Interest Rate Risks are Collapsing Banks

Issue 62

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

What is Interest Rate Risk?

Fed’s Breakdown of SVB

And Now…First Republic

Is the Banking Crisis Over?

What Can You Do?

Inspirational Tweet:

Sam makes a pretty good point here, doesn’t he? I mean, after the collapse of Silicon Valley Bank (SVB) the Fed stepped in to backstop the losses of regional banks by giving them special access to capital to ensure they remained solvent.

To prevent another bank failure.

Yet, here we are, just a few weeks later, staring down yet another meltdown. This time, the fourteenth largest bank in the US.

Even bigger than SVB.

So, what the heck happened? What is happening? And where do we go from here?

If this all seems daunting to you, no worries. We’re going to break it all down, nice and easy, as always, this morning.

But there’s a lot to cover.

So saddle up and settle in. It’s Informationist time.

Join the 🧠Informationist community and get access to every single post + the entire archive of articles for a fraction of the cost of a college finance course.

You’ll learn a whole lot more, faster and easier. That’s my guarantee.

Partner spot

Some of you have been asking recently what I read in the morning for fast, digestible news, and I’m happy to report that my new favorite source, hands down, is 1440.

The folks at 1440 scour over 100 sources every morning so you don't have to. You'll save time and start your day smarter. What more could you ask for?

Sign up for 1440 now and get your first issue, immediately. It's completely free—no catches, no nonsense, and absolutely no BS. I wouldn’t recommend it, if I wasn’t sure you’d love it, too.

Join 1440 for free today.

🧐 What is Interest Rate Risk?

If you’ve been bumping around Twitter recently or reading/listening to the news, you’ve likely heard the term interest rate risk.

Put simply, interest rate risk refers to the potential negative affects that fluctuations in interest rates can have on an investor or company’s financial position.

Banks, in particular, inherently have interest rate risk.

See, banks borrow and lend using instruments that involve both fixed and variable interest rates over different time horizons.

Remember this key phrase: different time horizons.

And so, changes in interest rates can affect the bank's net interest income (how much it earns from interest versus how much it pays on interest), the value of its assets and liabilities, and hence, its overall solvency.

There are a number of ways interest rate risks can affect the solvency of a bank. Let’s walk through them.

Repricing Risk

This happens when interest rates for loans and deposits mature at different times.

See, if a bank's loans have longer maturities than its deposits, a sudden increase in interest rates could lead to higher interest expenses without a corresponding increase in interest income.

That said, what we’ve experienced this last year is banks across the board refusing to pay higher rates on customer deposits, even though interest rates have skyrocketed in the past year.

Exhibit A:

Fed Funds is at 5% and they’re paying customers 15 basis points on deposits, keeping 97% of the spread for themselves.

Absolutely shameful.

Yield Curve Risk

We’ve talked about yield curves before and how inversions can negatively affect banks’ profitability. Basically there’s a risk that the shape of the yield curve changes unfavorably.

Much like repricing risk, if the curve flattens or inverts, this can negatively impact the bank's interest income and the value of its interest-earning assets. Depending on the severity, this can hurt a bank’s value of its loans and its ability to generate income.

Basis Risk

This occurs when the interest rates on assets and liabilities are based on different reference rates, leading to poor correlations between the two. A change in the spread between these reference rates can impact the bank's net interest income and overall solvency.

In English, please.

OK, let’s say a bank has issued an adjustable-rate mortgage (ARM) to a borrower that is linked to the 3-month LIBOR (London Interbank Offered Rate) rate. As 3-month LIBOR changes, the ARM will adjust accordingly.

At the same time, the bank has taken a short-term loan from another bank that is linked to the Fed Funds rate. As Fed Funds changes, the interest rate the bank pays on its short-term loan changes.

So, the bank's asset is linked to the 3-month LIBOR, and its liability is linked to Fed Funds. While similar, these do not always move in perfect correlation.

And so, if LIBOR decreases while the federal funds rate increases, the bank's interest income from the mortgage will decrease, while its interest expense on the short-term loan will increase.

Oops.

Optionality Risk

Some loans, such as mortgages and callable bonds, have embedded options that allow borrowers to prepay or refinance when interest rates fall.

This can lead to the early redemption of higher-yielding assets, forcing the bank to reinvest in lower-yielding assets, which could reduce its net interest income and solvency.

English, again.

Banks lose higher-paying loans and are forced to invest in lower-paying ones.

Market Risk

We’ve talked a lot about this recently, but basically changes in interest rates can change the value of the bank's assets (bonds) that it holds on its balance sheet as reserves.

And if the value of these investments drops, it impacts the bank's capital (reserves), leaving less capital on hand for customers to withdraw.

Now that we know what the main interest rate risks are for a bank, let’s take a peek at what the Fed itself just said about SVB, in its review of the recent meltdown.

Which risks did they miss?

Or ignore?

😱 Fed’s Breakdown of SVB

Just this week, the Fed released its own analysis of what happened with SVB and why the bank became insolvent, titled: Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank.

TL;DR: the review concluded:

“Silicon Valley Bank (SVB) failed because of a textbook case of mismanagement by the bank. Its senior leadership failed to manage basic interest rate and liquidity risk. Its board of directors failed to oversee senior leadership and hold them accountable. And Federal Reserve supervisors failed to take forceful enough action…”

While there’s far too much to unpack here, the report found that SVB failed to manage interest rate risk and its balance sheet in a few key ways.

From the report itself:

“SVB’s interest rate risk (IRR) policy did not specify scenarios to be run, how assumptions should be analyzed, how to conduct sensitivity analysis, or articulate model back-testing requirements”

Translated: management had absolutely no plan for market shocks 🫠

“When simple IRR results showed that there was a mismatch between … assets and liabilities on the bank’s balance sheet … SVB made model changes that reduced the level of risk depicted by the model”

Translated: management changed assumptions to hide risks rather than fix the actual balance sheet 🤥

“The bank [positioned] its balance sheet to protect against falling interest rates but not rising ones, and the bank [removed interest rate] hedges…Protecting profitability was the focus”

Translated: management made a bet on rates and removed hedges to profit more 😱

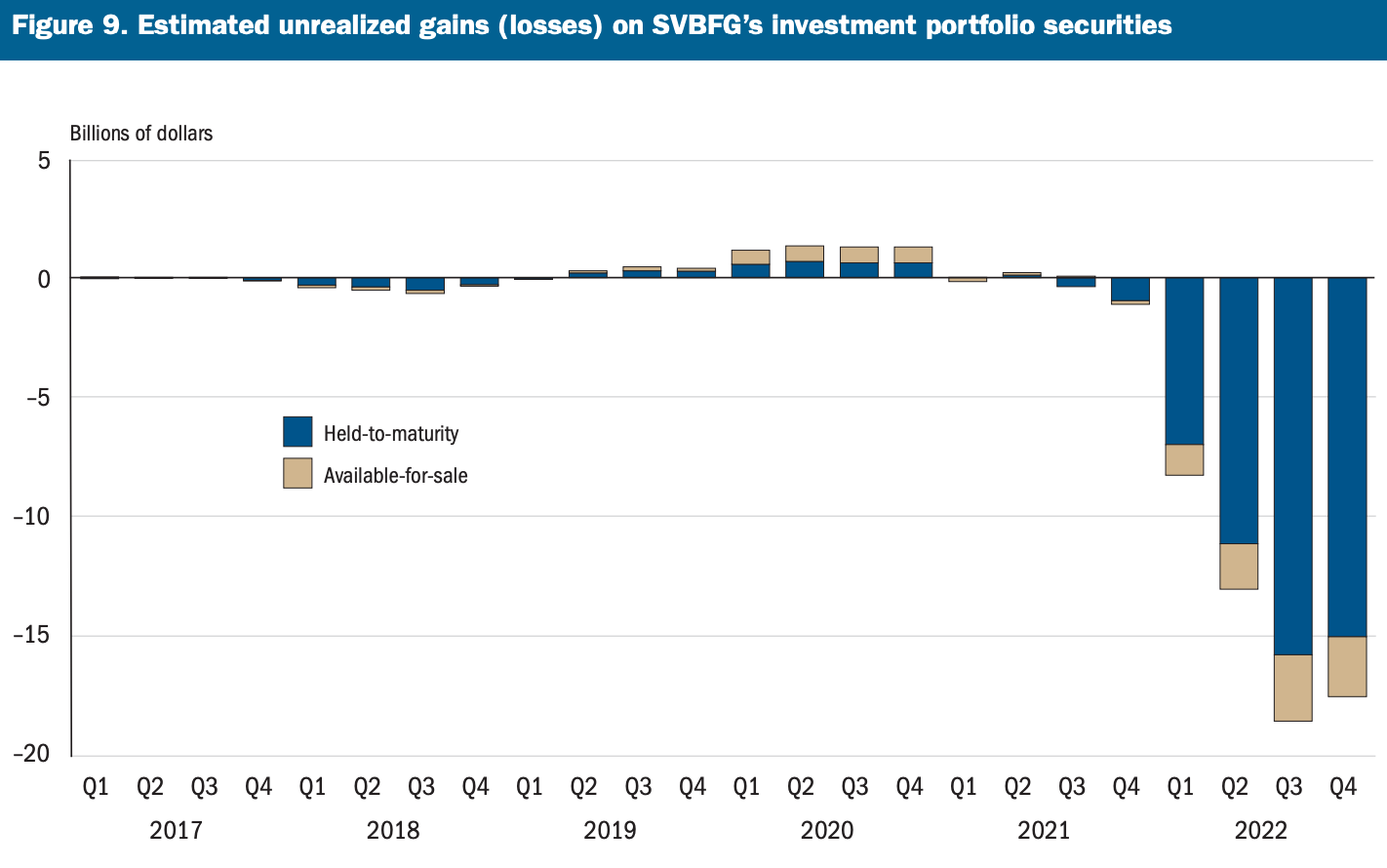

And… the result:

Yeah, not exactly shocking in context of the above.

Oh, but the Fed reviewed their own part in the shenanigans, saying:

“Federal Reserve supervisors identified some but not all of the interest rate risk-management issues

Supervisory responses for IRR were not rapid or severe enough”

Translated: yeah, yeah, we saw it, but it’s not our fault

So big of them to shoulder responsibility like that.

But we can assume it will never happen again, right?

I mean, everyone learned their lesson and we can move—

Wait, what do you mean, First Republic?

🤯 And Now…First Republic

While we still don’t know just how bad the situation is for First Republic, the FDIC has reportedly asked for large banks like JP Morgan and PNC Financial to submit bids to acquire the bank this weekend.

Interesting, since, as Sam points out in today’s Inspirational Tweet, First Republic has already borrowed over $105B in the last month to shore up its balance sheet.

It also received an injection of deposits totaling $30 billion from a group of 11 banks, including Bank of America, JP Morgan, and Wells Fargo.

Still. Not enough.

Apparently weighing heavily on First Republic’s balance sheet is a mountain of low-interest loans, which includes a huge portfolio of jumbo mortgages to wealthy clients.

According to Bloomberg, First Republic won super wealthy clients by offering them interest-only mortgages on about $20 billion of loans in San Francisco, Los Angeles, and New York alone.

Ahhh. California Dreamin’…

With markdowns on these mortgages and unrealized losses in bonds and loans, First Republic has a balance sheet hole that reportedly totals ~$30B.

A run on deposits has drained $100B from its reserves, and even though the stock traded all the way down below $3 yesterday, it’s actually mathematically worthless.

And so, enter JP Morgan and PNC. Like a couple of billionaires rummaging through fine china and junk at an estate sale.

The only two there.

Oh, except the Fed, orchestrating the whole deal.

🤨 Is the Banking Crisis Over?

Well, let’s say that we see a similar situation play out with First Republic that we did with SVB, and the depositors are made whole.

Does this calm down the market?

Well, it’s not really the market that’s a problem, it’s the banks themselves and their customers waking up to the fact that many of them have either poor risk management, or no risk management at all.

Many are exposed to the interest rate risks we outlined above.

Yet, the Fed concluded their SVB report, saying, “Our banking system is sound and resilient, with strong capital and liquidity.”

Uh huh.

Sounds a lot like:

“We see no bubble in home prices” in 2008, and “inflation is transitory” in 2021.

Because there’s a major mismatch here.

As it stands, there are roughly $17.2T deposits at banks in the US.

And the FDIC Deposit Insurance Fund, the account that collects insurance premiums from banks to guarantee all those deposits, has about $100B in it.

That’s a measly .58%.

Right, about 99.5% of those deposits have no real backing.

Except of course, the Fed itself.

And so, if they step in and guarantee all those First Republic deposits, just like they did with SVB, you can pretty much expect them to do the same with every bank.

Right?

So much for the ‘too big to fail’ requirement.

Yet, this is by no means any guarantee. And so any capital you have that is left in an account that is uninsured or exceeds the insured value, is also left up to the whims of the likes of Jerome Powell and Janet Yellen.

Do you trust them?

I sure don’t.

🤔 What Can You Do?

I’ve been saying it for many weeks now, I would be extremely careful about where my money is deposited and just how much I have at any one bank.

I personally do not have any deposits that are not covered by FDIC insurance, as I hold a large amount of cash in FDIC fully insured money market or cash-equivalent accounts.

I also own a large allocation of my personal portfolio in hard monies, like gold, silver, and Bitcoin. And finally, for excess cash that I don’t need access to, I hold super short-term US Treasuries and Bills.

This is a strategy that reflects a few of my personal opinions of the current market and what’s to come.

Because I personally calculate a high likelihood of a recession in the coming year. I also attach a significant probability (higher than 50%) that the Treasury stumbles over the debt ceiling and technically defaults, creating a dip in the markets and difficulty accessing certain UST liquidity until it is resolved.

And finally, I believe that the Fed ultimately has to step in and save the market financially, through another round of QE.

This is to prevent a total meltdown or economic depression-like scenario.

And the amount of money they will have to print to do this, IMO, will be staggering.

To recap:

Cash Equivalents (FDIC) → for opportunistic buying in market drawdowns

Short Term USTs → for additional yield on cash I don’t need access to, even if Treasury defaults (technical)

Gold, Silver, Bitcoin → Hard Monies for long term store of value, Bitcoin being the longest and hardest, will soar on M2 expansion

But that’s me, and everyone’s situation is different. I encourage each of you to dig in carefully and match your investments to your personal liquidity needs, appetite for risk, and long-term goals.

And for God’s sake, don’t do what SVB did, and just stick your melon in the sand.

That’s it. I hope you feel a little bit smarter knowing about interest rate risks and what’s been going on with all the banks recently. If you enjoyed this newsletter and know someone you think would like it too, please share with them!

And if you are a paid subscriber, leave a comment, answer a comment, join the awesome 🧠Informationist community below!✌️

✌️Talk soon,

James

Thanks, James. I am telling you, getting into Bitcoin has introduced me to thinkers like you, and in my early 50s, I finally can wrap my mind around “Macro” - which I had never heard of before BTC. I feel like I have a fighting chance to plan for what's coming down the pike and plan for the long term. Keep up the fantastic work, it is clearing up the financial fog for a lot of folks.

James,

I have been reading and following you for a long while, and want to thank you for the great content. I believe my introduction came via an interview with Preston Pysh, or Peter McCormack or Natalie Brunell not sure which, but thanks to them as well for the introduction.

That said, I like many in your following need to get this message of truth out to the power brokers in our system, i.e., our elected officials. To that end, below you will find a letter that I have drafted and sent to Congressman/Senators. The letter includes a link to this issue of the Informationist as I believe it would be great for our elected officials to get educated as well. Please feel free to share this letter with anyone and encourage them to copy or edit as they see fit to start a "correspondence movement". We are not powerless!

Here it is:

Dear Mr. Bennet,

I'm sure everyone would agree that "good decisions/legislation" require good information.

This week we are witnessing the failure of First Republic Bank (14th largest bank in the nation) despite 130 billion in capital infusions since the SVB failure in March.

These failures are just symptoms of the structural problems/disease inherent in our monetary system, and there is no more pressing issue before congress than understanding the problem before legislating a solution.

While this link (https://open.substack.com/pub/jameslavish/p/interest-rate-risks-are-collapsing?r=exxlp&utm_campaign=post&utm_medium=email) will give clarity on “interest rate risks” and how they have underscored the insolvency of those banks (and many more to come), the real problem is excessive debt/leverage in our system (public and private).

Here is a link to the Congressional Budget office’s own report that graphicly shows the “discretionary” spending that congress just passed for 2023 https://www.cbo.gov/system/files/2023-03/58890-Discretionary.pdf . How does congress sleep at night knowing that the CBO projected deficit for fiscal year 2023 (based on the first 6 months of data) is going to be 2 trillion dollars.

This type of fiscal deficit comes in the form of debt shouldered by the US tax payer. To be blunt, we are quite literally being monetarily enslaved by our elected officials.

Congress is about to engage in the perennial “debt ceiling” debate, and yet everyone knows that the ceiling will be increased. Why? Because not doing so will initiate a melt down of the world financial system. Such is the burden of being the “world reserve currency” and “world reserve asset”.

Currently there is no choice but to raise the ceiling; however, there is a choice about changing our future fiscal behavior so as to avert the impending debt spiral that is/will destroy our nation.

My first ASK: Please make sure any raising of the debt ceiling is tied to a real budget to constrain/reduce spending. This is the only way out.

My second ASK: Fall on your own sword, be brave, and do what is in the best interest of your constituencies even if that might jeopardize your re-election.

I am asking even as I remind you that you work for us.

Sincerely,

Mark R. Link D.D.S.