💡Is BlackRock Buying Bitcoin?

Issue 156

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

Who is BlackRock?

BlackRock’s Bitcoin ETF

BlackRock’s Model Portfolios

Who Else is Buying Bitcoin?

Inspirational Tweet:

Ever since the Bitcoin Spot ETFs were launched one year ago, there has been a ton of confusion around announcements of BlackRock (and others) buying Bitcoin.

Are they buying it for their own funds? Are they buying it for IBIT, the BlackRock Bitcoin ETF?

And how does that even work? How can we tell the difference?

Well, if this confuses you, have no fear. Because we are going to unpack and demystify BlackRock and this ETF business once and for all here today.

And we are going to do it nice and easy, as always.

So, pour yourself a hot cup of coffee, and settle into your favorite seat for a peek behind the BlackRock curtain today with The Informationist.

Partner spot

America's Most Secure Mobile Service

Really quickly and before we start, I cannot stress this enough. If you’re not protecting yourself from cyber attacks and SIM-swaps, you’re at serious personal risk these days. After seeing four of my colleagues go through the nightmare of SIM-swaps (someone literally taking control of your phone from afar)—identities stolen, bank accounts compromised, emails hijacked, social media held for ransom—I knew I was at risk, too.

So, I switched to a service called Efani, and it was super easy and seamless. It feels just like being with Verizon or AT&T, but I can rest easy knowing that my phone is ultra-secure. My colleagues learned the hard way, but now we’re all on Efani, and I couldn’t be happier. I honestly wouldn’t share this with you if I didn’t completely believe in the service myself. Whether you use Efani or something else, please don’t wait until it’s too late to protect yourself.

And if you choose Efani by using the link below, you get $99 OFF.

The Efani SAFE plan is a bespoke cybersecurity-focused mobile service protecting high-risk individuals against mobile hacks, providing best in class protection with 11-layers of proprietary authentication backed with $5M Insurance Coverage. Don’t wait. Protect yourself today.

🧐 Who is BlackRock?

BlackRock. A name that strikes both awe and fear when many investors hear it.

And why not, the firm is a Wall Street behemoth. So big, so powerful that it can influence financial followers and leaders alike, move markets, set trends and paces.

Globally.

But who the heck are they, and where did they come from?

Founded in 1988 by Larry Fink and a group of former investment bankers, BlackRock started as a risk management and fixed-income firm. But over the last three decades, it has transformed itself into a global financial powerhouse with over $10.5 trillion in assets under management (AUM).

That’s larger than the economies of many countries.

The transformation:

1988 – BlackRock founded as a subsidiary of Blackstone under the name “Blackstone Financial Management”

1992 – BlackRock becomes independent from Blackstone

1999 – BlackRock goes public with an IPO on the NYSE

2006 – BlackRock acquires Merrill Lynch Investment Management and doubles its AUM to $1 trillion

2009 – BlackRock buys Barclays Global Investors (BGI) for $13.5 billion, for its iShares ETF business (a brand now dominant in global ETFs)

2020s – BlackRock becomes the go-to institutional player, now advising governments and managing pension funds

Fast forward to today, BlackRock, with its $10.5 trillion in AUM, is the single most powerful force in institutional investing. It owns stakes in nearly every major U.S. corporation and is a top shareholder in Apple, Microsoft, Google, Amazon, and JPMorgan Chase.

At its epicenter, Larry Fink—once an obscure bond trader at First Boston and now BlackRock’s co-founder, chairman, and CEO—has become one of the most powerful voices in global finance.

But Fink was not always a Bitcoin proponent. Like many Wall Street so-called ‘experts’ (looking in the mirror here 😅) Fink has had a Bitcoin evolution, too.

BlackRock’s Stance on Bitcoin

2017: Larry Fink calls Bitcoin an “index of money laundering”

2020: BlackRock starts researching Bitcoin’s role in portfolios

2023: BlackRock files for a Bitcoin ETF (IBIT), signaling a major institutional shift

2024: Fink calls Bitcoin “an international asset” and says “Bitcoin is digital gold”

💬 Larry Fink on Bitcoin Today:

"Bitcoin is an asset class that people around the world want to play in. It has caught the imagination of so many people."

This shift has helped change the entire institutional Bitcoin narrative. When BlackRock went all-in, other firms took note, with Fidelity, VanEck, Franklin Templeton and others rushing in to create their own Bitcoin spot ETFs to compete.

Most importantly, though, BlackRock’s creation of the IBIT spot Bitcoin ETF legitimized Bitcoin for institutional investors.

🟠 BlackRock’s ETF

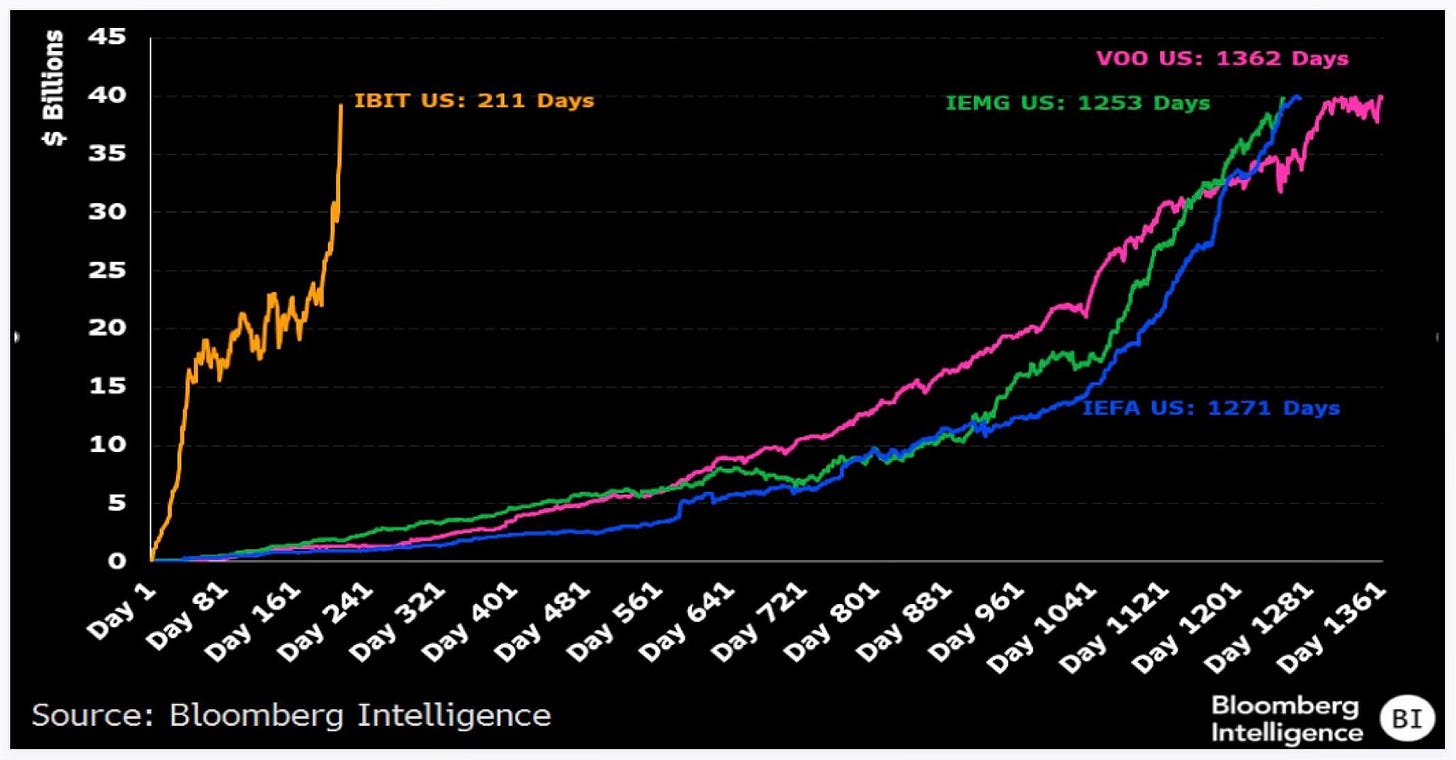

Put simply, BlackRock’s Bitcoin ETF (IBIT) was the most successful launch of any ETF in market history.

IBIT gathered over $50 billion in assets before a full year and took in $40 billion of those in the first 211 days, outpacing the other three best ETF launches by a large large margin.

But how does the ETF work, and what’s the confusion around BlackRock buying Bitcoin for its ETF versus for itself?

Part of the confusion comes around the fact that BlackRock’s iShares Bitcoin Trust ETF (IBIT) is a spot Bitcoin ETF.

This means that it directly holds Bitcoin rather than futures contracts. To fully understand how IBIT operates, we need to break it down into three key components:

Creation and Redemption Process (Authorized Participants)

Custody and Storage (Who Holds the Bitcoin?)

How Demand Affects Bitcoin Market Supply

Creation and Redemption Process: How New IBIT Shares are Minted

Unlike traditional ETFs that hold stocks or bonds, IBIT holds Bitcoin as its underlying asset. The process of creating and redeeming IBIT shares is handled by Authorized Participants (APs)—large financial institutions responsible for ensuring that the ETF’s price remains in line with the actual price of Bitcoin.

Who are the Authorized Participants?

APs for IBIT are: Goldman Sachs, Citigroup, UBS, Citadel, Jane Street, and JPMorgan, as well as others

These firms create and redeem shares of IBIT based on market demand.

How IBIT Shares Are Created:

Investor Demand Increases – When more investors want IBIT, the Authorized Participants step in to create new shares

Bitcoin Acquisition – APs purchase Bitcoin from exchanges or over-the-counter (OTC) markets, creating upward pressure on Bitcoin’s price

Bitcoin is Delivered to Custodian – The acquired Bitcoin is transferred to Coinbase Custody (BlackRock’s custodian for IBIT)

ETF Shares Are Issued – In exchange for Bitcoin, BlackRock issues new IBIT shares, which APs distribute to the secondary market

How IBIT Shares Are Redeemed:

Investor Demand Decreases – If more investors sell IBIT shares than buy, APs redeem shares

Bitcoin is Released from Custody – The ETF sells Bitcoin, or transfers it back to the AP

APs Sell Bitcoin on the Open Market – creating downward pressure on Bitcoin’s price

Custody and Storage: Where is BlackRock’s Bitcoin Held?

Because BlackRock’s IBIT holds real Bitcoin, the security and custody of those assets are crucial.

Coinbase Custody Trust Company – BlackRock selected Coinbase Custody as the primary custodian for IBIT’s Bitcoin holdings

Coinbase Custody is a regulated and insured custodian that holds Bitcoin in a mix of hot and cold storage wallets (i.e, on exchange and ready to be traded or off-exchange and safe from potential hacks or heists)

The key here is that BlackRock itself does not hold the Bitcoin—it’s entirely managed by Coinbase Custody.

OK, so now we all understand that the ETF buying on exchanges, like the NYSE, is not BlackRock buying. What’s this about BlackRock buying its own ETFs for its own portfolios?

🤨 BlackRock’s Model Portfolios

As we saw in the headline of today’s Inspirational Tweet, BlackRock has officially added its own IBIT ETF to select model portfolios.

So, what does that mean, exactly?

Well, BlackRock’s Model Portfolios are pre-constructed investment strategies created for financial advisors, wealth managers, and institutional clients.

In other words, instead of picking individual investments, advisors can follow BlackRock’s portfolio blueprints to simplify decision-making for clients.

Maybe lazy. Maybe smart. Especially if a manager is overseeing hundreds or thousands of client portfolios and is in need of ready-made, diversified strategies.

The model portfolios themselves are managed by BlackRock Portfolio Managers, and include different strategies to balance stocks, bonds, and alternative assets.

How big are these portfolios?

$150 billion large.

To be clear though, the $150B+ in AUM isn’t in one centralized BlackRock account—instead, it’s spread across individual client accounts at various financial institutions, such as:

Wealth management firms → Morgan Stanley, Merrill Lynch, Wells Fargo, etc.

Independent RIA firms → Firms using platforms like Schwab or Fidelity

Broker-dealer networks → LPL Financial, Raymond James, Edward Jones

401(k) and retirement accounts → Plans that integrate BlackRock’s models

And so, when BlackRock adds IBIT to a model portfolio, it’s essentially endorsing Bitcoin as a legitimate asset that financial professionals can include in their allocations.

You may now be asking, which portfolio is BlackRock adding IBIT to, and how much is the allocation?

BlackRock has added IBIT to its "Target Allocation" model portfolios that include alternative assets and suggested a 1% to 2% allocation to IBIT within these portfolios.

Some quick math tells us that this could equate up to as much as $3 billion of IBIT buying.

That is 50% larger than Michael Saylor’s last convertible bond issue for Strategy.

And perhaps more importantly, it signals to other firms and managers that Bitcoin, and IBIT specifically, are appropriate to add to diversified portfolios.

What’s also interesting are the statements we have heard coming out of BlackRock in reference to Bitcoin and IBIT.

Samara Cohen, BlackRock’s Chief Investment Officer of ETF and Index Investments, said:

“We are seeing increasing demand from financial advisors and institutions looking for efficient ways to gain exposure to digital assets. Our decision to include IBIT in select model portfolios reflects our commitment to meeting client needs in an evolving investment landscape.”

Another BlackRock strategist added:

“Bitcoin has matured as an asset class, and we believe its low correlation to traditional investments can provide potential diversification benefits for long-term portfolios.”

Most notably, in a note to investors on February 27, BlackRock investment executive Gates said:

“We believe Bitcoin has long-term investment merit and can potentially provide unique and additive sources of diversification to portfolios.”

A few takeaways from this.

Clearly, client demand was a major driver, and advisors and institutions want Bitcoin exposure.

Bitcoin is becoming recognized for its diversification benefits, reducing correlation to traditional markets.

And BlackRock views Bitcoin as having long-term investment merit, rather than just short-term speculative appeal.

Of course, it doesn’t hurt to drive traffic toward its own record-setting Bitcoin ETF, IBIT. But, hey, who’s going to fault them for talking their book. AMIRIGHT?

I mean, it seems to be working, doesn’t it? 😏

In any case, one major point of significance is that BlackRock essentially just gave financial advisors permission to buy Bitcoin.

And so, slowly but surely, the narrative around Bitcoin is changing from ‘it’s too risky’ to ‘it's a viable portfolio asset.’

This puts lots of pressure on firms like Fidelity and Morgan Stanley and even those who have shunned Bitcoin entirely up until now (ahem, VANGUARD), to start adding Bitcoin to the own portfolios and investments.

And then pension funds and endowments will likely follow suit, too.

Unless they’re already adding Bitcoin to their portfolios, of course.

Let’s see who is adding already, shall we?

🤑 Who Else is Buying Bitcoin?

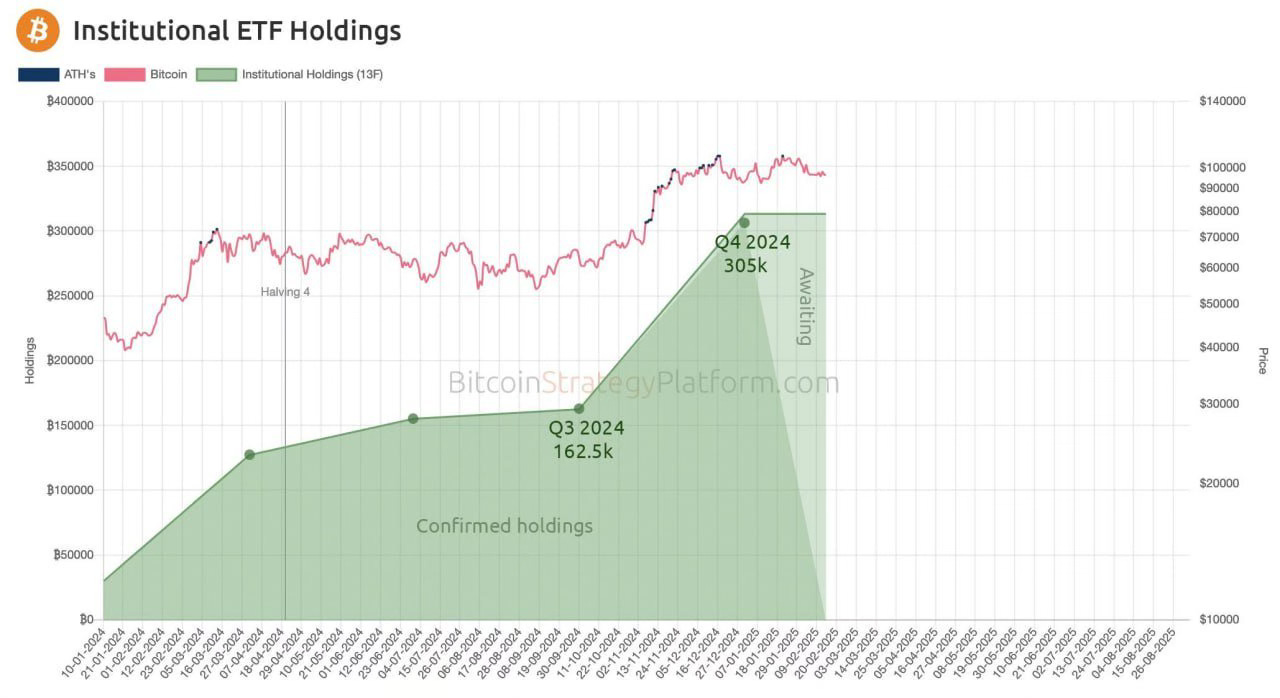

The reality is that BlackRock’s move into Bitcoin ETFs has opened the floodgates for institutional adoption.

As you can see here, the ETF influx of capital from institutions filing required SEC holdings is significant and growing:

But there’s still some confusion around the largest holders and what exactly they are doing with the Bitcoin they are reportedly holding.

There are a few major groups who have entered into the Bitcoin space with the various Bitcoin ETFs. We have:

Market Makers and APs

Hedge Funds

Traditional Asset Managers

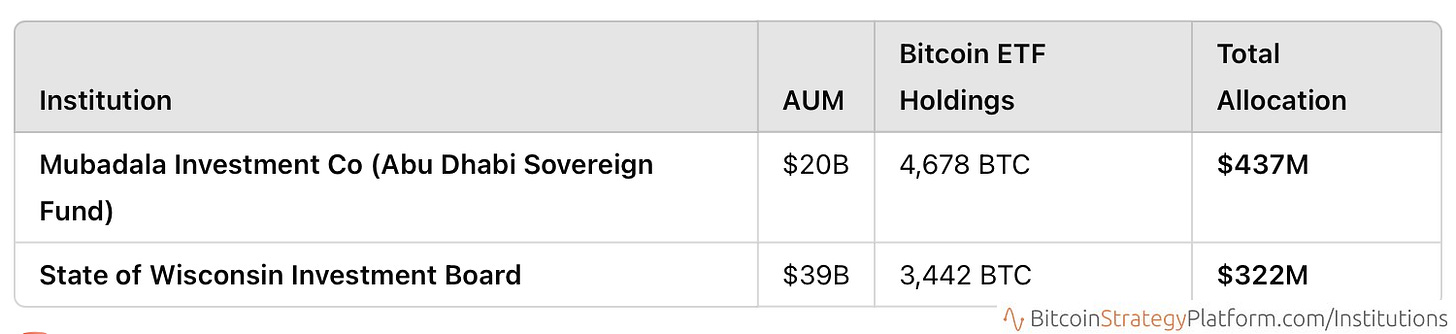

Sovereign Wealth and Pension Funds

Let’s have a look at each of these, shall we?

First, we have the market makers and Approved Participants, as described in the first section of this newsletter above. There are a few of these who are also hedge funds and so it is confusing, as well.

Like these:

Most of the above holdings are likely related to the market making and ETF Approved Participant activity. But they may also be holding for their own portfolios, at least the ETFs they are not in active market making, etc.

On that, hedge funds are among the most aggressive institutional buyers of Bitcoin ETFs, using them for long and short-term investment strategies as well as arbitrage.

Non-AP hedge funds with large holdings include:

I expect some of these investments are more opportunistic than long, long-term. I know certain hedge funds are arbitraging the price and borrowing costs, etc, versus the Bitcoin Futures market. This is called basis trading, and it is definitely an active space within the hedge fund community.

Others, however, have stated that they see Bitcoin as an essential long-term asset to have in portfolios for both diversification and performance.

Which leads us to traditional asset managers adding exposure to Bitcoin.

Again, the details around these holding are unclear.

Goldman is an Approved Participant, so they may be holding ETFs for market making and AP activities, but they’re also highly likely buying ETFs for their ultra-high net worth clients, the Private Wealth Management divisions.

The so-called sophisticated investors 😅 are finally getting on board with Bitcoin.

I know, I know, it’s about time.

Then we have sovereigns and pension funds. These are trickling in, but a couple notable ones are some of the largest holders.

And remember, with each government that adds Bitcoin to their sovereign wealth fund, there will be a growing amount of game theory that begins to gain steam and play out.

Translated: I expect numerous other sovereigns to start showing up in these holdings lists, and even more not showing up at all, as they quietly buy the real thing.

Bitcoin with no ETF.

And the same kind of game theory will begin to also play out—though to a lesser degree than sovereigns—with pension funds.

Because even though there is no direct currency devaluation issue with pension funds, there is a certain amount of competitiveness between them.

After all, some of you may remember the name David Swenson, the late CIO of Yale’s endowment. Well, back in the 1980s, Swenson began allocating to alternative investments, like hedge funds and private equity, in order to augment returns.

When other endowment CIOs and portfolio managers saw the returns David was generating with this strategy, they piled on and started adding alternatives to their own portfolios.

See how it works?

That’s right, my friends. Even Wall Street is full of sheep.

And now with BlackRock, Goldman, Millennium and others making major allocations, Bitcoin has officially crossed into institutional-grade investment status.

But it has only just begun.

The reality is that individual, small investors are still front-running what will likely be the largest rush into an asset in the history of the world.

Bitcoin will first demonetize gold, as it has already arguably begun.

Then it will demonize assets that people are using for stores of value, like art, collectibles, and to some degree, even real estate.

And then Bitcoin will come for bonds and Treasuries, the ultimate mantles for holding value versus inflation, the one that is already deeply flawed and returning negative real rates at the sovereign level.

And Bitcoin will grow from just a $2 trillion asset to $20 trillion, and someday $200 trillion.

Remember, I believe that Bitcoin is a long-term asset that will be volatile as it continues to be adopted as a truly separate asset class and store of value.

I think in years and decades, not days or weeks.

And I truly believe if you adopt the same thinking and add Bitcoin to your own portfolio, before the rest of Wall Street rushes in, then you will be extremely well-rewarded for being early, too.

That’s it. I hope you feel a little bit smarter knowing about BlackRock, its ETF and the institutional buyers involved.

If you enjoyed this free version of The Informationist and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️

Hi James - Excellent as always! Did have a quick question. Not clear to me from your Blackrock model portfolio discussion if Blackrock uses its own assets and actually buys shares in these funds, or merely offers these models as a guide for asset managers to follow in making purchases for clients. Can you clarify? Corey

How about a little cup of coffee like espresso? Is that ok too?