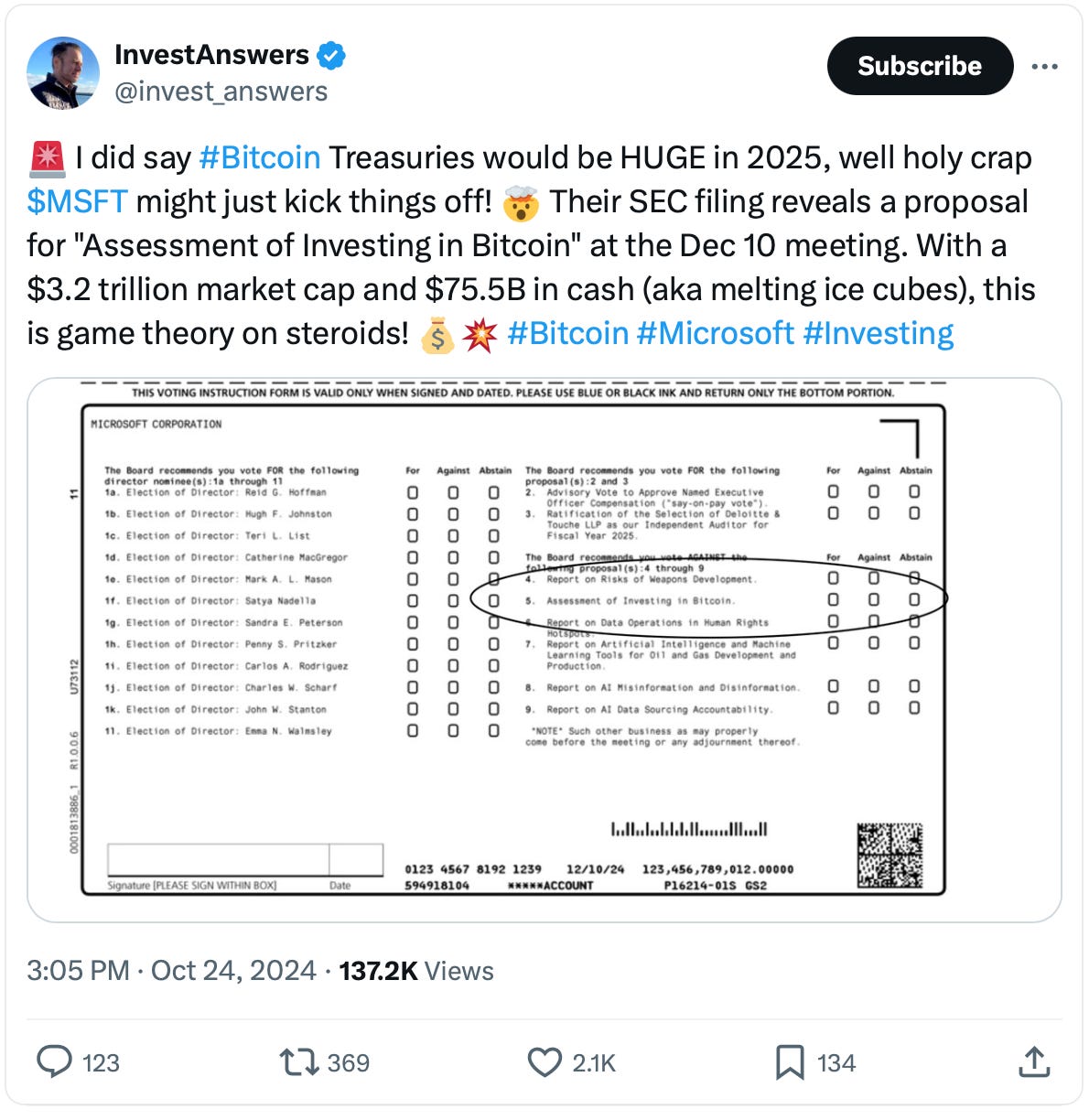

You may have heard Microsoft make some waves last week after publishing their Annual Meeting Voting Proxy that included a measure about Bitcoin.

Item 5, specifically, “Assessment of Investing in Bitcoin”.

Microsoft? Buying Bitcoin? What?

This understandably got Bitcoiners and investors all riled up one way or another, the possibility of an S&P 500—a MAG7 company, at that—taking the path of MicroStrategy and adding Bitcoin to its treasury.

Before we get ahead of ourselves, though, there are a few nuances to this situation that bear review. I.e., it’s not quite as simple and straightforward as it may seem on the surface.

But don’t worry, we are going to dive below that surface and uncover the challenges and realities, nice and easy as always, right here today.

So, grab a big old mug of coffee and settle into a nice comfortable seat for a peek into the world of proxies with this Sunday’s Informationist.

🤔 Shareholder Voting 101

Because public companies are primarily owned by the people who buy shares in the open market, a few layers of decision-making and oversight are created.

Shareholders have certain rights and powers to influence major decisions, typically through voting. Board Directors and executive management, on the other hand, are responsible for the day-to-day and strategic operation of the company.

Let’s break down how these groups interact in the voting process.

Shareholders

Shareholders have voting rights on key issues, such as electing board members, approving major corporate actions, and considering shareholder-submitted proposals.

And so, individual shareholders can submit proposals to be voted on by all shareholders, often on governance practices, executive compensation, or specific measures, like Bitcoin in corporate treasuries.

For such proposals to reach the proxy ballot, they must be reviewed by the board and meet certain regulatory requirements. Hold that thought, we will get back to it.

Directors and Management

Directors, elected by shareholders, have a fiduciary duty to act in the best interest of the company and its shareholders. They set strategic direction, and are supposed to ensure proper corporate governance. 🙄

Management, i.e., the CEO, CFO and other C-Suite handle the daily operations and implement the board’s strategic direction.

They are typically experienced and knowledgable in the specific field and operation of the company’s business.

Board Recommendations on Shareholder Proposals

Directors review shareholder proposals and decide whether to recommend FOR or AGAINST them. This recommendation signals to shareholders whether the board believes a proposal aligns with the company's strategy and risk tolerance.

Remember this part, it is quite important in the case of Microsoft and Bitcoin.

Proxy Advisory Firms

Wait, who?

That’s right, institutional investors often (the larger ones, almost exclusively) outsource their voting decisions to an advisory firm.

Firms like Institutional Shareholder Services (ISS) and Glass Lewis.

These firms analyze both the board’s recommendation and the potential impact on shareholder value, offering their own stance, which they then recommend to the investor.

Take the word analyze with a nice dose of salt, though, as ISS and Glass Lewis almost always recommend voting in-line with the board’s recommendation.

But there are a few instances where these firms recommend voting against the board’s recommendation, like:

an activist shareholder proposal (someone actively trying to change the direction of the company or oust board members for violating fiduciary duty, etc),

or mergers, especially when the board is recommending against a good merger just to save their own jobs or cash out at the expense of shareholders with a deal that undervalues the company.

But how often do institutions align with proxy firm recommendations?

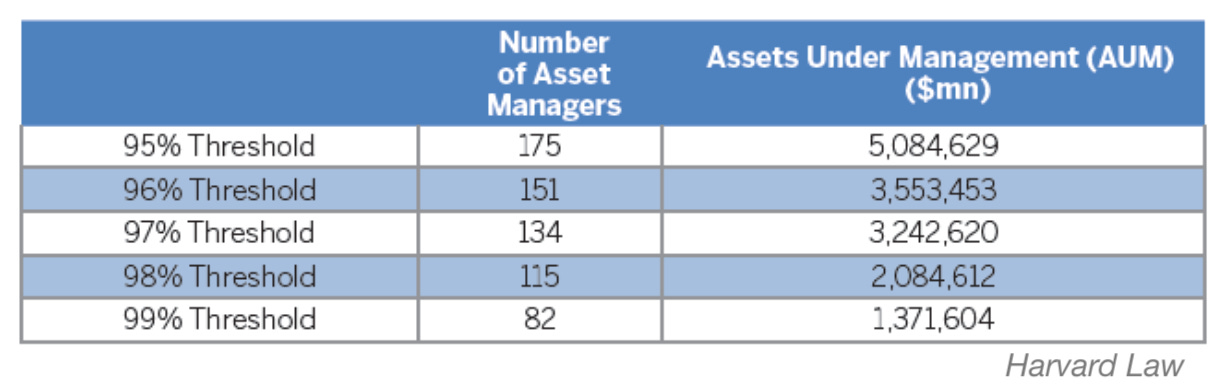

According to a 2018 study at Harvard Law, 175 asset managers with over $5T of AUM voted with ISS 95% of the time or more 🤯:

Quite often, then, it seems.

OK. So, where does this leave Microsoft and the Bitcoin proposal?

🧐 Microsoft’s Situation

As noted above, back in October, Microsoft announced that its shareholders would vote on a proposal to assess investing in Bitcoin during the annual meeting scheduled for December 10, 2024.

But how did this measure even hit the ballot?