💡Is a Stagflation Storm on the Horizon?

Issue 164

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What is Stagflation?

Is It 1970 All Over Again?

Where Are We Now?

Protect Your Portfolio

Inspirational Tweet:

That nasty word has started creeping up again. You know, the one that makes you twist your face in disgust just like University of Michigan’s Professor Wolfers above.

That word, of course, is Stagflation.

Like anchovies and ketchup, as he says, two bad tastes mixed together.

I don’t know, I kind of like ketchup on a burger and fries, at least.

That’s me. I agree on the anchovies, though. 🤢

In any case, stagflation should leave a pretty sour taste in your mouth, it’s a terrible state of the economy.

But what exactly is stagflation, how does it happen, and is there a Stagflation Storm on the Horizon?

Good questions, and ones we will answer today, quickly and easily, as always.

So, grab a nice big cup of coffee and settle into your favorite seat for some stagflation exploration with this Sunday’s Informationist.

Partner spot

America's Most Secure Mobile Service

Really quickly and before we start, I cannot stress this enough. If you’re not protecting yourself from cyber attacks and SIM-swaps, you’re at serious personal risk these days. After seeing four of my colleagues go through the nightmare of SIM-swaps (someone literally taking control of your phone from afar)—identities stolen, bank accounts compromised, emails hijacked, social media held for ransom—I knew I was at risk, too.

So, I switched to a service called Efani, and it was super easy and seamless. It feels just like being with Verizon or AT&T, but I can rest easy knowing that my phone is ultra-secure. My colleagues learned the hard way, but now we’re all on Efani, and I couldn’t be happier. I honestly wouldn’t share this with you if I didn’t completely believe in the service myself. Whether you use Efani or something else, please don’t wait until it’s too late to protect yourself.

And if you choose Efani by using the link below, you get $99 OFF.

The Efani SAFE plan is a bespoke cybersecurity-focused mobile service protecting high-risk individuals against mobile hacks, providing best in class protection with 11-layers of proprietary authentication backed with $5M Insurance Coverage. Don’t wait. Protect yourself today.

🧐 What is Stagflation?

First things first, let's clearly define stagflation, its causes, and the results of this phenomenon.

Stagflation is kind of what it sounds like—an economic period where we have high inflation, high unemployment, and stagnant demand in the economy.

In other words:

stagnation + inflation = stagflation

Stagflation Key Characteristics:

High Inflation: Persistent increase in the prices of goods and services

High Unemployment: Workforce is unable to find jobs

Stagnant Demand: Slow or no growth in consumer demand for goods and services, due to reduced consumer confidence and spending power

Why is stagflation so painful? Because it squeezes both sides of the economy at once:

Prices are rising, which reduces purchasing power.

Wages aren't keeping up, and job growth stalls.

Consumers pull back, which reduces demand and corporate revenues.

In short: it’s a vicious cycle of rising costs and weakening economic momentum.

This chart put out by Apollo last week shows how the four major cycles we can find ourselves within the economy.

Starting on the upper right, we have Overheating which recently happened after the Fed printed $5T and dumped it into the economy. Like pouring the entire can of lighter fluid on a BBQ of coals.

Oops.

Opposite that, in the bottom left, we have Recession, or a contracting economy, the fire is dying down in that BBQ, a the heat is no longer hot enough to grill anything.

Pretty bad.

On the bottom right, we have the ideal scenario, Goldilocks. The BBQ fire is perfect: economy is just cruising along, you can cook steaks, chicken, whatever you want. It’s the perfect temp and everything is groovy.

In a word, ideal.

And the opposite of ideal?

You got it, the upper left of this quadrant, Stagflation.

This is where the fire of inflation has caught the side of the BBQ itself and now the metal is burning but you can’t grill anything. The flames are in the wrong place: you have high inflation and low GDP.

And here’s the bad news that we have been dancing around until now: that’s exactly where the US appears to be drifting today with stock market volatility, rate uncertainty, and a sluggish economy.

But before we jump to conclusions here, let’s take a peek at the last time the US economy experienced significant and prolonged stagflation.

That’s right, the 1970s.

🤔 Is It 1970 All Over Again?

Ah yes, the 1970s. The age of bad economies and great music.

If you're a Baby Boomer or fellow Gen X-er, then you know that a lot of that music was focused on the problems of the times. Like Bruce Springsteen's Born to Run and The River—songs about economic desperation, struggles of the working class, and loss of the American dream.

There was plenty to write and sing about. The economy was a mess.

One of the clearest historical examples of stagflation occurred during the 1973 oil crisis, when inflation rates skyrocketed, economic growth stagnated, and unemployment surged. The entire episode centered around energy—particularly the oil embargo from OPEC.

TL;DR: In October 1973, OPEC declared an oil embargo against the U.S. and several Western countries for their support of Israel during the Yom Kippur War. Oil prices quadrupled from $3 to $12 per barrel almost overnight.

This energy shock came on top of years of expansionary fiscal spending—from the Vietnam War and social programs—and easy monetary policy that had already expanded the money supply.

Sound familiar?

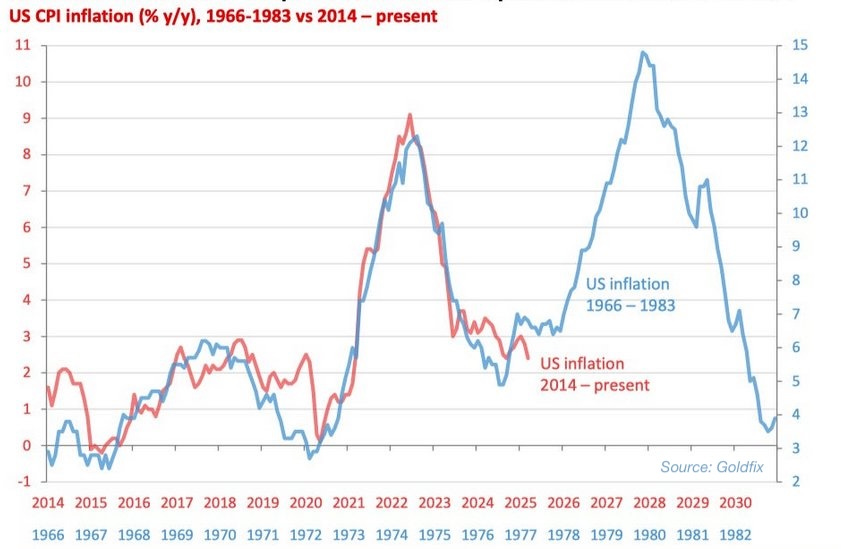

Take a look at this fantastic chart by 3Fourteen Research (@3F_Research on X).

It illustrates how energy inflation exploded in the 1970s, driving overall CPI much higher and triggering stagflation.

See, as energy prices rose, the cost of doing business spiked, leading to reduced industrial output, eroded consumer purchasing power, and a contraction in economic activity.

This created a feedback loop:

Higher costs → Less demand

Less demand → Lower output

Lower output → Job losses

By the time Fed Chair Paul Volcker came in 1979 and aggressively raised interest rates to crush inflation, the economy was already on the ropes. The early 1980s saw back-to-back recessions, 15%+ inflation, and unemployment pushing toward double digits.

The 1970s were a painful period of rising costs, falling output, and soaring unemployment—a textbook example of stagflation.

Now, fast-forward to today.

We’ve had massive fiscal stimulus, years of ultra-easy monetary policy, and geopolitical instability in energy-producing regions.

But there is one big difference: energy inflation isn’t driving this cycle.

This CPI overlay shows today’s inflation path (red) compared with the 1970s (blue).

The first surge looks similar, but we haven’t seen a second wave. Without an oil shock, we may avoid repeating the full 1970s playbook.

So far, the energy CPI has remained tame, but as global tensions rise, this remains a critical risk.

Still, the echoes of the 1970s are growing louder. Inflation is sticky. Growth is slowing. And uncertainty is rising.

Let’s see exactly where the economy stands now.

🫣 Where Are We Now?

Let’s connect the current dots:

GDP is shrinking.

The economy contracted by -0.3% in Q1 2025. That may sound small, but it’s the first quarterly decline since the post-COVID slowdown. It also contrasts with the high inflation backdrop, increasing the stagflationary risk.

Inflation is persistent.

The latest readings shows Core PCE stuck well above 2%, while GDP forecasts are collapsing. This kind of divergence rarely ends well for markets.

Manufacturing has stalled.

PMI indexes—especially new orders and employment—are hovering just above contraction. Prices are still elevated. This is a classic slowdown in output, with firms unable to pass along costs as easily.

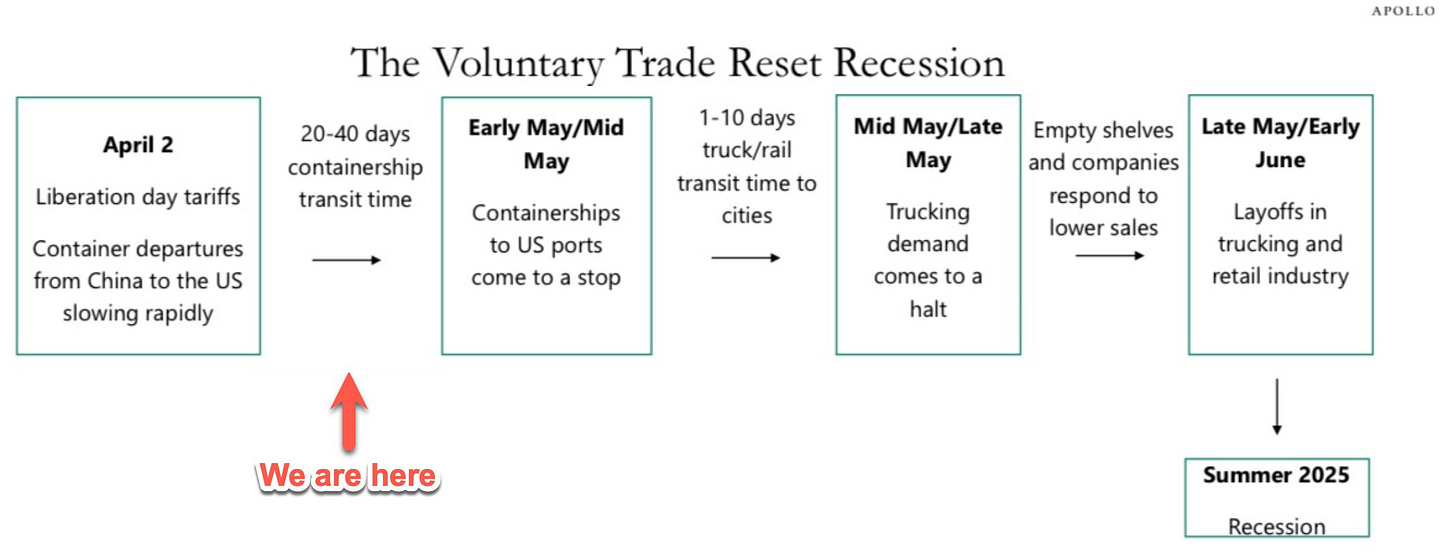

Tariffs may be this cycle’s oil shock.

In the 1970s, it was an oil embargo that disrupted global supply and sent inflation soaring. Today, we may be staring at a different kind of supply shock: one driven by tariffs and trade restrictions.

Apollo's "Voluntary Trade Reset Recession" map outlines the sequence:

Tariffs raise the cost of imported goods

Shipping delays and rerouted supply chains make goods scarce

Domestic production must ramp up (often inefficiently)

Businesses cut costs by reducing staff

This domino effect could produce a similar stagflationary outcome:

Higher prices (inflation)

Reduced output (slow growth)

Job cuts (rising unemployment)

We’re not there yet, but the early signs are flashing. Q1 GDP is already negative, core inflation is sticky, and global trade tensions are as hot as a BBQ that’s caught fire. 🔥

If this escalates, tariffs could serve the same role oil played in the 1970s: an external shock that hits both sides of the economy at once.

Whether that happens remains to be seen, but markets have absolutely shown plenty of concern around that uncertainty lately.

So, how do you protect yourself in this scenario?

🤓 Protect Your Portfolio

In stagflation, asset selection is often everything. You need protection from inflation and recession.

Some Core Principles

If you are into being exposed heavily to equites, all I can say is be cautious. How?

Look for pricing power: firms that can raise prices without losing customers

Favor real assets: those that can hold purchasing power over time

Avoid long-duration bonds: rate risk crushes their value in rising inflation

Avoid cyclical equities: they struggle in low growth environments

As a hedge fund manager of the Bitcoin Opportunity Fund, I’m not into general equities. And so, here is what I am holding in this specific environment and some added thoughts for you:

Lots of Bitcoin and Bitcoin related companies

True stores-of-value protect you against fiat debasement and negative real yields, and I choose Bitcoin as my SOV (if you have your limit of Bitcoin in your portfolio, you may want to add gold to the mix, and if you have all gold and no Bitcoin, I would highly recommend adding Bitcoin, too)

Bitcoin is increasingly being adopted as a digital hard asset with fixed supply and institutional demand, gold has established itself here

Cash? Use Short-duration T-Bills or Floating Rate Notes

The Bitcoin Opportunity Fund is on a Bitcoin standard, so we have no cash. If you do, I suggest you stay liquid and reduce exposure to long-term interest rate volatility by holding short-term USTs (like a money market account)

Strategic hedges

In our hedge fund, in particular, we are employing derivative and options strategies to enable us to continue to be fully invested in Bitcoin and Bitcoin-related companies while maintaining protection against systemic risk

Systemic risk refers to the potential for a shock—such as a major credit event, bank failure, or liquidity crisis—to trigger a chain reaction across the entire financial system, causing widespread asset selloffs and correlations to converge toward 1: i.e., all markets move together in a broad-based decline.

These hedges give us both peace of mind with our long exposures and help to mitigate some of the severe volatility we have seen in the markets lately.

But that is us and how we are positioned. You may have a higher tolerance for risk or be in a different position with your portfolio(s).

As long as you are being thoughtful and deliberate with how you are handling your exposures, that is good in my book and will help you weather any Stagflation Storm.

That’s it. I hope you feel a little bit smarter knowing about Stagflation, how and why it may occur, and how to position yourself to weather it.

If you enjoyed this free version of The Informationist and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️

What are your highest conviction BTC related companies/equities that have strong potential to outperform BTC?

James, would be interested to know if one is looking to deploy capital in the BTC Treasury company space, should one go with one of 1) the OG: MSTR - biggest best known - huge head start / most BTC 2) Metaplanet - Japanese OG - smaller less known biggest Asia based co - smaller size - perhaps more upside expanding Sh/er base 3) CEP / 21 Capital - Killer Oship (CF-Lutnick/Tether/Softbank but just starting out 4) ASST / Strive - Vivek Ramaswamy - also just starting out 5) OTHER player

1-4 All are well connected to Trump/Admin in one way or another.